The financial media is replete with advice on the new super laws. Advisers, accountants, SMSFs specialists (myself included) and product providers are flat out getting ready in time.

The $1.6 million transfer balance cap is receiving most attention as existing pension balances will be measured on 1 July 2017. If your pension balance is under $1.6 million, you may think you don’t need to worry about it, but what if you and your spouse have over $1.6 million between you?

Importance of dealing with transfer balance cap

In this circumstance, if one of you dies and the survivor wants to keep the assets in the advantageous superannuation environment, the transfer balance cap becomes very relevant.

Check how the pension is structured to be paid out after a death. Under the transfer balance cap rules, where the pension is not ‘reversionary’, but the surviving spouse elects to receive the benefit as a pension, the balance will count towards that spouse’s cap straight away, and that could tip his or her pension transfer balance over $1.6 million. This will need to be dealt with as soon as possible.

In the past, a surviving spouse was able to roll over a pension from a deceased spouse (known as a ‘death benefit pension’) after a specified time period (six months from date of death, or three months from grant of probate). This provision has been removed and it will always be a death benefit pension and unable to be rolled over.

So, if you receive a death benefit pension from your spouse which results in you exceeding your $1.6 million transfer balance cap, the only way to keep the money in the superannuation system is to roll your own pension back to accumulation.

A ‘reversionary’ pension, on the other hand, will not be assessed to the surviving spouse for 12 months from the date of death, buying a bit of time before having to deal with the excess. The same issues arise, but you have a year to figure out what to do.

Correct set-up makes a difference

Hence, setting up the pension correctly while you’re alive can make all the difference to your spouse on your death. Let me put that into a case study to illustrate.

On 1 July 2017, Brian, 76, has an account-based pension valued at $1,400,000, while his wife, Jenny’s, 72, is worth $900,000. Both pensions are ‘reversionary’ to each other.

On 25 July 2017, Brian passes away. His pension is valued at $1,380,000 and continues uninterrupted to Jenny. Technically, Jenny’s total pension balance is now over $1.6 million, however, the reversionary pension will not count towards Jenny’s cap until 25 July 2018, giving her time to consider her options.

Jenny cannot roll over any of Brian’s pension, she can elect to roll over some or all of her pension to accumulation. She decides to roll over enough to bring her transfer balance cap to $1.6 million.

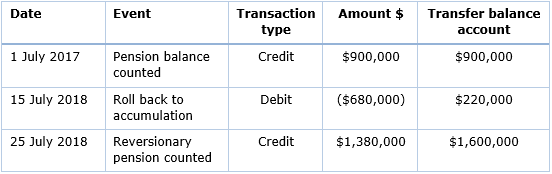

Jenny’s Transfer Balance Cap

Had Brian’s pension not been reversionary, Jenny would have had to deal with this soon after his death, at a difficult time for her. Being reversionary also gives tax free income and capital gains for an extra year. Jenny has time to decide that the assets supporting her own pension should be sold before being transferred to accumulation.

If Brian’s balance was over $1.6 million, Jenny would have no choice but to commute the amount over $1.6 million to a lump sum payment, and transfer her whole balance back to accumulation.

If both partners are still in accumulation phase, what happens if one dies? This is similar to a non-reversionary pension. If a surviving spouse elects to take the benefits as a pension, the value of the pension account will count immediately towards his or her transfer balance cap.

Can anyone be nominated to receive a reversionary pension on my death?

A death benefit pension can only be paid to a:

- Spouse, including de facto and same sex partner

- Person who was financially dependent on the deceased

- Person who had an interdependency relationship with the deceased person, and

- Child, including adopted, step and ex-nuptial, who is under 18, over 18 with a disability, or 18 to 24 and financially dependent on the deceased.

Next time you’re in for an investment review, speak to your adviser about the structure of your pension. It may need some tweaking.

Alex Denham is a Senior Adviser with Dartnall Advisers. Prior to becoming an adviser, she spent 20 years in senior technical roles with several financial services companies. This article is general information and does not consider the circumstances of any individual and is based on a current understanding of the rules.