Investors are increasingly concerned about global growth and how to adjust portfolios going forward. Most agree that the US and Asia are bright spots today and that exposure to technological innovation is needed to capture the transformation occurring in nearly every industry.

Why focus on Asian innovation?

Asia is home to 60% of the world’s population, creating immense opportunities for adoption and scaling of new technologies. Countries without strong bank penetration are skipping branches and going straight to mobile. A newly-formed middle class shops online, not in malls. Hands-on governments are sponsoring domestic innovation. The list goes on.

In our view, innovation in Asia consists of three big picture themes:

1. Digital Transformation: According to Microsoft, 60% of Asia’s GDP will be driven by digital products or services in 2021. Asia is the most digital region in the world: 2 billion internet users, 1.8 billion active social media users and 4.3 billion mobile connections. Digitizing business activity is a no-brainer given the scale of adoption possible. As an example, Indonesia has more Facebook users than the US. WeChat, WhatsApp, Line, KakaoTalk and Viber are widely used and build local solutions for digitization of business not possible at smaller scales elsewhere.

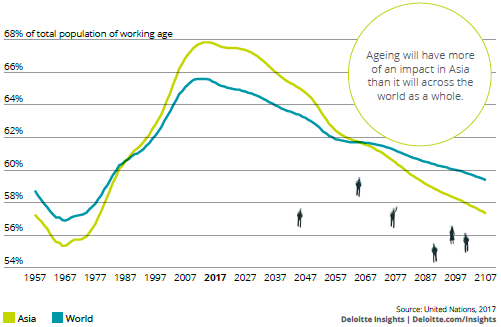

2. Health and Life Sciences: Asia will be home to 60% of the world’s elderly population (age 65 and above) by 2030, resulting in massive implications for healthcare. Pharmaceutical models will shift from volume to value through upgraded research and development (R&D) laboratories. Medical records will be digitized, initial diagnoses automated. Wearable health applications and data gathering will become the norm.

Working age population as a percentage of total population

3. Robotics and Automation: Asia is the world’s factory, but labour costs are rising due to an aging population, education increases and service industry growth. The only solution is aggressive automation. Japan has been at the forefront of automation for quite some time and China is ramping up its robotics R&D aggressively. Use cases range from automated fulfilment centres, farm irrigation and maintenance, assembly line automation, autonomous transport for the elderly, etc.

Defining technology and innovation in investment strategies

Some questions faced by investors looking for investment solutions on Asian innovations are:

- Thematic focus: whether to focus on only one theme requiring strong views or maintain a portfolio of strategies. Neither is ideal given the sizing and overlap concerns.

- Global versus Asian: both are valid, but Asia makes sense because of faster adoption and national policies for local champions.

- Beyond tech: technology’s benefits have spread well beyond the technology sector. Robotics manufacturers are industrial stocks and electric car companies are consumer stocks. A sector-agnostic approach is needed.

- Valuations and size: market cap weighting dilutes exposure and leads to concentration risk. In Asia, Alibaba and Tencent would make the rest of the portfolio irrelevant.

- Transparency: thematic exposures require certainty in team, process and methodology to avoid drift from desired themes.

- China as a proxy: Asian innovation goes beyond the top Chinese internet stocks. For a strategy to add value, it must go beyond a 5-stock portfolio that can be replicated with ease.

Among the above, industry classification 'beyond tech' is often considered as the biggest challenge as technology-driven innovations are not only influencing all kinds of industries but also disrupting the traditional investment paradigm, especially when screening for new industries beyond traditional classifications.

FactSet is an example of pioneering index providers redefining industry classifications. For instance, below is a sample of relevant RBICS® sub-industries for a Robotics and Automation theme:

- 3D Modelling/Rapid Prototyping Automation Providers

- Autonomous Drone Manufacturers

- Global Positioning System Manufacturing

- Industrial Robots and Robotic Assembly Line Makers

- Machine Vision and Quality Control

- Motion Control and Precision

Implementation for Asia

The recently launched Premia FactSet Asia Innovative Technology index aims to capture leading Asia-based companies engaged in emerging and disruptive solutions across technology-enabled sectors of digital transformation, healthcare & life sciences, and robotics & automation. These companies are selected for their significant revenue from the FactSet RBICS innovative technology sub-sectors, their growth characteristics, and their consistent investment in R&D. The exposure is currently largely North Asia – China is the biggest exporter of goods & services in the region and Japan is driving the automation revolution globally. About 64% of that is technology, but healthcare, industrials and even consumer stocks are all innovating their way to future growth. Most importantly, innovative industries are 75% of the index revenue, the growth forecast is 18%, yet forward PE is only 22x. It’s a high-quality tilt as well – R&D, margins and ROE are all above average.

Unlike cap-weighted indexes, this equal-weighted strategy provides investors with more diversified exposure to the high growth names across the three selected themes, such as: Tencent, Alibaba, Samsung (digital transformation); BeiGene, Otsuka, Daiichi (health & life sciences); Fanuc, Keyence, Nidec (Robotics & Automation). Since inception from 13 June 2014, the index has generated an annualized return of about 13% to date, outperforming the MSCI AC Asia Technology Index and most of the other broad China and Asia indices.

Aleksey Mironenko is Partner and Chief Distribution Officer at Premia Partners. This article is for general information and does not consider the circumstances of any investor. Past performance is no guarantee of future results. The opinions and views expressed herein are not intended to be relied upon as a prediction or forecast of actual future events or performance, guarantee of future results, recommendations or advice.