The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

Back in the day, I wrote a monthly column for a Fairfax publication called CFO, long before The Australian Financial Review replaced it with another publication in 2012. Although I was supposed to write about bond and capital markets, in one edition, I vented my frustration about the increasing tendency of companies to outsource important strategy and operational decisions to consultants. I could not understand why a board appoints a new CEO after a global search and the first thing he or she does is bring in a major consulting firm for help and advice. Didn't the board appoint the person for their expertise and ideas for running the company?

Sharing proprietary knowledge and insights with a consultant is annoying for many people in a business. Not only was that internal skill developed over many years, but there's always a suspicion that the knowledge will be shared with another client, probably a competitor. It's not normally as overt as copying a document or declaring the source, but the consultant learns on the job and takes the information to the next client. Moreover, the senior partner who pitched for the work to mates on the executive committee oversees 20 projects at a time. The person sent out on the job is often a few years out of university and less experienced than people who work in the company.

Then three months later, in the final report which costs the company millions, there are the words shared with the consultant looking back at you.

"A consultant is someone who borrows your watch to tell you the time, and then keeps the watch.”

In CFO magazine, I also argued that company executives should write the first version of a legal document themselves. Not only is it good skill to develop, but it forces them to write down exactly how the contract or transaction should work. It will also save costs by giving the legal team a start. Of course, legal expertise is required for final drafting, specific knowledge and accuracy, but at the start, there's now another option. The development of AI and ChatGPT and similar tools will allow far more executives to take the first drafting step. Tell AI what you want in a contract and look like a genius.

I gave ChatGPT on OpenAI this request:

"Write a legal document to appoint a fund manager to invest in global equities for a super fund including reporting, limits on types of assets, expected performance and size of portfolio."

If you need evidence of how AI will change many professions, including legal work, the result is impressive. If you own shares in a company which produces legal templates, sell. The first draft produced in 10 seconds is too long to reproduce here but it's a good starting point for a super fund executive thinking about what might be required rather than relying on a legal adviser to take a week drafting a document. In some cases, the legal firm takes a document off a shelf, but they still charge for it.

So at the start of a consulting or legal assignment, check if AI can give you a start. As with any major innovation, there is a dark side. Australian companies are introducing strict guidelines on the use of generative AI, especially due to the potential for data theft or breaches based on information loaded into system.

And so to the PwC consulting debacle. Yes, it a disgrace that knowledge of government plans for multinational tax avoidance were openly shared with multinational clients, and there will be severe repercussions for the consulting firm. But there's another side to the story which is less discussed. Why do government department pay billions of dollars a year to external consultants? There are more tax experts in each major consulting firm than there are in the Australian Tax Office, but why does the ATO hire these consultants when they know a major part of their business is helping other clients to avoid tax?

The consultants are responding to the contracts on offer or advice requested, or maybe they are skilled enough to create work for themselves. While PwC's breach was blatant, more common and subtler is simply knowing what is happening inside government and using the knowledge with another client, perhaps against the best interests of the original client.

Considering the findings of the Tax Practitioners Board (TPB) are at the centre of the PwC scandal, their website is a quiet space, with no media release updates since January 2023 on the biggest story in tax land. It's now June. It is to the great credit of The Australian Financial Review that it has stayed on top of a story which could have drifted by. Here is part of the TPB January statement:

"Peter-John Collins, a former tax partner at PricewaterhouseCoopers (PwC), has been deregistered as a tax agent for integrity breaches by the Tax Practitioners Board (TPB). Mr Collins’ deregistration includes a 2-year ban on becoming a registered tax practitioner.

The TPB conducted an investigation into Mr Collins’ conduct. The investigation revealed Mr Collins, while a partner of PwC, was part of a confidential consultation by Treasury in a confidential consultation to improve tax laws. This included new rules to stop multinationals avoiding tax by shifting profits from Australia to tax and secrecy havens. Mr Collins made unauthorised disclosures of this confidential law reform information to partners and staff of PwC."

Little more than a rap over the knuckles, plus a requirement to improve internal training. But now we have 144 pages of PwC emails showing Collins' confidential information became a major marketing ploy to avoid the Multinational Anti Avoidance Law (MAAL). PwC has won over $500 million in government contracts in the last two years.

Part of the answer lies in the stripping of experts employed in public service, of reducing departmental budgets, of telling senior bureaucrats that their opinion is not valued, and perhaps politicians lining up some future relationship with a major consulting firm. As Ross Gittins writes in The Sydney Morning Herald:

"These days, much of the big four’s income is from consulting to federal and state governments. In 2021-22, the feds paid $21 billion for “external labour” – consultants, but also contractors and labour-hire companies. Senator Barbara Pocock, of the Greens, says this is equivalent to 54,000 full-time workers, and compares with 144,000 directly employed federal public servants.

Barrister Geoffrey Watson has asked “why is Australia outsourcing so much of its governing to private enterprise? Policy development and implementation are now routinely taken from the public service and turned over to private consultants.”

Businesses should look around their own operations, check what work is outsourced to consultants and hire the best people to retain skills and knowledge in the firm ...

***

... and review what AI can do. They will join millions doing the same.

Source: Exploding Topics

Source: Exploding Topics

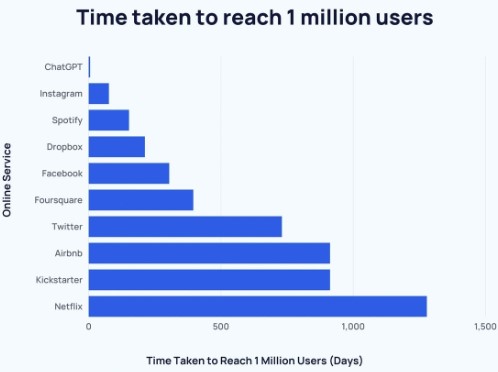

ChatGPT has rewritten records and Exploding Topics reports:

- ChatGPT currently has over 100 million users

- openai.com receives 1 billion visits per month

- Over 60% of ChatGPT's social media traffic comes via YouTube

When Bill Gates says that in his entire life, he has only seen two demonstrations of revolutionary technology, we should sit up and listen. His first was in 1980, graphical user interface (GUI), which became Windows. And then in 2022, when he saw the latest iteration of OpenAI after watching progress since 2016, he writes:

"I knew I had just seen the most important advance in technology since the graphical user interface."

It is headline-grabbing to talk about bubbles, but a few stocks riding the AI boom are creating major anomalies in markets that all investors need to appreciate. For example, although it looks like the S&P500 is performing well in 2023, only 20% of companies are outperforming the overall index on a 3-month trailing basis. It's another highly-unusual data point as the smallest % since the dot-com boom in 2000.

In the US, only three sectors – information technology, communications services and consumer discretionary – are outperforming the index while all others are underperforming. The winning sectors of communications services holds Meta (Facebook) and Alphabet (Google), consumer discretionary holds Amazon and Tesla while Nvidia is in information technology.

As this is such an unusual occurrence, and it may be the start of something revolutionary – or is that what the media says in every bubble? – we dissect how Bill Gates views the AI opportunity and why Nvidia and a few big companies are creating an historical moment in investment markets.

***

Mark Delaney is the Chief Investment Officer at AustralianSuper, the largest super fund in the country managing almost $300 billion. With a relatively young client base, fund inflows remain strong, and at this stage, a minority of members are old enough to draw down pensions. We highlight the implications from an interview with Mark at the Morningstar Investor Conference last week, including why he is confident holding illiquid assets.

He also addressed concerns about internal teams managing assets, a major trend among most of the large superannuation funds. Gone are the days when most investment management was outsourced, but criticisms include that it is more difficult to remove internal staff. He replied:

"We've terminated internal fund managers for not delivering the performance we're after. If anything, they get more scrutiny than the external managers do because the investment committee, and everybody else, is all over them. And we've actually hung out, when you look at over our history, we've hung on to external managers who haven't performed for too long. They used to be good ones, and now they'll just come back and they'll come good again. And how long does it take for you to give up faith? It's always when you look back on your record you should have got rid of them, when you first started to worry about them. How many of them come good after you first start to worry about them? One in three. Even when we know this, we still don't do it fast enough. So, reluctance to do anything affects all investment decision making."

Delaney's claim that only one in three fund managers "come good after you first start to worry about them" surprises me, because in my experience, fund managers go through periods when they underperform due to the market not favouring their style, and just after investors give up and redeem, the managers often starts to "come good". Delaney has seen far more examples than I have but selection of an active fund manager is a long-term commitment.

Delaney also discusses the controversial subject of investing in illiquid, private assets, explaining why it works for his funds and the limits he sets. It's a big advantage for industry funds as these assets have performed well with lower price volatility. Recent research from WealthData estimates that unlisted assets comprise 21.7% of industry fund asset allocations, 21.5% of public sector fund allocations but only 4.5% of retail fund allocations.

***

Yesterday's release on the CPI for the year to April 2023 showed an increase of 6.8%, higher than the 6.3% in March 2023 but below the high of 8.4% in December 2022. Michelle Marquardt, ABS Head of Prices Statistics, said:

“A significant contributor to the increase in the annual movement in April was automotive fuel. The halving of the fuel excise tax in April 2022, which was fully unwound in October 2022, is impacting the annual movement for April 2023.”

CPI inflation is often impacted by items with volatile price change such as automotive fuel, fruit and vegetables and holiday travel. Excluding these volatile items, the annual movement of the monthly CPI indicator was 6.5%, lower than 6.9% recorded in March.

It's a mixed result but it was enough for the stockmarket to sell off amid heightened concern of another cash rate increase.

Finally, my personal thanks to Jamie Wickham who left his role as Managing Director at Morningstar this week after 25 years of achievements and major milestones. Jamie was primarily responsible for Morningstar acquiring Firstlinks in 2019, giving our readers access to greater resources and ensuring sustainability of the newsletter. Jamie has always personified 'putting investors first' and my best wishes for his next step.

Graham Hand

Also in this week's edition ...

The fixed-rate mortgage cliff is front-page news and former RBA Governor, Ian Macfarlane, says seemingly radical solutions may be needed. He thinks APRA may need to lower lending buffers and the government could intervene to provide lending to those unable to refinance bank loans. Macfarlane also says rates could stay high for the next two to three years.

Daniel Pennell from Plato Investment Management reports that after two solid years of post pandemic global dividend growth, strong momentum has continued this year, providing great news for retirees. And the outlook for dividends remains positive, despite a challenging macroeconomic backdrop.

Last week, we featured a story on Jack Gance, the entrepreneur behind two market-leading businesses, including Chemist Warehouse. In Part 2, Lawrence Lam delves into how Gance built Chemist Warehouse from scratch and why he's succeeded in creating a national pharmacy chain, while many of his competitors have failed.

Despite a long laundry list of economic and geopolitical challenges, most stock markets are near all-time highs. Why? Erik Knutzen of Neuberger Berman attempts to provide a rationale for the markets' relentless drive higher, and the likely path ahead.

Anthony Kirkham from Western Asset Management says recent rate hikes have done wonders for bonds as an asset class. The key attractions for owning bonds are back, including high income and total return potential, diversification benefits via a low to negative correlation with growth assets, and defensive attributes linked to potential capital appreciation in times of stress.

Two extra articles from Morningstar for the weekend. James Gruber looks at how to find the next Nvidia while Megan Neil reports that Wesfarmers should benefit as consumers pull back from discretionary spending and seek value.

And in this week's white paper, Brandywine Global Investment Management, part of Franklin Templeton, looks at the business cycle and suggests a US economic recession may be baked in.

***

Weekend market update

On Friday in the US, the relentless rally in big tech, options positioning and bets on a Federal Reserve pause following a mixed jobs report put stocks on the verge of a bull market.

An advance of roughly 1.5% for the S&P 500 extended the benchmark’s surge from its October low to nearly 20%. The Dow was up 2.1% and the Nasdaq increased 1.1%. The yield on the US 10-year note lifted 10 basis points to 3.69%. The VIX slid more than 6%, falling further below 15. Brent crude ended with a 2.6% gain to US$76.24 a barrel, but gold dropped 1.5% to US$1948 an ounce.

From AAP Netdesk:

On the ASX on Friday, the market has gained ground after the US finally put its debt ceiling drama behind it, though it digested the possibility of more interest rate hikes in Australia, perhaps as soon as soon as Tuesday, following the biggest increase in minimum award pay in decades.

The benchmark S&P/ASX200 index on Friday finished up 34.3 points, or 0.48%, to 7,145.1, while the broader All Ordinaries rose 40.5 points, or 0.56%, to 7,331.2.

The mining sector was the biggest gainer on Friday, climbing 2.4% in its best single-day performance since November. BHP added 2.8% to $43.25, Rio Tinto climbed 2.5% to $110.15 and Fortescue Metals grew 1.7% to $19.69 as the iron ore miner appointed a new chief financial officer, Christine Morris. Gold miners and lithium miners also rose, with Newcrest up 4.6% and Pilbara climbing 3%.

The big banks were mixed, with CBA and ANZ edging slightly higher, Westpac down 0.3% and NAB falling 1% to $25.79.

Consumer-facing stocks where labour costs are a big expense were lower following the Fair Work Commission ruling. Woolworths fell 1.4%, Coles dropped 1.7%, Endeavour Group retreated 1.4% and Wesfarmers dipped 0.3%. Adairs plunged 14.9% to a nine-month low of $1.605 after the furniture retailer said group sales were down 7.0% in the past 21 weeks to May 28.

On the flip side, Appen soared 15% to an almost nine-month high of $3.76, finishing the week more than 50% higher. The Sydney-based company, which makes datasets for tech companies to train artificial intelligence algorithms, has been the apparent beneficiary of a rally in all things AI-related.

Paladin Energy rose 10.7% to 67c and Deep Yellow climbed 12.6% to 71.5 after the government of Namibia - where both companies are working on uranium mines - denied media reports it was poised to partially nationalise its resource industry.

From Shane Oliver, AMP:

- Global share markets rose over the last week helped by the US debt ceiling deal and Fed signalling of a pause in rate hikes this month. For the week US shares rose 1.8%, Eurozone shares gained 0.04%, Japanese shares lifted 2% and Chinese shares increased 0.3%. Australian shares fell 0.1% though, with increasing expectations for further RBA rate hikes with falls led by consumer, financial and energy shares. Bond yields and the oil price fell but metal and iron ore prices rose as did the $A on the back of increased RBA rate hike expectations and a softer $US.

- The suspension of the US debt ceiling out to January 2025 heads of a US Government default but also comes with some sting in the tail. The relative smoothness of the process compared to 2011 and 2013 is a positive sign in terms of the present workings of the US political system with President Biden and Speaker McCarthy proving far more willing to compromise than had been feared. However, just bear in mind that the spending caps for the next two years will imply around a 0.2-0.3% of GDP fiscal drag at a time when the US economy is already slowing. The resumption of bond issuance and rebuilding of Treasury’s deposit at the Fed will also reverse the liquidity boost that has been provided to markets by the Treasury running down its deposits since when it hit the ceiling in January.

- A rebound in Australian inflation and the latest minimum and award wage increases unfortunately now make a further RBA rate hike look likely and so we are allowing for another 0.25% increase in the cash rate on Tuesday taking it to 4.1%. Or if not on Tuesday, then in July. The money market now has priced a 42% chance of a 0.25% rate hike on Tuesday and an 80% chance by July.

- The ABS’s Monthly Inflation Indicator rebounded to 6.8%yoy from 6.3%yoy. While this partly reflected base effects from the fuel excise cut a year ago (which will drop out in May), an Easter related surge in travel costs (which looks likely to reverse), seasonal considerations and monthly volatility means the RBA will be concerned that inflation is too high.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website