The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

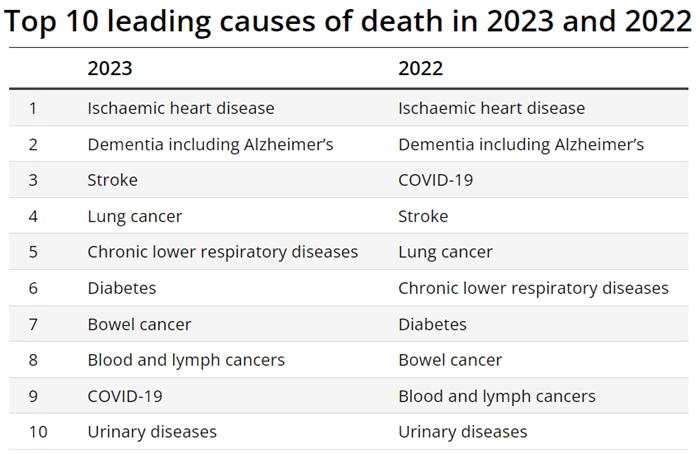

New data from the Australian Bureau of Statistics (ABS) on deaths in Australia has some good news, of sorts. Total deaths numbered 183,131 in 2023, a 4.1% drop from the previous year. The main reason for the decline was that the number of deaths from COVID-19 fell from 9,862 in 2022 to 5,001 last year. However, all the other leading causes of death decreased too, with the exception of bowel cancer.

These numbers are deceptive though. The ABS thinks that there was about 5% excess mortality in 2023. In plain English, that means there were higher than expected deaths. The ABS says that with an increasing and ageing population, the number of people dying should increase, yet improvements in health care should also mean that mortality rates fall. While the mortality rate for last year was lower than 2022, it was higher than that of 2020 and 2021.

Source: ABS

Dementia to become our biggest killer

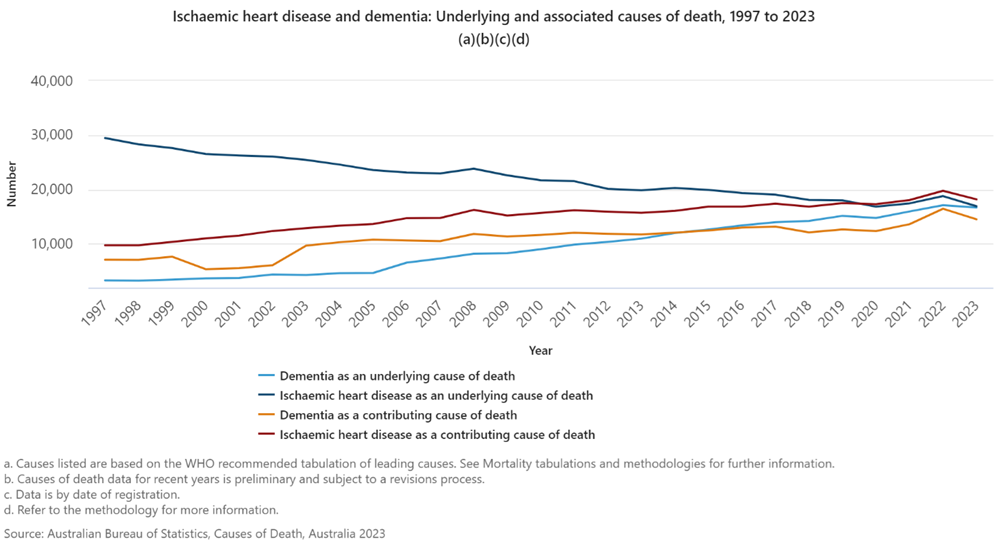

The big news from the data is that dementia is about to overtake heart disease as the leading cause of death.

In 2023, heart disease caused 9.2% of deaths, while dementia, which includes Alzheimer’s disease, accounted for 9.1% of deaths. It’s expected dementia will become our number one killer either this year or next.

For those unaware, dementia and Alzheimer’s can cause death by damaging the brain, eventually affecting areas of the brain that control the body, causing systems to go wrong and shut down.

Dementia is already the leading cause of death for women and has been since 2016. It makes up over 12% of female deaths compared to 6.4% for men. The reason for the disparity is that women have longer life expectancies than men and are more likely to live to an age when they have a heightened risk of developing dementia.

Dementia is already the leading cause of death in South Australia, the ACT, and for the first time in 2023, New South Wales.

In a separate study last month, the Australian Institute of Health and Welfare found that there were 411,000 Australians living with dementia in 2023. It revealed there were 26,300 hospitalisations due to dementia last year, with an average stay of 16 days, far longer than the average stay.

A historic change

Heart disease has held the unfortunate mantle of being the leading cause of death since 1968, so dementia overtaking it is a big deal.

Between 1968-1978, heart disease accounted for 30% of all deaths in Australia. That’s fallen to less than 10% today.

Meantime, dementia contributed to just 0.2% of deaths in 1968, and that’s now risen to 9.1%. It wasn’t until 2006 that dementia first appeared in the top five leading causes of death.

How it’s happened

The big question is why this change has happened. The fall in deaths from heart disease is likely due to several factors. For decades, there have been public health campaigns focused on the prevention of heart disease. I’m sure some of you may remember programs such as ‘Jump Rope for Heart’ in primary schools.

It’s not only preventative programs which have helped. Technological advances such as pacemakers have also allowed people to survive and live with heart failure.

Conversely, public health campaigns for dementia are only starting to be rolled out. A recent Lancet Commission study found that 45% of dementia cases could be prevented or delayed by addressing 14 risk factors starting in childhood.

Programs overseas are beginning to address brain health. In Scotland, the ‘My Amazing Brain’ program has reached thousands of primary school children, teaching them how to best protect themselves against dementia.

In Australia, Dementia Australia has several useful tools. It has a free Braintrack app as well as the CogDrisk program – a short assessment to help people understand their risk of dementia.

New drugs are also appearing to fight dementia. In July this year, the FDA approved Eli Lilly’s Alzheimer’s drug Kisunla, also called donanemab, for use in the US. It follows trials that showed the drug can modestly slow a decline in memory and thinking abilities.

An age-old debate

During COVID, there was divisive debate about whether people were dying from COVID or with COVID. It should be noted that a similar, albeit less public, debate is taking place in the medical community with dementia. Is dementia the real cause of death, or is it organ failure that’s secondary to vascular disease impacting the brain, body and so on? I’m sure we’ll hear more on this as dementia becomes more prevalent.

Premature causes of death

Talking about death is sad though talking about premature death is sadder still. One of the numbers that still stands out is that of suicides. There were 3,214 people who died by suicide in 2023, about 1.8% of total deaths. Men made up about three quarters of those deaths.

The median age for people who died by suicide was 46, making suicide the leading cause of premature death.

Another ‘silent’ killer is alcohol. There were almost 1,700 deaths from alcohol last year. Over the past six years, the alcohol death rate has risen from 4.7 per 100,000 people to 5.6.

****

My article this week looks into the puzzle of how so many wealth families through history have squandered their fortunes and the lessons that can be learned about the best ways to make and keep money.

James Gruber

Also in this week's edition...

Family trusts are widely used in Australia due to their commercial and tax benefits. Greg Russo provides an overview of how these trusts work, their advantages and disadvantages, and whether they may have a place in your individual investment strategy.

The makeup of stock markets changes all the time - companies come and go, through buyouts, mergers, acquisitions, delistings and so on. But how do indexes and the ETFs which track them adjust these changes? Vanguard's Tony Kaye has the answers.

Everyone seemingly loves AI and any businesses with exposure to it. Yet, there are other asset classes with significant structural growth opportunities that aren't getting the same attention and are fetching a fraction of the price. Jan de Vos of Resolution Capital focuses on one of these asset classes and the stocks he likes.

How can we prepare for the next market crash and the inevitable emotions that come with it? Geoff Saab thinks there's a lot that we can learn from the ancient Stoics and their idea of “premeditatio malorum”—the premeditation of evils.

Is it too late to buy bonds? Capital Group's Haran Karunakaran thinks not, given the impending US rate cutting cycle and that bonds are again proving to be a genuine diversifier with investment portfolios.

It may not be just bonds that benefit from US rate cuts. Samuel Bentley and Yuan Yiu Tsai believe emerging markets could be the biggest winners from monetary easing. And they address the elephant in the room: whether China's recent uptick is for real or just another head-fake.

Two extra articles from Morningstar this weekend. Jon Mills asks whether BHP shares are attractive after earnings and Joseph Taylor highlights two stocks in what is likely the ASX’s cheapest sector.

Lastly, in this week's whitepaper, and given the recent hurricane in Florida, Franklin Templeton offers a timely introduction to catastrophe bonds.

****

Weekend market update

US stocks on Friday cruised toward moderate gains of 0.4% on the S&P 500, leaving the broad index on the cusp of new highs set earlier in the week.. Treasury yields dipped in turn with the two-year note hovering near 3.95%, while WTI crude slumped below $69 a barrel, gold marched higher to $2,721 per ounce, and the VIX retreated to near 18.

From AAP Netdesk:

The Australian share market finished lower on Friday, giving back most of the previous day's gains that had pushed it to a record high. The benchmark S&P/ASX200 index on Friday finished down 72.7 points, or 0.87%, to 8,283.2, while the broader All Ordinaries dropped 72.9 points, or 0.85%, to 8,551.2. For the week, the ASX200 still rose 0.84% - its second straight week of gains.

All the ASX's 11 sectors finished lower on Friday, with utilities the biggest loser, dropping 3.5%, dragged by APA Group. The pipeline operator fell 6.3% to a decade-low of $7.16 after its biggest shareholder, Unisuper, sold $500 million worth of shares in a huge block trade.

Flight Centre had an even worse day, plunging 20.4% to a one and a half year low of $17.20 after the online travel agent issued a poorly received trading update. Corporate Travel Management dropped 9.5% on Friday, while WEB Travel Group fell 4.1% and Webjet Group dipped 2.4%.

The big four banks were mixed, with Westpac down 0.4% to $32.41 and ANZ dropping 0.7% to $31.59, while CBA added 0.6% to $142.85 and NAB grew 0.2% to $39.18.

In the heavyweight mining sector, BHP and Rio suffered their third straight day of losses, falling 2.2% to $42.06 and 0.9% to $117.62. Fortescue fell for a second day, losing 1.9% to $19.54.

Goldminers were mostly ascendant as the precious metal hit a record high of $US2,714 an ounce, up more than 30 per cent since the start of 2024. De Grey rose 1.5%, Westgold climbed 4.4% and Northern Star grew 0.3%, although Evolution dipped 0.2%.

In health care, Telix Pharmaceuticals climbed 4.6% to a record high of $21.96 after the radiopharmaceutical company announced it had brought in $201 million in revenue in the September quarter, up 55% from a year ago.

"Our achievements over the past quarter reinforce Telix's leadership in the radiopharmaceutical sector," CEO and managing director Christian Behrenbruch said.

From Shane Oliver, AMP:

- Global share markets mostly rose over the last week. US shares rose 0.9% on the back of solid economic data and a mixed but okay start to earnings reporting season. Eurozone shares rose 0.2% with the ECB cutting rates again. Japanese shares fell 1.6%, but Chinese shares rose 1% helped by better than feared economic data despite a lack of detail about fiscal stimulus plans. Australian shares benefitted from the solid US lead and made it to record highs, rising 0.8% for the week. Gains on the Australian share market were led by financial, industrial and health care shares offsetting weakness in energy and IT shares. Oil prices fell 8.4% and metal and iron ore prices also fell, but gold prices rose to a record high. The $A fell as the $US rose.

- Global disinflation and rate cuts continued over the last week. September inflation data in Canada and the UK saw inflation fall below 2% and September quarter data saw New Zealand’s inflation rate fall to 2.2%yoy, which is back within the target range for the first time since March quarter 2021. This leaves the Bank of Canada on track to cut rates again in the week ahead, possibly by 0.5%, the Bank of England on track for another rate cut in November probably of 0.25% and the RBNZ also on track to cut in November by 0.5% but possibly by 0.75% as it doesn’t meet again until Feburary.

- The ECB cut its key policy rates by another 0.25% taking its deposit rate to 3.25% and its main refinancing rate to 3.4% noting that “the disinflationary process is well on track”. While President Lagarde provided no forward guidance and noted that the ECB will remain data dependent the overall tone of the ECB’s communications was dovish with Lagarde seeing the risks to inflation as being on the downside. The ECB is likely to cut again at its next meeting in December.

- The past few weeks have provided mixed messages as to the outlook for Australian interest rates. On the one hand falling global inflation is a good sign that Australian inflation will continue to fall. This is backed up by falls in forward looking output price indicators – in the NAB and PMI surveys - and the Melbourne Institute’s Inflation Gauge which are pointing to more good news on underlying inflation. And the RBA appears to be getting a bit less hawkish - with no consideration of another hike at its September meeting, the RBA dropping the “no rate cut expected in the near term” line from its formal communication and RBA Chief Economist Hunter noting that its less concerned about a rise in inflation expectations. Against this though, the September jobs data came in on the strong side with unemployment falling back to 4.1% reducing the pressure to ease to help the economy and likely reinforcing RBA concerns that the jobs market is still too tight risking wages growth greater than is consistent with the 2-3% inflation target. That UK and US unemployment is also around 4% and yet they are seeing slowing wages growth and slowing inflation may provide the RBA with a bit of confidence not to be too concerned. But the September jobs data on its own reduces the possibility of a cut by year end (the money market now puts the probability at 26%) and puts greater importance on upcoming inflation releases. We think a December cut is still possible if underlying inflation comes in much weaker than expected, but our base case remains for the first cut to come in February.

Curated by James Gruber and Leisa Bell

A full PDF version of this week’s newsletter articles will be loaded into this editorial on our website by midday.

Latest updates

PDF version of Firstlinks Newsletter

Australian ETF Review from Bell Potter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website