“... we’ve got the chance in history. This is your great chance. This is the night you’ll remember. This is the night that we are going to create national superannuation for everybody.” Bill Kelty, former ACTU Secretary

“… now I have got the system up and ready to rumble.” Paul Keating, former Prime Minister

Paul Keating and Bill Kelty are rightly called the fathers of our world-acclaimed super system, but if they had attended the SMSF Association Annual Conference last week, they would have wondered who is looking after their child. This Conference of over 1,700 delegates is the leading event for SMSF experts from across Australia. As befits such an audience, the majority of the sessions were highly technical, but it was apparent that the supercharged complexity of the new rules was confounding many of those present.

Full credit to the SMSF Association for trying to bridge the knowledge gap, but the final summing up session concluded that the two most frequently heard words in the Conference were: ‘It depends.’

Confusion, lack of time and brain freezes

Many SMSF advisers went into the Conference believing they understood the new rules, but came away realising the complexity and uncertainty. One presenter said advisers who were not SMSF specialists were “hanging on by the skin of their teeth”. An SMSF technical specialist told me she was compiling a list of questions she could not answer. Another said he had been in a meeting with the Australian Taxation Office (ATO), the Financial Planners Association and the SMSF Association, and the ATO officers were openly disagreeing in response to questions. A leading provider of software to accountants and advisers said his company has not been able to programme the changes and their software will be out-of-date.

Specialist workshops run by SMSF leaders Graeme Colley and Peter Burgess called ‘Dancing with the experts – the SMSF strategy challenge’ did not complete their case studies due to adviser confusion about the new laws. Some speakers privately expressed surprise to discover a much lower level of adviser knowledge than expected.

Although the legislation on the new super rules was passed in November 2016, the consultation process on the finer details is currently underway. For example, the Law Companion Guide LCG 2017/D3 on ‘Superannuation Reform: Transfer Balance Cap – Superannuation death benefits’ was only released last week with a response deadline of 10 March 2017. The rules will be operational three months later, giving negligible time for technical areas to analyse and inform advisers on the correct treatment, never mind explaining to clients and implementing prior to 30 June 2017. Many delegates shook their heads in disbelief when a speaker said they had 134 days to sort it all out.

I sent Liam Shorte, NSW Chapter Chair of the SMSF Association and an SMSF Specialist Adviser, a draft of this article and he wrote back:

“This really sums up well the feeling that most advisers had coming away from the conference. The analysis of numerous strategies will play the biggest part of our advice with each client and investments will take a back seat. For many of us who had moved to focus on strategy it will be easier to have those conversations while others will struggle.

Since the conference I had to stop reading for a few days as I literally felt a brain freeze and I have had to break each issue down in to talking points. Now I am making my accounting partners aware of the detailed discussions we will need have with clients in a meeting where the accountants had previously just done a simple overview of the financials and collected signatures.

If there ever was a time for Financial Planners, Accountants and Lawyers to work as a team for SMSF clients, then this is it.”

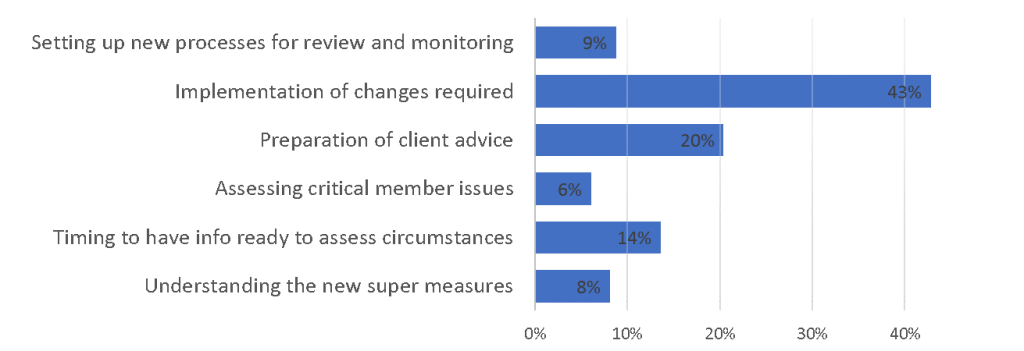

In Aaron Dunn’s (CEO of The SMSF Academy) session titled, ‘Capitalising on the super reform opportunities’, he challenged advisers to adapt and engage in the face of the reforms, recognising the opportunity presented to build a stronger business. He polled the audience with the question, “What do you feel is the greatest challenge with the super reforms?” The responses showed the critical issues advisers face in the next few months (and years!).

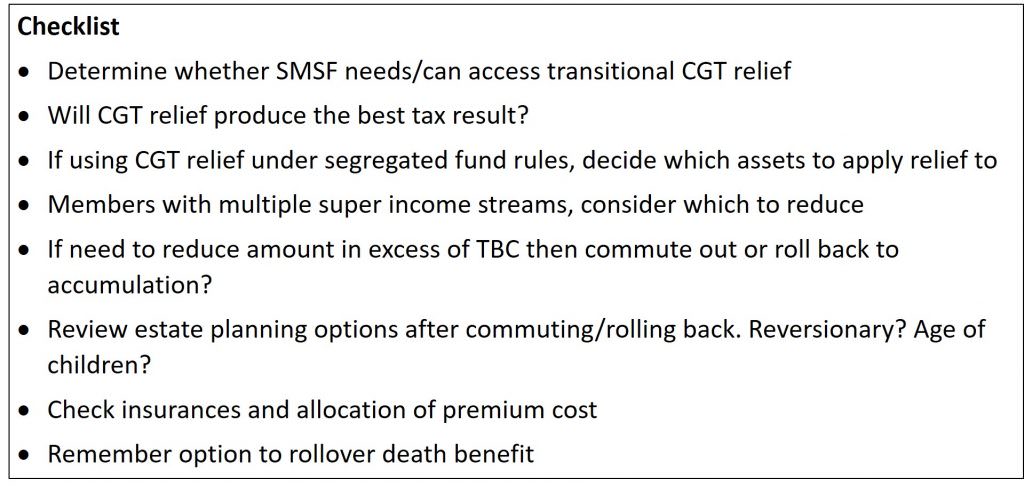

Aaron has prepared a detailed checklist on the new rules which runs to 11 pages, and to quote Liam, “I am using it in every client meeting and you cannot ignore any part of it.”

The example of transitional CGT relief

Consider one slide from one presentation, by Justine Marquet, Senior Technical Manager at AIA, titled, ‘SMSF pension opportunities, contingencies and some unfortunate realities’ on the subject of transitional CGT relief (if you don’t know what that is, this was not the conference for you):

That’s one slide in a 26-slide presentation in an hour. This is obviously not a criticism of Justine, but an illustration of the level of complexity the system now delivers.

Again on this one issue, Darren Wynen, a Senior Tax Trainer at TaxBanter, presented a paper called ‘Latest CGT issues for SMSFs’, and it ran for 13 pages of text, detailed examples and technical points. All for a transitional arrangement which ends in a few months. To quote Wynen,

“The relief allows complying superannuation funds to choose to apply the relief to reset the cost base on assets that are reallocated or re-proportioned from the retirement phase before 1 July 2017.”

Could it be the rules will not be finalised before the transition period ends?

Is this only a problem for the super-wealthy?

The Transfer Balance Cap is set at $1.6 million, which is a large amount. However, it will effect a spouse who inherits super from a partner, so arguably couples with $1.6 million between them need to know the options. With approximately two people per SMSF, it is instructive to consider the cap in terms of SMSF balances, not only per member.

In case this is considered a trivial issue relevant to a few large SMSFs, consider the statistics:

Number of SMSFs (June 2016): 577,236

Number of SMSF members: 1,087,741

Average assets per SMSF: $1.1 million

Average assets per member: $0.6 million

SMSFs by asset size:

>$1 million-$2 million, 18.8% of total or 108,000 funds

>$2 million-$5 million, 11.4% of total or 66,000 funds

>$5 million, 2.8% of total or 16,000 funds

That’s almost 200,000 SMSFs with balances over $1 million (recognising that many funds have two members). This does not include people in public super funds or those in defined benefit schemes. This complexity is not only an issue for a few super-wealthy.

ATO expecting errors from trustees and their advisers

The Commissioner of Taxation, Chris Jordan, told the Conference that the ATO would work with people who make an honest mistake. An adviser later told me this was wishful thinking, and recounted his experience with a client pulled over hot coals by the ATO after an insurance payment had created a small excess contribution, resulting in a heavy fine.

Also from the ATO, James O’Halloran, Deputy Commissioner, Superannuation, presented on ‘Navigating the new measures: How the ATO is responding.” He said the ATO is preparing tools, checklists and guidance notes, and they expect errors and non-compliance. He added,

“Come and talk to us when you think you’ve made a mistake. We do want early engagement. We may have discretion or conversely it may not be a mistake … We think there has been some misunderstanding around CGT relief and also how to apply for it. We want to help promote consistency and also draw together a greater common understanding of how to get things right in the first instance.”

Response from Government included a quote from Cuffelinks

The Minister with responsibility for superannuation, Kelly O’Dwyer, spoke on the final day. She quoted from an article written by Paul Keating in Cuffelinks. She acknowledged the somewhat strained relationship with the super industry when she said, “Not everyone is happy with all aspects of this legislation.” However, in a Conference where sessions were designed to use the system for tax minimisation, estate planning and wealth accumulation, she said:

“The new measures support the key objective of superannuation, which is to provide income in retirement to substitute or supplement the age pension. Superannuation is not a vehicle for tax minimisation, unlimited wealth accumulation or estate-planning purposes.”

Really? How many people with over $1 million in their SMSF reference the age pension as an objective and do not consider super as part of their estate planning?

A system few people fully understand

Since the Superannuation Guarantee was introduced in 1992 to address Australia's retirement income needs, it has become progressively more complex. Through preservation ages, salary sacrifices, preserved, restricted non-preserved and unrestricted non-preserved, non-concessional and concessional contributions, reversionary pensions, surcharge taxes, co-contributions, segregation, sole purpose tests … and on it goes, we have a structure that most people disengage from, despite it increasingly representing the second-largest part of their total assets.

The most recent changes are widely considered to be the most significant and complex in at least a decade, adding to the minefield of jargon and confusion. SMSF specialists, financial advisers and accountants have never been busier, with one presenter calling the new rules, “the gift that keeps on giving”. And at the time of writing, only about 128 days to work it all out.

I doubt all this expensive advice work is what Paul Keating meant when he said the super system was up and “ready to rumble”. Let’s leave the final words to Minister O’Dwyer:

“And it does mean the system must be the best it can possibly be.”

Graham Hand is Managing Editor of Cuffelinks. He attended the SMSF Association Annual Conference as a guest of the Association. The quotations at the start come from a new book, ‘Keating’s and Kelty’s Super Legacy: The Birth and Relentless Threats to the Australian System of Superannuation’ by Mary Easson.