The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

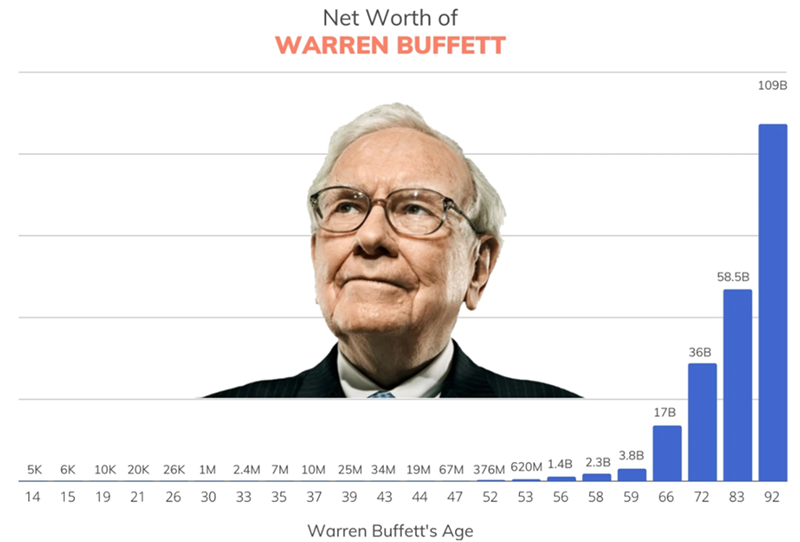

Writer Morgan Housel likes to tell the story of how Warren Buffett really got to become so wealthy. For the record, Buffett’s current net worth is an estimated US$121 billion, making him the world’s seventh richest person, according to Forbes.

Buffett is one of the greatest investors ever. Yet if you think that’s the only reason for his success, you’d be missing the full picture. They key to his wealth is that he’s been a phenomenal investor for more than three quarters of a century. If he’d started investing in his 30s and retired in his 60s, most people would never have heard of him.

Housel demonstrates this by running a thought experiment where Buffett started investing at age 30 with $25,000. And Buffett goes on to earn the extraordinary investment returns he’s been able to generate (22% per annum) but quits investing and retires at age 60.

In this experiment, what would be a rough estimate of his net worth today? The answer: US$11.9 million. An excellent number, though about 99.9% less than his actual net worth.

Instead, what Buffett did is that he started investing at the age of 10, and by the time he was 30, he had a net worth of US$1 million, or more than US$10 million in today’s terms, adjusted for inflation. And he didn’t retire in his 60s like most people do. He’s continued investing into his 90s.

In other words, the real secret to Buffett’s wealth hasn’t just his investing acumen, but the amount of time that he’s been investing.

Source: Finmasters. Note that this chart is about year old and Buffett’s net worth has risen to US$121 billion today.

Becoming a mini-Buffett

That’s what most people miss about the concept of compound interest – it isn’t just about the rate of return but time in the market. It doesn’t just apply to Buffett either.

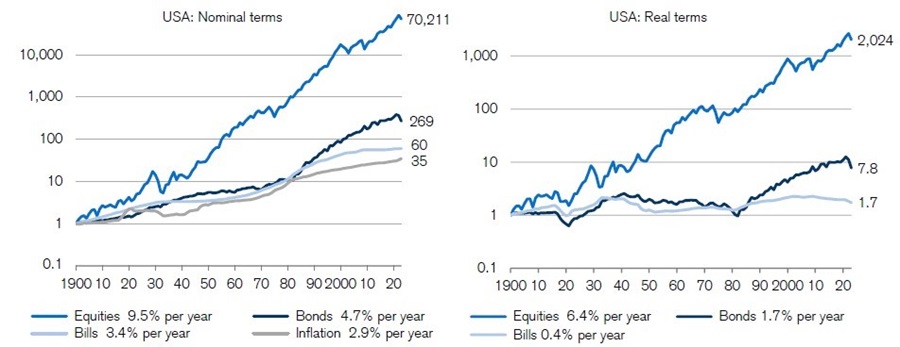

With enough time, anyone can become wealthy. Don’t believe me? Let’s look at historical returns from the US stock market. Since 1900, that market has had annual returns of 9.5%. If you’d invested US$1,000 in the market in 1900 (equivalent to more than US$30,000 today) and stayed invested to now, that would have turned into US$88.5 million (note the charts below are to the end of 2022).

Source: Credit Suisse

I can guess that you’re thinking: “c’mon, James, this is totally unrealistic. I don’t have 123 years to let compound interest work its magic.” True enough.

Let’s then run the same returns over smaller timeframes. Say, the amount of time that Buffett has been investing – 83 years. The result is that US$1,000 would turn into US$2.57 million. A larger sum invested of US$50,000 would result in US$129 million at the end of 83 years. That’s nowhere near Buffett’s net worth yet it’s a tidy sum.

What about an even shorter time of 60 years? Assuming the same annual return of 9.5%, US$1,000 would turn into about US$292,000, or US$50,000 would become US$14.6 million.

This demonstrates the power of time in compounding money.

Potential objections

There are several possible objections to this analysis:

1. 60 years is still a long time to let compounding work.

Yes, that’s right. Though I hope the analysis shows the potential to build wealth if not within your lifetime, certainly within those of your children or grandchildren.

2. Using the US is disingenuous because America has had one of the best-performing markets over the past century.

This is true. Since 1900, the US has gone from being a middling power to becoming the world’s only superpower. This rise has been reflected in the performance of its stock market. In 1900, the US made up just 15% of the world equity markets. Now, it’s 58%.

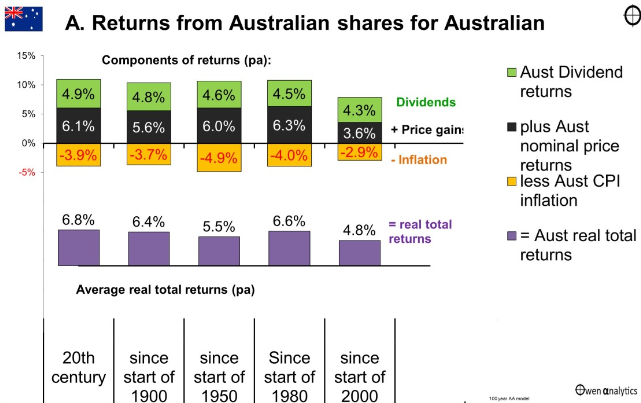

Funnily, Australia has performed even better than the US in the long term, at least in nominal terms. Since 1900, the market here has achieved an annual return of more than 10% per annum.

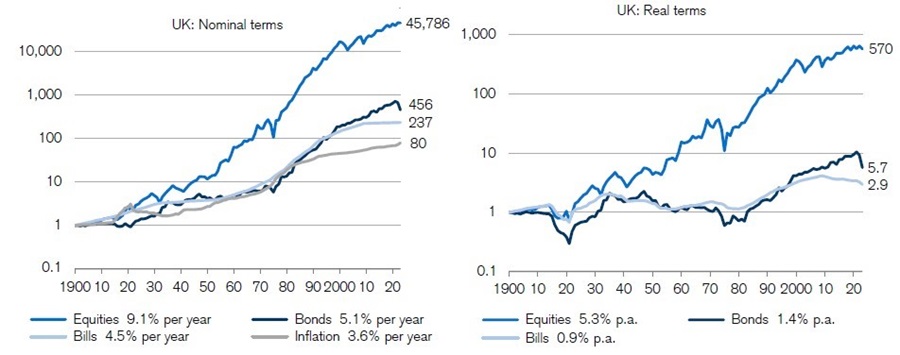

Let’s take a country where recent history hasn’t been as kind to it. Over the past century, the UK has gone from a global superpower to a middling one. Its economic decline accelerated over the past 40 years with sharp falls in oil production in the North Sea, among other factors. Yet, its share market performance, though not as good as the US and Australia, has still been impressive.

Source: Credit Suisse

3. Returns won’t be as high in future.

That’s a guess. While it’s right that past performance isn’t indicative of future performance, long-term equity returns should continue to be favourable, especially in Australia.

4. It doesn’t account for inflation and costs such as brokerage and taxes. It also doesn’t include the benefits of franking credits in Australia.

Yes, these are all things that need to be factored in and applied to potential portfolio returns.

5. It doesn’t include additions or subtractions to the initial amounts invested.

For simplicity’s sake, I've excluded that in this article.

Stop trying to beat time

Building wealth primarily depends on two things: the rate you can earn and the amount of time the money has to grow.

Most investors are obsessed with beating the market when time in the market is just as important, if not more so.

In markets as in life, time can be your most valuable asset.

***

In my article this week, I look at famed investor, Howard Marks', latest thoughts on what lays ahead for markets. He outlines why rates are unlikely to go down much, that many investors are unprepared for a 'higher for longer' rate environment, and where he sees the best opportunities in 2024 and beyond.

James Gruber

Also in this week's edition...

Retirees have faced a turbulent 12 months, dealing with volatile markets and cost-of-living increases. Aaron Minney from Challenger says building a retirement plan to withstand these challenges will be important for this year and beyond. And he has some ideas about the best strategies to achieve this.

Professor Lynda Gratton says we should be questioning the whole idea of retirement. She believes increasing life expectancy and technological changes mean the idea of working hard until our 60s and then retiring is outmoded. She puts forward suggestions about how to redesign our lives to better fit our needs.

Every era has its hot sector and/or country, which are bid up by investors into bubble-like territory. Today, US large-cap tech is arguably in vogue. Yet, Bradley Waddington from Longview Economics believes the parallels between the dotcom boom and bust of 2000 and now are eerie, and a change in market leadership may be near. He thinks the energy sector and Europe could be set for a change in fortunes.

Meg Heffron is back, this time to talk about SMSF trust deeds. Even though these deeds are often generic and almost always easy to change, she says they remain critically important.

While most property segments had a tough 2023, retail was comparatively resilient. Cromwell's Colin Mackay thinks the prospects for large retail assets catering to the likes of furniture and appliance stores look especially attractive for this year.

In this week's Wealth of Experience podcast, we have Peter Warnes on ASX opportunities for 2024, East 72's Andrew Brown on why he likes owners with 'skin in the game', including English soccer giant, Manchester United, and VanEck's Jamie Hannah explains the increasing popularity of smart beta ETFs and funds.

Two extra articles from Morningstar for the weekend. Mark LaMonica looks at 11 ASX offering great value right now, while Shani Jayamanne outlines the lessons from the best performing stock of the past 80 years (and the name will surprise you).

Lastly, in this week's whitepaper, Schroders thinks there's structurally higher inflation ahead, and details what that means for investors.

**

Weekend market update

On Friday in the US, markets rose early, faded, and then staged a minor recovery into the close of a long weekend. Bank results largely disappointed and traders increased bets that the Federal Reserve is set to pivot to rate cuts in March. The S&P 500 finished up 0.1%, while the Nasdaq was flat and the Dow lost 0.3%. Brent crude oil gained 1% amid Middle East concerns, while the 10-year yield fell three basis points to 3.94%.

From AAP Netdesk:

The local share market on Friday closed slightly lower after a US inflation readout came in slightly higher than expected. The benchmark S&P/ASX200 index moved in and out of negative territory all day, finally finishing down 7.7 points, or 0.1%, to 7,498.3. The broader All Ordinaries dropped 6.3 points, or 0.08%, to 7,730.5. For the week, the ASX200 rose 9.2 points, or 0.12%, after alternating each of the past five days between gains and losses.

The ASX's 11 sectors finished mixed, with three gaining ground, six losing it and consumer discretionary and real estate basically flat.

Consumer staples was the biggest mover, dropping 1.2%, as Coles fell 2.1% and Woolworths retreated 1.5% amid mounting pressure for a federal government inquiry into rising grocery prices.

The energy sector finished up 0.5% after the US and Britain began air strikes against the Iran-backed Houthi rebels in Yemen that have been disrupting international shipping in the Red Sea, pushing Brent prices close to a two-week high. Santos gained 1.5%, Woodside climbed 0.5% and Beach Energy rose 3%.

Uranium developers kept on surging amid soaring yellowcake prices, with Boss Energy rising 5% to an all-time high of $5.09 and Bannerman Energy up 5.6% to a two-year high of $3.38

The Big Four banks were mostly lower, with ANZ dropping 0.6% to $25.90, Westpac and NAB both falling 0.2% - to $23.19 and $30.91, respectively - and CBA basically flat at $113.63.

In the heavyweight mining sector, Fortescue added 1.2% to $27.37 and Rio Tinto rose 0.6% to $129.15, while BHP edged 0.2% lower at $47.71

JB Hi-Fi climbed 2% to an all-time high of $57.86, finishing the week up 9.8% from where it began amid signs of a rebound in consumer spending.

Rebel sports owner Super Retail Group rose 3%, Myer climbed 1.6% and Adairs added 1.1%.

From Shane Oliver, AMP:

The good news on inflation has mostly continued. Putting aside normal volatility, inflation in major countries appears to be falling almost just as quickly as it went up.

- Eurozone inflation rose to 2.9%yoy in December but core inflation fell further to 3.4%yoy.

- US CPI inflation rose to 3.4%yoy in December with higher-than-expected energy and food prices and still sticky services inflation. But the trend remains down with a fall likely in the months ahead as high increases in January and February last year drop out of annual calculations, core inflation fell further to 3.9%yoy, other measures of underlying inflation continue to fall, the breadth of high price increases is falling, and producer price inflation was less than expected in December. The six-month annualised rate of core private final consumption deflator inflation which fell below the Fed’s 2% target in November is likely to have fallen further to 1.8% in December.

- Australian inflation surprised on the downside for the second month in a row falling to 4.3%yoy in November, as large price rise a year ago in areas like food, transport, auto fuel and travel are replaced by more modest price rises or falling prices. While price rises are still rapid in rents, electricity and insurance they are slower or falling for fuel, holiday travel, food, clothing and household equipment and underlying inflation measures are also cooling. In fact, we expect December 2023 monthly inflation to fall to around 3.3%yoy as the 1.5% monthly surge in December 2022 (which was largely due to a 27% rise in travel costs) drops out of the annual calculation.

We continue to expect the RBA to start cutting in June with the cash rate falling to 3.6% by year end. The sharper than expected fall in inflation recently means that the RBA’s inflation forecasts (for 4.5%yoy in the December quarter 2023 and to only reach 2.9%yoy by end 2025) are looking too hawkish. Supply side problems associated with Red Sea shipping and the DP World ports dispute pose near term risks to inflation, but assuming they are resolved in the next few months we expect the quarterly CPI to show inflation around 3.5% in the June quarter and 3% by December this year. But with shorter term inflation momentum falling and growth weak the RBA (and other central banks) shouldn’t have to wait for inflation as measured on a 12-month ended basis to be back at target before starting to cut rates.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

LIC Monthly Report from Morningstar

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website