We are living through a revolutionary period in investing and portfolio allocation. All time low-to-no yields here in Australia and across global fixed income markets have upended the foundations of retirement portfolio construction. It is not hyperbole to say that investors face a new investment reality to be reckoned with.

At Martin Currie Australia, we feel it is important that investors and advisers adapt their portfolio construction methodologies to this new reality of financial markets. With this in mind, we have produced a new white paper, Investing for a Sufficient Retirement Income in a Post COVID-19 World.

The paper examines why traditional approaches to retirement investing are unlikely to achieve most investors retirement goals and how intelligent approaches to income-oriented investing can help bridge the gap between required and available income.

A sufficient income in figures – the risk of ‘defensive’ assets

In dollar terms, every retiree’s income stream needs will be different, but a good starting point is the ASFA industry standard which suggests a couple aged 65 needs $51,300 in income per annum. [Note that we have used the mid-point between ASFA’s modest and comfortable retirement figures to create what we think is a more reasonable estimate of retiree living standards.]

A couple with $500,000 in assets will be eligible for about $30,000 from the part pension based on government income and asset tests. The $21,600 not covered by their part pension needs to be received from their investment portfolio, and a yield of 4.3% is required to generate that today.

Source: Martin Currie, AFSA

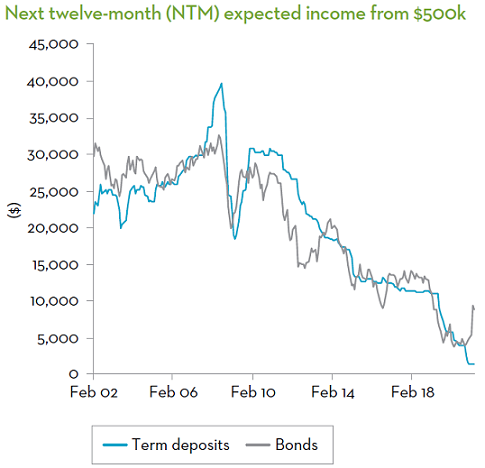

To earn that required $51,300 income at a 0.3% term deposit rate, a portfolio of over $17 million is required! Conversely, if a retiree had a $500,000 portfolio in 2008, the ~8% yields available would have met their income needs, but at today’s rates the $500,000 portfolio would not even provide for a month’s expenses.

It was clear in 2010 that when defensive asset yields fell, the resulting income from a traditional defensive portfolio would not meet these income level and income characteristics and risked sending a retiree’s hard-earned capital into a downward spiral without any capital growth to replenish it. We also knew that the age pension would not be a sufficient safety net for a comfortable retirement.

Asset allocation and risk from a sufficient income perspective

Our hypothesis in 2010 was a ‘sufficient income for life’ retirement solution was more like an asset liability matching problem, and we would need to move away from the Markowitz-based so-called ‘low risk’ defensive assets which were low growth with high income volatility, and into higher-growth equity allocations.

This is because when retirees are relying on the income generated by investments for their required drawdown, how that income stream behaves and grows over time is important. Thus, the attractiveness of different asset classes is significantly different when viewed through the lens of income volatility and growth.

For instance, most multi-asset retirement products assume is that when people reach 65, they automatically become more risk averse and should move away from ‘risky’, growth-style assets and towards ‘defensive’ assets.

We do not agree. So-called low-risk defensive assets have delivered low-to-no income growth with high income volatility over the past decade.

Instead, our research indicates investors will benefit from approaching retirement portfolio construction through the lens of income volatility. From this perspective, not all growth assets should be considered ‘high risk’ and all defensive assets ‘low risk’.

Instead of total volatility as a standard risk measure, we believed that for retirees, the concept of income stability, or in risk terminology, income volatility is a better proxy for the risk of impaired living standards. Income growth is also important to protect income against rising inflation.

As the chart below shows, the attractiveness of different asset classes is significantly different when looking through a total volatility lens. The more risk that you take in terms of capital volatility, the greater expected return you are likely to achieve out of each asset class along an upward sloping efficient frontier (left), and the retiree income volatility lens (right), where the level of income and income volatility is the critical issue.

Past performance is not a guide to future returns. The investment vehicles shown may have different risk profiles and a direct comparison may not be appropriate. Martin Currie Australia, FactSet, Morningstar Direct; as of 31 March 2021.

Not all equities are created equal - a sufficient income approach

Retirees require a reliable income stream to replace the wages they received when they were working. Thus, when constructing retirement portfolios, it is important to focus on the actual dollar income generated over time, rather than the markets traditional look at headline yield percentage.

This perspective leads to higher equity allocations but critically, not all equities are created equally.

The best equities for the retiree portfolio will be different from those of the accumulation investor. The sustainability of income, future income growth and diversification of income sources must be carefully considered within the choice of growth assets.

With this in mind, we build equity portfolios from the bottom up, and employ unique methodologies designed to secure a sufficient income for clients. Some key characteristics of our approach (more detail is included in the full paper) include:

- A truly sustainable dividend

- A focus on quality

- Benchmark unaware construction

- Maximising franking credits

- Australia specific inflation targeting

The result is often a portfolio that looks different from both traditional equities and other income-focused approaches to deliver on key aspects of our ‘sufficient income for life’ philosophy.

Innovation towards a sufficient income for life

Our Martin Currie Equity Income, Real Income and Diversified Income Funds are aligned towards generating sufficient income for life, and focus on achieving:

- a high and stable franked income stream to support annual expenses

- income growth for inflation protection, and

- capital growth to manage longevity risk.

In our paper, we compare these retirement income strategies across several metrics, versus traditional lower-risk income alternatives such as term deposits, bonds and defensive balanced funds, as well as other categories such as balanced funds, broader equities and a rules-based high-yield index approach.

While the risk profiles vary, our retirement income strategies often deliver the best probability of beating an income return target, compared with the income alternatives.

Towards a sufficient income for life

Despite the short-term impacts of COVID-19 on Australia equities, our retirement income strategies with a focus on a high and stable franked dollar income stream, through diversified sources of income and capital growth, were able to provide income in-line with our objectives during 2020.

Income alternatives for retirees who need a high dollar income stream have continued to be insufficient both pre, during and post-COVID-19, with lower income and capital outcomes. Should income and capital fall into a downward spiral, and retirees be forced on the age pension in the future, the consequences for the whole economy and future generations are concerning.

Read the full white paper here.

Reece Birtles is Chief Investment Officer at Martin Currie Australia, a Franklin Templeton specialist investment manager. Franklin Templeton is a sponsor of Firstlinks. This article is general information and does not consider the circumstances of any individual. Past performance is not a guide to future returns.

For more articles and papers from Franklin Templeton and specialist investment managers, please click here.