As we begin 2023, we are at a much better starting point than a year ago.

While global economic growth may slow this year (essentially a lagging indicator), several positives have already emerged:

- China is re-opening, which means a much-needed boost to economic growth in the world’s second-largest economy.

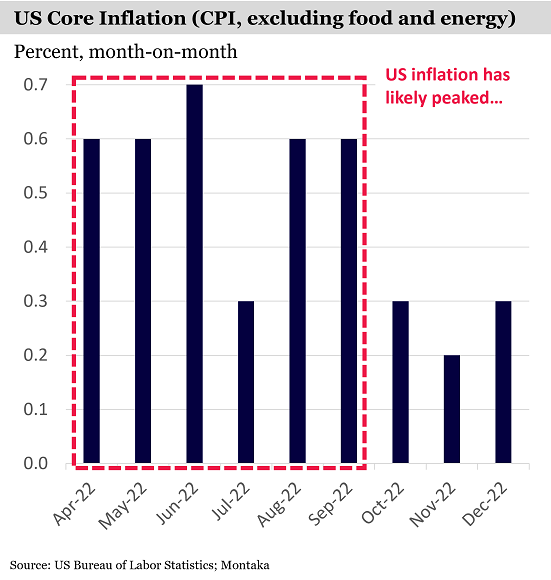

- There is now compelling evidence that inflation has peaked and will continue to abate. Therefore, interest rates will likely need not remain high for very long at all, though there always remains the risk of policy mistakes.

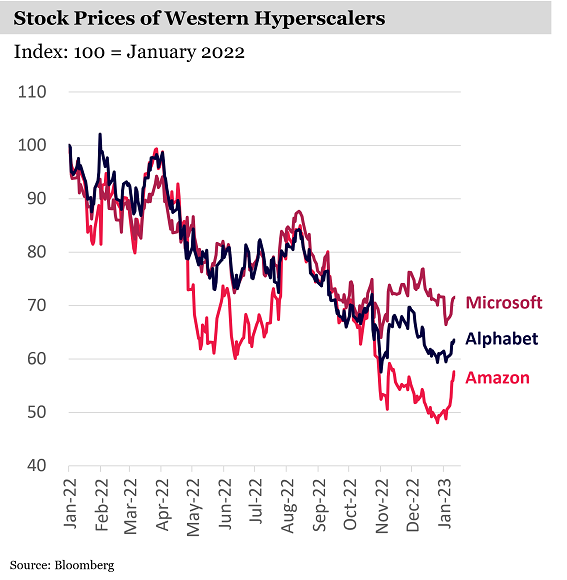

- The harsh sell-off of 2022 has also left stock valuations at attractive levels. Many leading companies, such as Microsoft, ServiceNow and Salesforce, experienced significant stock price corrections in 2022 as growth expectations were downgraded. We view this as excessive and believe the long-term opportunity for these businesses remains as attractive as ever.

With this brighter picture, there is a high probability of further positive surprises this year.

It’s a good time to step back and share five ways investors can position their portfolios for a more optimistic market outlook for 2023.

1. Exposure to enterprise intelligent software leaders

Intelligent software remains an enormous opportunity for enterprise customers all around the world. It allows them to better understand their data, extract rapid and actionable insights, and helps them make their internal business processes more efficient and valuable.

The leaders in this space, including Microsoft, ServiceNow and Salesforce, have several attributes that make them particularly attractive to Montaka:

- First, when customers spend on this software, they get a massive return. That points to long-term adoption, retention, and pricing power.

- Second, because these businesses have entrenched market positions and enterprise relationships, they effectively control the ‘distribution’ of new features and services to clients.

- And thirdly, these businesses are built in software with superior economics – the marginal costs of production and distribution are essentially zero. Data advantages, in the form of network effects and emerging AI models, are also more likely to be stronger.

All of these businesses experienced significant stock price drawdowns in 2022 after growth expectations were downgraded. We do not dispute the slowing growth outlook over the next 6-12 months. But the market is implicitly embedding such weakness for a longer period. This pessimism is excessive because the long-term opportunity for these businesses remains as attractive as ever.

2. The long-term opportunity in cloud and compute

The dynamics described above are even more pronounced in cloud computing.

While early signs of slowing revenue growth sent stock prices of cloud leaders falling – including those of Amazon, Microsoft, and Alphabet – the long-term market opportunity in cloud has only increased and is materially higher than what is embedded in stock prices.

Demand for low-cost, scalable, and secure compute, storage and networking are growing rapidly and structurally. Businesses and governments of all sizes see value in adopting a cloud-based IT architecture.

But a look over the horizon suggests we may only be at the tip of the iceberg as the emergence of AI accelerates.

For example, the popularity of large-language models, such as ChatGPT, or text-to-image models such as DALL.E-2 or Midjourney, which go a long way toward automating creativity, is exploding. But here’s the problem, the deployment of such large and compute-intensive AI models to consumers at scale is simply not possible today – the world does not have enough computer system resources. This is just one reason why we believe long-term demand for processing and storage will be significantly greater than forecasts embedded in stock prices today represent.

3. Massive upside in online retail

In digital commerce and marketing, the economic slowdown is not only real, but it comes as a stark contrast to the strong pandemic period. Back then, fiscal stimulus policies boosted personal savings when online goods were the primary channel of consumption.

But zooming out and taking a longer-term view, we need only remember that 85% of the world’s retail markets still remain offline today.

But this ratio between online and offline retail will eventually flip.

This is long-term positive for the world’s great ecommerce platforms including Amazon in the West, Alibaba and Tencent in China, and Reliance-owned Jio Platforms in India. It is also positive for those businesses involved in related sectors of marketing and advertising (Alphabet, Meta), and payments (Visa, Mastercard, Apple).

4. The unrivalled leverage of alternative asset managers

We continue to see substantial long-term investment opportunity outside of technology as well.

The world’s largest and most well-regarded alternative asset management platforms, including Blackstone, KKR and The Carlyle Group, continue to be the leading candidates to capture the incremental US$6 trillion opportunity in private market assets over the current 5-year period.

The market is drastically overweighting the temporary impact of reduced inflows and lower asset valuations and underweighting the value of long-term opportunities.

The market is also likely underappreciating the attractive economics of these platforms. For every ‘zero’ that Blackstone adds to its AUM, for example, it also adds a ‘zero’ to its revenue without the need for any substantial incremental investment in its cost base. And with fees tied to asset values, if global GDP continues to increase long-term, then Blackstone essentially gets to grow its revenues and earnings for free – even absent new flows.

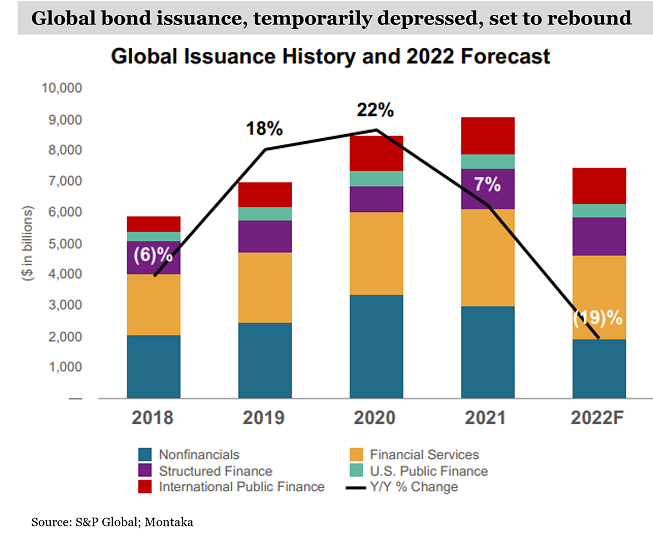

5. The structural growth of S&P Global

In a similar vein, and looking at a specific stock, the economics of S&P Global – a global leader in credit ratings, market data systems, and market indices – are also highly scalable. And its market opportunity is growing structurally with global GDP. Though its shares are currently depressed because fewer bonds are being issued in the current market. As is the case with all of Montaka’s areas of focus, we see these conditions as temporary.

Way below intrinsic value

The market’s myopia of 2022 has excessively depressed valuation multiples on cyclically depressed earnings. The result is that many of the world’s most advantaged businesses can be acquired today at prices that are far below their intrinsic values.

Andrew Macken is the Chief Investment Officer at Montaka Global Investments, a sponsor of Firstlinks. This article is general information and is based on an understanding of current legislation.

For more articles and papers from Montaka, click here.