Megatrends, super cycles, AI, technological disruption. They’re some of the buzz words continuing to drive more investors into the most crowded parts of global equity markets.

Attempting to be on the right side of structural growth is not misguided. But the loudest, most crowded, and generally most expensive parts of equity markets have not always been the right place for the capital growth and capital preservation needs of long-term investors.

Now for some good news. In today’s market there is a somewhat underappreciated asset class that provides tangible exposure to the real structural growth themes that are unfolding globally. It also happens to offer very attractive valuations in the current market.

GLI: The enabler

The Global Listed Infrastructure (GLI) market is a liquid US$3 trillion hunting ground for investors, predominately in developed markets. GLI companies are underpinned by real assets delivering hard cashflows. Assets like railroads, toll roads, airports and shipping ports, mobile network towers and fibre, along with energy utility assets.

When you think about some of the biggest structural growth drivers in markets and economies today – digitization, decarbonization, and mobility – it’s infrastructure that underpins them.

Take energy utilities for example. While some might label these ‘old world’ investments, right now, they are very much underpinning ‘new world’ technologies.

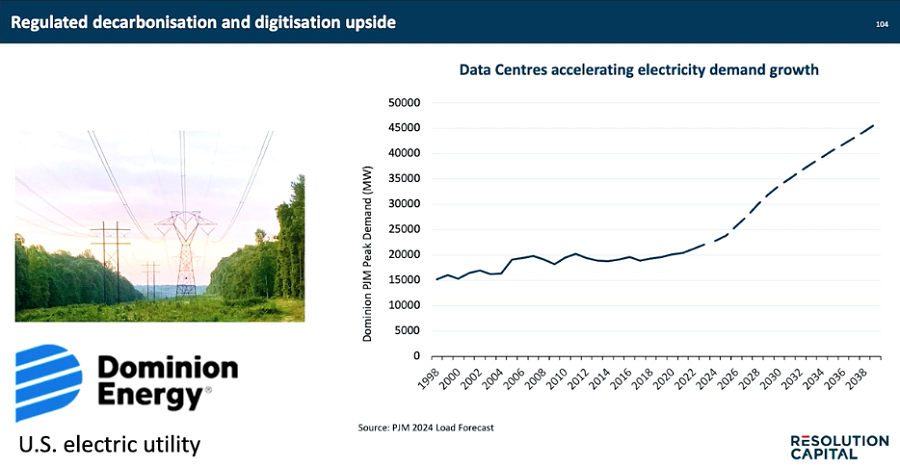

The NYSE-listed Dominion Energy is a great example. The company, a holding in the Resolution Capital Global Listed Infrastructure Fund, is a regulated electric utility and the sole distributor of energy in the US state of Virginia. This utility (like many of its peers) is on the frontline of digitisation and the growth of artificial intelligence.

Digitisation is structural shift that requires unprecedented increases in energy supply. Mostly because datacentres that power AI and machine learning are hungry for electricity.

For Dominion, Virginia is the home of what’s become known as ‘Data Centre Alley’. It has the world’s largest concentration of data centres – more than 300, all with high energy demand. The Alley relies on Dominion’s output.

But while datacentres and their high-flying tech and software customers attract the headlines and big multiples, Dominion Energy is currently trading at just 16.5x next year’s earnings. Those earnings are expected to increase 5-7% p.a. for the next 5 years, and it’s providing a 5% yield.

Not the only source of 'quiet' exposure to structural change

Dominion is just one example of how GLI can provide ‘quiet’ exposure to structural change. Digitisation also benefits communications infrastructure, another large subsector of GLI, and we are finding compelling opportunities in mobile network towers and fibre assets globally.

Beyond digitisation, mobility is another key trend, led by population growth and urbanisation. The likes of Uber and Tesla are some of the big-name stocks that can be linked to structural shifts in mobility. While in Australia, Transurban is another more obvious example. But far less crowded opportunities for exposure can be found in the GLI sector.

The Spanish multi-national infrastructure owner and operator Ferrovial (BME:FER) is a good example.

Among its high-quality global infrastructure portfolio, the company operates the 407 ETR highway in Canada – the world’s first all-electronic open-access toll highway. It provides stronger growth characteristics than both Sydney and Melbourne toll road equivalents, and its tolls aren’t capped, meaning the company can increase tolls above inflation.

Despite this, Ferrovial remains largely underappreciated by the market and offers an attractive multiple relative to the likes of Uber, Tesla, and Transurban.

Structural shifts within the asset class

There are also structural shifts underway within infrastructure investment that we think can provide a big advantage for the listed infrastructure sector.

At a time when government debt is at historical highs and the needs of economies are rapidly shifting, a challenging infrastructure investment gap has emerged. It is estimated this global investment gap could grow to almost $15 trillion over the next decade.

Infrastructure investment has traditionally been the domain of Governments, but private investment is rapidly increasing. The listed market provides the most liquid way to access and finance opportunities. It is an asset class key to filling the infrastructure spending deficit expected over the coming years, and investors are likely to benefit.

Structural growth backed by a compelling track record

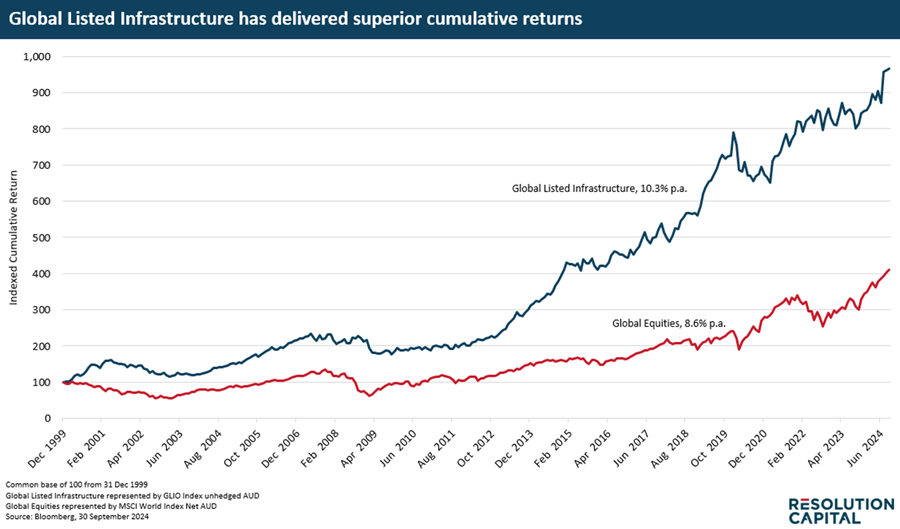

While this article has covered some of structural growth drivers that support the case for GLI investment in the coming years, it’s important to note the asset class has a good historical track record of providing attractive investment returns and risk characteristics.

It might surprise some to learn that since 1999, GLI has delivered stronger total returns than global equities. The chart below illustrates this and shows the power of compounded returns.

This performance has been driven by more consistent and stronger earnings, which result from the attractive investment characteristics of the underlying GLI assets:

- Many are monopolistic.

- They have high barriers to entry.

- They can maintain inflation-protected pricing power (which means over the long term their cash flows are generally not significantly impacted by the economic cycle).

- They generally have resilient demand due to their essential and critical roles in economies and communities.

It may be today’s quiet asset class for exposure to structural growth, but it has also been the great quiet achiever over recent decades within investment portfolios.

Jan de Vos is a Portfolio Manager at Resolution Capital, an affiliate manager of Pinnacle Investment Management. Pinnacle is a sponsor of Firstlinks. Resolution provides exposure to GLI through the Resolution Capital Global Listed Infrastructure Fund.

This article is for general information purposes only and does not consider any person’s objectives, financial situation or needs, and because of that, reliance should not be placed on this information as the basis for making an investment, financial or other decision.

For more articles and papers from Pinnacle Investment Management and affiliate managers, click here.