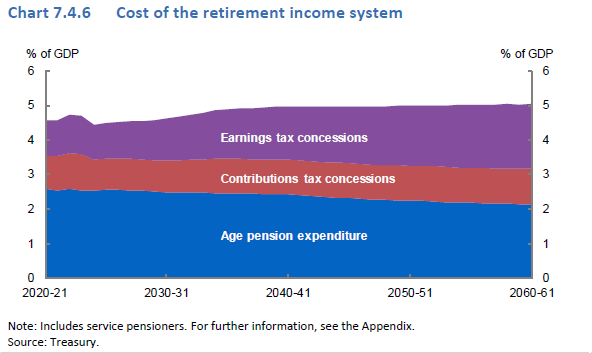

The latest Intergenerational Report (IGR) has reignited the debate about the value of the current superannuation tax concessions by projecting that the cost will rise from 2% of GDP in 2020-21 to 2.9% in 2060-61.

In contrast, the costs of the age and service pensions are projected to fall from 2.7% of GDP in 2020-21 to 2.1% in 2060-61.

In other words, the tax concessions will be worth more than the cost of the pensions, as shown in the following chart from the IGR. This finding is not new as the recent Retirement Income Review found that by 2047, the cost of superannuation tax concessions is projected to be greater than the cost of the age pension as a percentage of GDP.

The IGR raises the valid question as to whether the current superannuation concessions are worth it.

Direct cost versus estimate

Before answering that question, let’s recognise that in comparing the pension costs and the tax concessions we are really comparing apples and oranges. Let me explain.

The age and service pensions paid to some Australians each year are a direct cost to the federal budget, in the same way as health and education costs represent a direct expenditure.

In contrast, the super tax concessions are estimates as they do not represent a direct cost to the budget. Rather, less taxation is collected due to the concessions. The two major concessions are in respect of:

- Concessional contributions, including the Superannuation Guarantee (SG), where the tax paid by most Australian workers is about 15% less than their marginal tax rate.

- Investment earnings received by the super fund where the tax rate is 15% in the accumulation phase and zero in the pension phase.

The value of the super tax concessions estimate the tax forgone as a result of these concessions. It compares the tax actually paid with the tax that would have been paid if both the concessional contributions and the investment earnings were taxed at each individual’s marginal tax rate.

This approach is reasonable when estimating the value of the concessions for this year. However it is unreasonable to use this approach for future years as:

- It does not allow for the reduced investment earnings if the concessional contributions and investment earnings were to be fully taxed.

- It ignores any behaviour change that would occur if the tax concessions did not exist. As the Retirement Income Review noted, individuals may choose alternative savings vehicles. The Review calculated that at the end of four years, the earnings estimate is 14% lower because the earnings on these alternative tax-preferred vehicles are subject to lower marginal tax rates than those used in the original estimate. One can only estimate what the difference would be over decades.

Hence, pension costs are known but super tax concessions are based on a series of assumptions and benchmarks, which may be debated. The value of the concessions does not equate to future revenue gain if the current concessions were abolished.

An investment in the future

Another important difference, is that the super tax concessions are about the future. In effect, it represents the government making a contribution or investment today for the future. As we invest in education for the benefit of our future society, so it is with superannuation. Employers, individuals and governments invest money today for the benefit of both future retirees and future taxpayers.

While the benefit for future retirees may be obvious, the benefit to future taxpayers is equally important. As noted above, the cost of the age and service Pensions is reducing, when expressed as a percentage of GDP, even though we have an ageing population. As the IGR noted,

"As younger generations retire with greater superannuation savings, the total proportion of older Australians receiving the age pension will continue to decline.”

Indeed, a Senate Committee has previously recommended that this future saving should be calculated but this has never been completed.

The age pension costs and super tax concessions represent two very different forms of government support for our retirement income system. As Treasury notes, the value of super tax concessions “are not estimates of the revenue increase if a variation to the tax benchmark were to be removed.” Adding these estimates of an uncertain cost with a known cost of the current pensions is both unhelpful and misleading.

Finally, it should be noted that regardless of how the cost is calculated, the government’s financial support of the overall retirement income system does not exceed 5% of GDP for the next 40 years. That is financially sustainable as this figure is approximately half the average projected level of public expenditure on pensions for OECD countries in 2050. We are indeed well placed.

Let’s recognise that both the age pension and superannuation tax concessions represent important elements within our retirement income system. Let’s have some stability by not subjecting either to significant change in the forthcoming years which will also improve community confidence in the overall system.

Dr David Knox is a Senior Partner at Mercer. See www.mercer.com.au. This article is general information and not investment advice, and does not consider the circumstances of any person.