The Weekend Edition includes a market update plus Morningstar adds links to two recent stock pick highlights from the week.

On most days, months, even years, not much truly memorable happens, good or bad. I don't mean nothing interesting or enjoyable ever occurs - we do remember milestones like weddings, birthdays and holidays, etc - but daily living does not stick in our minds. For example, if you are 65 years old today, happy birthday, you have lived 23,741 days. And while you have many memories, you have no recollection of anything from the majority of those days. Who recalls what they did on the weekend a few months ago, never mind 20 years?

But in 2042, we will remember 2020 and 2022. Two years ago, on 11 March 2020, the World Health Organisation declared a global pandemic. And on 24 February 2022, Russia invaded Ukraine. We have seen wars before, but for generations, not one which threatens a nuclear escalation between super powers or even World War III (as the US President warned last week if the US air force closes the skies over Ukraine).

We are living through history, and aside from the terrible human consequences, both these momentous events will change the way we live and perceive the world. Few people at the start of 2020 had an inkling of the impact of a pandemic or a major conflict, nor the climate change effect on the bushfires that were raging and the floods about to come.

Inflation is far higher than anyone expected a few months ago, and the oil price which feeds into the costs of many goods is highly volatile around high levels. This is a genuine oil and energy shock which almost guarantees sustained inflation and higher interest rates for longer, and nobody knows how it will play out. New models for globalisation and world trade challenge many of our assumptions about how markets work.

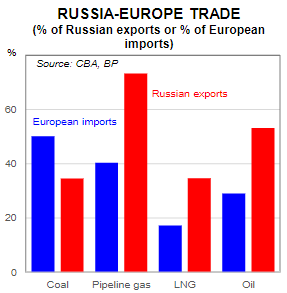

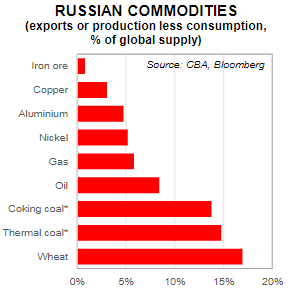

These two charts from CBA Economics show Russia's significance in energy supplies, and commodities generally.

Robert Reich is an American economist who served in the administrations of Presidents Gerald Ford and Jimmy Carter, and was US Secretary of Labor from 1993 to 1997 under Bill Clinton. He is currently a Professor of Public Policy at the University of California, Berkeley. He writes a regular newsletter (which will not be everyone's cup of tea) and in the latest edition, he identifies six things that he assumed about the future which he now believes are false:

1. Nationalism is disappearing.

2. Nations can no longer control what their citizens know.

3. Advanced nations will no longer war over geographic territory.

4. Major nuclear powers will never risk war against each other because of the certainty of 'mutually assured destruction'.

5. Civilization will never again be held hostage by crazy isolated men with the power to wreak havoc.

6. Democracy is inevitable.

That's quite a list of lost assumptions from someone who sat near the top seat of global power for so long. It makes guessing about the direction of markets, inflation and interest rates appear as banal as most forecasting actually is.

(This week's article by Phil Ruthven also examines this turbulent time).

Notwithstanding, we need to invest and that often requires a forecast. The threat of a recession and stagflation has increased and supply chains will take time to adjust. In the US, petrol over US$5 a gallon and over US$100 to fill a tank feeds into consumer confidence and inflationary expectations, akin to a massive tax increase, especially when combined with rising food costs and other energy increases. Society relies on relatively cheap energy and this will not be replaced by renewables any time soon. For all the future promise, it is estimated that solar and wind provide less than 4% of Europe's current energy needs with negligible battery storage capacity.

To add a brighter note, here's an extract from Future Crunch, a blog that finds good news in the main stories of the day.

"The invasion has brought a wartime energy transition to Europe. The continent’s decades-long timelines for overhauling energy systems that support 440 million people is now being revved up under extraordinary duress. The European Commission has already released a plan to cut most of its reliance on Russian gas by the end of this year, which is insane, considering the continent got 40% of its gas from Russia last year. As the EU's Green Deal chief, Frans Timmermans said, “We are now protecting our vital interest."

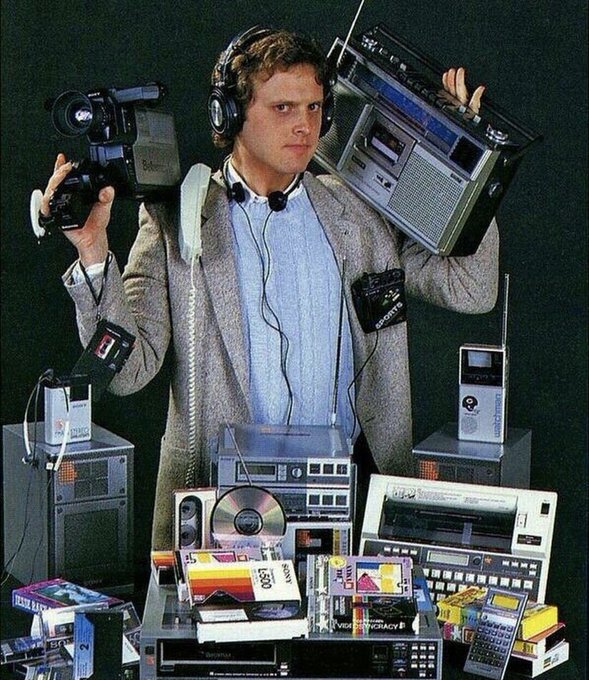

And still in a lighter mood on the subject of change, most of us are old enough to remember buying the gear below individually, and in this photo, all the stuff was made by Sony. Now a smart phone can do all this and more. Anyone own a Sony phone?

Like Nokia, Blockbuster and Kodak, Sony was once at the leading tech edge. In 2000, Sony was valued at over US$100 billion or five times Apple. Sony's market value is now about US$80 billion while Apple is the world's most valuable company by market cap at about US$2.5 trillion. Indeed, times change.

Graham Hand

***

Weekend market update

From AAP Netdesk: A late spike on the Australian share market has ensured its best week in more than 12 months, despite no end to the war in Ukraine and a string of US rate rises forecast. Materials and energy shares powered the indices for much of Friday and helped produce a third consecutive day of gains.

The ASX gained 3.3% over five days in which the US Federal Reserve raised rates for the first time since 2018, and projected six increases to come this year. Financial and technology stocks were the better performing categories this week. They improved by 6% and 7% respectively. Financials were helped by increasing expectations of higher rates.

The Russia-Ukraine conflict continues to keep commodity prices elevated. Oil stayed above three-figures and Brent crude last traded for $US108.69 per tonne.

From Shane Oliver, AMP Capital: The past week saw share markets rebound helped by optimism about a peace deal in Ukraine, a fall back in oil prices, relief that the Fed’s first rate hike was broadly as expected with the Fed seeing the US economy as strong and indications that China will provide more policy stimulus partly to combat covid related lockdowns. This saw US shares gain 6.2% for the week, Eurozone shares rise 6.1% and Japanese shares gain 6.6%.

Have we seen the low in shares? After a 13% top to bottom plunge US and global shares have rebounded cutting the decline to around 7% from their bull market high. Similarly, Australian shares have cut their losses from last year’s bull market high (with the market down 10% to its low in January) to around 4.5%. It’s possible we may have seen the lows, but uncertainty remains high around the war, and inflation is still likely to get worse before it gets better keeping uncertainty high around the extent of monetary tightening. And so far the rebound in shares has lacked the breadth and strength often seen coming out of market bottoms. So, while we remain of the view that share markets will be higher on a 6- to 12-month horizon it's still too early to say we have seen the bottom.

Ukraine-related risks for investment markets remain high in the short term. Ukraine and Russian peace talks seem to be making some progress but reports are conflicting. With Russia under immense pressure economically due to sanctions and with no hope of an easy victory, a peace deal is possible based on a neutral Ukraine and security guarantees for Ukraine. If one is reached markets would see a strong bounce, but if not, things could get a lot worse before they get better.

***

In this week's edition ...

Funds management is a tougher business than it appears, as witnessed by the minority of active managers who outperform their benchmarks after fees. In Australia, active fund inflows still dominate passive but what's the difference between investing in the business of a fund manager versus the funds they manage?

We sat down last week with Roger Morley of MFS Investments in London to gain a global perspective on the war and its impact on portfolios. Among the opportunities and threats, he also identifies stocks that he expects to hold for a long time regardless of the macro or geopolitical environment.

Speaking of long-term, Phil Ruthven goes back to the beginning of the 20th century to look at the tumultuous decades and thinks that the 2020s are already exhibiting many of the traits we’ve seen before in unsettled times.

One bright spot in any turbulent period is usually gold and it has not disappointed so far in 2022. Jordan Eliseo explores a topic that many gold investors overlook and makes a case for holding the precious metal in Aussie dollars.

Thinking about gold to hedge against inflation? The US Federal Reserve also has inflation top of mind as another era of quantitative tightening beckons, writes Michael Collins. On Thursday morning AEST, the Fed raised the target range for the Funds rate by 0.25%, its first interest rate hike since 2018. This comes as US inflation is at 40-year highs of 7.9% amid rising gasoline, food and housing costs.

With everything else going on in the world, it's easy to overlook some major US elections are coming soon, the 2022 midterms in November. They can lead to a change of policy control with implications for budgets and spending. Chris Buchbinder and Matt Miller explore what has happened in past midterms with an emphasis on likely sharemarket implications.

And finally, Professor Kevin Davis, a former member of the 2014 Financial Systems Inquiry, offers his solution for how a universal pension might work. This topic is often raised by our readers but the budget and superannuation implications must be addressed.

Two bonus articles from Morningstar for the weekend as selected by Editorial Manager Emma Rapaport.

Knowledge of the local market, strong branding and a growing subscription service should see Kogan retain market share in the rapidly growing online sales category, says Roy Van Keulen. And BHP, Rio Tinto and a slew of smaller miners stand to gain if the supply shock to commodity markets persists, writes Lewis Jackson.

This week's White Paper from Fidelity is the latest research into women and their attitudes to money. There remains a lot of difference in gender attitudes.

Latest updates

PDF version of Firstlinks Newsletter

IAM Capital Markets' Weekly Market Insight

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Monthly market update on listed hybrids from ASX

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Monthly Investment Products update from ASX

Plus updates and announcements on the Sponsor Noticeboard on our website