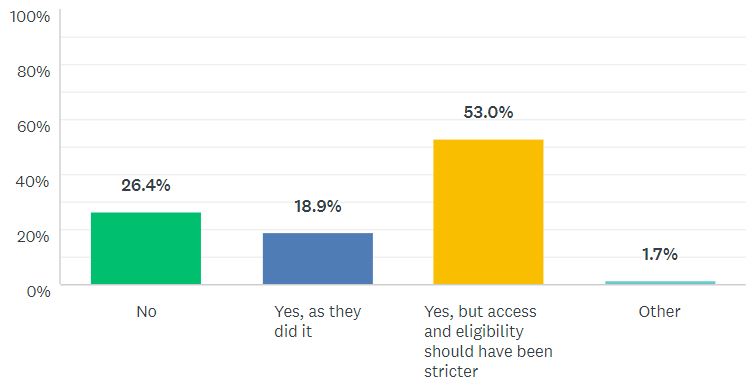

Our September 2020 survey sought readers' views on how the Government has handled the COVID pandemic. We received over 400 responses with hundreds of comments. The first question was:

Was the Government correct to allow early access to superannuation?

About 26% of readers disagreed with the early release of super, while 72% agreed with the policy. However, 53% thought the assessment for eligibility should have been a lot tighter.

The reasons for people answering 'no' included that access should have been assessed under super's existing 'hardship' provisions; that allowing early withdrawal was too short-sighted and defeated the purpose of super; that JobKeeper and JobSeeker should have been enough support; that reduced or depleted super balances will mean additional reliance on the aged pension in future; or dismay at reports of the misuse of the funds.

A wide range of comments are replicated below.

Comments

I am 79 years of age, self funded retiree, still with a major super account in the accumulation phase. I worked till 75 to build the account balance! Now uncontrolled access by others to their accounts has had a negative impact on my account balance. Why!!

It took pressure off the government's need to borrow from the future.

Emergency situations require emergency responses. However, if people have abused the rules the ATO will come after them.

I am 78, left school at 14 and have never been able to get 1 cent from the government. Many will take their super, spend it and when they reach retirement age will all be on the public tit, from the exorbitant taxes I have paid all my life!

Needed closer checking on real need.

Too many young Australians accessed their super for non-essential spending on luxury items and gambling - evidence of decreased earnings should have been mandatory from the outset.

Paying out without checking eligibility is irresponsible.

Evidence now exists that a lot of money was withdrawn from super accounts for expenditure on lifestyle assets. This was not the purpose of allowing early super withdrawals.

I work in the airline industry which has been disproportionately impacted by Covid. In my opinion, the Government allowed workers to access their super in order to reduce the burden on the Government and subsequently the Australian taxpayer. The problem with this approach is that those most affected by Covid are the young, those on casual, part time or contract work and it is these people who will pay in the long term by reducing their super balances and compound benefits of super and also being made responsible to repay the Covid debt.

So much was spent on unessential things such as gambling, alcohol and "toys"

It was just a mechanism to save the government from that particular support. People need to be forced to save for the future.

The money belongs to the contributors not the government.

When the Government was providing jobkeeper allowance, there wasn't a need for early super access.

This is simply another brick out of the wall in the federal government's campaign to undermine the super system.

I understand the need of those who couldn’t access the govt subsidies, also that they would be sacrificing future for immediate needs, but the situation shouldn’t have been allowed to deteriorate to the extent that people needed early access.

It sent the wrong message for Super access to be the first measure announced, before JobKeeper was announced.

Preservation is the fundamental pillar of super, we have now broken the piggy bank and the consequences will not be felt in ScoMo's time in government (this is not a responsible government).

Financial hardship provisions were already in existence. They only needed to promote and resource the existing structure rather than introduce a new (and apparently unsupervised) arrangement.

Many people who have withdrawn their super now have nothing in their account. Some may have been in dire straits but I suspect many have chosen to use these funds to live a lifestyle that is not sustainable. They will have locked themselves into dependency of social security in their senior years.

Desperate times call for desperate measures.

There are normal hardship provisions. It maybe should have been restricted to small balances which would be better unable to make any difference in retirement anyway.

It is good to withdraw funds from some of the super funds, especially industry funds who were funding the ALP and not subject to disclosure laws.

Some people have wasted the money on consumer goods, but most people have used it for proper reasons. I don't think there was any choice but to allow people access to their Super.

Difficult to see why it was necessary while JobKeeper and JobSeeker were widely available. Existing hardship provisions would have sufficed for most needy cases.

Super is for retirement and accessing it early defeats the purpose. The people accessing it early are demonstrably those who are otherwise unable to save. The ATO was extremely remiss in not enforcing the advised conditions for access.

Young people don't understand the long-term implications of early withdrawal. And JobKeeper/JobSeeker was not far away...

You need to get out of financial trouble now: the younger super members will contribute larger amounts when retirement gets more attention.

Too many people withdrawing funds for anything but hardship, and probably not realising the long-term implications of their actions.

I consider it is a far better investment to pay off the mortgage (or pay the rent) than not. Remember that 80% of people get a pension, and probably 99 % of those withdrawing Super. So, long term, they have lost little or nothing.

The liberals have always been against average wage slaves having access to superannuation but OK for executives.

Real hardship should have been the criteria for access. Super is tax advantages savings for retirement, not a tax advantages savings scheme for consumption.

It is unclear how much of the withdrawal money was wisely spent.

While some people would clearly have needed assistance, I suspect, like Keating, that many people took out more than needed and splurged it. They will regret that on retirement and the State will have to fork out too much to look after them.

Genuine compassionate grounds is the only valid reason, with experienced public servants seconded to administer, whilst others should have been hired to fill the secondment gaps.

Some people cannot help themselves and will spend if they can, so stricter criteria are desirable.

There are already hardship provisions in super. People who can prove a genuine need and apply can access it. I think it would have been better to advertise the hardship provisions and provide extra administrative assistance than let individuals do it all at themselves through mygov. Accessing super early should have been a last resort. Just like tax cuts, this will create more structural imbalance for future governments to deal with. There will be more people reliant on the full aged pension and part aged pension.

It just means that the people accessing it will have to rely on pension to some degree in the future when they retire.

Negative impact on people who can least afford it (while halving pensions which benefits those that are well off). Funds withdrawn when share market down increasing the negative impact. Extremely unlikely that funds will be put back in by individuals (Loss of compounding effect). Likely to increase dependence on aged pension when people retire. Long term impact on how superannuation funds invest.

That was a cop out by the government not helping those who had no other source of income other than raid their own Super.

Unfortunately, a proportion of the people accessing their superannuation early, did so apparently only to appease their "instant gratification" desires.

I think its human nature to take the easiest path. So in times of hardship, borrow from the future. My concern is not so much access to super, but rather how the monies withdrawn were used. For example, if directed towards another tax effective super type vehicle - owner occupied real estate - then so be it. But for most other uses, can that really justify the loss for a young person of 40 years of tax effective compounding? And from a government perspective, wouldn’t we be best supporting people in need now, rather than have them dependent on a government pension forever?

The reason superannuation was made compulsory and untouchable until retirement was the recognition that not all recipients could be trusted to act wisely with the money. The early access scheme made the poorest and least knowledgeable of our community pay their own Covid-19 support costs.

There is the ‘sole purpose test’ which simply means super is to fund retirement.

Premature decision before we knew how bad the virus was going to affect people.

Access should have been policed more closely with more control over where the funds were going.

When Scott Morrison was treasurer in the Turnbull Govt. he tried to let people access their super for home purchase - equally dumb. Turnbull stopped him. So he had another bite of the cherry which long term will put more people on a government pension sooner. We have to make/encourage the population to be self-supporting in retirement. We already have too few paying for too many.

Saving for the future is meaningless for those for who necessarily are living for the present.

Future generations will be more reliant on government pensions so the cost to taxpayer will far outweigh any short-term support costs.

Unfortunately many young people cannot really relate to life in retirement as it is too far in the distance and have a tendency to live for the moment,

Despite existing hardship provisions, introduction of unrestricted access to super has helped fuel the boom in share trading, sales of used cars, home entertainment systems, furniture, hardware, cosmetic surgery, etc. at the expense of future taxpayers who will have to fund more aged pensions.

Whenever the proceeds are used for "discretionary" items, it appears the point of both the super savings and the early access have been frustrated.

Super is a long-term investment and tax scheme. The struggle during my early years has paid off with a decent super lifestyle, which has taken a blow now and I have seriously reduced what I draw down and curtailed spending. But then I am 71 now, so it's probably wrong to criticise. Younger people don't appreciate the power of compound growth over 20+ years.

Some people who would not have survived financially without the extra money so it provided peace of mind and flexibility. Stricter conditions were required.

If you have genuine hardship you have always been able to get some funds from super. Over the last few months I have talked to two separate couples at Bunnings. One got super money to do up the bathroom (looked like pretty upmarket) and one couple was building a deck.

Super is for retirement. The govt panicked. Most people are fine at this time with asset price recovery, jobseeker and JobKeeper. Banks allowed people to suspend mortgage payments. The govt should have waited and implemented this strategy if required in the future.

You should have been able to "borrow" from your super, such that when your income returned you would automatically pay it back much like student HECS debt. This would allow temporary use of your funds but also would have eventually returned your super balance to where it would have otherwise been.

Much of it appears to have been poorly spent. Will have an impact on pension provisions by the government many years down the track.

Smaller amounts, $5000 and only once hardship clearly identified.

Many Australians are really struggling and need cash now.

Too many people appear to have accessed their superannuation for non-essentials. Perhaps checks should have been made to see if those involved really needed the money. For example, did they have other savings? Had they lost their jobs or were on drastically reduced hours?

We should not lose sight of the purpose and goal on superannuation and use it as an alternative to financial disruption.

Superannuation is meant for retirement and death benefits - not to help fund new cars for millennials. The government should have borrowed more.

This decision had no effect on me in regard to access of Super. Firstly, Super has never been regarded as personal savings. However for those in need to access means they get an immediate benefit secondly it not a government hand out so there is some skin in the game which is good.

Provided post pandemic there is a forensic check to catch and penalise the (likely) thousands of cheats, who withdrew contrary to the rules.

Has been exploited, they should have stuck to existing system for an early release.

The purpose should have been investigated but maybe there was no time. I hear that a lot was spent on gambling.

Poor policy, ideologically driven. Complete abrogation of Government responsibility. Better fiscal and economic alternatives exist.

Super is for retirement, not government stimulus.

Young financially insecure were I believe the main participants , although there were undoubtedly a number of folk with less good intentions … but its their money!

They could have just borrowed more (at v low rates!). As it is, it has just caused a bigger problem for the future; greater pension take up and higher taxes.

I'm aware of several people who've accessed their super but strictly speaking weren't eligible. Swimming pools are being constructed as I write...

Young superannuees live for the day and the opportunity to get some cash to spend is too great.

Nothing materially changed, and the government provided sufficient bail-out to people anyway. All this did was to damage people's ability to look after their retirements.

I appreciate it helped people without other options but it makes a mess of super.

It’s nanny state gone mad to argue that people ought to suffer today so they (or the taxpayer) might be better off decades in the future. Basic utilitarian analysis.

Very blunt instrument. people have extremely different financial positions and financial literacy. so access should have been tailored to individuals

People have the right to use their own money when times are tough.

This decision will place a higher burden on the federal government to provide more in pensions to these people in years to come.

If genuinely in need of super to meet short term cashflow problems, who is to say people shouldn't have access to what is actually their own money.

The whole point of super has been undermined greatly by allowing early access too easily

Superannuation is a retirement fund, the Centre Link age pension is a safety net and ones super fund is not an emergency piggy bank.

It's for retirement not now and shouldn't be played with. Alot of these people who took their super out will lose a lot more when they want to retire and more will end up on pensions

It is meant to be money for retirement and is contributed at concessional taxing for retirement. However in these circumstances some withdrawal is warranted but it should not have been used for frivolous purposes

Given the ATO have warned they are monitoring for people re-contributing the super they withdrew and claiming a tax deduction, clearly it was too easy for some people to get access

The compassionate grounds criteria could have been modified but introducing a 'self-assessment' opportunity was a reckless act. If the opportunity was premised on the basis that it is "your super" than the tax concessions provided to super come under scrutiny. The trade-off for the concessional tax is the cashing restrictions. Jane Hume is providing more evidence that she misunderstands her role as an elected official responsible for a portfolio - to govern by the people, for the people, not pursuit of individual advancement (which is a natural consequence of effective and sound public policy administration)

Not for the govt to decide to rape the savings of the people especially those uneducated as to its negative effects and burden on future taxpayers.

I think access should have only been given to people who could demonstrate they were in a dire financial position. Drawing on super balances will have significant adverse consequences on the retirement balances of many who withdrew funds

Whilst it would be ideal if more checking had been done on the eligibility side it wouldn't have been feasible given the manual checks that would have been needed to be done. It should have been quite clear to most people whether they were eligible or not.

Surely ATO/bank data could confirm whether there was a reduction of flows into account.

Easy to say we need the money now but after paying super contributions for 30+ years and now retired the money saved under super has allowed us a modest worry-free retirement.

There are reports that much of the accessed money was not used very usefully (eg gambling) which is hardly a good trade-off against future individual super income and is also a future cost to welfare.

While some used the funds well anecdotal evidence indicates many wasted the funds. The whole reason behind super is to save which this was contrary to.

It was not compulsory and people need to make decisions and take personal responsibility for their current circumstances and the future. Good for them if they paid off sum or all of their mortgage.

Comments regarding young people missing out on retirement income are flagrantly wrong. No one bothers to do any basic research anymore. How does anyone know what is going to happen in 30 plus years from now?

Reports that many people such as public servants who did not lose a cent in wages, drew down from super, made the scheme laughable.

Superannuation is wages stolen when people need them most. It is better value to own your own home as soon as possible. This is the best way to a comfortable retirement.

The government should have demanded proof of a significant drop in personal income as they have done with JobKeeper

Super was and is for long term. Blowing it early jeopardises the future for those who took it early. Always difficult decision for the individual. If you cannot afford avocado toast, you do not get it.

Hardship provisions exist in Super - and that is the mechanism that should have been used.

Australia's early access scheme was simple but, in not asking some further questions, undermined the long-term purpose of super

People needed money and had to be given the right to take control of their future.