The key objectives of the superannuation and retirement income systems are the provision of security and a reasonable income in retirement. The Federal Budget made significant changes to social security means tests, effective 1 January 2017, which demonstrates the lack of integration between retirement income policy and social security. The changes have some perverse consequences, notably people with lower assets possibly having greater retirement incomes than those who have prudently accumulated more savings.

Doubts about fairness

One of the key benchmarks the Government has determined for the assessment of Federal Budgets is fairness.

The age pension asset test and, in particular, the age pension tapering rules, will challenge that notion of fairness. This primarily arises from the interaction of the 7.8% tapering rules and the current (ultra) low rate environment.

It is true that the lifting of the assets threshold will allow more people to be eligible for a full age pension. For non-homeowners (single and couple), thresholds have risen from $360,500 to $450,000 and from $448,000 to $575,000 respectively, while for homeowners (single and couple), they have risen from $209,000 to $250,000 and $296,500 to $375,000, respectively. The increases will allow an estimated 50,000 more Australians to receive the full pension.

But part-pension thresholds have been reduced. Significantly. For non-homeowners (single and couple), they have fallen from $945,250 to $742,500 and $1,330,000 to $1,010,000, respectively, while for homeowners (single and couple), from $793,750 to $542,500 and $1,178,500 to $816,000, respectively.

It is estimated the lower thresholds will see 300,000 retirees have their part-pensions reduced and 100,000 will lose them altogether. And the Government casts a wide net when determining assessable assets, including boats, caravans, household contents, personal items, financial investments, and business assets. The family home, however, remains excluded from the age pension assets test.

The bad news does not stop there

The pension taper rate increased from $1.50 to $3. For every $1,000 of assets beyond the assets test level ($250,000 for a single homeowner and $375,000 for a home-owning couple), the pension is reduced by $3 a fortnight or $78 per year. Call this a 7.8% taper rate ($78/$1,000). When this is coupled with the current low interest rates, Middle Australia is the meat in a tasteless sandwich.

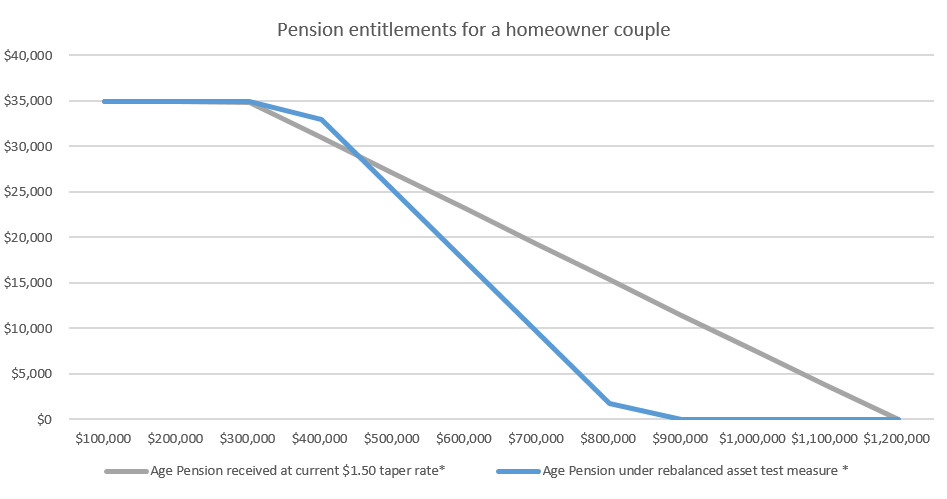

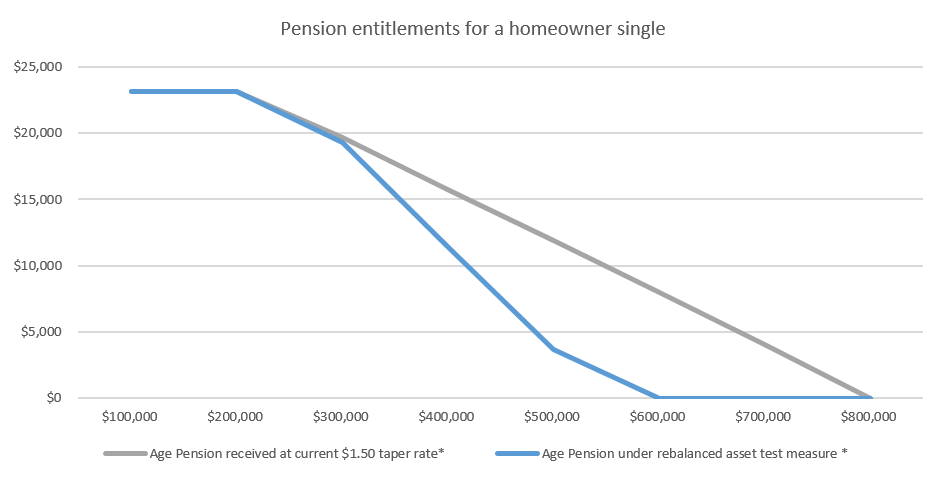

The graphs below highlight the punitive impact of the new tapering rules and asset thresholds. Among those most harshly affected are couples with between $600,000 and $1 million in financial assets (excluding the family home) and singles with financial assets of between $400,000 and $700,000. Non-home owning people are even worse off.

Age pension for a home-owning couple, new asset test (blue line) versus old (green)

Source: SMSF Association

Age pension for a home-owning single, new asset test (blue line) versus old (green)

Source: SMSF Association

Dramatic reductions and perverse results in age pensions

To drill down further into the numbers, a home-owning couple with financial assets of $800,000 faces a pension reduction of about 85%, from about $16,000 to about $2,000. Again, it is worse for non-home owning couples who have rent to pay. A home-owning single with financial assets of $500,000 faces a reduction in the partial pension of about 70%, from about $13,000 to $4,000.

Now consider the following:

- Assuming a 4% earnings rate (conservative portfolio), a home-owning couple with:

- $300,000 in financial assets will have total investment earnings and pension income of around $47,000

- $800,000 in financial assets will have total investment earnings and pension income of around $34,000.

- Assuming a 4% earnings rate (conservative portfolio), a home-owning single with:

- $200,000 in financial assets will have total investment earnings and pension income of around $31,000

- $500,000 in financial assets will have total investment earnings and pension income of around $24,000.

(The above simple analysis ignores the overlay of the Senior and Pensioners Tax Offset, or SAPTO).

In both cases, the whole purpose of saving for retirement – to produce a decent income in retirement – is largely undermined. The couple with additional savings of about $500,000 or the single with an additional $300,000 are significantly worse off in total than their counterparts who have accumulated less.

The asset means test could encourage people in retirement to take on additional risk with their investments to generate higher investment earnings to offset the 7.8% tapering rate.

Even if one allows for consumption of additional capital over life expectancy, the conclusion remains that the incentive to save for retirement is significantly diluted. It may well encourage prior capital consumption or increasing capital committed to the family home.

For example, a way to provide an income stream with the same longevity protection as the age pension with inflation adjustment and consumption of capital, is an inflation-proofed lifetime annuity. If the couple with $800,000 in assets were both aged 65, and each purchased a lifetime annuity with inflation protection and declining liquidity (representing capital consumption) then the currently quoted annual income streams per $100,000 cost from Challenger are:

Averaging this figure at $4,629/$100,000 or effectively 4.6%, this couple could produce an assured annuity income with inflation and longevity protection (replicating that provided by the age pension) of $37,032 a year, plus receive an age pension of $962, for a total of approximately $38,000 per annum. They are worse off than the couple with $300,000 in assets, who have not had to consume their capital to produce the income!

No incentive to save created by black holes

Surely Middle Australia will question the worth of saving extra retirement dollars if this is the outcome as there is absolutely no incentive to accumulate assets in a certain band. In the case of the home-owning couple, it is between $375,000 and $816,000. It is literally a savings ‘black hole’. Remember, too, our home-owning couple with $800,000 in financial assets will now be on a par with the ASFA Modest Retirement Standard for couples of $34,560 a year, and way below the ASFA Comfortable Retirement Standard of $59,619 a year.

How does this come about? Well, the 7.8% tapering is much higher than the earnings rate (say 4% in the above example) on additional assets. For tapering to work effectively and provide a modest incentive to save for retirement, the tapering rate ideally needs to be less than the earnings rate – and certainly not substantially exceed it.

And for members in the SMSF sector, where about 48% are either transitioning to retirement (60 to 65) or in retirement (65 plus), the need to preserve capital is critically important. So, for these people, matching a 7.8% tapering rate when the official cash rate is at 1.5% is very difficult.

Possible solutions

What possible solutions are there to this dilemma? A few come to mind:

- Shift to a single deeming rate (same deeming rate used for the incomes test and assets test), though this would be very expensive, and probably not acceptable to Government in the current fiscal environment

- Have a gentler tapering rate in which case the threshold levels would most likely also need adjustment, or

- Have a two-tier tapering rate, gentle at first (say 4% tapering for assets above a certain amount), and a steeper tapering rate (say 7.8%) for assets above a higher amount. Obviously, the asset figures would vary between couples and singles, homeowners and non-homeowners.

These are not wealthy Australians

Underpinning all these changes is the notion that our home-owning couple with $800,000 in financial assets is somehow wealthy. The concept of a ‘million dollars’ signifying real wealth persists, encouraged, perhaps unwittingly, by the Government, and certainly by elements of the media, some think tanks and others active in the social policy arena.

It’s just not the reality. As demonstrated, in the current low earnings rate environment and earning 4% a year with a conservative portfolio, a couple with $800,000 will be earning $32,000 a year (before tax) and a single person with $500,000 will be earning $20,000 a year. Hardly wealthy Australians. They are simply hard-working Middle Australians who have done the right thing in following their personal goals and Government exhortations to provide for their retirement. Right now, they must be asking why.

This is why there is such a pressing need for much greater integration of public policy for the retirement phase. At the very least, this needs to embrace superannuation and retirement incomes, social security, tax and aged care. It could also embrace health but that’s starting to become complex, so starting with the narrower integration framework is more pragmatic and a useful start.

Andrew Gale is Non-Executive Director of various entities in the financial services sector, including Chairman of the SMSF Association. The views expressed in this article are personal views and are not made on behalf of any organisation.