From the Australian Bureau of Statistics:

At 30 June 2013, the managed funds industry had $2,130 billion funds under management, an increase of $33 billion (2%) on the March quarter 2013.

The asset types that increased were overseas assets, $20.9b (7%); deposits, $7.6b (3%); other financial assets, $4.2b (14%); units in trusts, $3.6b (2%); land, buildings and equipment, $3.3b (2%); short term securities, $1.3b (1%); and derivatives, $0.3b (20%).

These were partially offset by decreases in shares, $8.7b (2%); other non-financial assets, $0.6b (3%); and loans and placements, $0.6b (2%). Bonds, etc. were flat.

The following chart shows the levels of the asset types of managed funds institutions at 30 June 2013.

Managed Funds Institutions Assets

Graph: Managed funds institutions assets

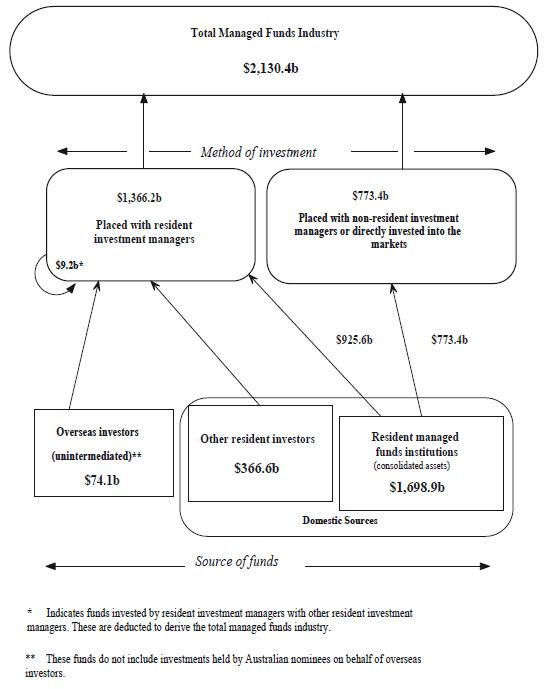

The following diagram shows the value of the Total Managed Funds Industry at 30 June 2013 and the relationships between the components of this industry: