Investors need to manage different type of risks, including inflation risks and ongoing trade and geopolitical tensions. Building a diverse, multisector exposure to corporates, high yield, and other fixed income sectors can play a part in portfolios that maximise yield and return potential while limiting exposure to market volatility and default risk.

Re-emergence of inflation risk

Looking into 2021, we anticipate strong, if uneven, recovery across regions as the pandemic plays out. The expected availability of COVID vaccines, the reopening of economies, continued monetary and fiscal policy support, and pent-up demand in pandemic-sensitive sectors of the economy should provide a significant boost to demand.

Although our outlook is heavily dependent on a successful and timely distribution of safe, efficient and effective vaccines, we believe that recent approvals and distribution suggest that the end of the pandemic is in sight.

We expect the reopening of economic activity to lead to labour sector recovery, with job growth shifting higher and unemployment rates gradually trending lower as labor force participation increases. We also expect stronger consumption due to heavy consumer spending in certain sectors like travel, given that consumer savings have stayed elevated through the crisis.

Focusing solely on the impact of the COVID crisis on end demand and the labour sector could easily reach the conclusion that inflation may prove similar to the post-GFC ‘low-flation’ regime. But the nature of this crisis is very different from any in recent memory. It’s critical to assess the inflation outlook through the prism of demand, supply, central bank policies and structural forces to achieve a more holistic view.

Demand impact and outlook

Overall, the recession led to increased spare capacity and higher unemployment, which are both deflationary forces. However, the shuttering of supply and huge fiscal stimulus helped temper the downward pressure on consumer prices and provided a bridge for lost wages until global economies fully reopen and lost jobs are restored. Therefore, we believe that slack will have a less meaningful effect on inflation than in previous crises.

Supply outlook

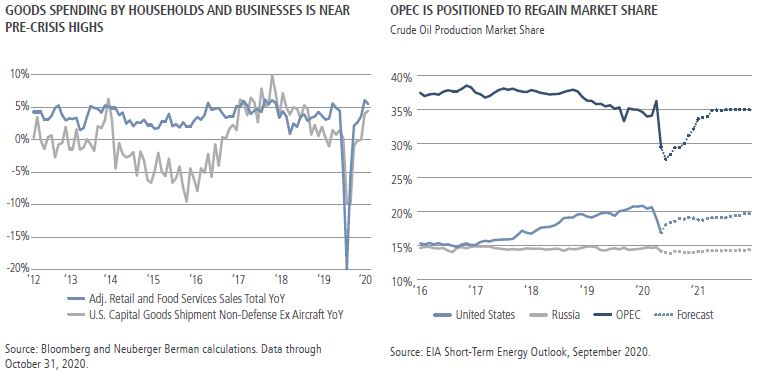

With demand weak, one might assume that goods and commodities prices would remain muted. However, there are signs of an upward shift in consumer goods prices with recent changes in spending patterns. The question is in which sectors these changes could persist, and continue to boost inflation until supply realigns with demand.

Perhaps surprisingly, not only have consumer goods benefited from pent-up demand and rotation to durable goods, but business spending seems to be exhibiting similar trends as well. This is reflected in raw capital expenditure data despite industrial production being below pre-crisis levels, a clear sign that companies are drawing down inventories.

In our view, the reopening of economies post-vaccines should motivate a sharp inventory rebuild by businesses that drives a strong final goods recovery and exerts further strains on the supply of goods in the near to medium term.

The recent pickup in demand for housing further solidifies our thinking that strength in durable goods might be undergoing more of a structural transition than previously thought.

The crisis has also created a long-awaited opportunity for old and traditional oil players to reclaim market share and regain their stranglehold on the supply outlook. OPEC and its partners have been successful in eliminating smaller U.S. shale producers and many survivors have been forced to consolidate with bigger U.S. producers. This leads us to believe in a firmness in oil prices.

Another variable of importance for inflation rates globally will be exchange rates. We expect the US dollar to weaken modestly as interest rates have converged to around zero globally. This should boost the U.S. inflation rate while the rest of the world experiences a moderating impact.

Overall, we think the probability of a ‘cost-push’ positive impact on inflation rates is higher than market expectations.

Monetary and fiscal policy transition

The lessons for central bank policymakers, governments and investors from the GFC were relatively straightforward:

First, central bank policies do not generate inflation but rather provide the channels for inflationary pressures to build and lift inflation expectations. Central bank policies, however, can block these channels and shift the inflation trajectory lower in the event of a policy mistake of tightening monetary policy before it is necessary.

Second, monetary policy in isolation has limitations, but can be powerful when combined with fiscal responses.

Policymakers seem to be taking these lessons to heart, as shown by their response to the current crisis, which has been more timely and larger than during earlier crises. With central banks massively increasing their balance sheets, the argument has been rightly made that increasing money supply by itself is not inflationary, but we believe that combined with other factors it could incentivise ‘green shoots’ of inflation.

Our argument is built on the premise that consumer and bank balance sheets were in good shape coming into this crisis. This has created a low bar to increasing leverage, as we think the unprecedented level of money supply currently in the system could fuel pent-up demand in consumer spending, the creation of small businesses and bank relaxation of loan requirements, all of which are key in generating economic activity and an upward trajectory in inflation.

Clearly, the COVID crisis abruptly tilted the balance of price pressure back toward disinflation. Moreover, the magnitude of current economic slack will continue to create strong headwinds against inflation. While we expect the global recovery to be choppy, with elevated inflation volatility, disinflationary pressures are starting to ease and should gradually reverse in favor of higher inflation, with the potential for a resilient up-tilt in global core consumer price inflation over the next 12 – 36 months.

Three key themes for fixed income positioning

The potential transition to higher inflation represents a significant shift in the economic and market environment.

What could it mean for investors?

We anticipate a calibrated and slow rise in yields in 2021. Overall, we see an investment environment of renewed growth and improving fundamental conditions, combined with increased inflation pressures, but without any significant change in monetary policy as central banks maintain current support in light of ongoing, though potentially fading, pandemic conditions and lockdowns.

As such, we are constructive on inflation-sensitive assets and select credit securities that favour earning carry with minimal duration impact. In our view, this makes COVID-sensitive, non-investment grade loans and emerging market FX attractive.

From a multi-sector perspective, this leads us to three key themes:

- Focus on yield without duration. For investment grade credit, low yields coupled with long durations are creating return risk even with positive credit fundamentals. Portfolios should emphasize high yield, loans and other sectors offering attractive yields with minimal duration risk.

- Protect against inflation. Inflation is likely to increase starting in the second quarter, on the back of pent-up demand and loose monetary conditions. This suggests the potential benefits of global sovereign inflation bonds and non-dollar currencies, particularly in emerging markets.

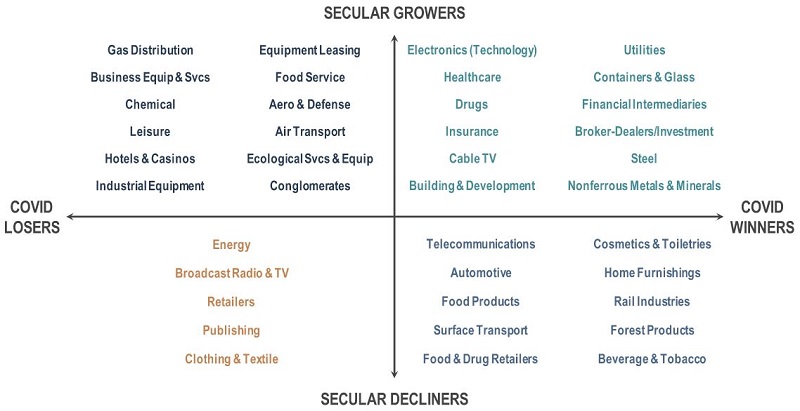

- Sector and security selection rise in importance. Even with the virus likely to fade, we continue to focus on secular winners, as not all “COVID losers” will benefit from vaccines. Opportunities also should develop in sectors that have strong secular tailwinds, but have perhaps faced headwinds from this COVID period.

Sector outlooks

Investment grade fixed income: improving fundamentals

Although 2020 was a year of historic volatility, spread levels ultimately were little changed, with unprecedented fiscal and monetary actions, including low rates, critical to the recovery of credit conditions. These factors, coupled with improving fundamentals and solid technicals, should prove supportive to credit spreads in the investment grade credit market. In aggregate, metrics around cash flow and leverage will likely improve for companies as vaccines are distributed and the economy begins to emerge from COVID-19.

Non-investment grade credit: inflation isolation

Most significantly, the average duration of non-investment grade corporate credit is well below that of many other fixed income alternatives, which creates a positive backdrop for these sectors as a vehicle to earn attractive income with minimal duration risk.

At the same time, we view security selection as the primary driver of relative returns in the non-investment grade universe. So, in considering the outlook for inflation and interest rates, we focus on what it means for individual issuers, sectors and segments of the high yield and loans markets, as well as the relative valuation between the two asset classes.

Research Challenge: Identify Secular ‘Winners’ Coming Out of COVID-19

Source: Neuberger Berman

High yield: interest rate impact and equity correlation

High yield bonds have a higher correlation with equities than with interest rates. While interest rates tend to rise in an economic recovery, issuer fundamentals are levered to that growth and benefit from increasing volumes and pricing power. Furthermore, high yield spread compression will tend to offset any negative duration impact from rising interest rates.

Emerging Markets debt: return to growth

Our base case for continued gradual recovery in Emerging Market Debt (EMD) may hit speed bumps along the way as countries grapple with virus flareups and temporary restrictions, but we believe the risks to the EMD asset class are subsiding. Valuations for EM hard currency bonds remain at reasonably attractive levels, especially in the high yield space. Local bond yields have tightened meaningfully, but we continue to see value in high yielders while EM currencies are still cheap. The yield pick-up offered by EM sovereigns and corporate credits could lead to a sustained resumption of inflows and allocations to the asset class.

Adam Grotzinger is a Senior Portfolio Manager at Neuberger Berman, a sponsor of Firstlinks. This material is general information and does not constitute investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. You should consult your accountant or tax adviser concerning your own circumstances.

For more articles and papers from Neuberger Berman, click here.