Eric Marais, CFA, is an Investment Specialist at Orbis investments. He joined Orbis in 2013 and is a member of the institutional client servicing team and retains portfolio responsibilities in the investment team. He spoke to Firstlinks from his San Francisco office. The Orbis Global Fund started in 2005 and holds A$28 billion including $2.5 billion in Australia.

GH: The strong growth market between 2018 and 2021 didn't suit the Orbis style but relative performance has improved in 2022. How do you read the current market conditions for your Global Equity Fund?

EM: Yes, it's definitely better. We’ve seen some recovery of value shares versus growth. What is less talked about is that over the last 10 years, most of the returns in the global index have come from the US. And we’ve been underweight US for some time because we found better value outside of the US as bottom-up stock pickers. So, in addition to value, the other thing that’s changed recently is the US underperformed a little.

(Editor's note: 'Value' investors typically look for shares trading below their estimated intrinsic value, or companies which look inexpensive on metrics such as low multiples of their profits or assets).

GH: It’s been amazing to watch many US companies that did so well in those years up to 2021 are now down so much. About 300 of the Russell 3000 companies are down 80%, not just 20% or 30%, well-known names such as DocuSign and Rivian. And Amazon is off 30%, Meta 50%. Are you seeing any value in the tech or disruptor space now they have fallen so much?

EM: Yes, in technology broadly defined. With some stocks you simply can’t argue that they are expensive anymore – a company like Alphabet that's very profitable, very cash generative, growing much faster than the market, yet trades at a P/E multiple slightly above market level. On the other hand, the Rivians of the world have unproven businesses that received funding.

GH: And despite building hardly any vehicles …

EM: Exactly. The last decade, with its ultralow interest rates, was a perfect funding environment for speculative business models. Many of the stocks that are down by as much as 90% have never generated $1 of free cash flow. It's hard to argue they are cheap despite the sell off. Who knows how those business models will pan out? I'm sure there will be a handful of great stocks in there but the average or median stock will not be great.

We distinguish between ‘promise generators’ like the Rivians of the world versus ‘cash generators’ which are real cash-generating tech companies that trade on reasonable multiples today. They’re starting to look more attractive. We constantly compare them to the rest of the investible universe but less so the unproven ‘promise generators’.

GH: Your Global Fund allows up to 25% in emerging markets. It’s a sector that always seems to have potential but rarely delivers. Has it been a disappointing experience for Orbis?

EM: Lately, yes, but if we take a step back, while buy-and-hold hasn't done well in emerging markets, the returns during recoveries from global crises have been better. We don’t buy regions as a whole - just a handful of stocks.

However, our Chinese shares have suffered in the last year from China’s 'common prosperity' move. One of those, our investment in Naspers, gave us discounted exposure to Tencent so you can see the appeal for a value-oriented contrarian manager. However, that discount has gone even wider in the last year to well over 60%. We’re still excited about its valuation, we still own it, and it’s recovered in recent weeks but we needed to balance the bottom-up view against China country risks. We reduced the position size over the last year to reflect that, which is the most painful thing a contrarian manager can do.

GH: How do you balance such big macro themes, like China, with the merits of individual companies?

EM: We invest bottom up so we almost always start with the specific company first, and look at what has done poorly. Allan Gray, our founder, said that when looking for stock ideas, you should forget about the best-performing half of the market and focus on the worst-performing half over the last five plus years. That’s where our contrarian approach comes from, where we've seen something going wrong. Then we marry that with macro in our risk process because we know big macro risks can impact the whole portfolio.

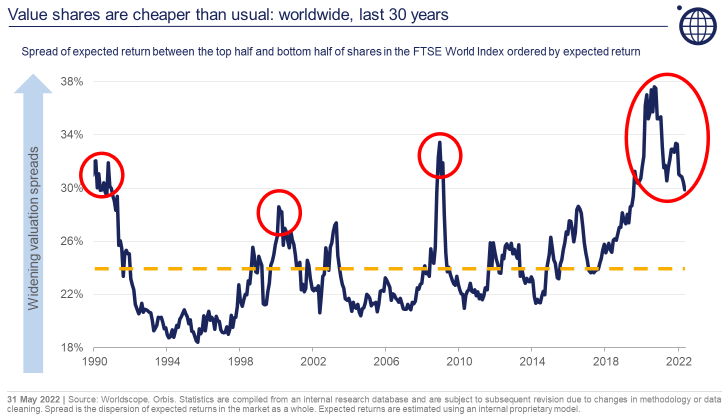

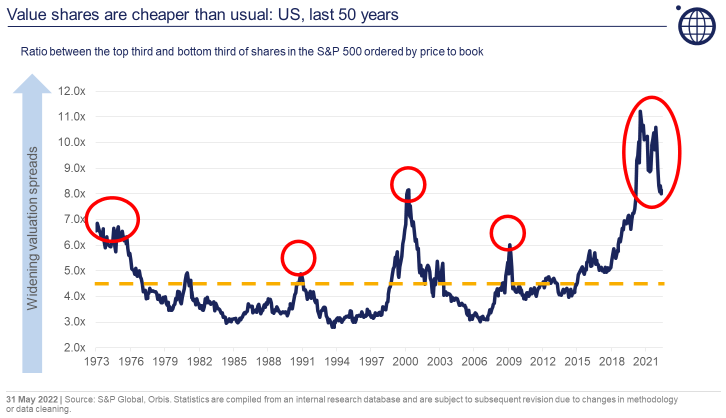

Value shares still look cheap to us, although they were probably cheapest this time last year. One of our internal measures tells us that it's still on par with every extreme except the height of Covid.

GH: Last time I spoke to Orbis, in August last year, the only Australian company in the Global Fund was Newcrest. Why does Australia rank so low?

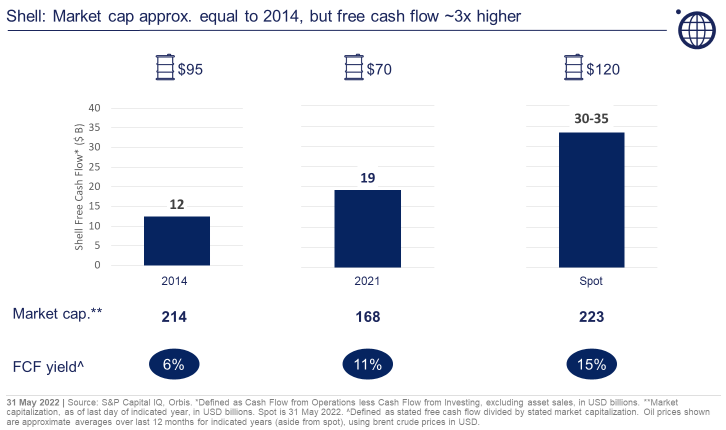

EM: We now own Woodside as well. We have about 3% of the Fund in Australia, or a little more than the global index. The simple answer is that we have a wide opportunity set of about 5,000 companies we can invest in, and we find stocks that are more appealing to us. For example, we also own Shell but an Australian investor might only consider Woodside.

GH: You’ve been underweight US stocks, do you expect that to change in future?

EM: It is a significant underweight of about 20% or so versus the weighting in the global index. Another way to look at it is that we’re underweight technology shares which make up much of the US weight in the global index. So our view is more about the companies than the country and where we find value.

GH: When you talk to clients, how do you explain your contrarian style? Isn’t an emphasis on unpopular companies a difficult story to tell, with the cyclical underperformance that comes from it?

EM: We’re not contrarian for its own sake. We believe that to outperform the market requires a meaningfully different portfolio from the market by doing something different. Adam Karr (President and Head of Investment Team) likes to say "It works because it hurts". We think this is the way to outperform, but it can be challenging to an individual investor’s psyche and not everyone can do it. The firm also needs the right structural elements that allow us to execute the investment philosophy. For example, we are privately held and employ refundable performance-based fees. Our clients are well-aligned and understand our approach.

GH: So do you need a certain type of personality to be an Orbis Portfolio Manager?

EM: I think so, yes. They need to think independently and be willing to look wrong for extended periods of time. Investing our way will go against you, and if you start to feel uncomfortable, that will affect your decision making. A huge amount of our value add comes from sizing up during times when stocks have performed poorly so you want to be in a mental position to lean into things that have done poorly to maximise the benefit when they recover.

GH: A mix of humility and resilience.

EM: That’s a good way to put it.

GH: Is there a stock in your portfolio that you're so confident about that you would expect to own for say 10 years?

EM: 10 years is a big commitment. Outside of marriage and children, I’m not sure I’d go that far. NetEase is an example that we’ve owned continuously for maybe 12 or 13 years. Another longstanding holding is XPO Logistics, which spun off GXO in 2021 and we continue to own both companies. A major reason is that they are run by owner-operators, such as William Ding at NetEase and Brad Jacobs at XPO. XPO is Brad’s third public company. We’ll watch it carefully if he goes for number four.

GH: Final question, is there a theme where you’re seeing good opportunities?

EM: Although energy prices such as oil and natural gas are high, we don’t think company share prices are valued highly enough relative to normal energy prices, and certainly not relative to spot energy prices. For both Woodside and Shell, we estimate they are trading in the ballpark of seven or eight times free cash flow. That looks very attractive compared with their growth prospects which could justify a low teens multiple of free cash flow. We can have a debate about the sustainability of spot prices, but the free cash flow of around 15% is being returned to shareholders, not reinvested in the ground to increase supply. It’s a good setup for shareholders, even if spot prices are not maintained forever.

Graham Hand is Editor-At-Large for Firstlinks. Eric Marais is an Investment Specialist at Orbis Investments, a sponsor of Firstlinks. This report contains general information only and not personal financial or investment advice. It does not take into account the specific investment objectives, financial situation or individual needs of any particular person.

For more articles and papers from Orbis, please click here.