With workplaces and schools finally starting to hum again after the summer break, now seems like a good time to look ahead at what the balance of the year has in store for us. This article touches on five key macro developments expected to influence commercial property performance and investment over the rest of 2025.

1. Rate cuts

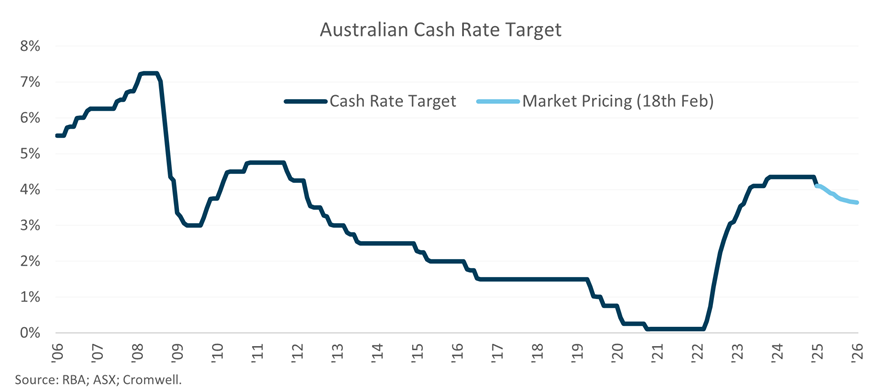

After hopes of a late-2024 rate cut were dashed in October by resilient labour data, attention switched to 2025 for the turning of the economic cycle and a return of looser monetary policy supportive of stronger growth. Financial markets were pricing a 90% probability of a rate cut prior to the RBA’s decision on 18th February, an expectation shared by most economists. The central bank didn’t disappoint, reducing the cash rate for the first time in over four years.

Governor Bullock’s post-meeting comments struck a hawkish tone, drawing attention to the upside risk to inflation that a tight labour market still poses and appearing to reflect a preference for a relatively measured and cautious cutting cycle. The market now expects two additional cuts this year, with economists generally forecasting a further 1-3 cuts. Because these cuts are expected by the market, instruments like Australian Government 10-year bonds have likely already ‘priced in’ most of the change – and so long-term bond yields may not see significant movement from their current level of around 4.5%[1] even as further cuts occur.

Regardless, rate cuts should be a net positive for commercial property by supporting a stabilisation of asset pricing, increasing transaction activity, and easing cost of debt pressures. An ‘easier’ monetary policy environment should also stimulate the economy, which is a benefit for a growth asset class like commercial property where tenants’ demand for space is linked to economic activity such as jobs growth, retail consumption, and trade volumes.

2. Shifting capital composition

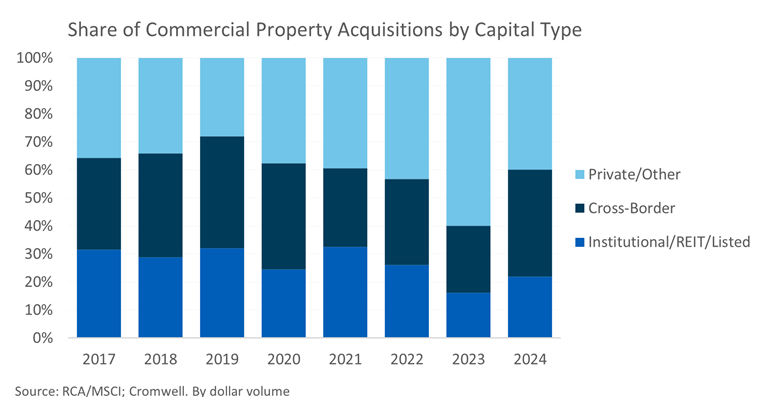

In downturns, nimble private investors tend to trade commercial property more actively than institutional holders. This cycle has been no different, with private buyers making up 45% of acquisitions (by dollar volume) from 2022-23, up from 32% in the five years prior. As 2024 progressed, offshore institutional capital thawed and allocated to the Australian market, becoming the dominant buyer type. Such investors have been involved in some of the headline transactions of the year, including Sydney office towers 55 Pitt Street, 255 George Street and 10-20 Bond Street.

Over the course of 2025, we expect domestic institutional capital to join the party and step up acquisition activity. This expectation reflects the turning of the cycle which appears to be occurring, and the stabilisation of prices that should continue as the cycle enters its next phase.

Deepening of the capital pool and increased activity from institutional buyers will be important precursors to price recovery – with more competition comes more aggressive bidding for assets. This competitive shift will likely be felt in specific asset segments (e.g. premium office) before others, and to differing degrees. While markets and segments that follow the cycle (rather than lead it) may face a slower price recovery, acquirers can benefit from a longer ‘buying window’ where sentiment is yet to align with property fundamentals.

3. Stronger consumers

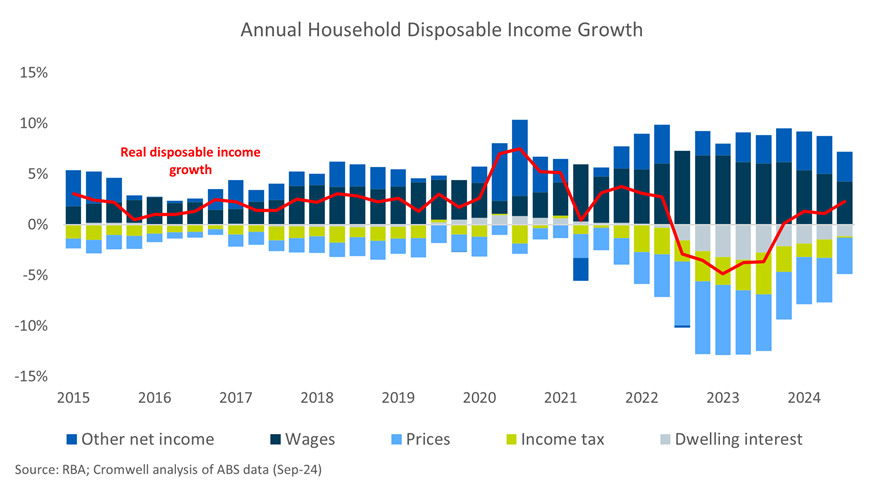

Consumers have been buffeted since 2022 by various cost-of-living pressures, spearheaded by surging inflation, higher interest rates, and bracket creep. These contributed to a stark fall in consumer confidence, subdued retail sales growth, and tough trading conditions for businesses that cater to households more broadly.

In good news for 2025, many of these headwinds are abating.

- Headline inflation has slowed from a peak of 7.8% in December 2022 to 2.4% as at December 2024[2]. Lower inflation is benefitting the real (inflation-adjusted) spending power of households.

- The arrival of rate cuts will lead to a decrease in what is the biggest expense for many Australian households.

- The Stage 3 tax cuts went live from July and are improving households’ disposable (post-tax) incomes.

With a federal election approaching, we may also see additional assistance for households announced in the first half of the year as politicians try to shore up support before voters head to the polls.

An improved outlook is starting to become evident in stronger consumer confidence measures, setting the stage for stronger retail sales growth. While rising disposable incomes will be welcomed by retailers across all categories, we believe long-term consumption trends will continue to provide outsized benefits to shopping centre assets which are resilient to e-commerce competition and more heavily weighted towards ‘essentials’.

4. Improved market sector job growth

The labour market has been remarkably resilient considering the broader economic slowdown – jobs growth of 2.5% was recorded over the year to September 2024, in stark contrast to GDP growth of only 0.8%[3]. However, the robust outcome was largely driven by the non-market sector, comprised of industries such as education, healthcare, and public administration, where demand is not determined by typical market forces or the business cycle. During this period, the non-market sector accounted for 94% of the jobs created and market sector jobs growth was a meagre 0.2%.

Demand for office space is correlated with white collar jobs growth, which is largely represented by the market sector. Although headline jobs growth may slow in 2025, market sector jobs growth should accelerate from its low base due to the anticipated rate cuts, which benefit industries exposed to the business cycle. This is expected to contribute to stronger jobs growth in the typical ‘office-using’ industries, positively impacting office space demand, reducing vacancy rates, and enhancing rental growth conditions.

While the outlook for office market conditions appears more favourable over the next twelve months, the risk of asset obsolescence remains elevated due to shifting ways of working and amenity preferences. Property selection will be a key driver of outperformance for investors.

5. Geopolitical uncertainty

Geopolitical uncertainty was a key feature of 2024. It was the biggest election year in history globally, with 80 countries heading to the polls and incumbents’ power diminishing in over 80% of the elections held[4]. At the same time, conflict in the Middle East escalated and the Russia-Ukraine war continued unabated.

It looks set to be much of the same in 2025. While most of the election outcomes are now known, implications for the global and domestic economies are yet to become evident. Trade policy is top of mind following Trump’s campaign trail promise of 60% tariffs on Chinese goods, 25% on Mexican and Canadian imports, and 10% on imports from all other countries. While negotiations are underway and such extreme tariffs are unlikely, increased protectionism of some degree is anticipated and could lead to retaliatory measures including counter-tariffs. Similarly, tariffs are typically viewed by economists as inflationary and may stoke cost-of-living pressures once again, particularly if combined with fiscal stimulus. But it’s also possible that disrupted global trade has a deflationary effect if confidence and growth take a significant hit. It is a time of known unknowns.

Whatever occurs, times of volatility and uncertainty often reward quality and security. Assets with strong tenant covenants and stable cashflow are well placed, as are those with enduring location advantages. Shifting trade dynamics are of particular relevance to industrial property and assets which can cater to manufacturing occupiers may benefit from an increased focus on domestic industry.

5b. A Broncos premiership

The author is unable to provide supporting data for this prediction.

A year with something for everyone

Economic growth should improve in 2025 as the RBA lifts its foot off the interest rate brake pedal, easing pressures on household wallets and business investment. A stronger economy is a positive for commercial property as increased consumption, jobs growth, and trade volumes underpin leasing demand.

Lower interest rates should also support the continued stabilisation of asset pricing, as capital markets normalise after several years of constrained liquidity and elevated debt costs. A stable price environment will be more conducive to improved transaction activity and subsequently valuation recovery.

There are some potential speed bumps which could sap momentum, not least of which is the geopolitical landscape. Given the environment of uncertainty, flight to quality is a theme which will likely continue to play out over 2025, rewarding assets that can provide investors with stable and secure income.

[1] RBA (as at 12th February 2025)

[2] December 2024 Quarterly CPI, ABS (29th January 2025)

[3] ABS September Labour Account and National Accounts (Dec-24)

[4] Market Outlook, Westpac (Dec-24)

Colin Mackay is a Research and Investment Strategy Manager for Cromwell Property Group. Cromwell Funds Management is a sponsor of Firstlinks. This article is not intended to provide investment or financial advice or to act as any sort of offer or disclosure document. It has been prepared without taking into account any investor’s objectives, financial situation or needs. Any potential investor should make their own independent enquiries, and talk to their professional advisers, before making investment decisions.

For more articles and papers from Cromwell, please click here.