Information technology is not the only sector holding up share markets. There is another industry. We all rely on it, but the opportunity on ASX is scant. It’s a global sector hiding in plain sight.

Protecting its citizens and keeping them safe is the responsibility of governments. Since ancient times civilisations have grappled with this, and the changing technologies and material demands of protecting borders and populations are complex. More recently the cyber world has become a battleground, and the defence industry is again at the forefront of technology.

But when we read stories about defence spending, we do not normally associate this with investing. The reality is that governments are spending more than ever on defence, and much of the budget is being directed toward listed companies that are leaders in their fields. These companies operate in diverse sub-industries including aerospace & defence, and electronic equipment & instruments.

These sectors are typically under-represented in broad market benchmarks. The S&P/ASX 200 index has zero exposure to these military and defence industries, while the S&P 500 and MSCI World ex Australia indices have 1.95% and 1.98% exposure respectively.

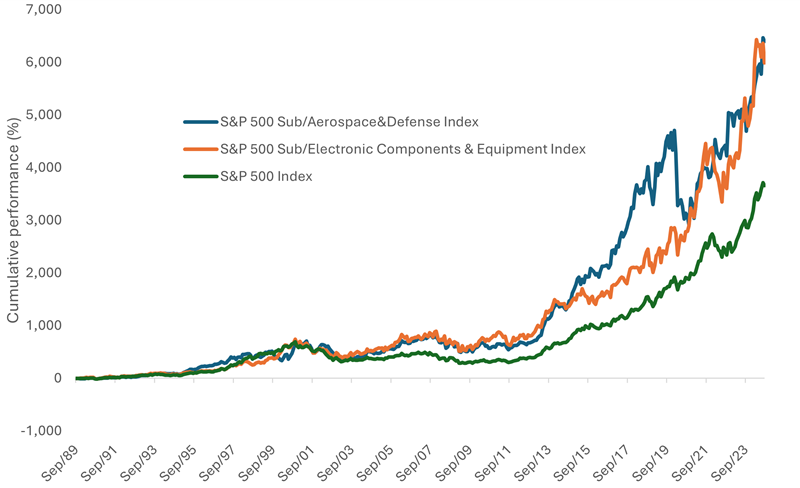

For long-term investors, these sectors have historically outperformed the broader market.

Chart 1: Total cumulative index returns since 1989.

Source: Morningstar Direct 1989 to 31 August 2024. Past performance is not a reliable indicator of future performance. You cannot invest in an index.

Unhappily, the world has changed from countries celebrating the peace dividend, a term used to describe the economic benefits of a decrease in defence spending. Instead, countries are ramping up military expenditure.

We think there are three key reasons for investors to consider a defence allocation within a diversified equities portfolio.

1 – Spending by governments toward the sector is increasing

Although Australia is far removed from troubles plaguing other parts of the world, it is not immune from the flow over effects from uncertain times. In 2023, defence expenditure hit a record high and accounted for 1.92% of GDP and 5.06% of total government expenditure in Australia – a 6% increase from the previous year. Australia’s defence spending is set to increase further with the Government committed to spending 2.4% of GDP to this sector by 2033-34, which is roughly $100 billion.

It is a similar story for other NATO (North Atlantic Treaty Organisation) and NATO-friendly countries. NATO was founded in 1949 following WWII by Canada, United States and several Western European nations. This Alliance was created to provide political integration and collective security across the regions and now includes 32 countries. In 2014, NATO governments agreed to commit 2% of their national GDP to defence spending to help ensure the Alliance’s continued military readiness.

Compared to other parts of the world, the post-Cold War period has seen significant underinvestment in the defence sector by European nations. As a result, defence capability has suffered in many nations. This has begun to shift in recent years, with Germany a prime example.

A leaked Inspector General report on the state of the German army in 2022 highlighted poor results for functional weapons. It further implied the situation was even more dire in the other parts of the army. As a result, the German government passed a bill allocating €100 billion to a special defence fund and also announced intentions to increase its yearly defence spending.

Elsewhere, The Netherlands shifted policy and approved an additional €5 billion in defence investments and the UK announced that it would increase defence spending to 2.5% of GDP by 2030. This will inject an additional £75 billion over six years and retain the UK’s place as the second largest defence spender in NATO.

This year, 23 NATO allies are expected to meet or exceed the defence spending target, compared to only three Allies in 2014. This represents a significant increase in collective investment to the industry. NATO Allies have also agreed that at least 20% of defence expenditure should be devoted to major new equipment. This includes associated research and development, perceived as a crucial indicator for the scale and pace of modernisation.

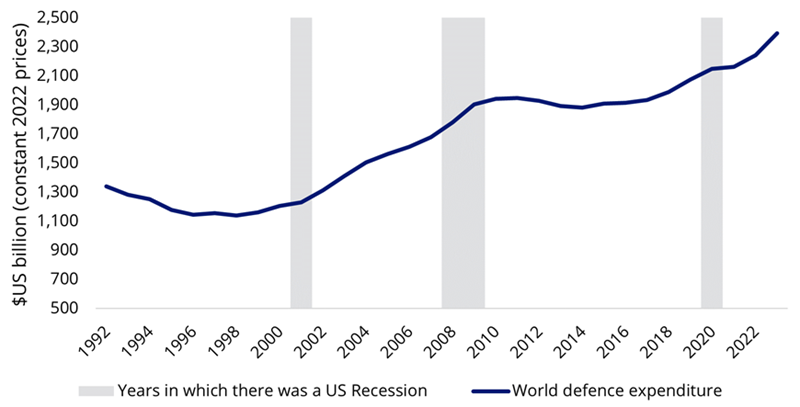

Globally, data released by the Stockholm International Peace Research Institute (Sipri) for 2023 showed that global military expenditure grew 7% to US$2.43 trillion, the steepest annual rise since 2009 as international peace and security deteriorated.

Chart 2: World defence expenditure: 1992 to 2023

Source: Sipri, VanEck, figures are represented in constant 2022 US dollars.

2 – Demand for the sector’s products and services has not historically correlated to the economic cycle.

It is important to note that defence expenditure has historically been agnostic of the economic climate. Looking at chart 2 above, defence spending rose during the last three US recessions (the grey shaded area).

3 – The defence industry has historically been at the forefront of technological development and advancement

Military and defence sector companies generally invest heavily in research and development to create new technologies, inventions and products.

This can often lead to technological development and advancements that spill over into areas beyond military use to everyday life. Some everyday products and innovations that have deep roots in the military sector include the internet, GPS satellite navigation, microwave ovens and super glue.

Additionally, in the modern world, defence strategies must consider a broad range of factors, beyond military and weapons, to effectively protect a country’s security and prepare for potential threats.

Cyber security, satellites and communications, analytics and event response software, and training services are now included in defence budgets and represent further growth opportunities for defence firms.

Australia’s first defence ETF, the VanEck Global Defence ETF (ASX: DFND) launched earlier this month on ASX.

Key risks: An investment in our defence ETF carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. Once available, see the PDS and TMD for more details.

Arian Neiron is CEO and Managing Director - Asia Pacific at VanEck, a sponsor of Firstlinks. This is general information only and does not take into account any person’s financial objectives, situation or needs. Investors should do their research and talk to a financial adviser about which products best suit their individual needs and investment objectives.

For more articles and papers from VanEck, click here.