Increasing attention is being directed at whether the activities of super funds may have ‘systemic’ effects, with particular focus on the potential for adverse impacts. We define ‘systemic’ for the purpose of our research as: “aspects of the super system that have widespread and significant implications for either the Australian economy, Australian financial markets or a significant number of Australians”.

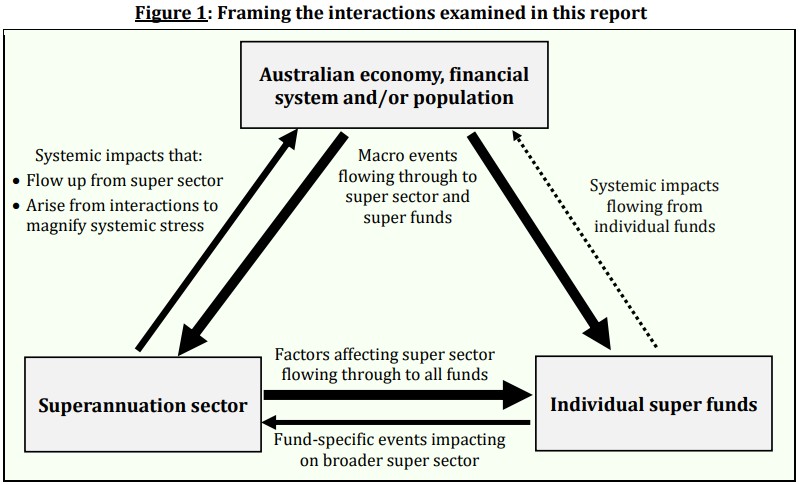

Figure 1 outlines the interactions that are considered between three broad areas – the Australian economy, financial system and/or population; the superannuation sector (the collective of all funds); and individual super funds. To be denoted ‘systemic’, an aspect needs to have a significant impact on one or all of the three ‘macro’ components identified in the top box.

The width of the arrows that interconnect each area in Figure 1 represents our evaluation of the degree to which the interconnection is consequential. For instance, we consider impacts flowing from the broader macro environment to be quite consequential for the super sector and individual super funds. Meanwhile, the systemic impacts flowing up from the super sector are seen as moderately consequential and those flowing up from individual funds to be of limited consequence.

Key theme #1: Big super is a boon overall

Australia benefits from having a large super industry for four main reasons, which together well-outweigh any problems and risks:

- Super establishes a significant pool of retirement savings that may not have otherwise existed.

- Super funds operate as a vehicle for professional management of those savings by fiduciaries who are subject to various regulatory requirements.

- Super funds are well-positioned to act as effective stewards of the capital that they invest.

- The super sector rounds out the sources of finance within the Australian economy in ways not well-accommodated by other providers such as banks and direct investment by private investors.

The benefits of big super might be appreciated by considering the counterfactual. In the absence of the super industry having developed into its current form, many individuals would be left to their own devices in saving for retirement. The outcome probably would have been many people under-saving for retirement, poorer decisions by some as they attempt to invest for themselves, heightened agency risk and higher fees for individuals who invested via commercial operators, and greater potential exposure to scams and fraud.

In short, Australia and Australians are much better off with a large super industry than without.

Key theme #2: Super as an unlikely source or propagator of systemic stress

A key theme that sits at odds with the tenor of current commentary is that we view super as having limited consequences for systemic risk. First, we see super as an unlikely source of major systemic stress due to an absence of financial leverage and a lack of clear mechanisms for spreading problems from super to the broader system. Basically, problems within super may cause harm to fund members, but the damage is likely to remain within the sector’s perimeter rather than the cause of major disruption in the Australian economy or financial markets.

We are more open to the idea that super might magnify stress arising from elsewhere. This could occur if the super sector becomes a forced seller of assets and/or withdraws funding from a key sector. However, super could equally act as a stabilising force through buying assets most under pressure or providing funding where it is most needed (as in the GFC). What happens will depend on how the situation unfolds.

An important element is that we see limited potential for broad impacts to arise from a liquidity squeeze within the super sector or a run on a large super fund. The notion that super funds offer redemption at call with up to 30%-35% invested in unlisted assets coupled with potential for cash calls on foreign exchange (FX) hedges has been highlighted as a possible source of liquidity risk. Potential for this situation to result in major liquidity strains is limited by:

- Low member propensity to switch or redeem;

- Accumulation balances needing to remain within the super system;

- Asset sales merely transfer assets, which may lead to wealth transfers if assets are sold cheaply, but likely quite limited wealth destruction;

- Liquid assets can be sold to satisfy cash demands, merely resulting in ‘out-of-shape’ portfolios; and,

- The authorities can take action if required, e.g. APRA can suspend redemptions, RBA can step in if super funds withdraw funding from the banks.

While a sector-wide liquidity event or run on a big super fund could cause harm to the members of the funds or fund involved, it is hard to envisage significant systemic impacts arising given the above.

Nevertheless, super does have potential to give rise to adverse consequences that could impact on many Australians. Our two main areas of concern are discussed as theme #3 and theme #4.

Key theme #3: Super serves to heighten exposure to economic and market risk

Super funds expose their members to economic and market risk in order to seek higher expected returns, with a sector weight in growth assets of about 70%. This is entirely appropriate, as it boosts expected outcomes for members, e.g. likelihood of higher income in retirement. Such exposures also come with some danger. We sense that the risks associated with economic and market exposure are underappreciated, probably because the lived experience is that markets have always gone up. History contains ample examples of risk assets such as equities suffering declines that result in substantial loss of wealth spanning multiple decades. Never say never!

While extended weakness in markets is unlikely, if it were to occur the impacts could be dire for the wealth, retirement income and possibly confidence of super fund members. Further, any extended loss through super is likely to occur in conjunction with major economic problems that are causing broader harm. Super is effectively doubling down on economic exposure on behalf of its members.

Key theme #4: The sector’s operational infrastructure is an area of concern

Underdeveloped operational infrastructure is our other main area of concern. Failures in member servicing – as highlighted by regulators and media – stand as an indication that something is not quite right somewhere in the system. We suspect this may reflect issues with the systems, processes and staffing on the operational side, particularly in relation to member administration. The likely root cause is that super is transitioning (quickly) from something of a cottage industry into a major financial sector but is struggling with legacy systems and processes.

Upgrading the operational infrastructure in the industry will be challenging and is likely to entail considerable cost, time and effort. We would like to see greater recognition of the situation, rather than presuming the underlying problems can be easily addressed and that ‘super funds are failing their members’ simply because they are incompetent or uncaring. What matters is whether super funds are working towards addressing any problems.

Other potential risks

Other aspects typically offer limited potential for systemic impacts of any major significance and/or have mixed or debatable implications. The following are notable:

- FX exposure – FX amounts to a significant exposure, with large super funds having about 43% in overseas assets. It is difficult to see how either direct FX exposure or FX hedges could be a major source of system stress, especially as any liquidity impacts should be manageable (see theme #2).

- Concentration of service suppliers – The super industry relies on a limited number of suppliers in custody, insurance, consulting and cloud computing (as well as member administration). It is hard to see how these relationships could result in significant harm or disruption to the system.

- Vulnerability to scams – While scams are a major concern in themself, the impacts tend to be felt by those affected rather than the overall system.

- Common approaches to investing – Super funds tend to invest in a similar fashion, giving rise to the possibility of herding and potential reduction in market depth and resilience. Systemic impacts should be limited by the presence of other investor types.

- Unreliable source of funding – We hold some concern over the potential for ‘feast or famine’ cycles in the funding provided by super as assets fall in and out of favour. While there could be potential harm within sectors affected, any systemic impacts will depend on the size of the sector and whether other funding sources exist.

- Loss of confidence and trust – Any loss of confidence and trust in super funds could play through via outflows and diminished ability of super funds to effectively service their members. While potentially disruptive, major systemic impacts are unlikely.

- Large fund getting into trouble – A large fund getting into trouble, potentially involving a run by its members, could harm the members of that fund but is unlikely to be a systemic event.

- Influence – Large super funds wield significant influence over their investments and possibly policymakers that could be used for good or ill. Either or both is possible.

How it all lines up

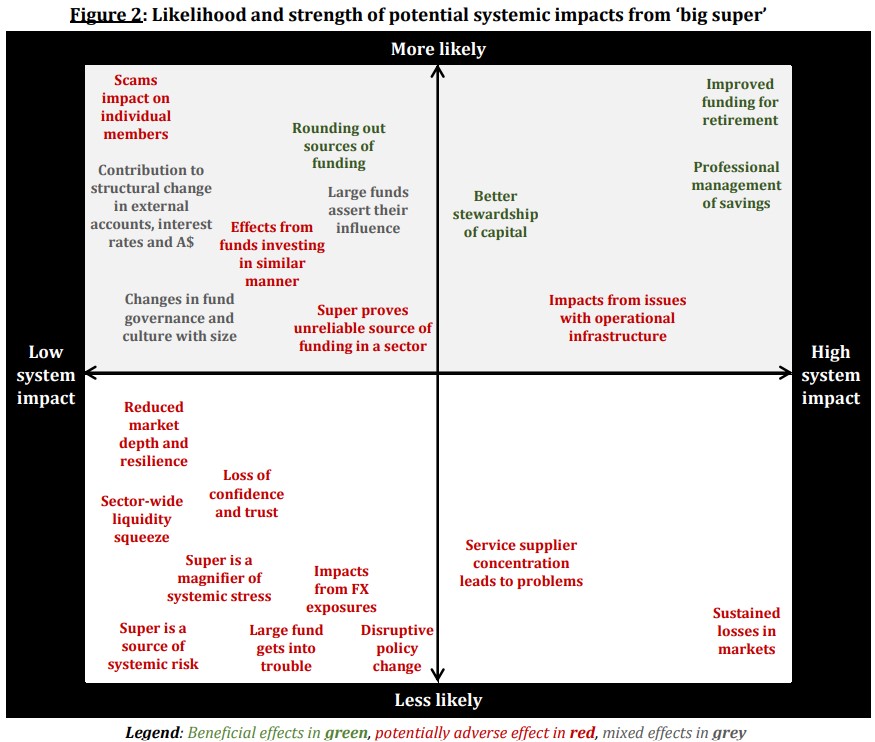

Figure 2 maps out the potential systemic impacts that could arise from the aspects identified and discussed within the report, with each notionally positioned according to likelihood of experiencing a systemic impact (vertical axis) and the potential strength of any impact (horizontal axis). Potentially beneficial systemic impacts appearing in green are skewed towards the upper right. Aspects with potentially adverse impacts appearing in red are greater in number but tend to sit to the left and lower in the diagram as they are considered either of lesser likelihood and/or lower magnitude. The overall mapping conveys a message that big super is beneficial on balance, with a few major benefits being squared off against more minor problems and threats.

Our overarching conclusion is that Australia is much better off with a large super industry than without it. In short, the growth of super has been a major boon for Australia on balance. However, no system is perfect, and big super gives rise to issues and risks to be considered or addressed. A key theme of this article is that problems within the super sector or a large super fund are likely to remain localised, causing harm to the fund members involved, but probably not having adverse systemic impacts to any significant degree due to a lack of clear channels through which problems in super can lead to stress across the Australian economy, financial markets or population.

* This is a edited extract from a more comprehensive report that can be found here.

David Bell is the Executive Director of The Conexus Institute. Geoff Warren is a Research Fellow with the Conexus Institute, and an Honorary Associate Professor at the Australian National University.