When financial historians reflect on 2020, they will probably focus on a few stock stories that capture the zeitgeist of our age. Tesla is sure to be on the list. It is the embodiment of several unsustainable dynamics that characterise today’s markets.

In some ways, the Tesla bubble is more about investors and our economic environment than it is about the company. The faith in market efficiency, the focus on being ‘green’, the fear of missing out, and the increasing power of storytelling by celebrity leaders have created fertile ground in which the Tesla bubble took root and grew. I believe it is about to burst.

How did we reach this point?

But before articulating why I think so, let’s understand how we got here. When it comes to bubble-spotting, context matters.

The first dynamic that enabled the Tesla bubble to blow is the widely-accepted faith in market efficiency and passive investing. As fewer and fewer professionals actively consider the merits of a company’s prospects, stocks become disproportionately driven by capital flows. Stocks disconnect from fundamentals as pricing distortions are compounded by momentum-driven algorithms and traders. Further, as hedge funds have been vilified and have shrunk as a percentage of the market, the useful price-discovery role played by short-selling has been diminished.

This is a dynamic likely to get worse as the passive investing bubble continues to inflate. Relatedly, interest in environmental, sustainability, and governance (ESG) matters has grown rapidly. Yet the availability of ESG investment opportunities has not grown as quickly, leading those with ESG mandates to focus on fewer and fewer investments. In the quest to invest in ‘sustainable’ companies, many investors have stopped thinking about prices, creating unsustainable investments.

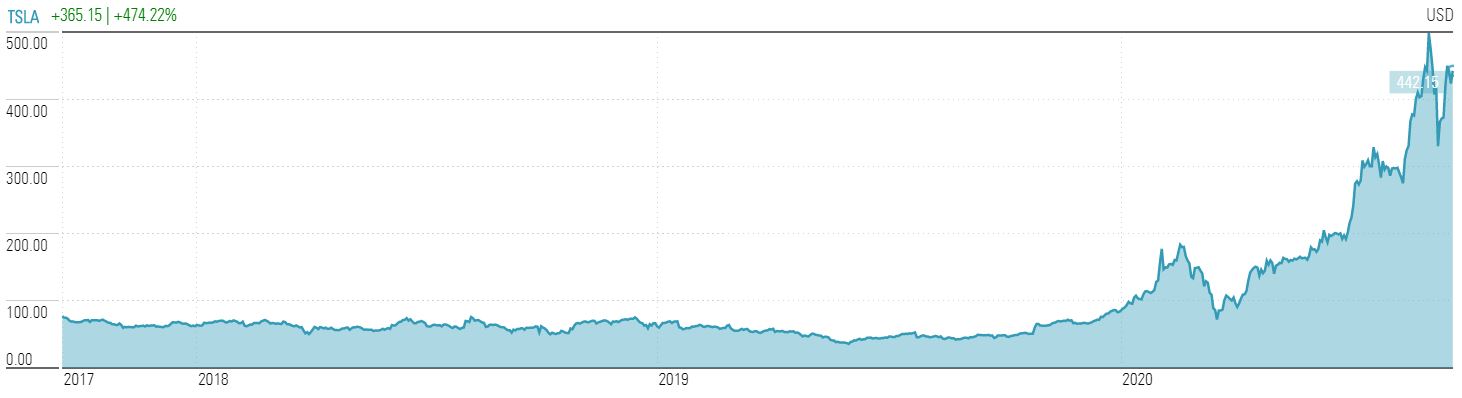

Second, the rise of social media has exacerbated the dreaded ‘fear of missing out’ (FOMO). Individuals and portfolio managers alike are uncomfortable with contrarian and independent thinking. Greed has come to trump fear. Everyone wants to keep up with the Joneses, either personally or professionally. Such a dynamic is easily spotted when higher prices incentivize, rather than reduce, the number of new buyers. Consider the fact that Tesla is worth 10x what it was around one year ago. Fewer and fewer investors are worried about downside risks.

Source: Morningstar, as at 18 September 2020

Lastly, stories have come to trump reality in many walks of life. Like the movie Wag the Dog, sentiment can and is manipulated to create perceptions that often differ radically from underlying reality. Celebrity story tellers in business and government come to wield enormous power over cult-like followers. This tends to generate highly polarized groups that blindly follow or routinely criticize. Facts matter less in our post-truth society. Nuanced and critical thinking have been replaced by unquestioned faith.

As fewer investors think for themselves, the bubble has grown to concerning levels and a five-lens framework I’ve developed to spot bubbles before they burst points to imminent risk.

1. Price action

My first lens is price action. The stock’s parabolic rise to $500 per share ($2500 pre-split) is the result of individuals buying without regard to price. This may be hedge fund managers covering shorts or individual traders planning to buy high and sell higher. As the FOMO music plays, investors continue to dance. The music appears to be slowing, if not stopping.

2. Mispriced or misallocated capital

Evidence of mispriced or misallocated capital is my second indicator. And here, global central banks have penalised savers and rewarded those with ongoing capital needs. Tesla has tapped capital markets numerous times (including a recent offering) over the past year and achieved a $400+ billion valuation, making it worth more than Walmart, Procter & Gamble and JP Morgan. When money is mispriced, it tends to be misused and enables unsustainable business models to thrive. Further, as the share price rises, the company’s cost of capital falls, enabling investors to justify higher prices.

3. Misplaced vision

Almost every bubble has a sexy new story associated with it that allows investors to envision a fantastic new world that lies ahead. Tesla’s 'new new thing' is autonomous driving and the vision that CEO Elon Musk paints of robotaxis taking over transportation is one that captures the imagination. Add on top of this the allure of the recently announced US$25,000 electric (autonomous) vehicle, and you’ve got a strong cocktail. Investors are giddy with optimism.

The vision is so seductive that analysts reach inordinately far into the future to justify today’s prices. Several analysts now have valuation-based models using operating assumptions in 2030 (or beyond) to justify today’s prices. Between now and then, rapid growth is assumed to be certain. Hope turned to expectations which in turn are now assumed to be virtually certain. Competition (and lots of it) appears on the horizon. Yet headlines like 'Why Tesla could become the world’s first US$10 trillion company' capture the spirit of the times. There is widespread belief that 'it’s different this time'. It rarely is.

4. Government policies

The fourth sign of a bubble about to burst is political manipulation of underlying demand. And in this regard, the impact of subsidies has proven that Tesla demand has been impacted by government policies. A quick glance at California and the Netherlands demonstrates that demand can and does plunge after subsidies end. Demand has been artificially elevated by political actions. Further, because owners of electric vehicles don’t contribute to the Highway Trust Fund but use the same highways as the contributing gasoline car drivers, the cost of operating a Tesla is being indirectly subsidised. Lower subsidies will reduce demand, particularly if the economy slows further.

5. Popular sentiment

My final indicator is one about popular sentiment. Think of a financial bubble like an epidemic, one spreading through a population. One key variable to watch in gauging the maturity of a bubble is the population of still ‘infectable’ individuals. And with respect to Tesla, the question is about popular sentiment. When cocktail party banter and dinner conversations turn to a topic, the universe of new buyers is likely dwindling. The fuel to pour on the fire is running low. Everyone is talking about Tesla.

The recent surge in advance of the stock split suggests amateur investors are a driving force. Others, eager to join the party, justified purchases as a trade to profit from the company’s inclusion into the S&P 500 index, a hope that failed to materialise. While games can and do go into extra innings, Tesla appears to be a ninth-inning bubble.

Some have suggested Tesla should be thought of as similar to Amazon during the internet bubble. But let’s not forget that Amazon stock fell from over $105/share to under $6/share as the internet bubble burst. It took almost a decade for the company’s share price to again cross the $105/share value. Even if Tesla does achieve its grandiose ambitions, its stock appears to be way ahead of itself. Musk himself seemed to suggest this very fact, highlighting during Battery Day this week that the company is not as profitable as its valuation may suggest. Like Amazon, Tesla may prove to be a wildly disruptive and successful company that changes the world, but that does not make it a promising investment today.

Distancing from popular sentiment

Investors need to step back and think for themselves, free and clear of the popular sentiment that surrounds them. When I did so, it led me to short Tesla’s stock and buy put options. Some may argue I’ve written this piece because of this economic exposure, but such logic is flawed. I’m betting against the company’s equity because of my arguments in this article, not the other way around.

Vikram Mansharamani is a Lecturer at Harvard University and the author of "Think for Yourself: Restoring Common Sense in an Age of Experts and Artificial Intelligence" (HBR Press, 2020). He is also the author of "Boombustology: Spotting Financial Bubbles Before They Burst" (Wiley, 2019) and previously taught a course on Financial Booms & Busts at Yale University. This article is general information and does not consider the circumstances of any investor. A version of this article previously appeared in Newsweek.