We are at an inflection point when it comes to the outlook for US monetary policy because three macroeconomic realities are colliding that could lead to a sudden tightening by the Federal Reserve over the next 12 to 18 months. The risks for investors are skewed to the downside.

The first macro reality is that asset prices around the world are elevated. Asset prices are not at ‘bubble’ levels but they are expensive. Global stocks and investment-grade and non-investment-grade bonds are at, or near, their most expensive in 20 years. This view shouldn’t take anyone by surprise.

The second is that the world’s major central banks are reducing the support they have provided to markets since 2008. Even if we go back just 12 months, the Bank of Japan and the European Central Bank were conducting asset purchases of US$1.5 trillion a year, which helped keep down long-term interest rates. Nowadays the European Central Bank is winding back its quantitative easing while the Federal Reserve is implementing quantitative tightening. From October 2018, the Federal Reserve will be shrinking its balance sheet by US$50 billion a month or US$600 billion a year. In January 2018, the European Central Bank halved its monthly asset purchases from 60 billion euros to 30 billion euros and it plans to stop purchases by year-end. We will be in a world of no net central bank support for markets. That is a different environment compared with what markets have enjoyed over the past decade. We would expect bond yields to drift higher still.

The third important fact is that the US is injecting fiscal stimulus into a growing economy at full employment. The US budget deficit is rising mainly because of the tax cuts initiated by President Trump that Congress approved last December. The US budget deficit is about 4% of GDP now and is expected to rise to about 4.25% of GDP in 2019 and 2020.

Fiscal stimulus despite full employment

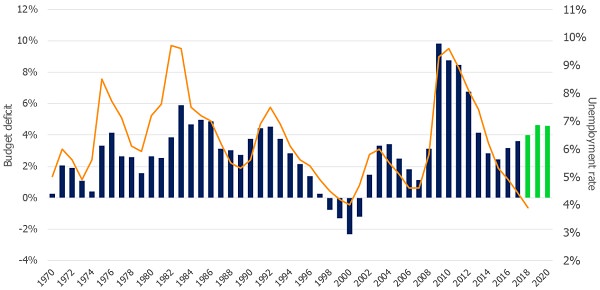

The chart below shows that over the past 50 years, the US federal budget has usually gone into deficit only when the unemployment rate was climbing. For the first time since 1970, the US budget deficit is rising when unemployment is falling. The US jobless rate fell to 3.7% in September 2018, the lowest level since 1969. Other broader measures of US unemployment are dropping too, even if they are not approaching 49-year lows. All the evidence points to a humming US economy, yet policymakers are injecting fiscal stimulus.

US fiscal stimulus arrives when the economy is reaching full employment

(US budget deficit % of GDP (LHS) and US unemployment rate % (RHS) since 1970)

Click to enlarge. Source: Congressional Budget Office, Bureau of Labor Statistics

What does the intersection of these three realities mean for monetary policy?

Two main scenarios could play out

We call the first the Goldilocks scenario. This outcome describes the largely benign situation where no material increase in US inflation occurs over the next 12 months or so. It assumes that average weekly wages growth goes no higher than that annual pace of just below 3% it’s recording today.

But since 1950, there have been only four periods when the US unemployment rate has fallen below 4% and the first three led to higher inflation. We have never seen a multi-year period where the jobless rate remained below 4% and inflation stayed at 2% or below. Yet this is what the Federal Reserve is forecasting for the US economy over the next two years. Under this Goldilocks scenario, the Federal Reserve has indicated that it will increase the US cash rate to 3-3.25% by the end of 2019. If inflation stays low and the Federal Reserve were to implement such a gradual increase in the US cash rate, we would expect the yield on 10-year US government bonds to rise from about 3.2% now to about 4%.

If these events were to happen, it’s straightforward to predict what might happen to global markets. Moderately higher interest rates would be a minor headwind to economies and stocks. The US dollar would probably rise. Investors would probably want to stay away from emerging markets and yield-sensitive stocks. But we don’t see any great disruption for markets. Long-term forces are putting downward pressure on inflation and wages and the Goldilocks scenarios could well play out, something that market prices tell us that investors are expecting to happen. But this is a bet against history.

We don’t have a name for the second scenario. It’s when inflation emerges after average weekly wages growth accelerates beyond a 3% annual pace. If Trump’s tax cuts fan the economy and the labour market tightens we would expect meaningful wages growth to occur in the US. Evidence is already emerging that companies are struggling to contain labour costs so this outcome is possible.

What would this mean for US monetary policy? It would mean that the Federal Reserve is wrong to flag just four more quarter-point increases in the US cash rate over the coming 12 months or so. If inflation were to accelerate beyond the Federal Reserve’s target of 2%, we would expect the central bank to act forcibly to counteract inflationary pressures – Chairman Jerome Powell has said it would. Under the non-Goldilocks scenario, the US cash rate could climb to between 4% and 4.25% and the yield on 10-year Treasuries could rise above 5%. This could happen quickly too. By the second month of reports showing US average weekly earnings growing at an annual rate above 3%, a major reassessment of the tightening of US monetary policy could take place. If this were to happen, a 20% to 30% drop in global stocks is foreseeable.

The probabilities of these market impacts

We put the odds of scenario two taking place at about 50%, the same probability that we put on the Goldilocks scenario. In other words, we don’t know which of these two scenarios is more likely but we are not talking about a 5% probability of market ructions.

Due to these heightened risks, we have maintained a defensive stance in the Global Equity portfolio over this year. We are holding about 18% cash, which should enhance the defensive characteristics of our portfolio and act as a partial hedge against a potential market correction and higher interest rates in general.

Hamish Douglass is Co-Founder, Chairman and Chief Investment Officer of Magellan Asset Management, a sponsor of Cuffelinks. This article is for general information only and does not consider the circumstances of any investor.

For more Cuffelinks articles and papers from Magellan, please click here. You might also like to receive Magellan's Insights direct to your inbox - make sense of the global investment landscape with timely updates, articles and videos from Magellan's investment experts.