The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

There are five ways to get very wealthy, so wealthy that you don’t have to worry about money for the rest of your life: a highly paid career, having equity in a business or businesses, family money, luck, or a combination of these. Let’s go through them:

1. A highly paid career

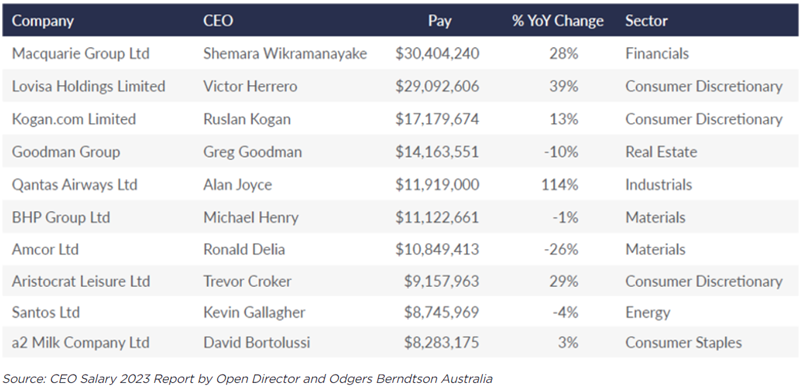

This is the least likely to get you exceptionally rich. Sure, CEOs at leading ASX companies get paid well. Macquarie Group’s Shemara Wikramanayake got paid more than $30 million last year, the highest of any ASX CEO. That just topped Lovisa’s Victor Herrero who earned $29 million. And there are plenty of companies outside the ASX 300 where CEOs also get paid generously.

Top paid ASX CEOs for 2023

How do people reach these CEO positions? They often make it to CEO from being Chief Financial Officers (CFOs) or Chief Operating Officers (COOs). These positions are occupied primarily by those with commerce and legal backgrounds, with university qualifications and MBAs to back them up.

There aren’t many human resource or marketing employees that make it to CEO. Recently, the widely respected former CEO of Mirvac, Susan Lloyd-Hurwitz said it’s a pity that more leaders don’t have human resources or marketing experience as being a CEO required generalist skills and 90% of the job was dealing with people. I agree.

There also aren’t many employees who rise from the bottom of a company to the top. Woolworths incoming CEO Amanda Bardwell is one exception, having been at the company for 23 years, and starting in retail at the age of 15.

Suffice to say, the chances of becoming a CEO are low. The top 500 current ASX companies CEOs come from a pool of 14.2 million Australian workers.

Outside of company leadership positions, there aren’t many roles or professions that offer life-changing pay packets. There are the obvious ones of being a leading doctor or lawyer. These roles are well paid because they offer essential services that are in high, and often urgent, demand. People can’t wait for an essential medical operation or a top lawyer for a high-profile legal case, so they’ll pay up to get them. And supply of doctors and lawyers is limited, deliberately so in the case of doctors via university admission and medical board entry requirements.

The odds of becoming a leading doctor or lawyer are certainly a lot better than those of rising to be a CEO. However, the ranks of the nation’s mega rich aren’t filled with doctors and lawyers.

Besides these roles, are there others that can deliver highly paid careers? It’s possible, though I can’t think of many. Perhaps, specialist technology roles have offered high pay in the past, though that has receded since the tech downturn of 2021. Plus, the real money in tech was made through employees owning shares in the company they worked for rather than through salaries.

2. Family money, or winning the genetic lottery

The second way to become very wealthy is through family money, or the Bank of Mum and Dad. You’d be surprised how many ‘rich listers’ come from family money. In Australia, there are the likes of James Packer, Gina Rinehart, Anthony Pratt, Harry Triguboff, and Jerry Schwartz.

I must admit to a personal bias for the wealthy person who’s come from nothing, versus those who’ve built off the back of family money. In my experience, it’s much easier to make money when you’ve already got money, than if you start from scratch.

With skyrocketing asset prices during the past four decades, more wealth is now being passed down from parents to children. The Productivity Commission estimates $3.5 trillion will be transferred from Baby Boomers to their children in Australia by 2050.

3. Equity in a business or businesses

This is the most common way to become wealthy. In the US, close to 90% of the nation’s millionaires own businesses. Of the top 10 richest Americans, all of them own businesses.

Top 10 richest Americans

Source: Forbes, Firstlinks

Warren Buffett is a fascinating case study – is he a businessman or an investor? I think he’s both as he’s succeeded by owning whole businesses and parts of businesses. He started off his first fund in 1956 with just US$100 of his own money and raised US$105,000 from seven others. Four years later, he’d turned his stake into US$1 million or more than US$9 million today. He took control of Berkshire Hathaway in 1965, and his full ownership of insurance companies since then has helped fuelled much of the growth of the company. Insurance has given Buffett access to a low-cost source of funds that’s allowed him to subsequently buy minority stakes in leading companies such as Coca-Cola, American Express, and Apple.

The US story of billionaires having their own businesses is also true of Australia. Here, nine of the top 10 richest people has sourced most of their wealth from owning businesses.

Top 10 richest Australians

Source: Forbes, Firstlinks

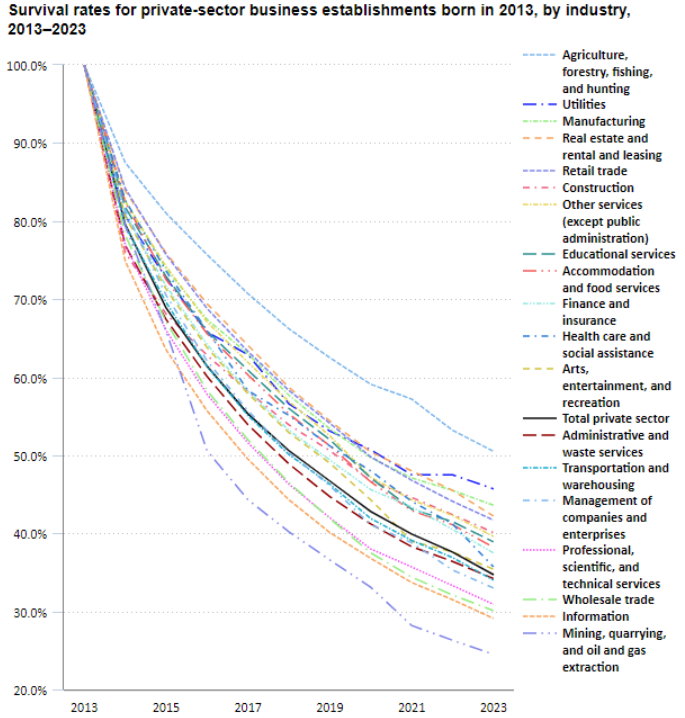

Billionaire entrepreneurs are rightly lauded for starting and growing their businesses. Yet for every one entrepreneur that makes it big, there are thousands that fail. The media highlights the successes, though the failures are largely hidden from the public eye.

The US has better statistics than Australia on small business failure rates, and the Bureau of Labor Statistics there suggests that of the small businesses started in 2013, only one third survived thorough to 2023.

In Australia, the ABS says that 23% of businesses fail within their first year, and 48% don’t make it to the fourth anniversary.

That means becoming wealthy through starting a business comes with large risks along with large potential rewards. It shouldn’t surprise that wealthy entrepreneurs can come with big egos, given the confidence and resilience required to get a business off the ground.

4. Luck

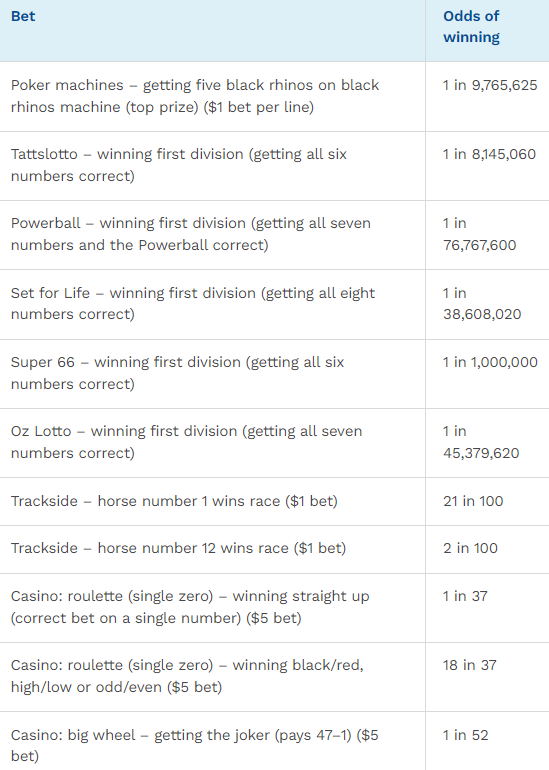

Luck can be a source of wealth. We’ve all heard of the lottery winners taking home tens of millions of dollars. The problem is that the odds of being a winner are incredibly small.

Here are the chances of winning from various gambling activities in Victoria.

Source: Victorian Government

Luck can come in other ways, though. I agree with Nassim Taleb who suggests that luck plays a huge, often unacknowledged role, in success and wealth:

“Hard work will get you a professorship or a BMW. You need both work and luck for a Booker, a Nobel or a private jet.”

Malcolm Gladwell, in his book Outliers, details the role that luck played in the rise of Bill Gates and Microsoft. Gates was born and raised in Seattle to wealthy parents, who sent him to a private high school, which happened to be the only one in America with a computer terminal in 1969. The University of Washington happened to be across the road from his high school, and it had an even more sophisticated computer. At the university, he met Paul Allen, who went on to become his business partner. Later, his mother’s social connection with IBM’s chairman helped him to gain a contract from the then-leading PC company that was crucial for establishing his software empire.

Gladwell says of Gates and other ‘outliers’:

“These are stories … about people who were given a special opportunity to work really hard and seized it, and who happened to come of age at a time when that extraordinary effort was rewarded by the rest of society. Their success was not just of their own making. It was a product of the world in which they grew up.”

5. A combination of factors

Getting wealthy invariably involves a combination of the above factors. For instance, Gina Rinehart had family money that led her to own the Hancock Prospecting empire, which has benefited from her nous and an iron ore boom to propel her into being the richest Australian.

Harry Triguboff also came from money. He turned to property development in the early 1960s just as Australia was about enter a decades-long housing boom. His almost sixth sense for property eventually led him to build the hugely successful apartment and hotel brand, Meriton.

Others have done it in different ways. David Di Pilla went from being an investment banker to running UBS in Australia to then building his own business, HMC Capital. Di Pilla is credited with putting together the proposed merger of Chemist Warehouse and Sigma, and he's already made a lot of money from the deal.

Roman philosopher, Seneca, perhaps sums it up best: “Luck is what happens when preparation meets opportunity”.

-----

Graham Hand's article last week understandably struck a chord with readers. It wasn’t just his battle with brain cancer. It was also his revelations of struggling with not being able to work, and in some ways, of losing his personal identity.

It brought home that in debates about retirement or semi-retirement, there’s a lot of focus on the financial aspects, but less attention is paid to the psychological challenges of retirement, which can be even more demanding. In my article this week, I outline these challenges and what can be done to overcome them.

James Gruber

Also in this week's edition...

Australia's population will increase by 3.7 million over the next decade, the equivalent of three Adelaides. Yet, the growth won't be evenly distributed. Over 85s will see the fastest growth, while the number of younger people will barely rise. Simon Kuestenmacher says this will have a significant impact on future housing demand and consumption patterns.

Dr. Ken Henry has again made headlines with calls for tax reform, this time at the launch of a new book by Paul Tilley, Mixed Fortunes: A History of Tax Reform in Australia. Tilley is a former economic adviser to governments and in an extract from his book, he outlines a brief history of tax reform and explores the pathway forward.

Clime Asset Management's Paul Zwi has written a great article on one of the major, yet little talked about, macroeconomic developments of recent years: the rise of America as a global energy superpower. Paul looks at how it came about and its global implications.

Japan is the flavour of the month among international fund managers as corporate governance reforms lead to a surge in optimism, coinciding with the share market reaching all-time highs. Antipodes Partners' Alison Savas says Korea is now following the Japanese reform playbook and that may bode well for its stock market.

The real estate sector isn't renowned for being forward thinking when it comes to technology. But Cromwell's Colin Mackay says now is a critical juncture, as the emergence of AI is likely to transform the industry, by changing the way that people live, work, and play.

Tax time is fast approaching. Rachael Rofe says that with impending Stage 3 tax cuts incentivising people to bring forward future tax deductions while tax rates are higher, it’s a good time to explore how to bolster your tax savings and community impact through structured charitable giving.

Two extra articles from Morningstar for the weekend. Nathan Zaia looks at the top ASX banking opporunities following the recent sector rally, while Seth Goldstein asks whether Tesla is yesterday's story.

Finally, in this week's whitepaper, ‘divergence’ is the key theme for VanEck's latest update as 2024 heralds a de-syncing of central banks, which had been following a similar approach to monetary policy for the last few years.

***

Weekend market update

On Friday in the US, stocks lurched lower as the S&P 500 logged a 1.4% decline to wrap up its second consecutive weekly loss. Meanwhile, Treasurys pared their recent losses 2- and 30-year yields settling at 4.88% and 4.61%, respectively, down five and four basis points on the session. WTI crude gave back a sharp early advance to remain just below US$86 a barrel, gold reached US$2,427 per ounce before reversing sharply to $2,344, and the VIX settled north of 17, up more than two points.

From AAP Netdesk:

The local share market on Friday closed lower as traders adjusted to the likelihood interest rates won't be reduced soon, although gold miners continued their show of strength.

The benchmark S&P/ASX200 index on Friday fell 25.5 points, or 0.33%, to 7,788.1, while the broader All Ordinaries dropped 23.9 points, or 0.3%, to 8,050.2. For the week the ASX200 rose 0.2% thanks to its gains from Monday until Wednesday.

Eight of the ASX's 11 sectors finished lower, with health care flat, tech up 0.5% and utilities climbing 1.2%.

Consumer staples was the biggest loser, dropping 0.9% as Coles and Woolworths both fell 1.1%.

The heavyweight mining sector suffered its first losses of the week, falling 0.4% as BHP dropped 0.9% to $45.52, Rio Tinto dipped 0.3% to $127.90 and Fortescue edged 0.1% lower at $25.75.

But gold miners were ascendant was the yellow metal pushed further into record territory, continuing its bull run of the past three weeks. Newmont rose 0.8% to a three-month high of $60.27, Evolution added 0.5% to a three-month high of $3.98 and mid-tier miners Regis Resources and Red5 both climbed a bit more than 6%.

In the energy sector, uranium miners turned in a solid performance, with Deep Yellow and Bannerman Energy both rising 6.7% to hit multi-year highs and Boss Energy advancing 5.2%.

In the utility sector, Origin rose 2.4% to a more than five-year high of $9.77 after the electricity and gas company agreed to buy one of the most advanced wind and energy storage projects in NSW from a Belgium company for $300 million.

Genex Power, a Sydney-headquartered renewable energy company, rose 6% to 26.5c after agreeing to be bought by Japan's J-Power for 27.5c per share, or $381 million.

The Big Four banks were mostly lower, with CBA down 0.5% to $116.24, Westpac dipping 0.3% to $26.02 and NAB falling 0.4% to $34.15. ANZ was the outlier, basically flat at $28.95.

Star Entertainment dropped 7.3% to a three-week low of 50.5c after the beleaguered casino operator said its premium gaming rooms had underperformed during the third quarter, with revenue at the Star Sydney's premium rooms down 19.3% from a year ago.

Cettire fell 6.7% to $3.12 despite the online luxury retailer announcing $191 million in third-quarter sales, up 88% from the same quarter a year ago.

From Shane Oliver, AMP:

- Shares had another rough ride over the last week as higher than expected US inflation saw expectations for Fed rate cuts pushed out further, and reports of imminent strikes by Iran on Israel in retaliation for an attack in Syria pushed US shares down sharply on Friday, not helped by a fall in some bank shares. For the week US shares fell 1.6% and Eurozone shares fell 0.9%. Chinese shares fell 2.6% but Japanese shares rose 1.4%. Despite the messy global lead and the local money market pushing RBA rate cuts out to later this year or early next year the Australian share market managed a modest gain of 0.2% for the week with gains in materials on the back of a rise in the iron ore price and utilities offsetting falls in property, consumer and IT stocks. Bond yields rose in the US, UK and Australia but fell in Europe. While oil prices dipped slightly despite fears about an escalation in the war around Israel to directly include Iran, the copper price rose to new cyclical high and iron ore prices also rose. The $A fell as the $US rose.

- Hot US inflation for the third month in a row. US inflation came in at 0.4%mom in March for both headline and core which was yet again above market expectations for 0.3%mom, with key drivers of the upside surprise being rents and transport services. Three hot US CPIs in a row are a concern because it suggests a possible trend. The good news is that producer price inflation came in less than expected at 0.2%mom, March core PCE inflation (which the Fed targets) looks like it will come in lower at 0.26%mom and asking rents still point to a slowing in CPI rents. But the three higher than expected CPI readings in a row and the renewed upswing in services inflation will be a concern for the Fed at a time when strong economic data means it’s in no hurry to cut.

- Hotter US inflation delaying Fed rate cuts adds to the risk of RBA cuts taking longer too, but ultimately local inflation will determine what the RBA does and the money market reaction pushing rate cuts off into December or February 2025 looks overdone. The message globally is not all in alignment with the US with both Canada and Europe heading towards rate cuts around mid-year, which will likely be ahead of the Fed, so central banks don’t have to follow the Fed and this also applies to the RBA. Like Canada and Europe, Australia also has weaker economic growth (at 1.5%yoy) than the US. But the US experience will concern the RBA and on its own adds to the risk that rate cuts here are also delayed beyond our expectation for cuts to start around mid-year.

- More bigger government – its popular, but we have seen it all before. The last two weeks have seen a further push towards bigger government involvement in the Australian economy – with the ACCC to be given power to review more mergers and the launch of a “Future Made in Australia” plan with more to come in the Budget. The bigger government trend started with the GFC, got a push along by Covid and is being supercharged by the energy transition, heightened national security concerns, a more left leaning electorate and the dimming of memories of the problems of high government intervention in the past. “Making more things in Australia” is a worthy objective. I was buying Holdens up to their very end in 2017, but ultimately not many fellow Australians were and so they went bust. I am all for making things in Australia but not if its dependent on subsidies, trade barriers and government trying to “pick winners”. Unfortunately, the “Future Made in Australia” plan sounds just like old fashioned protectionism. It will feel good for a while - just as government protection creating the industries of the post WW2 future (notably cars and consumer whitegoods) did initially. But there is little evidence that we have a comparative advantage in producing things like solar panels (where prices are collapsing globally) or that government has any ability to pick industry winners to be bestowed with taxpayer money.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Monthly Bond and Hybrid updates from ASX

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

LIC (LMI) Monthly Review from Independent Investment Research

Monthly Investment Products update from ASX

Plus updates and announcements on the Sponsor Noticeboard on our website