Australia’s tax reform debate is in desperate need of a circuit breaker, and our report Mythbusting tax reform #2 aims to achieve exactly that. It slices through the myths that clog clear thinking on super, negative gearing and capital gains, and recommends reforms that return simplicity, fairness and sustainability to the way Australia taxes superannuation contributions and capital gains.

This is the second of Deloitte’s mythbusting tax reform reports. The first focussed on issues that are central to Australian prosperity – bracket creep, GST and company tax. This second report covers matters at the heart of Australian fairness – super, negative gearing and capital gains.

Myth 1: Superannuation concessions cost more than the age pension

Super concessions do cost a lot – but nothing like the pension does.

The Treasury estimate of the dollars ‘lost’ to super tax concessions uses a particularly tough benchmark: the biggest possible tax bill that could be levied if super was treated as wage income. It also doesn’t allow for offsetting benefits via future pension savings, or any offsetting behavioural changes. Better measures of super concession costs are still huge, but rather less than the pension.

Myth 2: We can’t change super rules now, because the system needs stability to win back trust

So super concessions don’t cost more than the pension. Yet the costs are still pretty big. And that’s what puts the lie to this second myth. If our super concessions cost lots but achieve relatively little, then Australians are spending a fortune on ‘stability and trust’ in super settings while actually achieving neither. Governments can only truly promise stability if the cost to taxpayers of our superannuation system is sustainable.

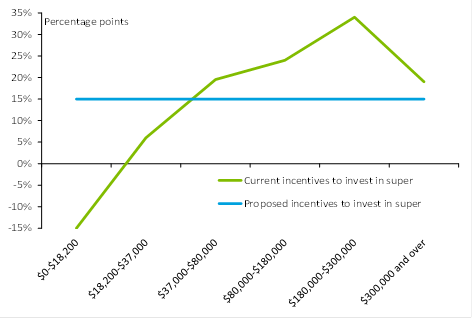

Chart: Proposed reform of the tax benefit (loss) of diverting a dollar from wages to super

As the chart above shows, there’s a Heartbreak Hill at the centre of Australia’s taxation system: low income earners actually pay more tax when a dollar of their earnings shows up in superannuation rather than wages, whereas middle and high income earners get big marginal benefits. So one example of a better super tax system would be an updated and simplified version of the contributions tax changes proposed in the Henry Review – where everyone gets the same tax advantage out of a dollar going into super, with a concession of 15 cents in the dollar for both princes and paupers.

Making the tax incentives for contributing into super the same for everyone also comes with a pretty big silver lining. As current incentives are weighted towards the better off, there is a tax saving from making super better – a reform dividend of around $6 billion in 2016-17 alone.

Even better, because this is a change to the taxation of contributions – when the money goes in – it avoids the need for any additional grandfathering. Nor does it add extra taxes to either earnings or benefits.

And because the incentives are simpler and fairer, the current caps on concessional (pre-tax) contributions can also be simpler and fairer. They could be abolished completely for everyone under 50, and the cap could be raised for everyone else (subject only to a safety net of a lifetime cap). That would put super on a simpler, fairer and more sustainable basis.

And, depending on how the super savings are used (to cut taxes that really hurt our economy, or to fund social spending, or to help close the Budget deficit), the resultant package could appropriately help Australians to work, invest and save. For example, this reform alone would pay for shifting the company tax rate down to 26% from the current 30%.

Myth 3: Negative gearing is an evil tax loophole that should be closed

The blackest hat in Australia’s tax reform debate is worn by negative gearing. Yet negative gearing isn’t evil, and it isn’t a loophole in the tax system. It simply allows taxpayers to claim a cost of earning their income. That’s a feature of most tax systems around the world, and a longstanding element of ours too.

Yes, negative gearing is over-used, but that’s due to (1) record low interest rates and easy access to credit, (2) heated property markets and (3) problems in taxing Australia’s capital gains. Sure, the rich use negative gearing a lot, but that’s because they own lots of assets, and gearing is a cost related to owning assets: no smoking gun there.

Myth 4: Negative gearing drives property prices up, but ditching it would send rents soaring

And those who argue the toss on negative gearing raise conflicting arguments on its impact on housing.

Let’s start with a key perspective: interest rates have a far larger impact on house prices than taxes. The main reason why housing prices are through the roof is because mortgage rates have never been lower. And, among tax factors, it is the favourable treatment of capital gains that is the key culprit – not negative gearing.

Equally, while negative gearing isn’t evil, nor would ditching it have a big impact on rents. By lowering the effective cost of buying, negative gearing long since raised the demand for buying homes that are then rented out. Yet the impact on housing prices of negative gearing isn’t large, meaning that the impact of it (or its removal) on rents similarly wouldn’t be large.

Myth 5: The discount on capital gains is an appropriate reward to savers

The basic idea of a discount on the taxation of capital gains is very much right. There should be more generous treatment of capital gains than of ordinary income, because that helps to encourage savings (and hence the prosperity of Australia and Australians), and because the greater time elapsed between earning income and earning a capital gain means it is important to allow for inflation in the meantime.

But we overdid it. We gave really big incentives for some taxpayers (such as high income earners) to earn capital gains, versus little incentive for others (such as companies). And the discounts adopted back in 1999 assumed that inflation would be higher than it has been – meaning they’ve been too generous.

So the capital gains discount is no longer meeting its policy objectives. That not only comes at a cost to taxpayers, but to the economy as well. One possible option would be to reduce the current 50% discount for individuals to 33.33%.

Deloitte’s report ‘Mythbusting tax reform #2’ was prepared by tax and superannuation specialists from Deloitte in conjunction with economists from Deloitte Access Economics. See full report for disclaimers.