Parents are often uncomfortable talking to their adult children about personal matters, but there are many benefits in having such a conversation. It should include our investments and more generally, our goals and plans.

My wife and I first did this some years ago, when I decided to graduate from full-time work. Most retirees find, after time passes, that it’s useful to repeat the exercise, as circumstances change and nothing ever works out quite how you projected. It then could become the year's most important focal point.

I realise that some families, particularly in generations past, have found it difficult to discuss personal details at this phase of life with their adult children. Neither my wife nor I ever had such a conversation with our parents.

Our first talk

Our first effort with our own children has gone down in family history as ‘Dad's Decumulation Talk’. Yes, as you might guess, I did most of the talking. Just before we started, my wife placed a cartoon in front of me. In it, there’s a family sitting around a kitchen table. The youngest one’s head barely comes above the table. And Dad is saying: “Before we begin this family meeting, how about we go around and say our names and a little something about ourselves.”

I got the message: “Remember you’re their father, not a businessman.” I’m told I conducted myself appropriately. It became a bonding experience in the family, and we’ve been able to discuss financial matters with our children, our matters and theirs, ever since.

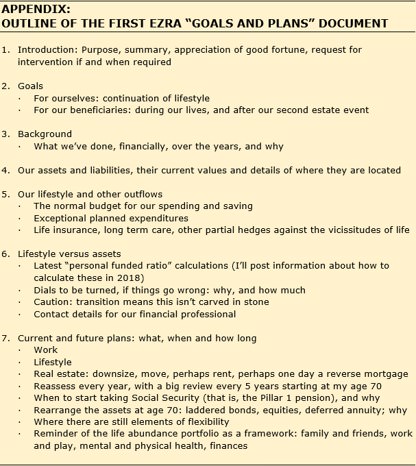

At the time I gave them a document entitled “Goals and Plans,” which we prepared to give them enough background that, if and when the need arose, they could be confident about making decisions for us.

I’m including an outline of what our document contained as an appendix, as some people asked for it when I mentioned it in a talk.

The following is not meant to be a comprehensive list or a substitute for talking to your legal and financial advisers. When I refer to your adult children or other close family members, that’s a generic way of saying ‘whoever it is that you’d like to have take charge of your affairs, during or after your lifetime’. That might be a professional or a financial institution.

I’ve found it helpful to think of three dimensions regarding the information to be shared.

1. Where the important documents are

The first is a list of important documents and where they are to be found, preferably in one place, known to your children. This includes government-issued documents relating to your identity (birth, marriage, citizenship etc.) Include in this information regarding assets and liabilities, such as home ownership, cars, bank accounts, savings bonds, credit cards, life insurance, savings plans related to work or retirement, other invested assets, and other miscellaneous things you own.

There are also important legal documents under this heading, such as your will, powers of attorney, and advance directives, like a living will, medical power of attorney, end-of-life instructions, and so on. And contact details of important people, not just professionals like your doctor, your lawyer, your financial professional, but also close friends and relatives.

It’s often said that many people die without a will. My father-in-law, who was in the insurance business, told me that everybody already has a will. A will is a document that says what will happen to your estate after you’re gone. The law says what will happen, if you haven’t written your own document. So think of the law as your will. You do have a will, no matter what you think – it just may be that somebody else wrote it for you. Better to override it with your own wishes!

2. Sharing goals and plans

The second dimension relates to levels of involvement. (I found this at Anderson Elder Law, in an article in their Resources section dated 24 March 2015.)

The least involved level is where your children know where to find the information mentioned above. Next, you may want to share some of the actual information with them, such as your finances and your will. Once you start doing this, you will probably want to repeat the exercise periodically, as we now plan to do. At this stage you’re still in full control. It may later become necessary for them to assist you, or to share responsibility for your affairs, or to take over that responsibility completely.

A friend who is going through her own parents’ late phase of life reminds me that, in that phase, the relationship between parents and children can change completely. The parents need the children, rather than the other way around. The parents can become fragile and susceptible, and easy to be taken advantage of. The children worry about the parents and have to soothe them. My friend adds, feelingly: “I don’t know what I’d do if I couldn’t trust someone to take care of me …”

No doubt, therefore, you will have consulted your children before making the required arrangements and got their agreement to whatever goes into the relevant documents. And you’ll have given them a list of the medications you take and ensured that your professionals know they should consult your children and where to find them. It can provide great peace of mind to know that all of this has been discussed before the need for the arrangements to be carried out ever arises, even if one day you may not remember ever having done this.

It's peace of mind not only for you but also for your children, who may be worried about whether they'll have to support you financially at the end. For your children's sake, don't leave this conversation so late that your mental capacity is declining.

3. The ‘estate event’ (otherwise known as death)

The third dimension involves saving trouble for your executor after your estate event. (I was amused to discover that American insurance agents don't like talking about death. Instead, they refer euphemistically to your ‘estate event’.)

Some wills are hotly contested by family members who can’t stand one another. You may not be able to solve this conflict while you’re alive. The angst that it may be possible for you to spare your executor arises from dividing up your personal possessions or leaving clear instructions about how to divide. Paul Sullivan (in his Wealth Matters column in The New York Times on 15 April 2016) wrote:

“… just think for a second what it would be like on Christmas morning if your children ran downstairs and there were all of these presents, bright and shining, big and small, but with no name tags on them. Can you imagine the free-for-all that would ensue?”

Don Ezra has an extensive background in investing and consulting and is also a widely-published author. His blog posts at www.donezra.com focus on helping people prepare for a happy, financially secure life after they finish full-time work.