While most property types have experienced a performance slowdown on the back of rising interest rates, retail has been comparatively resilient. The sector was already being viewed with some caution pre-COVID due to the impacts of e-commerce, contributing to less substantial cap rate compression through that phase of the cycle – over the last five years, retail saw a cap rate low of 5.2% compared to 4.8% for office and 4.1% for industrial1. This different starting position has meant the negative valuation impact from cap rate expansion has been less pronounced.

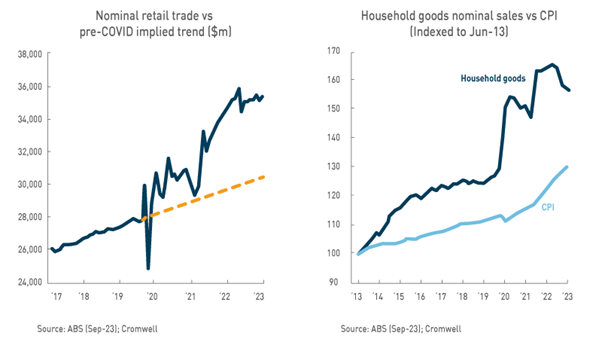

The sector has also benefitted from strong fundamentals, namely strong consumption growth and a muted supply pipeline. Incomes have risen, retail spending’s share of wallet has increased, and population growth has surged. These drivers have seen Australian retail trade grow by 28% since Feb-20, with spending levels sitting 16% above the pre-COVID growth trend2.

One of our preferred exposures to retail is Large Format, a sub-sector that isn’t often in the limelight. These assets don’t have the scale or luxury brands of a major shopping centre. It’s a no-frills, back to basics retail proposition – but that’s not a bad thing. While underwriting assumptions do have to account for a weaker consumer outlook over the next 12 months, Large Format is expected to benefit from resilient fundamentals, offers an attractive yield and ‘clean’ income, and is better positioned to leverage e-commerce as an opportunity rather than a challenge.

Population growth is a powerful driver of demand

Nominal retail consumption growth can be boiled down to three buckets:

- People paying more for the stuff they buy (retail price inflation)

- People buying more stuff (real growth per capita)

- More people buying stuff (population growth)

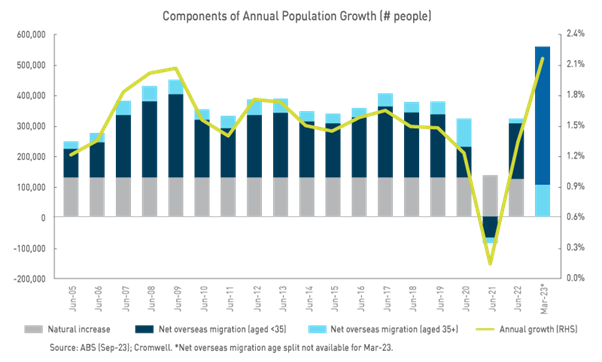

Of the three, population has been the most significant driver of retail growth over the last decade, averaging 1.4% p.a3. It has strengthened further post-COVID, with Australia recording population growth of +2.2% in the year to March3 and preliminary indicators of net overseas migration suggesting the pace hasn’t dropped off over the course of the year. The growth tailwind is expected to persist, with population forecast to grow by 1.4% p.a. from 2022-23 to 2032-334.

Positively for Large Format and its typical occupiers, Australia’s population growth skews to younger families. Around 60% of growth is due to net overseas migration, of which circa 80% comprises those aged under 35. This demographic is central to household formation and the retail activity that comes along with it, which is more heavily represented in Large Format assets (e.g. furniture/appliances).

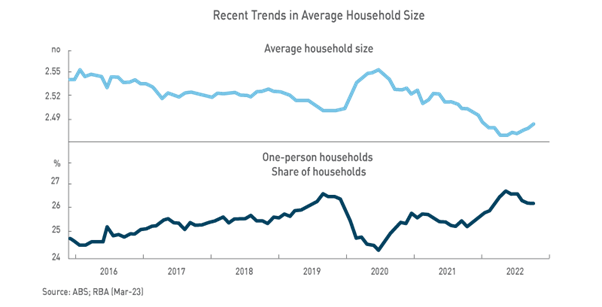

Another boost to demand is the changing nature of dwelling composition. Australia is seeing the number of occupied dwellings increase faster than the population, as single person households become more common5. This has resulted in a lower average household size, or thought of another way, more dwellings required per person. While people are increasingly living in smaller dwelling types (e.g. apartments versus houses), we expect the net result to be greater demand for household goods and furnishings.

The growth of the under 35 demographic is central to household formation and the retail activity that comes along with it, which is more heavily represented in Large Format assets (e.g. furniture/appliances).

Clean income and an attractive yield

In a time of slowing growth and elevated inflation, the ability to generate stable, growing income is an important driver of investment returns. Large Format’s yield nationally is 6.1%6, higher than many commercial and residential property sectors. We also consider the yield to be “cleaner” – what you see is what you get. Compared to major shopping centres for example, which are complex structures with substantial plant and equipment, often less capital expenditure is required to maintain a Large Format asset. This means the post-capex yield, or the money that actually ends up in your pocket, may be more attractive than a simple comparison of headline yields suggests.

The income underpinning the yield also grows over time, in contrast to the fixed nature of bonds. Like the broader retail sector, Large Format leases typically stipulate rent escalation each year of 3-5% or a CPI-linked amount, usually providing growth in excess of inflation. The income stream is dependable, with the majority of Large Format income derived from 5–10-year leases to ASX-listed or national retailers, such as Bunnings, The Good Guys and Freedom.

We believe the runway for rental growth in Large Format is sustainable, given the lower starting level and attractive economics for retailers. Mosaic Brands recently announced plans to open 40 “mega stores” through to Jun-24, as the larger format is 3x more profitable than their normal store size7. For some assets, further growth can be derived from intensification – development of unutilised land, car parks, or air rights into income-generating improvements.

Omnichannel-ready

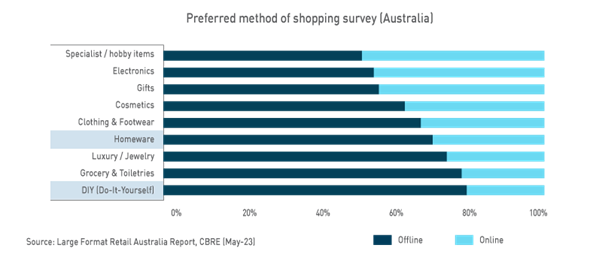

Online’s share of Australian retail trade has increased from 5.1% five years ago to 10.7% today8. The rise of e-commerce has dampened demand for physical retail space relative to household consumption, particularly across discretionary shopping centres with large exposures to categories such as clothing and department stores. Cromwell forecasts online’s share of spending to increase to 20% by 2030, however there are several reasons why Large Format can view the shift as an opportunity, given its role in omnichannel retailing.

From consumers’ perspective, Large Format minimises much of the friction associated with a traditional shopping centre experience – friction which turns shoppers towards e-commerce. Convenience is the number one reason for purchasing online9,10, as large multi-level shopping centres provide a frustrating car parking11 and navigation experience. In contrast, Large Format assets are often a simple rectangular layout with large on grade or basement car parks. These assets can provide the benefits of a physical shopping experience, such as better customer service8 and the ability to touch and trial products12, while minimising the pain points. In-person shopping is particularly valued across Large Format’s typical retail categories such as homewares and home improvement.

For retailers, Large Format facilitates an improved omnichannel proposition in a number of ways. Rents are typically in the range of $300-600 per square metre, much lower than traditional shopping centres and closer to levels being seen across industrial assets today. Sites are generally large, flat, and designed to be accessible to the heavy vehicles delivering bulky goods to occupiers. Assets are also often well-located, with ample arterial and motorway connections servicing significant population catchments. These attributes make Large Format assets well suited to the full suite of omnichannel product ‘delivery’ options, including buying in store, click and collect, and ship from store, while also offering reasonably cost-effective inventory storage – Nick Scali for example stores 55% of inventory in its showrooms13. In this respect, Large Format can offer investors a quasi-industrial exposure spanning warehousing and fulfilment, with the added fillip of revenue generation (making sales).

The physical store presence also aids in reducing last mile reverse logistics costs14 and processing times15, and provides retailers with an additional opportunity to engage with customers and generate a sale when products are being returned. By offering a seamless omnichannel experience, retailers can drive customer engagement and loyalty.

Customers’ preference for omnichannel is evidenced in trading outcomes, with ‘Bricks & Clicks’ retailers winning online market share at the expense of ‘Digital Native’ retailers16, and multichannel customers spending 2-3x more than single channel customers17. Omnichannel is important to customers and retailers alike, and Large Format’s characteristics can make it a preferred component in that proposition, particularly as e-commerce increases its share of sales and industrial rents reach higher levels.

Large Format is an omnichannel hybrid of retail and industrial, offering consumers a ‘touch and trial’ shopping experience and retailers a cost-effective shopfront and inventory storage.

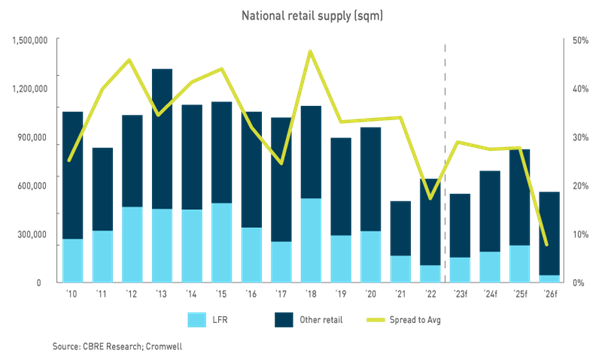

Supply is constrained, good news for existing owners

One of the reasons retail in Australia has avoided the “dead mall” phenomenon seen in the US is sensible planning policy and constructive relationships between developers and councils. In the US, developers have taken advantage of lax policy to build more than double the shopping centre floorspace per capita than Australia18, causing supply to considerably outstrip demand and leading to significant space hand-backs and store closures. Australia, by comparison, has restricted development to more sustainable levels, raising barriers to entry and lowering the likelihood of value-destroying competition impacts for both landlords and retailers. While there are more land zones where Large Format is permissible compared to traditional shopping centres, the lack of excess shopping centre space more broadly means a better supply-demand balance across the whole spectrum of retail typologies.

In addition to the above, Large Format supply has been constrained more than normal by rising construction costs, labour and material shortages, and a lack of suitable sites, exacerbated by competition from industrial uses. The characteristics which make a site compelling for Large Format (size/configuration/access/location) are also desirable to industrial facilities. With industrial vacancy below 1%19 and yields remaining tighter than other sectors1, developers are prioritising industrial over other uses such as Large Format. A recent example is Goodman’s 2022 acquisition of Alexandria Homemaker Centre with the intention of future conversion to logistics, which will result in the withdrawal of Large Format space from the market (a positive for existing asset owners). Such transactions also highlight how Large Format centres can be used as a way to land bank large sites in tightly held corridors, with the benefit of income generation over the hold period.

Large Format outlook

The outlook for demand is robust with retailers continuing to look for space – Super Retail Group for example is looking to open an additional 61 stores by Jun-26, while the likes of Baby Bunting, Bedshed, Nick Scali and Plush require a combined 125+ locations to reach their target store networks20. The vacancy rate has tightened to 3.2%21, its lowest level since at least Jun-17, meaning limited space is currently available and future availability will be constrained by the muted supply pipeline. These dynamics are expected to create conditions conducive to rental growth, which CBRE forecasts will run at +3.0% p.a. nationally from 2023 to 202622.

Stock selection is key, with Large Format performance closely linked to location, the strength of the surrounding catchment (i.e. income/population growth), and impacts from competition. Metropolitan sites in land-poor markets are preferred given the protection that scarcity (and lack of competition) provides to valuations over time – acquiring at attractive pricing is a key challenge for these types of assets. Dominant assets in fast-growing non-metropolitan markets can also be attractive if the risk of future competition can be adequately priced.

1. The Property Council of Australia/MSCI Australia Annual Property Index, MSCI (Jun-23)

2. Retail Trade August 2023, ABS (Sep-23)

3. Based on analysis by the Centre for Population, National population projections in the 2023-24 Budget; Cromwell (May-23)

4. National, state and territory population, ABS (Sep-23)

5. ABS 2021 Census; Cromwell

6. Australian Retail Figures Quarterly Market Report, 2Q 2023 (CBRE)

7. FY2023 Market Update, Mosaic Brands (Aug-23)

8. Rolling 12-month basis as at Jul-23. ABS Retail Trade (Aug-23)

9. IAB Australia and Pureprofile Australian Ecommerce Report 2023

10. Shopping Pulse, Klarna (Q2 2023)

11. Bricks & Clicks, UBS (2019)

12. Retail Monitor, Australian Consumer and Retail Studies, Monash Business School (Nov-22)

13. FY23 Results Presentation, Nick Scali (Aug-23)

14. Wallenburg, Einmahl, Lee & Rao (2021)

15. McKinsey (2021)

16. Inside Australian Online Shopping, Australia Post (2023)

17. Myer (Sep-23); Coles (Feb-21); Accent Group (Aug-18); Pallant et al (2020); KPMG (Dec-22)

18. SCCA (Sep-23)

19. Australian Industrial and Logistics Figures Q2 2023, CBRE (Jul-23)

20. Company reports; Cromwell (Sep-23)

21. JLL Research (Jun-23)

22. Large Format Retail Australia, CBRE (May-23); Cromwell. Rental growth refers to Prime net face rents (AUD/sqm).

Colin Mackay is a Research and Investment Strategy Manager for Cromwell Property Group. Cromwell Funds Management is a sponsor of Firstlinks. This article is not intended to provide investment or financial advice or to act as any sort of offer or disclosure document. It has been prepared without taking into account any investor’s objectives, financial situation or needs. Any potential investor should make their own independent enquiries, and talk to their professional advisers, before making investment decisions.

For more articles and papers from Cromwell, please click here.