About 850 readers fired up to share their reactions to the Financial Services Royal Commission. Here is a summary of the results, along with some of the comments received.

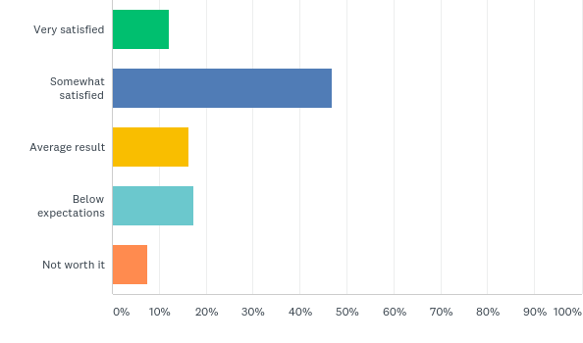

Q1. Overall, are you satisfied with the recommendations in the Final Report?

Although only 12% were 'very satisfied', the majority of survey takers (59%) were satisfied or somewhat satisfied with Kenneth Hayne's recommendations. A solid 25% were underwhelmed.

Comments

- Remember that the sole focus was misconduct

- Expected a 7 or 8 out of 10, give a 3 - more about politics than changing the landscape

- Execution of some recommendations may be quite difficult - the devil is in the detail

- No actual recommendations of prosecutions, therefore no disincentive

- Great job finding the ammunition, the RC just failed to fire their guns when the opportunity presented

- The Report on the whole is balanced

- Suggesting that customers pay home loan brokers will reduce competition

- A fee as a percentage of money under advice is still a trail commission and was missed

- The Commission did a great job and delivered a service to the hard working people of this country. The recommendations in the Final Report however are manifestly short of what is required to address the crimes uncovered. The banks must be laughing.

- The value of the recommendations depends on the implementation of reforms and that is hardly Haynes' problem

- Recommendations made with a complete lack of direct experience in individual financial disciplines. The recommendations on upfront commissions for Financial Planners (Life Insurance) & Mortgage Brokers reduces any independence and any opportunity for consumers to easily review other rates/life insurance premiums available in the market.

- Doesn't go far enough. Banks got off too easy. No one going to jail.

- Who is going to implement the recommendations when APRA and ASIC are embroiled in this?

- We should all remember that a Royal Commission can only report and recommend not punish, it's now up to Parliament

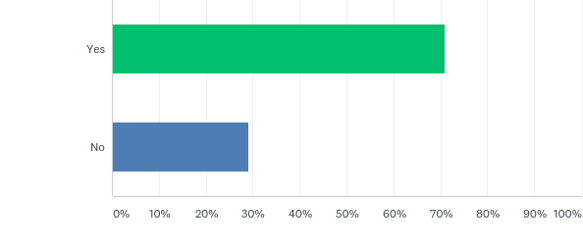

Q2. Should the Commission have addressed vertical integration by separating financial advice from product manufacture?

A clear majority wanted vertical integration addressed: 71% yes, 29% no.

Comments

- One of the biggest issues wasn't tackled, very disappointed

- Advice led by internal product is never going to be in clients' best interests

- Customers should expect that by approaching a bank for advice they will only be offered products from that bank

- Always should have been. Advice and product must never be integrated. Sometimes best advice is to do NOTHING - no product

- What business would not expect its employees to promote its own products? The problem is the way the employees are remunerated

- Advisers are under an obligation to the client and if they take that role seriously it is easy to manage these conflicts. It is about being open and honest about them

- The UK gives an example of why banning vertical integration is bad policy, they are now changing as they realised the ban did not benefit consumers

- There needs to be greater disclosure to customers when vertical integration applies

- Must be removed. Product and Service/Advice are two distinctly different elements of providing great quality results for clients

- Vertical integration is satisfactory providing the right checks and balances are in place

- It is a ridiculous form of hypocrisy to suggest grandfathered commissions are conflicts that must be addressed, and then leave vertical integration alone

- Separation would not of itself end corrupt & unethical practices

- The conflicts are obvious - how can you recommend your own product unless you contrast it with other products to show that it is superior and in the customer's best interest?

- Are the vast majority of people really getting bad advice? Get rid of the thieves for sure but pretty hard to say which Aus Share fund is better than the other. They all hold the same stuff!

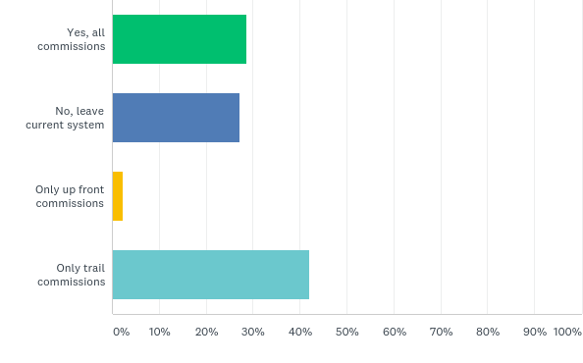

Q3. Is the Commission right to ban commissions for mortgage brokers?

Not all people are against the idea of commissions, with 71% agreeing that some, if not all, should remain. A sizeable 42% of respondents believe just the trail commissions should be abolished, and 29% want all commissions banned.

Comments

- May be worth a try at just scrapping them. They always do blur the line as to who the “adviser” is working for.

- They have a valuable role to play in the market. Find a way to transform that value into a new remuneration model.

- There needs to be more transparency, so clients know what the brokers are being paid to do.

- Need a fifth option. Mortgage brokers have helped mortgage competition. The system could regress from here. Maybe there is a better idea to limit/manage the 'fees for doing nothing'

- Even though brokers are paid by banks they have helped produce a more competitive environment for borrowers. banning commissions will only help the banks, not consumers

- Leave it to the market to work itself out.

- Brokers are distributors not permanent advisers. They assist the bank with document completion and should be paid a distribution fee but not a commission as an incentive to continue to favour a particular lender.

- Trail commission doesn't make sense as rarely have I seen a broker regularly check in with their client.

- As long as the trail commission value is returned to customers not retained by the banks.

- I believe there is a positive role for brokers but controls need to be much stronger.

- Trail commissions reward the broker for getting their client into the most suitable product for the longer term. There is not one person in Australia who will pay an upfront fee.

- I see them as increasing efficiency, and a help to smaller banks.

- Mortgage broking is just not tick and flick. Most of my clients have difficulty obtaining a loan as its now so complex. They are also busy. I search the best option, collate all the paper work, lodge the loan, liaise with the real estate agent/accountant/solicitor/vendor etc. to make sure the transaction is smooth. The current system works very well and clients are very happy.

- Brokers have a role and deserve to be paid for that work. Maybe greater transparency required, but there is an element of "buyer beware" here.

- It appears that Hayne did not understand the true role of mortgage brokers i.e their responsibility continues after the mortgage is established.

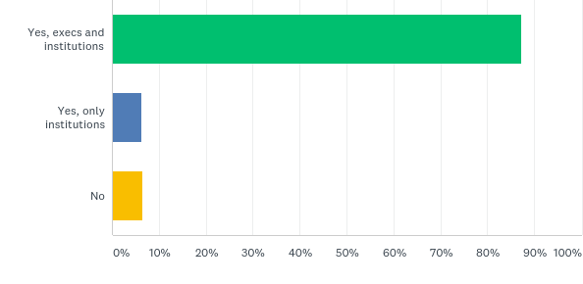

Q4. Should regulators prosecute in court more often as recommended by Hayne?

The strong words from ASIC since the Final Report was released are supported by the majority of responses. More than 87% said that both institutions and executives should be subject to prosecution for misconduct more often. Only 6.5% of respondents thought regulators should not increase prosecutions.

Comments

- The message that they are real crimes will not be evident unless there is prosecution.

- The threat of legal action 'should' positively affect behavior but want to avoid extending the lawyers' picnic

- But be selective about which cases to prosecute - don't waste resources on minor infractions.

- There should be clear guidelines on prosecution against executives. Ultimately, this may lead to some areas of higher executive pay as there is increased risk for execs.

- ASIC ceased taking parties to court because they kept losing cases. It was cheaper and more effective for ASIC to use enforceable undertakings. ASIC should continue to use EUs but not allow compromise by way of negotiation to the extent used in the past.

- The cost of litigation will be passed on to retail customers and paranoid institutions will become even more so.

- Executives need to take responsibility for their actions or lack of action.

- Executives are the people who implement the moral compass of a business and set the example.

- As an ex regulator I would agree that often the enforceable undertaking achieves what you would have in court, just for a lot less money. But there are egregious examples who will only ever understand a custodial sentence.

- I suspect ASIC isn't necessarily up to task and that industry will improve (anyway) following the report.

- It is disgraceful that shareholders' funds are used to pay for mistakes by executives who are still receiving rewards by way of bonuses.

- The regulator is there to regulate within the law so this must include courts.

- Like with our children, if there is no real punishment, the behaviour will continue.

- Gross breaches should be prosecuted but regulators need to guard against an overzealous approach to breaches that involve little or no loss to customers.

- In the absence of proper ethical standards, the law sets a minimum standard which must be imposed, or the law is hollow.

- Only if serious infringements of duty.

- Laws were already in place they just weren’t used.

Q5. Is Hayne correct to leave the implementation of his recommendations to regulators?

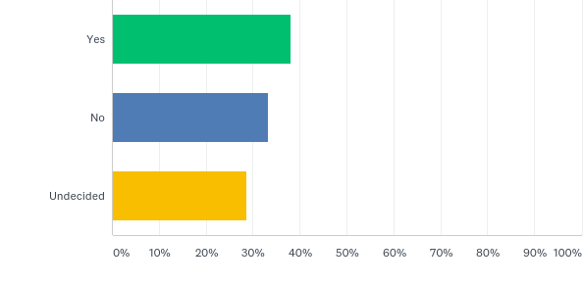

There was an even spread of opinion on whether regulators should be guiding the implementation of Hayne's recommendations, with 38% supporting, 37% opposed, and 29% undecided or believe that it's too early to tell.

Comments

- Difficult to see ASIC or APRA change their spots.

- I just hope that they are selective and prioritised.

- I doubt much will change, regulators appear too afraid of embarrassing themselves when litigation fails.

- Regulators have turned a blind eye to obvious conflicts on interest for too long. We'll have to wait and see whether they now step up and enforce the law, particularly the obligation to act in the client's best interest.

- I agree that sufficient regulations are there now, they just need to be enforced properly and publicised.

- Regulators need to be accountable for the administration of financial regulation. Early enforcement will enable the industry to adopt compliance programs.

- Yes regulators should implement the changes, however, there needs to be MORE consultation regarding unintended consequences.

- Who else is going to implement his decisions if not regulators and legislators? It was never his role to go further.

- The regulators and their financing need attention now and in the future. Certainly bravery is needed.

- Knowledge can be a powerful thing. Put it on the record.

- Need to be careful not to over regulate and they now know if they prosecute they will get community and political support.

- Regulators need to be better funded to execute their obligations.

- What are the consequences for regulators who do not do THEIR job?

- Regulators are too often at the mercy of their political masters.

- Provided they have the right people who understand the industry no ex public servants who have no idea how the industry operates.

- Regulators and Industry to work together.

- The regulators have the responsibility to conduct such actions. If they perform poorly change the personnel in the regulators.

- The regulators should do what they are paid to do and should be resourced accordingly.

Q6. How likely are you to change any of your financial service providers as a result of the Royal Commission?

After excluding answers of 'not applicable', an average of just 15% of people indicated they were likely or very likely to change financial service providers following the Royal Commission. The providers highest on people's hit list were wealth/fund managers and financial advisers/planners with a dissatisfaction rating of more than 17% each. Least likely to be affected was insurance providers at just over 13%.

Changing superannuation fund/SMSF topped the 'very unlikely' category with 56% saying they would not consider a change. However, a decent number of 13% are 'likely' or 'very likely' to change.

| Very likely | Likely | Unlikely | Very unlikely |

| Wealth or fund manager | 6.95% | 10.34% | 38.50% | 44.21% |

| Main bank relationship | 4.87% | 10.13% | 38.46% | 46.54% |

| Home loan provider or lender | 6.34% | 9.82% | 38.24% | 45.60% |

| Insurance provider | 6.58% | 7.87% | 39.97% | 45.59% |

| Financial adviser or planner | 8.58% | 8.82% | 35.50% | 47.10% |

| Superannuation fund or SMSF | 5.72% | 7.39% | 30.68% | 56.21% |

Q7. What did the Royal Commission miss or any other comments?

As question 7 was an open-ended question, with some 350+ comments, a selection can be viewed in the accompanying article this week.

Leisa Bell is Assistant Editor of Cuffelinks. These comments by readers are shared in the interests of informing our community and no responsibility is accepted for their accuracy or fairness.