[Vanguard has released a report called 'How Australia Retires' about our attitudes towards retirement and how we feel about this phase of life. It surveyed 1,814 people, 20% of whom were retirees, and the remainder were working-age Australians. Here are the report's key findings.]

Expectations of retirement differ greatly from reality

Between working-age Australians and those already retired, there exists significant variance on the ideal age to retire, how they envision they will spend their time during retirement, and crucially, how much income will be required to fund their ideal retirement lifestyle.

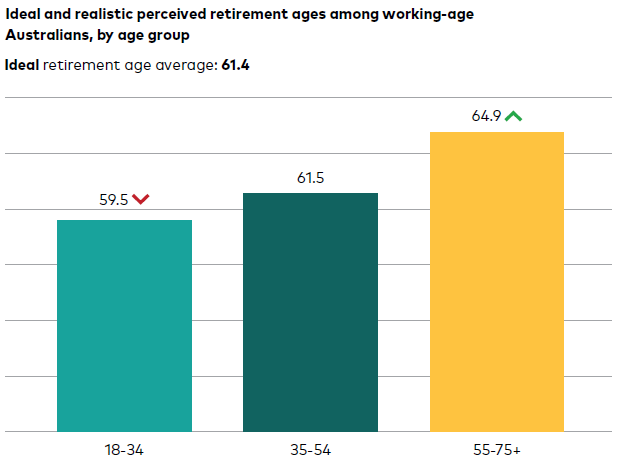

Working-age Australians do not agree on an ideal age to retire. While the average ideal retirement age reported by respondents is a little over 61 years old, there is significant variation in responses across the different age groups surveyed.

On average, those participants aged between 18 to 34 hope to retire by age 59.5, those aged between 35 to 54 hope to retire by age 61.5, and those aged between 55 to 75 and beyond want or wanted to retire by 64.9 years old, a notable increase in ideal age for those entering the pre-retirement phase (over 55 years) when compared with the perceptions of younger age brackets.

This suggests that as working-age Australians edge closer to their retirement phase, their expectation of the ‘ideal age’ at which to retire increases. This might be a result of Australians becoming more realistic about their retirement age as they near this phase of life, as opposed to younger Australians who might be more idealistic about earlier retirement or haven’t yet given retirement planning appropriate thought.

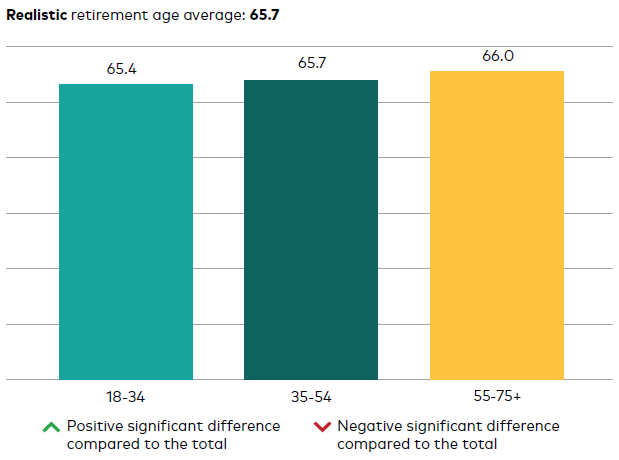

When considering their circumstances, working-age Australians agree that between 65 to 66 years old is the realistic age at which to retire.

On average, young Australians under the age of 35 see their realistic retirement age as 65.4 years old, those aged between 35 to 54 see their realistic retirement age as 65.7 years old, and those aged between 55 to 75 and beyond believe 66 is a realistic retirement age.

50% of working-age Australians want to retire with a yearly income significantly higher than the yearly income currently required by older generations.

When contemplating their desired yearly income during retirement, working-age Australians who are yet to retire expressed that they would like to have an income of on average $99,000 per annum (assuming today’s dollar value). Those who have already retired said that they desire on average $68,000 (in today’s dollar value) as a yearly income, significantly less than the desired income of current working-age Australians.

Interestingly, the figures were much lower for both working-age Australians and current retirees when asked about the minimum yearly income they think they would need in retirement, with working-age Australians indicating an average of $62,000 (assuming today’s dollar value) and current retirees stating approximately $41,000 on average (assuming today’s dollar value) per annum. While the yearly amount that current retirees perceive they need is significantly lower than their desired yearly income, current retirees still indicated they need substantially less than working-age Australians did, which may suggest that retirees find they can manage on a lower income than expected.

With more time to work towards their retirement goals, working-age Australians may be setting themselves higher post-retirement income targets and setting a new retirement standard. However, there may also be an element of working-age Australians’ expectations of retirement not aligning to reality. This could be because:

- Working-age Australians may not be able to effectively predict what their financial wants and needs will be during retirement, especially due to retirement not being in their near or immediate future.

- Working-age Australians may not be able to envision their retirement lifestyle, therefore not being able to effectively foresee how their current incomes and expenses will translate to their retirement income and expenses, which may be leading to an over-estimation of their retirement spending needs.

- Working-age Australians are less likely to own their home compared to older generations, leading to expected rental expenses.

- Working-age Australians’ expectations of retirement lifestyles and the activities they would like to differ from expectations held by older generations. For example, when asked about the lifestyle they would like to lead in retirement, working-age Australians prioritised travel (should financial considerations allow). Current retirees, however, prioritise spending time on hobbies.

Superannuation is still the foundation of retirement savings

50% of working-age Australians view superannuation as a key part of their retirement plan but expect it to account for a smaller proportion of their total assets than current retirees.

54% of working-age Australians estimate that their superannuation balance constitutes 50% or less of their total investment balance. That is, at least 50% of that total balance is comprised of non-superannuation investments such as savings account, property they live in or investment properties, and shares and exchange traded funds (ETFs). Most notably, 1 in 4 working-age Australians highlight investment property as a key part of their financial plan.

By contrast, while only 1 in 3 current retirees consider superannuation as a core part of their financial plan, especially those younger than 65 years old, they are more likely to rely on it. Retirees are significantly more likely to expect the Age Pension to form a part of their retirement plan, and only 1 in 10 report investment property as an asset.

Despite the importance of superannuation in working-age Australians’ plans, fewer than half make additional superannuation contributions to maximise their future returns.

Financial information is abundant but professional advice creates value

In recent years, the financial advice industry has faced severe criticism and undergone substantial structural change following the Royal Commission into Misconduct in the Banking, Superannuation, and Financial Services Industry.

Consequently, these developments have resulted in a lack of trust in the financial advice industry, and it is therefore not surprising that working-age Australians would seek alternative sources of guidance and advice. The proliferation of social media and online forums has also spawned a wide range of channels, with some being useful hubs for information-sharing but many offering unsubstantiated information without the required regulatory authorisations and oversight.

In addition, the cost of seeking financial advice remains a barrier for many Australians and is driving a growing advice gap that may be detrimental to their financial outcomes.

Almost 2 in 3 working-age Australians have never engaged a financial adviser.

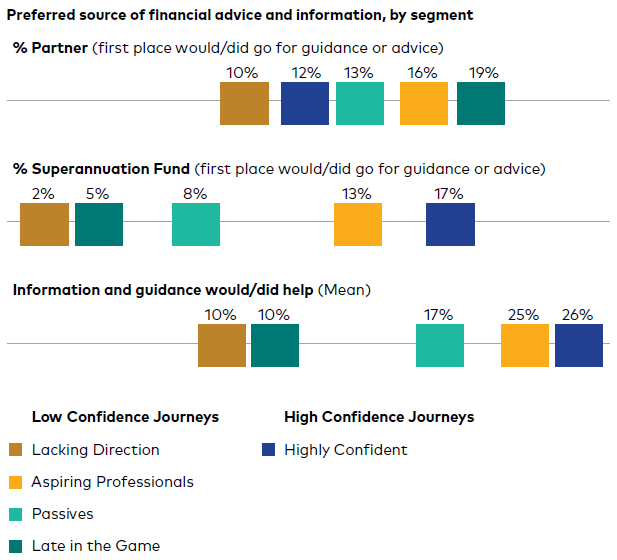

Financial advisers are not the leading source of professional guidance for working-age Australians. Superannuation funds are in fact the primary source, alongside banks, accountants, and government websites.

Working-age Australians however are more likely than current retirees to consult a non-professional source, preferring to do their own research or seek guidance from their partner or family and friends. This indicates a wariness of professional advice (whether that be due to a lack of trust or as a result of high fees) or simply because friends and family are more easily accessible.

Working-age Australians are also much more likely to seek information from digital sources including podcasts, blogs, and social influencers. In contrast, retired Australians predominantly consult professional sources of guidance, such as financial advisers or their superannuation fund.

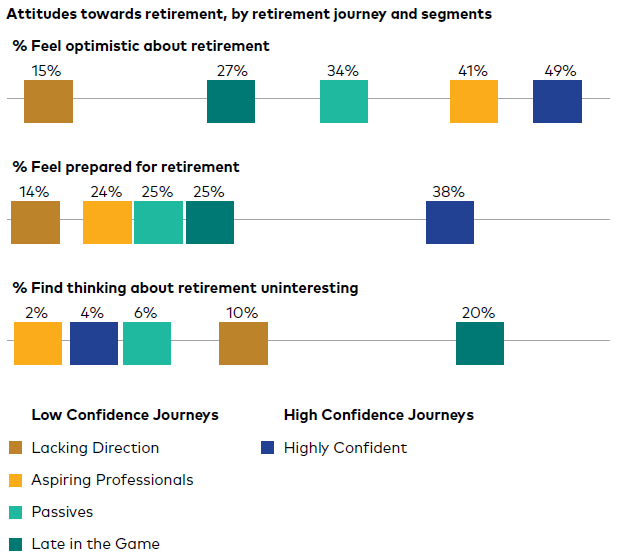

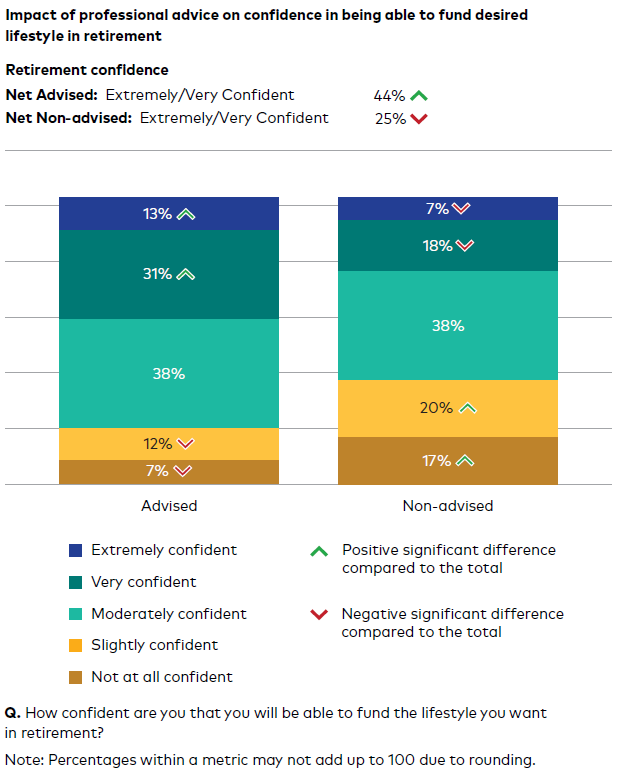

Despite the abundance of financial information online and elsewhere, the study found a strong relationship between the use of a professional financial adviser and the retirement confidence it can inspire.

Of the study participants that have received professional advice, 44% indicate they are extremely or very confident in funding their retirement.

In contrast, Australians who have not sought professional advice, only 25% report being extremely or very confident in funding their retirement.

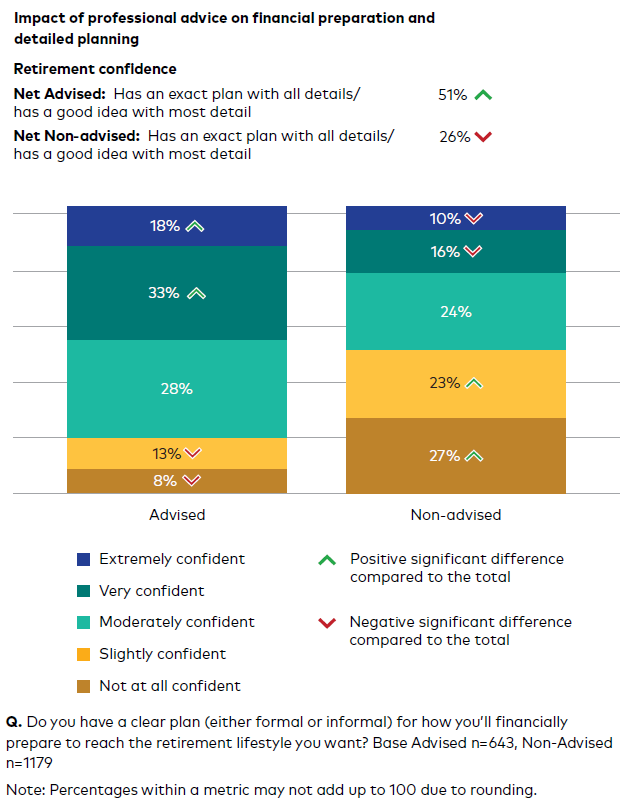

Australians who have received professional advice are also twice as likely to have a clearer, more detailed retirement plan, and are twice as likely to feel confident that they will be able to fund their retirement lifestyle.

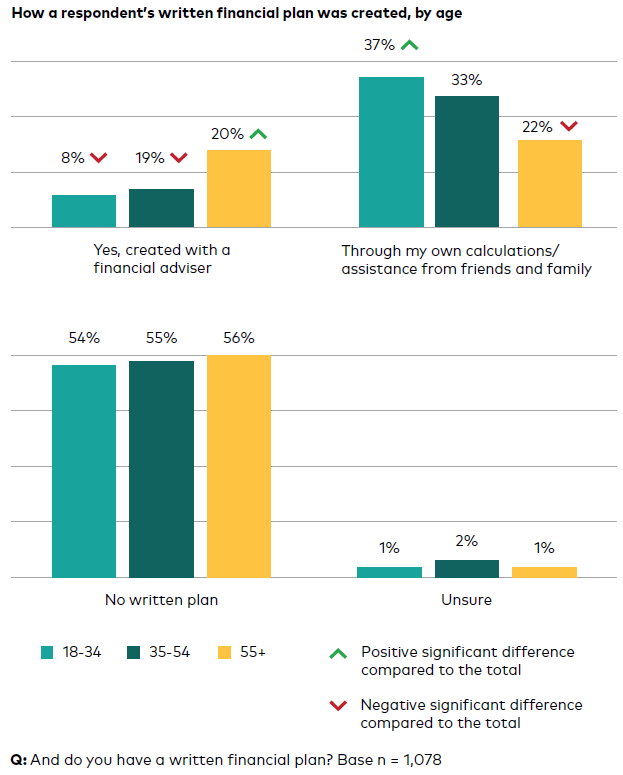

Working-age Australians who have developed their own financial plan are relatively likely to have prioritised budgeting and regular savings, while those with a financial plan from an adviser are more likely to prioritise superannuation contributions.

Further, those who have a more detailed plan have typically taken more purposeful action to prepare for retirement, particularly in debt management and budgeting while also making additional superannuation contributions and investing in securities and property.

Vanguard Investments is a sponsor of Firstlinks. This article is for general information purposes only. Vanguard has not taken your objectives, financial situation or needs into account when preparing this article so it may not be applicable to the particular situation you are considering.

For more articles and papers from Vanguard Investments Australia, please click here.