Within the world of retirement income planning, there are two major opposing schools of thought: probability-based and safety-first. Understanding the distinctions and thought processes of both schools is important in achieving the best outcomes.

Separating accumulation from drawdown: the difficulties of retirement income planning

In defined contribution schemes, there are differences between the wealth accumulation phase and the income distribution phase. One important difference is that the investing problem fundamentally changes in retirement.

The traditional goal of wealth accumulation is generally to seek the highest returns possible in order to maximise wealth, subject to the investor’s risk tolerance. After retiring, however, the fundamental objective is to sustain a living standard while spending down assets over an unknown, but finite, length of time.

Investing during retirement is a rather different matter from investing for retirement, as retirees worry less about maximising risk-adjusted returns and worry more about ensuring that their assets can support their spending goals for the remainder of their lives.

The two schools of thought

As an introduction to these schools, consider a simple example. Suppose a retirement plan has a 90% chance of success of providing income for a retiree taking into consideration longevity and market risk. Both sides will have dramatically different interpretations about what this number means.

From a probability-based perspective, 90% success is a more than reasonable starting point. It is likely to work. Safety-first advocates, however, will not be comfortable with this level of risk, focusing instead on the 10% chance of failure. They will seek a solution that removes the impact from any possible failure.

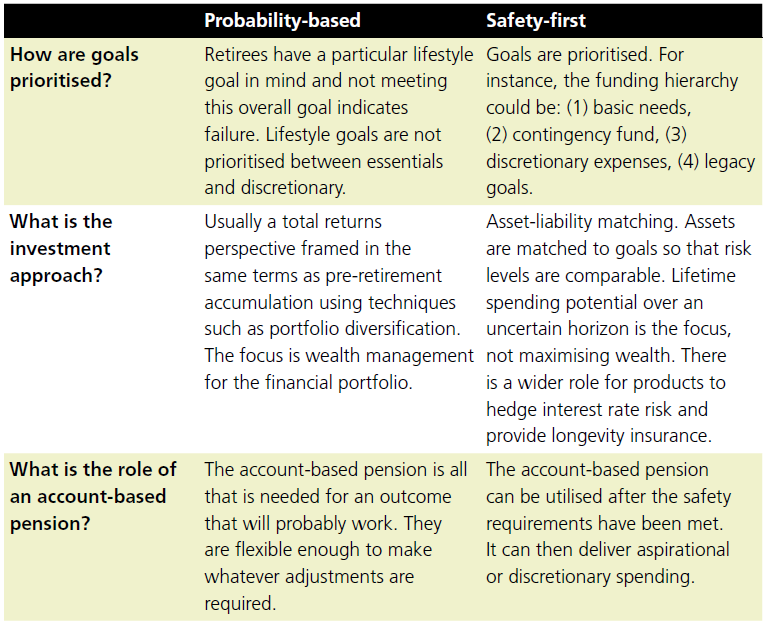

Table 1: Retirement income philosophies

The probability-based school of thought

The probability-based approach is closely associated with the traditional concepts of wealth accumulation. In this frame, people do not differentiate between essential needs and discretionary expenses. Rather, people operate on a total budget concept.

Probability-based approaches are based closely on the concepts of maximising risk-adjusted returns from the perspective of the total portfolio. Different volatile asset classes, that are not perfectly correlated, are combined to create portfolios with lower volatility that provide the highest ‘expected return’. It is an assets-only analysis, and the investor’s spending needs are not relevant to determining the appropriate asset allocation.

For retirement planning, spending and asset allocation recommendations are based on mitigating the risk of wealth depletion that is inherent in drawing down a portfolio of volatile assets (ie due to sequence of returns and market risk). The failure rate is the probability that wealth is depleted before death, or before the end of a fixed time horizon.

Probability-based advocates tend to focus on the potential of equities to provide positive real returns and to outperform bonds over the long run. Retirees are thus advised to take on as much risk as they can tolerate to minimise the probability of failure. This has led advocates of the probability-based approach to use more and more aggressive asset allocations.

The safety-first school of thought

Advocates of the safety-first school of thought view prioritising retirement goals as an essential component of developing a good retirement income strategy. Prioritisation will be very important because the investment strategy is to match the risk characteristics of assets and goals.

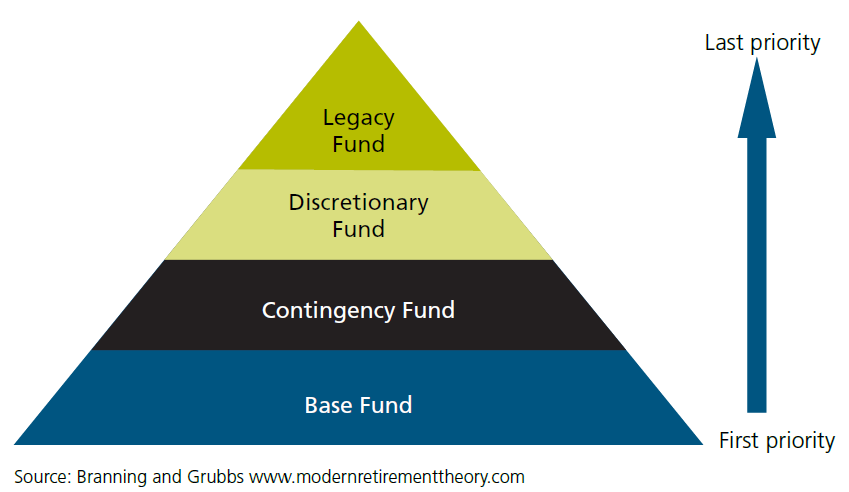

Retirees’ spending priorities are prioritised like the pyramid in Figure 1. Essentially, spending is required to satisfy basic needs, with additional spending on discretionary items after basic needs are met. The pyramid model requires each goal to be properly funded before continuing to the next level.

Figure 1: Modern Retirement Theory hierarchical pyramid

The general view of safety-first advocates is that retirees only have one shot at getting sustainable cash flows from their savings. This means they must develop a strategy that will at least meet their needs, no matter the length of life or the sequence of post-retirement returns.

Retirees often have little leeway for error, because returning to the labour force is not a realistic option for many retirees. Volatile investments like stocks are not appropriate when seeking to meet basic retirement living expenses. Volatile (and hopefully, but not necessarily, higher returning) assets are suitable for discretionary expenses and legacy, where the spending is more flexible.

The goal is to have cash flows available to meet spending needs as required. Investment assets are matched to goals so that the risk and cash flow characteristics are comparable. This can include defined-benefit pensions, bond ladders, and fixed rate annuities.

The retirement income challenge

The essential difference between the schools of thought relates to the degree of comfort people have that equities will always perform well enough for a broadly diversified portfolio to meet a retiree’s basic needs, without relying on more secure assets. With essentials-versus-discretionary, lifetime flooring protection is created for essential needs. This is really ‘goal segmentation.’ Systematic withdrawals generally leave the entire lifestyle spending goal at risk, since spending needs must be supported from a portfolio of volatile assets.

Concluding remarks

Super funds and financial advisers alike can help retirees overcome the complexities of generating retirement income by first understanding the different philosophical approaches to retirement. While neither a probability-based nor a safety-first approach is definitively right or wrong, different people will align more easily with one or the other. Nor is it an all or nothing approach. A fund or adviser shouldn’t advocate for only safe assets and no risky assets. The safety first approach is about securing essential spending needs in retirement, with room for more probability-based approaches for discretionary spending.

The full paper by Pfau and Cooper is available here. An extended version of this summary is here.

Wade Pfau is professor of retirement income at The American College and hosts the Retirement Researcher blog at wpfau.blogspot.com. Jeremy Cooper is Chairman, Retirement Income at Challenger Limited.