The Weekend Edition includes a market update (after the editorial) plus Morningstar adds links to two additional articles.

A quick reminder to please fill in our Reader Survey. Every response helps us to understand ways to deliver a better newsletter for the next 500 editions. We will publish the results in the next couple of weeks so please have your say.

***

What a week for the 500th edition of Firstlinks! The biggest US bank collapse since the GFC in 2008 put the skids on markets. More on that and the implications for interest rates later.

To mark our milestone, three special pieces outside our normal content:

- Rather than reminisce ourselves about the past 10 years, we publish an extract from a forthcoming book by Greg Bright, well known to industry participants for four decades of publishing on wealth management. Plus an interview with me by media company, Telum Media.

- A new and free eBook to ponder over a Sunday coffee where we ask 30 fund managers, “What part of your investment process has contributed most to identifying winners?”

- A Reader Survey, the first we have conducted in many years. Please help us to understand more about who you are and what you would like to read on investing, asset management, retirement saving, etc.

The first edition was published on 8 February 2013 so that's about 50 editions a year, with a break for Christmas. Phew! All our content is online in a searchable archive.

Here's how the All Ords Price Index has changed since we started. It has risen 44% in 10 years, with losses in three of the last nine years and 2023 down to date. The per annum return of the price index is 3.6%, while the total return index is up 7.9%, which shows how much returns rely on dividends.

To put all this in an overall wealth context, the big asset numbers are:

- Australian listed securities, $2.8 trillion

- Residential real estate, $9.3 trillion

- Superannuation assets, $3.4 trillion

- Commercial real estate, $1.3 trillion

It explains why most of our interest rate discussions focus on the implications for residential property which dwarfs other asset classes in Australia.

***

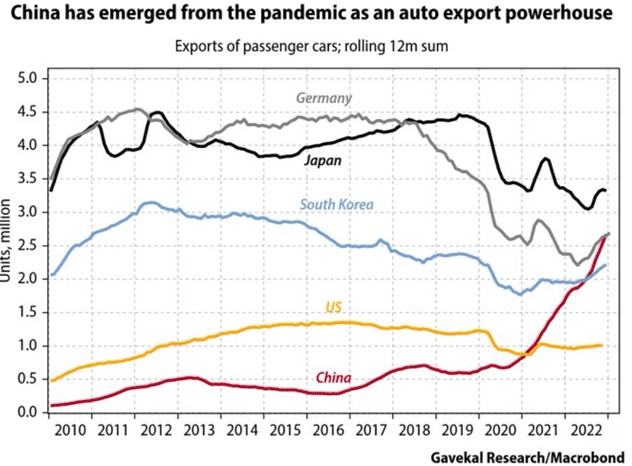

The AUKUS announcement and a substantial boost to Australia's equipment manufacturing capability brings another historical change into perspective. A few months after we started publishing, in May 2013, Ford announced it would cease production of motor vehicles in Australia by 2016. The final Holdens and Toyotas rolled off the local production lines in 2017.

At that stage, Chinese cars represented less than 1% of cars sold in Australia, and now the share is over 10%. A few years ago, it would have been difficult to argue China would soon overtake Germany and South Korea as a car export powerhouse, and it's mainly due to EVs. We are changing our minds about the quality of cars built in China, as all Australian-delivered Tesla Model 3s, the Polestar 2 and most Volvo XC40s and XC60s are made in China. Markets and competitive advantages can change quickly.

***

***

The new tax on super above $3 million dominated the headlines for a week or two but submarines and bank collapses have pushed super down the line. But with advisers already planning new strategies and large super holders reviewing whether to hold wealth in super, it's important to understand the implications. There is no legislation yet and implementation is beyond the next election and plenty can change, so it is premature to take action.

This week's article by Ashley Owen shows how someone in the top marginal tax bracket and subject to the new $3 million rule may pay more marginal tax in super than outside. It seems intuitively wrong but Ashley's calculation uses a typical portfolio and past returns to show the impact of taxing unrealised capital gains.

Here is an example of a strategy already used by financial advisers which will become more prominent (I am not recommending this, just sharing it):

- Where a Condition of Release has occurred, cash out the amount in excess of $3 million.

- Move the money into a Discretionary Family Trust (DFT) which includes a company as a beneficiary.

- Pay the income from the DFT to the company beneficiary which pays tax at 30% (or to any family member with a marginal tax rate at or below 30%)

Tax is still paid at 30% but only on realised gains and it also removes the risk of paying the 17% 'death tax' when super is not paid to a dependant. Treasury should expect a significant increase in the use of DFTs, or maybe there will be a restriction.

It shows that when Treasury prepared its estimate of the cost of superannuation concessions at $50 billion a year, based on an assumption that the highest income earners will pay tax at 47% outside super, it is vastly overstated. The Stage 3 tax cuts will also bring far more people down into the 30% bracket and encourage a move out of super.

We explain why Treasury adopted the taxing of unrealised capital gains as its recommended and 'simple' measurement method. They were faced with the dilemma that most people and the ATO do not know how much tax they pay on super, yet the tax is implemented at the individual level.

***

I spent many years of my banking career working on Asset Liability Management (ALM). Even 30 or more years ago, we measured and managed balance sheet interest rate exposure within strict limits and reported every month to the bank's ALTCO (Asset, Liability and Trading Committee). This was not only for Treasury trading books but the entire bank balance sheet.

So it's gobsmacking to hear how Silicon Valley Bank collapsed. It is a serious failure of bank management and regulator duty. SVB accepted billions in deposits from its tech customers, who were loaded with cash from equity raisings but who did not need debt. Instead of matching maturities of assets and liabilities, SVB decided to improve the margin by a modest amount by buying long-term US government bonds and mortgage securities without hedging (which would have made the exercise pointless anyway).

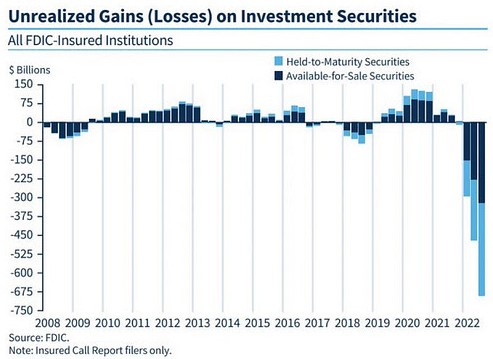

As interest rates rose beyond expectations, the mark-to-market losses ran into billions, but they may have survived if they were not forced to sell. As soon as a few leading VC firms started telling their companies to take deposits out of SVB, social media drove a frenzy, and the bank needed money to pay withdrawals. Only 7% of their deposits were FDIC-insured, increasing the panic in the tech sector, which had parked much of its cash in this one bank. Another example of poor risk management. Then the market realised that many more banks might be holding bonds with massive unrealised losses, and more panic followed, sending two other banks down. Bank unrealised losses shown in the chart below are over $A1 trillion.

Crazy numbers. SBV had a US$200 billion balance sheet with US$120 billion in long-dated securities. This was not a credit problem, as their purchases were supposed to be the safest of investments. It was a maturity mismatch without hedging. There are nearly 5,000 US banks and failures are not uncommon, with 513 since 2009.

There seems little risk for depositors in Australian banks. Not only is regulation here much stricter, the banks are better managed. The Financial Claims Scheme (FCS) protects deposits in banks, building societies and credit unions (or authorised deposit-taking institutions or ADIs). The scheme covers deposits of up to $250,000 per account holder per ADI. For example, a family may access $1 million of protection at the same ADI by investing in the name of a husband, wife, SMSF and company. Or more by spreading across many ADIs. But the FCS only covers the first $250,000 for a fund that has invested $100 million with one bank, even if that investment is on behalf of 1,000 unitholders.

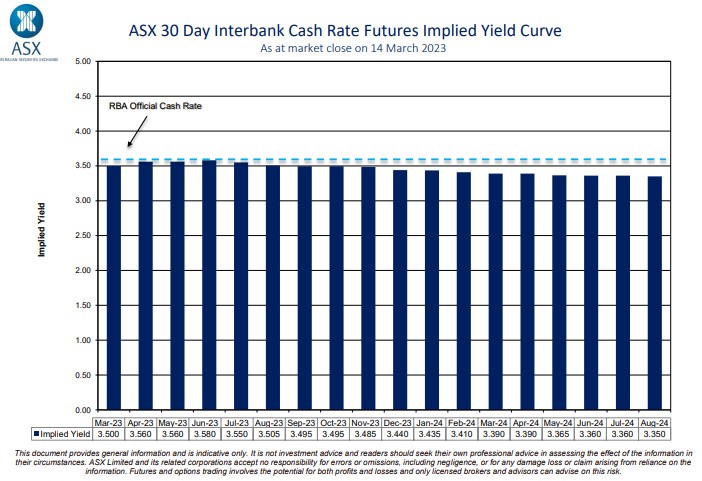

The main implication of SVB is on rate expectations both here and in the US. At end of February 2023, barely two weeks ago, the futures market was pricing cash at 4.35% by October. Not only has the cash rate moved up to 3.6% since then, but the futures market is now down to 3.5% by August and across all future maturities. Due to a perception that central banks will feel too much stress has been placed on banks and other borrowers, the market now thinks the next movement may be down. While the likelihood of a pause has significantly increased, the loss of a relatively-small, poorly-managed US bank should not cause a dramatic policy swing in Governor Philip Lowe's thinking.

In the chart of cash futures below, all the bars from June 2023 onwards were well above 4% at the end of February, and now they are all below the cash rate of 3.6%. It's an extraordinary change due to the collapse of a US bank few of us had heard of a week ago.

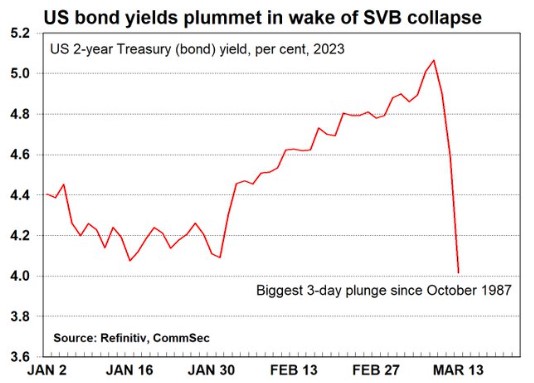

The three-year bond rate in Australia is now about 3.05% and has been below 3% this week, at a time when cash rate is 3.6%. For the sake of hundreds of thousands of borrowers coming off 2% fixed rates in coming months, let's hope the market is right this time. In the US, the two-year bond rate fell 0.58% in a day, driven by rate expectations relating to SBV.

Again, the Federal Reserve and other central banks will step in and rescue bad banking practices. The Fed has guaranteed all SVB deposits to avoid a run on banks overexposed to uninsured deposits. The implication is that the Fed may now be caught guaranteeing all deposits of any size fo all banks. Quite a change.

Many of the tech entrepreneurs who placed company cash with SVB are wildly rich beyond their dreams, enjoying all the trappings of a free enterprise system and plenty of VC cash. Yet with the first whiff of a banking problem, they rush to the regulators for help. The expression 'privatising profits and socialising losses' comes to mind when the AFR reports that a group of 250 tech founders wrote to Jeremy Hunt, the British Chancellor of the Exchequer, requesting urgent help.

“The recent news about SVB going into insolvency represents an existential threat to the UK tech sector. This weekend, the majority of us as tech founders are running numbers to see if we are potentially technically insolvent. Most businesses are operating on very fine margins in the current economy and the contagion from the initial insolvencies will be vast and impact the economy far beyond the tech sector.”

Sob. They might not be able to afford the second Ferrari.

Graham Hand

Also this week ...

While 2022 was a year of inflation, 2023 will centre on the economic cycle, according to MFS CEO Michael Roberge. And he thinks it's likely to feature a slowdown in growth. That should suit bonds and help the much-maligned 60/40 investment portfolio.

After three decades of phenomenal growth nationally, it seemed as though Australian house prices would never go down, until they did last year. Yet the downturn has been mild so far compared those of the past. James Gruber takes a look at previous property downturns and what we might learn from them.

In the weekend update by Morningstar, Jakir Hossain looks at the US banks most at risk of a liquidity crisis, Josh Peach identifies three undervalued ASX small cap stocks.

Lastly, in this week's White Paper, Franklin Templeton Fixed Income's ESG Engagement Report highlights several key themes, including transparency being the bedrock of sustainable finance.

***

Weekend market update

On Friday in the US, Treasurys once again caught something resembling a panic bid, as the two-year yield plunged to 3.81% from 4.14% a day ago and the long bond declined to 3.6%, down 11 basis points on the day. Stocks pulled back from the recent euphoria as the S&P 500 fell 1.2%, though tech continues to outperform in the wake of the SVB depositor bailout as the Nasdaq 100 fell less than 0.5%. WTI crude was hit hard again dropping to $66.5 a barrel for its lowest finish since December 2021, gold ripped higher by 3.5% to $1,990 per ounce and the VIX bounced back above 25.

From AAP Netdesk:

On Friday, the local share market suffered its longest weekly losing streak since the global financial crisis, as well as its biggest weekly drop in nearly six months, but has at least managed to claw back a bit of those losses.

The benchmark S&P/ASX200 index finished close to the highs of the day on Friday, up 29.3 points, or 0.42%, to 6,994.8, while the broader All Ordinaries gained 35.6 points, or 0.5%, to 7,188.3.

For the week the ASX200 was down 2.6%, its worst weekly loss since the week ending September 23. The week was also its sixth consecutive week of losses, its longest weekly losing streak since a nine-week stretch in mid-2008 during the GFC.

Eight of the ASX's 11 sectors finished higher, with energy the biggest gainer, rising 2.3%. Woodside gained 2.7% and Santos added 1.6%.

Property was the biggest loser, dropping 1.5% with losses across the entire interest-rate-sensitive sector. Westfield owner Scentre Group fell 2.1%, warehouse owner Goodman Group dropped 1.3 per cent and diversified property trust GPT Group retreated 3.3%.

The big banks all recouped some of this week's losses, with CBA up 1.2% to $96.45, NAB climbing 1.7% to $28.28, Westpac adding 0.2% to $21.24 and ANZ advancing 0.4% to $22.81.

The heavyweight mining sector gained 0.4%, with BHP flat at $43.39, Fortescue Metals up 1.8% to $21.42 and Rio Tinto edging 0.1% higher at $114.80.

Goldminers mostly lost ground. Newcrest dropped 2.2% and Northern Star fell 2.3%.

But Kingsgate Consolidated soared 13.3% to $1.71 after announcing that the Thai government had approved the reopening of its Chatree goldmine, six years after it was closed by the ruling junta.

Elsewhere, Neuren Pharmaceuticals gained 6.5% to an all-time high of $13.23, having soared 72.5% this week following a drug approval in the United States.

From Shane Oliver, AMP:

- Global share markets had a volatile week reflecting the problems in banks but with banking system backstops and hopes of less central bank rate hikes providing some support. US shares actually rose 1.4% for the week having fallen further than other markets the week before in an initial response to the banking problems. But Eurozone shares fell 4.2%, Japanese shares fell 2.9% and Chinese lost 0.2%. Australian shares fell 2.1% playing catchup to the falls in US shares and as global worries weighed on energy & material stocks via lower oil and metal prices with sharp falls also in IT, retailers and financials. Bond yields fell again in response to safe haven demand & a fall in expectations for short term interest rates. Gold and iron ore prices rose but oil and metal prices fell on growth worries. The $A rose as expectations that the Fed is near the top on rates weighed on the $US.

- First the bad news. While bank failures so far do not look anything like a re-run of the GFC, they are still a reason for concern with the problems at Credit Suisse and First Republic highlighting “contagion” risks. Headlines screaming that the US has seen the biggest bank collapse (with Silicon Valley Bank) since 2008 naturally engender fears of a re-run of the GFC. However, the situation today is radically different to 2008 when US bank failures reflected systemic issues in their assets where lending to US sub-prime and low doc home borrowers had ballooned, were packaged into heavily geared securities and sold globally causing big problems as the borrowers defaulted en masse. This time around the problems in US banks have reflected poorly diversified deposit bases (tech and some crypto in the case of SVB) and large scale withdrawals as depositors needed the cash forcing the banks to sell bonds at a loss. Poorly diversified deposits and assets (with SVB’s security holding at 57% of its assets being an outlier amongst US banks). But not the stuff of the GFC. Nevertheless, its still a sign of rising financial stress and the refocus on already weak Credit Suisse followed by issues at First Republic Bank (resulting in big US banks moving to deposit $US30bn into it) show how it can spread globally as investors speculate who might be next. Record bank borrowings of $303bn at the Fed’s discount window (presumably by banks not wanting to sell their bond holdings at a loss in order to meet deposit withdrawals) highlight the scale of stress in the US banking system. Unrealised losses on banks bond holdings are also likely to be an issue outside the US.

- Whether it’s the sort of crisis that in the past has ended and then reversed Fed monetary tightening is still unclear. But it could be. So far, the US authorities have sought to protect uninsured depositors (to prevent runs on other banks and large scale economic damage) and the Fed has pledged cheap liquidity for banks so they don’t have to sell securities at a loss. And the Swiss National Bank has provided $US54bn in liquidity support for Credit Suisse. Whether this is enough remains to be seen. But central banks will also need to move more cautiously in terms of interest rates as we know from history that financial crisis lead to tighter bank lending conditions – they were already tightening prior to this according to the Fed’s bank survey (next chart) - and this will adversely affect economic growth which adds to the already high risk of recession in the US and Europe. And weaker global growth will in turn impact Australia even though our banks are less vulnerable to the issues impacting banks in the US and Europe – adding to the risk of recession here flowing from significant rate hikes.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Monthly Investment Products update from ASX

Plus updates and announcements on the Sponsor Noticeboard on our website