The Weekend Edition includes a market update plus Morningstar adds free links to two of its most popular articles from the week, including stock-specific ideas. You can check previous editions here and contributors are here.

Weekend market update

From AAP Netdesk: The ASX gained 1% in a week in which local and overseas investment groups tried to swoop on stocks they considered cheap. Sydney Airport and Spark Infrastructure have so far resisted offers, while Seven Group gained majority ownership of Boral. Meanwhile, US second-quarter earnings season will continue to attract attention next week. The four largest US lenders reported this week and posted a combined $US33 billion in profits. The benchmark S&P/ASX200 index on Friday closed up 0.2%, just short of its record close, 7,386. BHP shares notched a record high of $51.91.

From Shane Oliver, AMP Capital: Share markets were buffeted by concerns about higher inflation and rising coronavirus cases over the past week. US shares fell 1% through the week (S&P 500 down 0.8% on Friday) and European shares fell 0.8%. However, Japanese shares rose 0.2%, Chinese shares rose 0.5% and Australia benefitted from the rally in US shares at the end of the previous week. The gain in Australian shares came despite bad news on lockdowns and was led by utility, material, retail and industrial shares. Bond yields continued to fall. While iron ore prices rose, metal prices fell as did the oil price as OPEC and the UAE closed in on a deal to boost production. The $A fell as the $US rose.

***

Noise. It causes such basic errors in our decision-making (including investing) that a new book from three top-selling US authors is called: 'Noise: A Flaw in Human Judgement'. The examples in the book include wide variations in prison sentences for the same crime and insurance assessors awarding different damages for the same event.

Two key points in the book include:

"First, judgement is difficult because the world is a complicated, uncertain place. This complexity is obvious in the judiciary and holds in most other situations requiring professional judgement … Disagreement is unavoidable wherever judgement is involved. Second, the extent of these disagreements is much greater than we expect."

The authors are no less than Daniel Kahneman, author of the wonderful Thinking, Fast and Slow, Cass R Sunstein, author of the famous Nudge and Olivier Sibony of You're About to Make a Terrible Mistake. That's an impressive trio spending 454 pages on noise.

So with all this noise hitting us every day, we should be forgiven for wondering what the heck is going on in financial markets. Rising virus cases with a new strain amid all-time market highs. Falling long-term bond rates amid rising inflation. Loss-making companies valued in the billions. We have witnessed a year of incredible stockmarket returns, despite headlines on one day saying (see below) 'the Dow's best week since 1938' and '16 million Americans have lost jobs'. As the book says, "the world is a complicated, uncertain place."

Source: CNBC and Seeking Alpha

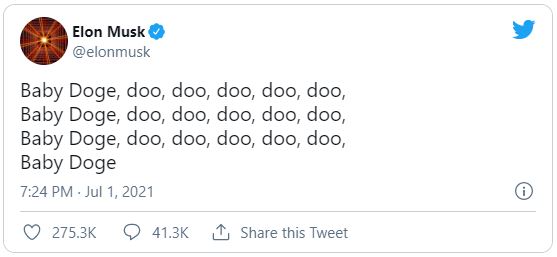

It's a strange time when Elon Musk gains profile by tweeting inciteful messages about nothing, while Warren Buffett's insightful thoughts are criticised because he's 'old school'.

Amid this noise, here are the returns (complied by BetaShares) from various stockmarkets as the pandemic has dominated every new bulletin for the year:

- Everyone's a winner but the US, driven by big tech, was up 41% versus Australia's 28%.

- The worst-performing global sector was that 'safe harbour' in tough times, utilities, up only 13%, and the goods we all need, consumer staples, only 18%. Technology topped the charts at 45%.

- And we are told about Japan's slow growth due to a declining population, up 31%, and 'old industry' Europe up 30%.

The Morningstar chart below places this in a long-term context. In fact, the 30-year average annual returns across Australian equities (9.8%), international equities (8.3%), A-REITs (8.6%) and international fixed interest (7.6%) are surprisingly close. What is not close is the risk involved to achieve those returns, as shown in the standard deviations below. They confirm the cost of the superior equity returns is a need for risk tolerance.

We lead this week with a look at the noise which is distorting asset values with suggestions on how to react. There is an extreme valuation disconnect, suggesting something 'old' and 'new' is happening, where each side does not even speak the same language, never mind have different interpretations. Find out why some young fish don't even realise they are in water.

Then in our white paper section from AMP Capital, Shane Oliver suggests five ways to turn down the noise, saying it is more difficult than ever in a digital age with rapid dissemination of news and opinion.

Last week's article by former leading super consultant, Don Ezra, on his own retirement spending has been viewed over 12,000 times, and many readers offered their own take on not running out of money in retirement.

Tracy Li with Matt Reynolds focus on the main cloud which hangs over big tech companies, the threat of regulatory restrictions on their business. US President Joe Biden has been talking about new rules this week. Tracy's experience in banking and the internet gives us the best summary of the risks I have read.

Still on technology companies, Tim Davies offers three reasons why investors should look for weaknesses in share prices to buy, focussing more on the positives than short-term negatives.

David Knox takes a critical look at the way the Intergenerational report places a cost on superannuation. It's an important argument as influential voices seek to control the growth of super.

There is no more important sector in Australian stockmarkets than the banks, especially the Big Four, and Tariq Chotani picks favourites including the vital factor to watch for. Some have it, some don't.

Then Francyne Mu says that in her years of studying the ability of management to focus on a business, 'pure play' and 'best-in-class' companies are better at managing a range of risks than less-focussed conglomerates.

We have covered the Your Future, Your Super legislation in detail, such as here and here, including doubts about the way it works. But the legislation has received a far more optimistic interpretation in other places, such as Jessica Irvine in the SMH. She wrote:

"I ran the numbers for my super balance of about $300,000 and calculated that if I invested it in the MySuper option of the best-performing fund (and made no further contributions and the 6-year net return was replicated each year) it would be worth about $1.3 million in 20 years. If I invested in the worst fund, it would be worth only $700,000."

Wouldn't it be great if we could ask a super fund or fund manager that had done well in the previous six years to back-date our application. It's such a shame when we actually invest, we don't know which fund will do best in the only time that matters ... the future.

Two bonus articles from Morningstar for the weekend as selected by Editorial Manager Emma Rapaport.

Ethereum has the potential to revolutionise the entire financial landscape, but this cryptocurrency is a high-risk investment asset writes Amy Arnott. And Lewis Jackson speaks to investors about Vanguard's platform fee change. Head of personal investor Balaji Gopal said the new fee structure is designed to help investors make “smart, long term choices” but it could also make small contributions more expensive.

The Comment of the Week must come from my school economics teacher, Paul Coghlan, after my editorial on the need to give students more investing skills. Paul wrote:

"As the teacher who taught you Economics at Randwick BHS back in the mid 1970s, I offer a few observations based on teaching the discipline for almost fifty years. Before the introduction of Business Studies, Economics was the most popular Social Science of the HSC offerings. Prior to this, it became apparent at the HSC marking centre that there was an increasingly long tail of students who simply could not attain a reasonable level of economic literacy. For many students and probably some teachers, Economics had become too challenging. Rather than dumb down Economics, the new easier and more descriptive Business Studies course was offered. A fellow teacher described the new course as being “a mile wide and a foot deep”. The fact that a diminishing, though more able cohort, was studying Economics, meant that it was far more favourably scaled for the UAI was sometimes overlooked by teachers advising students on course offerings in Years 11 & 12."

Don't forget our Education Centre which is brimming with updates on listed investments (see links below), including a new monthly report from Chi-X.

I will be presenting a webinar for the Australian Shareholders' Association on Tuesday 20 July 2021, as shown below. See here for more details.

Graham Hand, Managing Editor

Latest updates

PDF version of Firstlinks Newsletter

Australian ETF Review from BetaShares

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Monthly market update on listed bonds and hybrids from ASX

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

LIC (LMI) Monthly Review from Independent Investment Research

Monthly Funds Report from Chi-X

Monthly Investment Products update from ASX

Plus updates and announcements on the Sponsor Noticeboard on our website