The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

We tend to think about technology as a relentless march forward, but as writers from Jonathan Swift in the 1700s to Stephen King and our own Peter Allen have espoused, 'Everything Old is New Again'. In an interview in Wheels magazine May edition, Hyundai's Chief Designer, SangYup Lee argues that placing all the functions in a car into a single infotainment system creates safety hazards. Tesla drivers, for example, cannot quickly switch on lights and wipers because they need to take their eyes off the road, delve into the screen and find the right icon.

In its electric vehicles, Hyundai is foregoing the streamlined look in the interests of safety and function:

"We have used the physical buttons quite significantly in the last few years. For me, the safety-related buttons have to be hard key. When you're driving, it's hard to control it. That's why when it's a hard key, it's easy to sense and feel it."

Tesla is lauded for its touch screen and uncluttered cabin, making buttons and switches seem old-fashioned. But the habits of how we interact with a car suggest scrolling through a screen is not a better and safer way, although no doubt car design will head in this direction.

And what is Wheels' overall verdict?

"What's beyond debate is that the Ioniq 6 is a bigger, heavier, more technologically dense vehicle that the Tesla Model 3 and while there's an argument that the Tesla does more with what it has, the Hyundai just does more full stop. Put simply, it feels a step or two forwards in terms of overall cohesion than the Tesla Model 3."

More advanced and yet it uses traditional switches and buttons.

There is a parallel in investing. One of the stockmarket's most significant developments is the growth of Exchange-Traded Funds (ETFs). They give investors easy and instant access to a wide range of investment styles, markets and thematics. The main alternatives are managed funds and platforms, which can be more inconvenient to invest in and harder to liquidate same day. It feels cumbersome and time-consuming to fill in a paper form requiring a wet signature, certified copies of an SMSF's trust deed and identification of company trustee directors.

But for some investors, the traditional managed funds are the car safety buttons of investing. The inconvenience and timing delays might force a pause at a moment of panic. Some funds allow only monthly exit with five day's notice, and others make no guarantee of liquidity. Given the weight of evidence that investor returns are generally worse than the indexes or funds in which they invest, many people need protection from themselves. An instant screen-activated ejector seat may be the wrong option.

As Joel Greenblatt, author, hedge fund manager and founder of Gotham Capital, said:

“Unless you buy a stock at the exact bottom (which is next to impossible), you will be down at some point after you make every investment. Your success entirely depends on how dispassionate you are towards short-term stock price fluctuations."

I confess in my own case, I avoid the paperwork involved with some unlisted funds, and I tend to exit my listed investments first during an asset allocation change, and leave the unlisted to chug away in the background. They are easier to ignore when they do not feature on my broker revaluation which hits my screen every moment of every trading day.

Similarly with bonds. If a five-year, fixed rate bond investment bought two years ago at par to yield 5% has fallen in price to 95, just leave it in a bottom drawer and enjoy the 5% and the surety of money back at par in three years.

Back on cars, in Jeremy Clarkson's latest review of the BMW M3, which he describes as so rapid that it is 'eloquently violent and deranged', there is still a place for buttons:

"But that’s the thing with a modern day M3. If you push a lot of buttons, it can become as sensible as a Volvo."

So we explore many ways in which investors can be "as sensible as a Volvo" by protecting themselves from bad investing behaviour, perhaps by pushing some traditional buttons. Mind you, these days, Volvo no longer deserves its boring image.

***

Readers may recall my article a few weeks ago I described problems with the offer of some new securities, where issuers and managers have decided to limit distribution to their own clients due to a strict interpretation of ASIC's Design and Distribution Obligations (DDO). I have since been in contact with ASIC, which has give permission for this clarifying statement to be published:

"The law is designed to allow flexibility as to how offers can be structured. ASIC cannot prescribe in detail how issuers and distributors comply, as under the legislation that is a matter for them. For example, ASIC does not have the power to require a minimum number of brokers be appointed to an offer, nor can ASIC require an offer to be distributed beyond an appointed broker’s client base."

So ASIC cannot fix the problem identified but DDO is supposed to offer flexibility and in my view, issuers are being overly cautious and ASIC does not require the restrictions issuers have adopted. But perhaps the interpretation is convenient for brokers to retain transactions for their own clients.

***

The ACCC has launched an enquiry into how banks set the interest rates on savings accounts. The ACCC says:

“We are aware that deposit and savings accounts are an important source of income for many Australians, typically supplementing their income from employment, superannuation and the pension. Australian households together hold more than $1.3 trillion in savings and deposit accounts ... In many cases, banks have only applied increases in the cash rate to some of their deposit products, often with conditions attached."

They should read my book where I cover this subject in great detail.

We were contacted last week by a pensioner whose age pension is paid into an IMB Bank account called a Wisdom Savings Account. Given it is a "high interest transaction account available to members 55 years or over, or members who receive an eligible permanent pension", it sounds like a special deal. And aren't the small banks competing hard for deposits, and hopefully looking after their loyal pensioner customers? Here are the rates:

Up to $9,999: 0.05%

$10,000 to $49,999: 1.25%

$50,000 to $249,999: 1.6%

Given pensioners are likely to hold less than $10,000 in their account, this 'high interest' account for those on a 'eligible permanent pension' is miserable. Nothing. Put that in your ACCC enquiry.

Australian banks are not alone. The largest bank in the US, JP Morgan, into which deposits are flowing as regional banks suffer, holds US$2.4 trillion in deposits (yes, trillion). In 2022, it paid about US$10 billion in interest, or 0.4%. Like IMB, many JP Morgan accounts pay 0.01%. Apple recently introduced a new savings account paying 4.2% and it will be swamped. The ACCC report will make fascinating reading.

***

Tuesday's Budget confirmed the Government's intention to proceed with the proposed $3 million superannuation tax despite recent consultations with the industry. Peter Burgess from the SMSF Association immediately issued a statement:

“If the Government proceeds with the taxation of unrealised gains as proposed in their consultation paper released in late March, given many small business premises and farms are owned by SMSFs, this new tax could drive up their costs substantially at a time of unprecedented cost of living increases. We stand by our position that using a member’s total super balance to calculate earnings is neither simple nor fair. By definition, a member’s total super balance includes unrealised gains and a growing list of items that will need to be excluded to ensure ‘earnings’ for the purposes of this new tax are not overstated. This methodology discriminates against those funds who can identify and report to the ATO actual taxable earnings attributable to each member.”

James Gruber summarises the relevant parts of the Budget and links to longer Budget papers from nabtrade and Heffron. Worth noting:

- The revenue attributed to the new $3 million super tax has increased from $2 billion to $2.3 billion a year, suggesting no material change in the calculation method but some extra dollars from somewhere.

- No continuation of the 50% discount for minimum super pension drawdowns as allowed in recent years, so SMSF trustees in particular should ensure they have enough in cash to meet higher pension obligations.

- No mention of removing the indexing on the Transfer Balance Cap, now expected to go to a healthy $1.9 million on 1 July 2023.

- The increase in the Superannuation Guarantee to 11% on 1 July 2023 looks locked in.

- The instant asset write-off scheme will decrease the maximum amount for new equipment to $20,000 from $150,000. Higher limits have contributed to Australia's three top-selling vehicles being the Toyota Hilux, Ford Ranger and Isuzu D-Max as tradies write off their purchases. Finally, the Government really is taking away your utes.

***

Finally, three charts caught our attention this week.

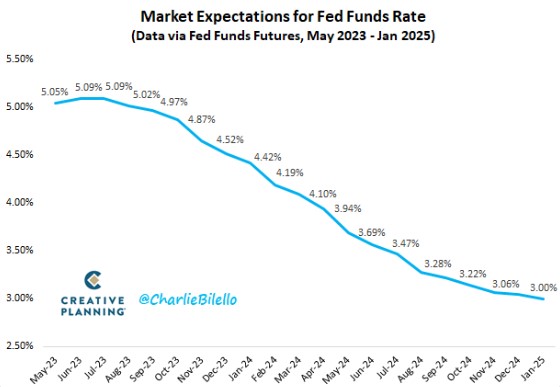

First, amid the speculation about whether further interest rate rises are necessary in Australia and the US, the market is building in an extraordinary amount of easing in the US Fed Funds Rate. Herein lies the dilemma for stockmarket investors. While global growth is expected to slow in 2023, the equity market often looks 18 months ahead and will take support from lower interest rates. It's one reason why the bond and stock markets are behaving differently.

In Australia, the Budget inflation forecast for FY23 is 6%, but it falls to 3.25% in FY24, 2.75% in FY25 and then 2.5%. Real GDP growth next year is only 1.5%, and the current three-year bond rate is about 3%. There is clear expectation that central banks will subdue inflation soon.

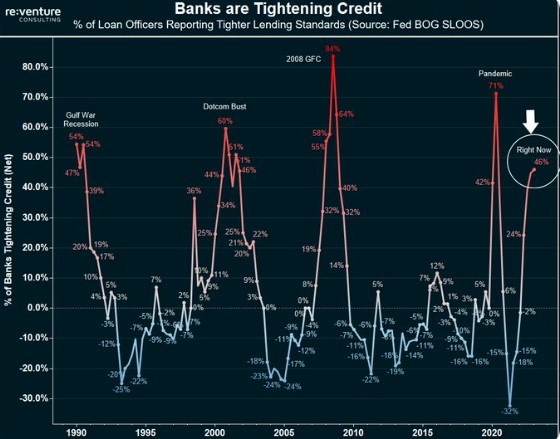

Second, on the back of the crisis among regional banks in the US, a Fed survey of bankers showed 46% tightened lending standards in Q1 2023. That is nearing the levels during other crises.

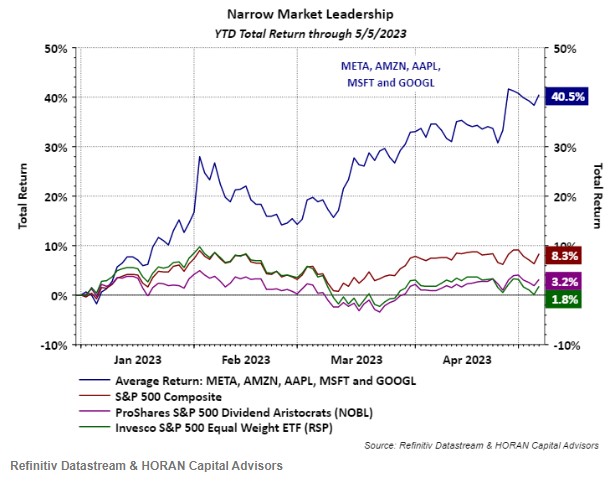

Third, the strong run in the US market in 2023 disguises how narrowly based the winners are, with five big tech companies up an extraordinary 40% in 2023. There is lots of FOMO at play here because the Price to Earnings ratios of these stocks are back to expensive levels, with Amazon at 252, Microsoft at 34 and Apple at 29 (but Google is at 24, the same as the average for the S&P500).

Graham Hand

Also in this week's edition ...

There’s lots of negative press about the outlook for Australian banks with worries over declining net interest margins and a coming consumer crunch as fixed mortgages are refinanced. Yet Hugh Dive says the latest bank results show the Big 4 are in fine shape, and with the tailwind of rising interest rates and high employment levels, patient shareholders should be rewarded.

A new report from Vanguard Australia shows something extraordinary: many working-age Australians expect to have an annual income of almost $100,000 in retirement. What gives? Well, perhaps they have included rent as some aren’t homeowners or they don’t know how much is really needed in retirement. What’s clear is that this expectation stands in stark contrast to current retirees. The full Vanguard report also features as this week's White Paper.

A high 97% of wealthy Australians surveyed by consultant, EY, admit they change their investment behaviour when the value of their portfolios declines. It’s a frank admission although perhaps it shouldn’t be so surprising when the volatility of 2022 tested even the most battle-hardened investment veterans.

Everyone knows that the ASX is heavily skewed towards banks and mining. How then do you diversify beyond these sectors but remain in an Australian share index? Van Eck’s Cameron McCormack suggests equal weighted indices have merit as an alternative. Historically, these indices have outperformed their market capitalisation counterparts.

Hybrid securities have gained popularity, though that faith was shaken when Credit Suisse bonds were wiped out. Yarra Capital Management’s Phil Strano says what's overlooked is that the turbulence strengthens the case for owning superior quality Australian bank T2 bonds.

Two extra articles from Morningstar for the weekend. Joshua Peach suggests Australia's lithium mega-merger makes strategic sense, while Sarah Dowlong explores AGL and the road to recovery.

***

Weekend market update

In the US, stocks again finished little changed on the S&P 500 as the broad index finished a forgettable week 0.3% lower, while Treasurys fell with the two-year yield jumping nine basis points to 3.98% and the long bond rising to 3.78% from 3.73% yesterday. WTI crude dropped to $70 per barrel, gold edged lower to $2,016 an ounce and the VIX crept above 17.

From AAP Netdesk:

On Friday in Australia, the local market has finished slightly lower for a fourth straight session, this time amid weakness in the energy and material sectors. The benchmark S&P/ASX200 index on Friday finished down 4.8 points, or 0.07%, to 7,256. The broader All Ordinaries was down 3.5 points, or 0.05%, to 7,453.

The market made mostly small moves throughout the week despite the big news around the federal budget and US inflation data. Despite the four-day losing streak the ASX200 finishing the week 0.5% higher, thanks to a 0.8% gain on Monday.

Eight of the ASX's 11 sectors finished higher, but the heavyweight materials sector fell 1% and energy dropped by 0.5%.

Major mining companies moved lower, with BHP falling by 1.2% to $43.48 and Rio dropping by 1% to 107.96.

But the same could not be said about lithium companies, which were still riding high following Thursday's Allkem merger announcement. Allkem was up by 1.3% to $15.14, Liontown Resources increased 1.4% to $2.97 and Pilbara remained flat at $4.78.

In the energy sector, Woodside was down 0.4% to $33.66, Santos fell 0.8% to $7.12, Boss Energy dropped 2.5% to $2.76 and Whitehaven Coal fell 0.9% to $6.94.

The biggest gains at close were in the health care and tech sectors. Blood products giant CSL was up by 1.4% to $306.36 and cloud-based software developer WiseTech Global rose 1.1% to $70.97.

Australia's major banks managed to claw back losses, with the sector rising by 0.2%. CBA increased 0.6% to $98.96, ANZ rose 0.8% to $24.50, NAB increased 0.2% to $26.41 while Westpac was the outlier, falling by 0.19% to $21.09.

Insurance company QBE fell 3.6% to $14.61 after warning on Friday it anticipates earnings this year will be worse this year. Flooding in Australia and damage from winter storms in the US has meant a rise in claims, with the insurer taking a profit hit of $190 million.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Monthly Bond and Hybrid updates from ASX

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website