It’s been a common and persistent claim in global financial markets for the last year or so that “Bonds are back!”

Performance from fixed income markets over this time has indeed been favourable, with global core bonds returning 6% over the last 12 months, and global credit performing even better, with 8% returns for investment grade and 12% for high yield[1] .

Yet some investors may understandably be asking themselves: Have I missed the boat?

I believe that the answer to that question is an emphatic "no" and that the opportunity in fixed income is just getting started. The combination of high starting yields and a supportive macro backdrop means that the stars are finally aligning for investors considering a fixed income allocation.

The power of yield

The post-GFC period was one marked by near zero rates, quantitative easing and other forms of liquidity provision by central banks. This was a challenging environment for fixed income, reflected in lower bond returns.

The environment today is very different. The hiking of monetary policy rates by central banks in 2022/3 was painful at the time but had a silver lining – investors in fixed income are now well compensated for holding this defensive ballast, in the form of historically high bond yields.

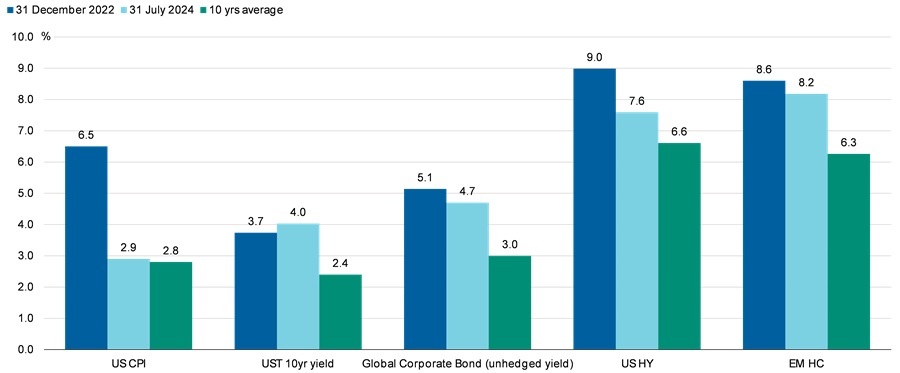

And even with the strong returns of bond markets over the last 12 months, those yields remain well above historical averages today. In addition, inflation has come down, meaning real yields are today well into positive territory.

This is important because the starting yield of a bond is highly correlated to its future total return. For example, high quality global corporate bonds today offer a starting yield of more than 5%; history suggests this correlates to mid-to-high single digit total returns over the coming 5 years.

Potential benefits from rate cuts

In addition to the high starting yield, returns generated by fixed income could see an additional tailwind from the capital gains that typically come with rate cuts.

The macroeconomic backdrop has been marked by a shift in focus from one of inflation to a potential slowdown in growth. This means duration changes, from being a possible drag on portfolio results to a positive contributor.

The disinflation trend that we’ve seen in the US over the past 18 months has led the Fed to begin cutting rates – a first 50bps rate cut in September is expected to be followed by more cuts over the coming quarters and years. If this does in fact play out, higher quality fixed income markets such as global corporate bonds should benefit from price appreciation as a result of their duration.

Analysing past rate cycles confirms the strong boost to returns that fixed income securities can expect to see in this environment. Looking back at every period of sustained rated cuts of the last 40 years reveals that, on average, investment grade credit returned 10% p.a. in the 3 years after the last hike in a cycle.[2]

In the current cycle, the last Fed hike was just over a year ago in July 2023. Since then, global corporate bonds have returned 9.5%. If historical patterns hold, history suggests that the next few years should provide similarly strong returns – an opportunity that investors will need to move quickly to take advantage of.

The defensive role of fixed income is more important than ever

A key role of bonds in a broader portfolio is to provide defensive ballast – to protect investors capital and diversify against equity market volatility.

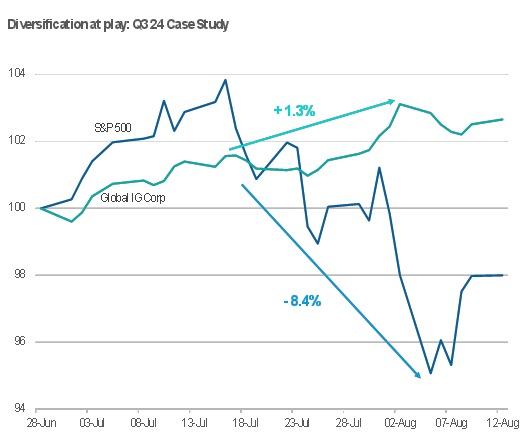

While this diversification role has been less prevalent in recent years, there is reason to believe it is returning. In the recent mini correction in global equity markets, bonds delivered positive returns (see chart below). What we saw was a return of the ‘fabled’ negative stock-bond correlation.

As the market narrative on risks has shifted, from concern about a potential reacceleration of inflation, toward recession concerns, we believe the negative stock-bond correlation could well persist.

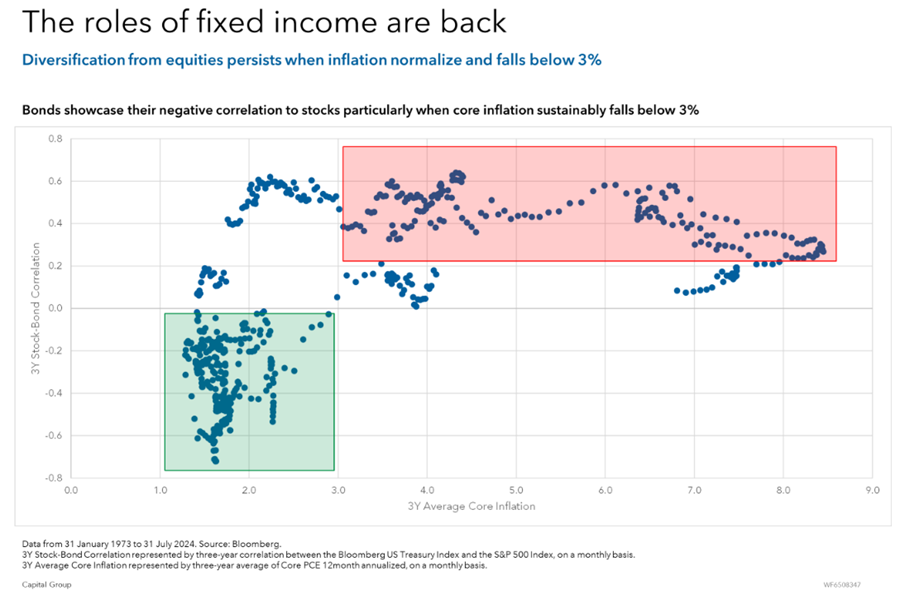

Historical analysis shows that the stock-bond correlation varies over time. Typically, in periods of greater inflation uncertainty it turns positive, while in periods of growth uncertainty it is often negative.

Further, as shown in the chart below, historically when inflation falls below 3%, the correlation between bonds and equity normalises and turns negative.

The current environment of moderating inflation, along with a Fed that is primarily concerned about growth risks, suggests a higher likelihood of bonds playing that diversifying role in the future.

So, what does all this mean for investors?

Given the historical relationships between bonds and equities, and the current macro environment, investors might consider deploying cash and investing in fixed income, gradually increasing duration to benefit from the price appreciation coming from lower yields.

Inflationary concerns are today much lower and Fed rate cuts are now more certain; the question is how much rather than if the Fed is going to cut. Investors have the opportunity to take advantage of this early phase of the easing cycle by investing in fixed income securities and particularly high quality corporate bonds, which we expect to deliver high single to low double digit total returns over the next years, driven by a combination of income and price appreciation from yields dropping.

Haran Karunakaran is an Investment Director at Capital Group (Australia), a sponsor of Firstlinks. This article contains general information only and does not consider the circumstances of any investor. Please seek financial advice before acting on any investment as market circumstances can change.

For more articles and papers from Capital Group, click here.

[1] As of 30/8/2004 in AUD hedged terms. Based on Bloomberg Global Aggregate Total Return AUD Hedged, Bloomberg Global Aggregate Corporate Total Return AUD Hedged and Bloomberg Global High Yield Total Return AUD Hedged indices respectively.

[2] Source: Bloomberg. Based on Bloomberg US Corporate Bond Index. Rate cycles captured 1988-89, 1994-95, 1999-2000, 2004-06, 2015-18.