What’s ahead for our housing markets in 2025?

Clearly residential real estate has defied the many doomsday forecasts made over the last few years, having moved through the bottom of its cyclical downturn in early 2023 and experiencing an overall strong recovery since.

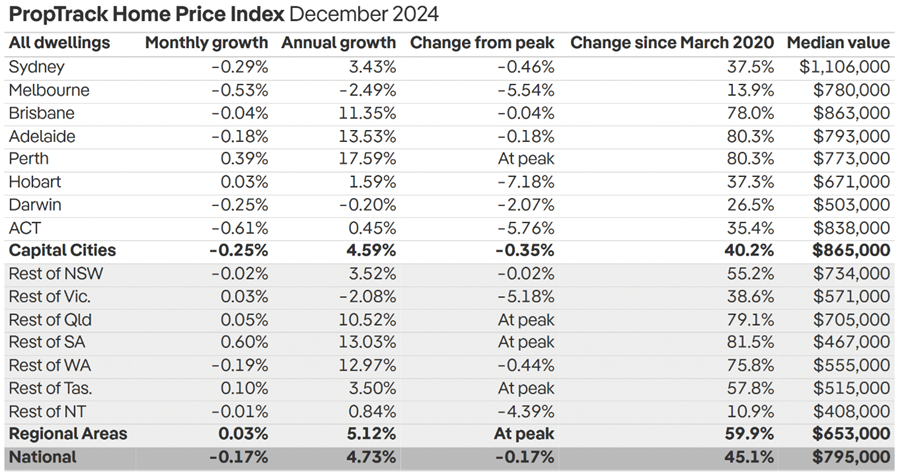

However, national home prices fell by 0.17% over the month of December, according to the latest PropTrack Home Price Index, though they remain 4.73% higher than 12 months ago and are up 45.1% since the beginning of COVID-19 in March 2020.

Source: PropTrack

Moving forward, our housing markets will likely experience a year of two halves in 2025, with a slower first half and then a resurgence in both buyer and seller confidence and, therefore, activity when interest rates eventually fall – probably in the second half of this year.

The resilience of the market

Of course, property has always been a cornerstone of Australia’s wealth, weathering economic turbulence with remarkable stability.

The total value of Australian residential real estate was estimated by CoreLogic to be $11.1 trillion at the end of November 2024; however, outstanding mortgages against all residential housing are only $2.3 trillion – resulting in a very comfortable 21% overall Loan to Value ratio.

In fact, 56.3% of total Aussie household wealth is held in residential property - one of the many reasons neither the banks, the government nor the RBA wants a property crash.

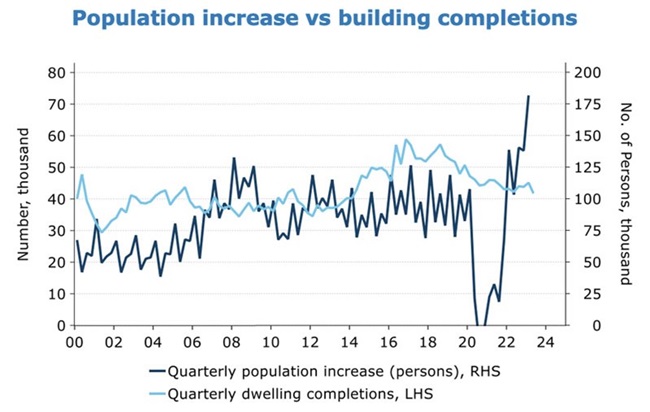

As we head into 2025, our markets will remain challenged by persistent high interest rates, an affordability crisis, a cost-of-living crisis, a Federal election and ongoing geopolitical problems. But one thing that won’t change any time soon is the chronic undersupply of housing, with the supply of new housing unable to keep up with demand from Australia’s growing population which will continue to be fuelled by strong immigration.

Source: ANZ Bank

And with the cost of new dwellings rising because of the ongoing challenges in construction, including labour shortages and rising material costs, this supply-demand imbalance is expected to keep upward pressure on property prices and rents in our capital city markets.

Economic and interest rate dynamics

With the Reserve Bank of Australia (RBA) tightening monetary policy since May 2022 in an effort to curb inflation, interest rates were constantly in the news in 2024. While rates have now stabilised, their higher levels compared to recent years will continue to negatively affect borrowing capacity and buyer behaviour in 2025.

However, as inflation eases and the economy adjusts, the RBA is likely to start cutting interest rates in the second half of this year and I can see the market then moving to the next phase of the property cycle.

In general, when interest rates decline, the market tends to experience a surge in activity as borrowers can afford larger loans, buyers who were previously priced out of the market start to re-enter, and those who were sitting on the sidelines rush to buy before prices climb too high. This creates a snowball effect that can rapidly drive up property values.

Other forces that could influence the market include:

- Wage growth: Rising wages will bolster borrowing capacity for many Australians, supporting demand in the property market.

- Employment stability: Even though the unemployment rate may creep up a little, anyone who wants a job can get a job, and this security means it is likely that buyer confidence will stay strong.

- Consumer sentiment: While sentiment remains cautious due to economic uncertainty, when our federal election is over and once interest rates start to fall, confidence will return, and Australians will again feel ‘confident’ in making big purchases like upgrading their homes.

Clearly, affordability has decreased, and property values have fallen a little in a number of our capital cities, but the housing markets are being underpinned by a number of factors:

- Wealthy buyers entering the market with higher deposits.

- Downsizers who had a lot of equity in their homes are buying debt free - in fact a third of properties last year were transacted with no mortgage at all.

- The bank of mum and dad and inheritances are helping many buyers with a deposit.

- Some buyers are buying in cheaper markets while others are buying units rather than houses.

- The property boom of 2020-21 left many homeowners with significant equity in their homes.

Migration and demographics

In the year ending 30 June 2024, overseas migration contributed a net gain of 446,000 people to Australia's population. While this decreased from the record 536,000 people the previous year, this was a pivotal driver of rental markets as most immigrants rent for the first 3 to 5 years before putting down permanent roots. And while the government keeps talking about decreasing our migration levels, this influx of skilled migrants is not only revitalising our workforce but also fuelling demand for housing, particularly in urban centres like Sydney, Melbourne, and Brisbane, as these three cities are set to absorb the lion’s share of population growth, creating opportunities for investors targeting rental properties.

In addition to migration, demographic shifts within our domestic population will play a significant role. Younger generations, Millennials and Gen Z, are increasingly entering the housing market, either as first-home buyers or investors.

While there has been a lot of talk about the plight of first home buyers, there were a total of around 550,000 property transactions in 2024, and according to ABS finance figures, around 110,000 first home buyer transactions. In other words, around 20% of all property sales last year were to first home buyers, and it is likely that a number of investor transactions were also to first time buyers who chose to ‘rentvest’ – rent where they want to live but can’t afford to buy and then use their funds to invest where they can afford to buy.

What’s ahead for 2025?

The last few years have shown us how hard it is to forecast property trends, and as always, there will be headwinds and tailwinds buffeting our property markets.

As I said, I see a year of two halves for our housing markets, which will remain fragmented with local economic factors, such as consumer sentiment, employment, and migration, predominantly driving the markets.

While the outlook is largely positive, the market will likely experience a number of hurdles:

- Affordability concerns: Despite softening growth rates, housing affordability will remain a critical issue, not only for home buyers but also for renters, with rents skyrocketing over the last few years as vacancy rates hit historically low levels.

- Construction bottlenecks: While the government is encouraging the construction of 1.2 million new dwellings in the next 5 years, labour shortages and rising costs will continue to delay new housing projects, which will also be more expensive, exacerbating the supply-demand imbalance.

- Regulatory changes: Ongoing debates about taxation policies, such as stamp duty reforms, and potential changes to negative gearing could influence market dynamics. As will any further interference to residential tenancy regulations by state governments, which have already scared off many investors.

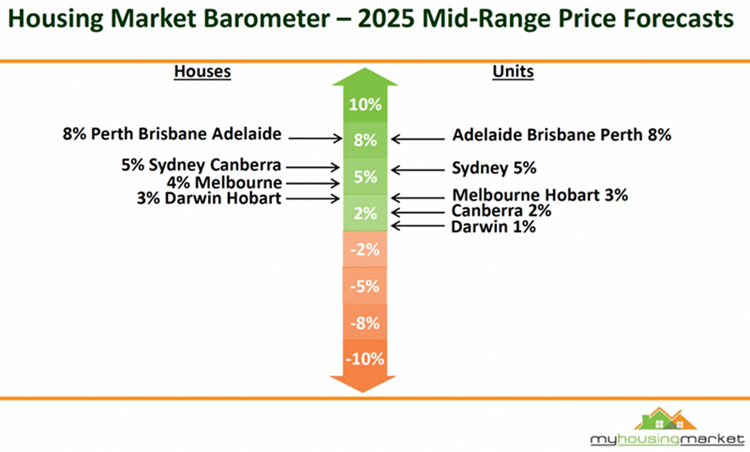

Dr Andrew Wilson, chief economist of My Housing Market, has made the following forecasts for 2025.

Conclusion

The Australian property markets are poised for another year of resilience and opportunity in 2025. While challenges persist, and prices may continue to fall a little in the next few months, the market’s fundamentals – robust demand from a growing population at a time of limited supply, a strong jobs market and demographic shifts – provide a solid foundation for further price growth, albeit at a slightly slower rate than last year.

While it might feel counterintuitive to buy at a time when there are so many mixed messages in the media, home buyers and investors with a long-term focus will benefit from less competition, minimal downside risk and minimal risk of oversupply.

Michael Yardney is the founder of Metropole Property Strategists who help their clients grow, protect and pass on their wealth through independent, unbiased property advice and advocacy. He's once again been voted Australia's leading property investment adviser and one of Australia's 50 most influential Thought Leaders. Subscribe to The Michael Yardney Podcast.