Most of America’s largest companies grew explosively from small minnows into global giants in just a couple of decades or so. In Australia, this small-cap to large-cap experience is relatively rare. Our stock market has been dominated by the same old low-growth giants for more than a century.

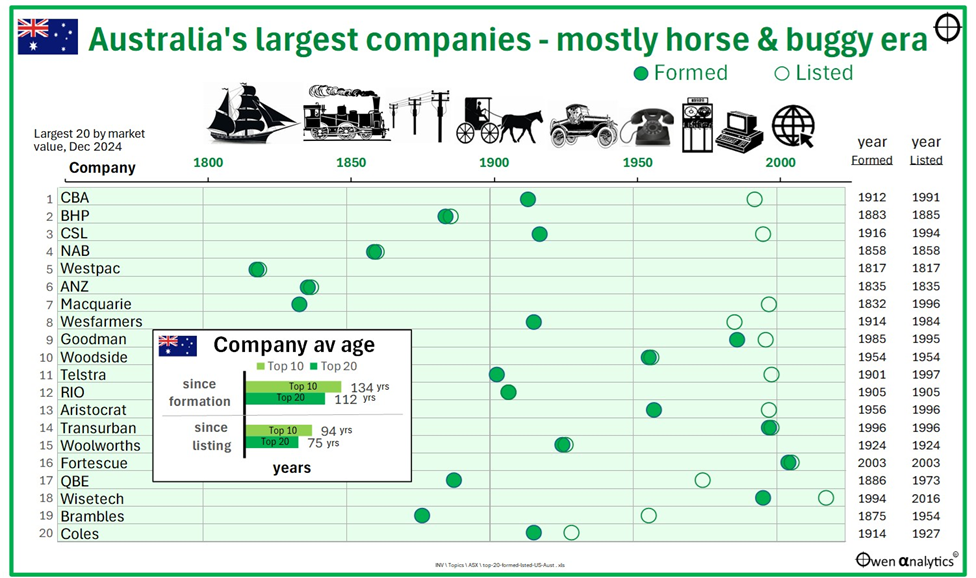

Here are Australia’s 20 largest listed companies (as at start of 2025) – showing the year of their formation (filled circles) and stock exchange listing (hollow circles). Most of them are from the horse and buggy era.

Only one company is from the current century – Fortescue (the company was actually listed in 1987 as Lake Raeside NL, but Andrew Forrest took over the tiny shell in 2003, changed its name to Fortescue Metals, and embarked on his grand iron ore adventure, so I credit its ‘formation’ as 2003).

Macquarie Bank is a re-named and spun off branch of London parent company Hill Samual, originally formed in 1832 in the same banking boom that spawned the three forerunners of ANZ, which were also formed and headquartered in London.

Only four are from the computer era, but only one of those – Wisetech – is actually a computer era business. Fortescue digs rocks, Goodman builds and manages warehouses, and Transurban builds and operates toll-roads. Nothing wrong with that, but hardly high-tech or globally scalable.

The rest are mostly from the first half of the last century or relics from the century before that.

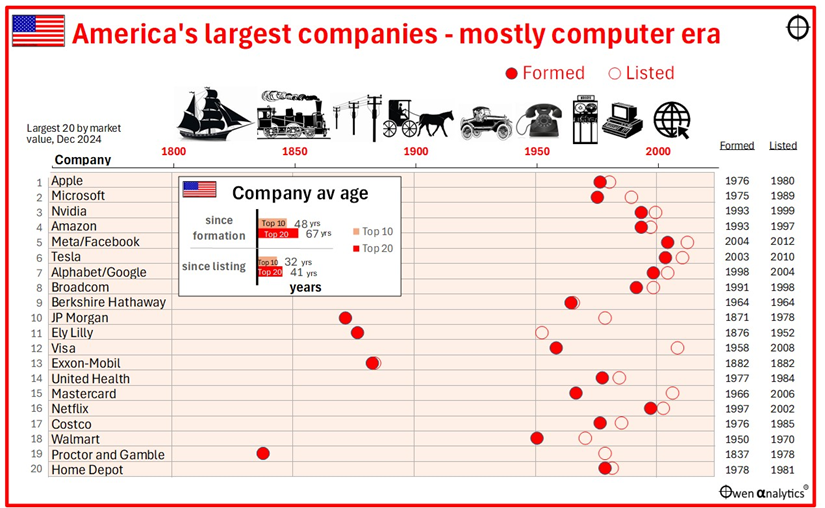

Now let’s take a look at the same picture for the largest 20 listed companies in the US. Most are the product of the modern computer age. In fact, these are the companies that created, shaped, and defined the modern global computer age:

Here is how they shape up:

Mature (aging, decaying), low-growth dinosaurs

In Australia, eight of the largest 10 companies, and 14 of the largest 20, are more than 100 years old.

They potter along, relying on domestic population growth as their main source of growth. They entrench their dominant positions by gobbling up younger, innovative challengers, and use their oligopoly pricing power to extract profits by punishing suppliers and crushing remaining competitors.

For a bit of excitement (and ‘free’ overseas trips for execs and directors), nearly all of these Aussie giants have embarked on grand, ego-boosting overseas adventures from time to time, with almost universally disastrous results, so they inevitably retreated back home to Australia. The only rare exceptions to this overseas failure rule have been Macquarie, Aristocrat, Brambles, and CSL (although the jury is out on Vifor, its largest overseas adventure).

To have survived from the horse and buggy era to today, they have stood the test of time, through world wars, economic depressions, inflation spikes, deflation, enormous upheavals in global trade patterns, geo-political shifts, local political crises, countless recessions and boom/bust cycles along the way.

Long-term survival through all of these changes and crises required fairly conservative, unimaginative management most of the time, low or moderate debt levels, not ‘betting the house’ on rash projects or expansion plans, and more than a little political lobbying to protect their cozy domestic positions.

Founders’ vision and drive

Unlike the centuries-old Aussie dinosaurs, most of the US giants are still largely driven by their founders’ vision and drive. seven out of largest 10, and 10 out of largest 20 US companies are still founder-led, or their founders still have sizable/influential stakes.

In Australia it is just one out of the largest 10 (Goodman), and three out of the largest 20 (Goodman, Fortescue, Wisetech).

In the Aussie dinosaurs, the CEOs are hired help with no skin in the game (they are gifted truckloads of free shares and options, they did not sell their houses and put up everything they own). Then they are given just five years (at best) before they are turned over, so there is no time or patience for long-term visions or plans.

Their boards are stacked full of well-meaning accountants, lawyers, and other independent directors where ‘governance’ rules deliberately prevent them from having any actual experience or interest in the company, suppliers, customers, or competitors.

‘Founder problem’ -v- ‘Agency problem’

We have a few examples of the ‘founder problem’ – (eg Wisetech, MinRes, FMG), because visionary, laser-focused founders are often mad, flawed geniuses. That usually comes with the territory.

But we have a much larger ‘agency problem’ – where the lack of visionary, driven founders results in a situation where short-term, manager-CEOs and independent boards with no deep knowledge and no real skin in the game are not aligned with the interests of the owners of the business.

Personally, I would back a diversified bunch of visionary founders with real skin in the game and everything they own at stake, over decaying dinosaur companies with short-term, visionless, ridiculously over-paid, revolving-door, manager-CEOs, supervised by well-meaning but ineffective, ‘professional’ directors who sit on the boards of half a dozen companies from unrelated industries, with deep expertise in none.

What about returns?

The remarkable thing is that the overall stock markets in Australia and the US have delivered almost exactly the same overall returns to shareholders over the past century – total returns averaging 6.5% per year above inflation in each market. See: Australia v US share markets – it’s our turn next!

In Australia it has been the same dominant banks and miners for the past 100+ years (with a fair bit of consolidation within both industries culminating in the companies we see today).

However, in the US it has been a continual process of innovation, change, and renewal. Some of the leaders of a hundred years ago are still around today but are relatively small now (eg General Electric, US Steel) and/or have been chopped up (eg. Standard Oil, and the Baby Bells). In between, there has been a succession of RCAs, Fords, GMs, Kodaks, DuPonts, Hewlett-Packards, Dells, and IBMs, etc that have grown, dominated, but then been overtaken and replaced by the next wave of newer, better ideas and companies within a few decades.

Returns on equity, re-investing for growth

In this endless process of innovation, growth, and renewal, the US market has delivered double the average returns on shareholders’ equity than the Australian listed company market. In the US market, aggregate returns on equity have averaged 14% pa this century, and is currently running at 17%. That is well above the cost of equity capital (around 10%), so they have created value for their owners.

Returns on equity for the Australian market have averaged just 8% pa this century, and is currently running at 7%, less than half that of the US market. This should be a national scandal. Any company that has a return on equity consistently below its cost of equity is destroying value and should simply be closed down and the money handed back to shareholders.

Earnings per share growth comes from investing in the future. US companies, on average, retain more than 50% of their profits to invest for future growth (and buying back shares, which reduces the number of shares and boosts earnings per share), but Australian companies retain less than one third for growth, and pay out the rest in dividends.

The next 100 years?

If we were to fast-forward one hundred years into the future – I reckon many or most of today’s ASX top 10 will probably still be in the top 10 in 100 years’ time (just as they were 100 years ago).

But I reckon it’s a pretty sure bet that the US top 10 companies will look completely different to the current set, not just in the next 100 years, but probably in just 20 years. Then change again in the 20 years after that, then change again in the 20 years after that.

The current US top 10 will probably be overtaken by a whole new set of global leaders, just as the Apples, Microsofts, Nvidias, Amazons, Googles, Facebooks, and Teslas of today grew rapidly from small caps into global giants by replacing the previous incumbents that dominated only a couple of decades before them.

I would rather invest in innovation, growth, and renewal any day. Bring on the future and let’s see!

Ashley Owen, CFA is Founder and Principal of OwenAnalytics. Ashley is a well-known Australian market commentator with over 40 years’ experience. This article is for general information purposes only and does not consider the circumstances of any individual. You can subscribe to OwenAnalytics Newsletter here. Original article is here: Australia – land of horse & buggy era dinosaur companies. Where is the innovation, growth, renewal?.