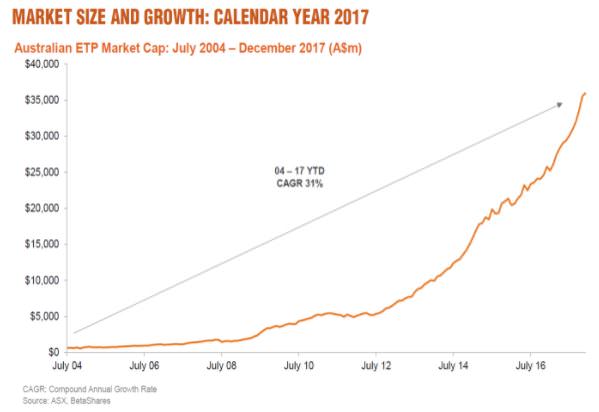

The Australian exchange traded product (or Exchange Traded Fund – ETF) industry is set to grow significantly in 2018 based on the momentum of last year. As at end of 2017, Australian ETFs reached an all-time high of $36 billion, up from $25 billion in 2016. Investors increasingly recognise the ease with which ETFs can be used to diversify their portfolios, as well of their cost-effectiveness and transparency benefits.

Before we look at the prospects for 2018, here are some other highlights from 2017:

- Annual new flows (net new money) reached a record $7.8 billion. The three largest issuers (Vanguard, iShares and BetaShares) attracted 72% of industry flows.

- 226 Exchange Traded Products are listed on the ASX, with 31 new products opened and 3 closed or matured in 2017.

- Trading volume increased by 41% over 2016 to reach $32 billion.

- The traditional index-tracking ETFs remained dominant taking 79% of flows, with smart beta (13% of flows) and active (8%) raising the rest. The latter two grew strongly in dollar terms but low-cost tracking still appeals most.

As an indication that direct investors accept they are underexposed to global shares, international equities attracted the most inflows:

Also notable that fixed income did well, while only currency ETFs as a group experienced net outflows for the year.

Also notable that fixed income did well, while only currency ETFs as a group experienced net outflows for the year.

Here are our predictions:

Prediction one: Millennials will continue to be an important driver of growth

Although investors of all types have embraced ETFs, millennials are attracted by the low cost and ease of use of ETFs, as well as the tailored exposure to investment themes that matter in their lives. In our product suite, for example, ETFs such as the Australian and Global Sustainability Leaders ETFs allow younger people to invest according to their values. Products such as the Nasdaq 100 ETF or the Cybersecurity ETF allow exposure to companies whose products resonate with their daily lives.

Market figures to bear out these trends, and according to CommSec, 25% of all ETF trades are now done by millennials. The diversification benefits of ETFs make them a good way to start investing in the sharemarket.

Prediction two: Greater innovation in bond ETFs

Fixed income has long been acknowledged as a good way to diversify a portfolio, but bond markets have historically been difficult for individual investors to access directly. In the last year in particular, there has been significant innovation in this space, with rapid growth in fixed income ETFs globally. With interest rates at record lows, ETFs give exposure to bonds that go beyond traditional fixed-rate exposure.

The recent launch of floating-rate bond ETFs offer a lower volatility alternative to traditional fixed-rate bond exposures as their interest payments adjust to reflect rises or falls in benchmark interest rates. This is particularly useful in a market where interest rates are rising, and floating rate ETFs appear well-placed to perform well given current interest rate expectations.

Beyond this particular style of fixed income investing, in 2018 more generally, we expect to see further innovation in fixed income ETFs, providing direct investors with much-needed access to lower risk, income-producing assets.

Prediction three: Active ETFs will grow in popularity

Last year saw the continuation of active ETF launches, giving investors more opportunity to diversify their portfolios alongside the passive ETF investments. Indeed, active ETFs offering access to a variety of active management strategies have the potential to match the growth of passive ETFs. For example, BetaShares recently launched the first active ETF with exposure to a professionally managed portfolio of Australian hybrids.

While we remain a strong advocate of passive investing, there are a number of asset classes and managers who can add value via active investing. For example, the complexities of hybrid securities and relative inefficiency of the hybrids market make investing in this asset class via a professionally managed fund vehicle a worthwhile alternative for many investors.

Across all predictions, growth remains the consistent theme

The growth of the ETF industry in Australia will continue on a strong trajectory, and we expect ETFs to reach $47-49 billion by the end of 2018.

Ilan Israelstam is Head of Strategy & Marketing at BetaShares, a sponsor of Cuffelinks. This article is general information and does not address the needs of any individual. Latest editions of BetaShares’ monthly ETF Review can be accessed here.