If there were ever a year in which the benefits of rebalancing were clear, 2020 was it.

We’re still immersed in the middle of a market, economic and societal event like none of us have ever experienced. We’ve all been impacted, if not directly to our health, then by changes to the way we work, the way we connect to each other and certainly by the way we think about financial security.

When markets are rising calmly, it can be easy to underestimate the importance of disciplined rebalancing. But when markets gyrate wildly, as they did in March last year as the pandemic shuttered many aspects of the global economy, the value of active rebalancing can’t be understated.

Minimise the drift

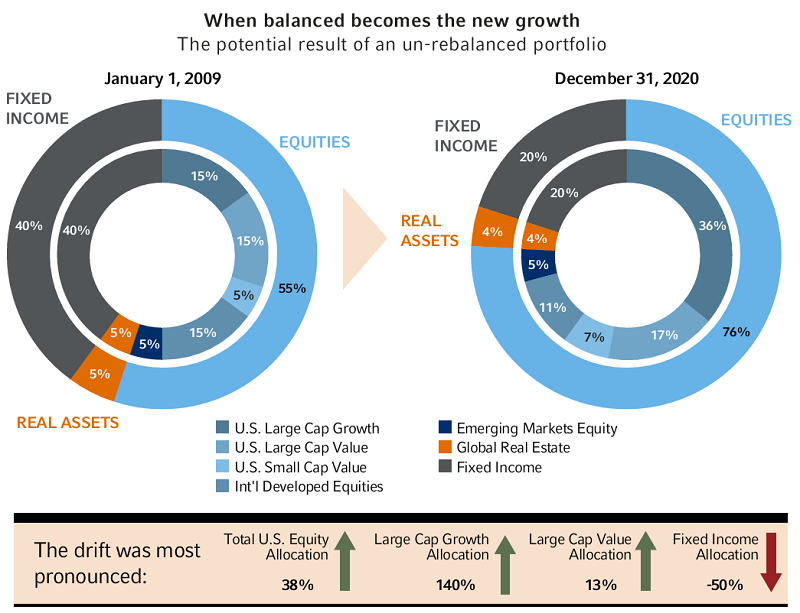

As the chart below demonstrates, a hypothetical balanced index portfolio that has not been rebalanced since the last major bout of market volatility during the GFC Crisis would have ended 2020 looking more like a growth portfolio, and would have exposed the investor to unintended risk.

Indeed, without rebalancing, by the end of December 2020, this hypothetical portfolio’s exposure to U.S. large cap growth would have risen from 15% to 36% and the exposure to fixed income would have fallen from 40% to 20%. That's an unintended shift from a 60% equity/40% fixed income portfolio to an 80% equity/20% fixed income portfolio.

We all know the important role fixed income plays in smoothing out portfolio returns. More importantly, the portfolio would have a strong tilt to U.S. large cap growth and increasingly dominated by technology names. That tilt could be a concern if that sector were to suddenly reverse.

Source: Hypothetical analysis provided in the chart & table above is for illustrative purposes only. Not intended to represent any actual investment. Source for both chart & table: U.S. Large Cap Growth: Russell 1000 Growth Index, U.S. Large Cap Value: Russell 1000 Value Index, U.S. Small Cap: Russell 2000® Index, International Developed Equities: MSCI World ex USA Index, Emerging Markets Equity: MSCI Emerging Markets Index; Global Real Estate: FTSE EPRA NAREIT Developed Index, and Fixed Income: Bloomberg Barclays U.S. Aggregate Bond Index.

Markets turn fast, is now the right time to rebalance?

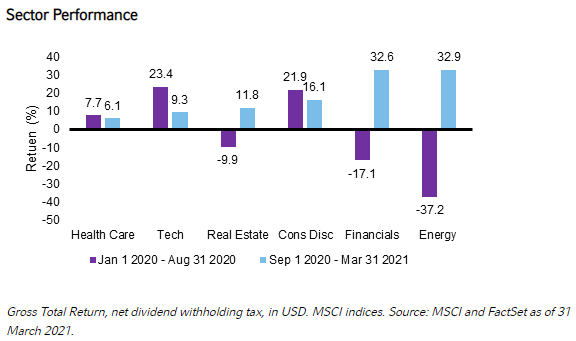

Last year, 2020, was a textbook example of how quickly markets can turn. The chart below shows just how dramatic the shift in sector performance was over the past year. For the first half of 2020, healthcare and technology stocks led the market. Within technology, those companies that benefited from the move to a virtual environment in 2020, such as Amazon, Alphabet (Google), Facebook, Microsoft and Apple, rose to represent 26% of the market cap of the S&P 500 Index in 2020. That’s a level of market concentration we haven’t seen in data we have going back 40 years! Since September 2020, traditional value-oriented sectors such as financials and energy have outperformed.

All of this speaks to the importance of regular rebalancing. Without it, it’s likely that the increasing dominance of certain technology names could push asset allocations away from their policy targets to something with a greater tilt toward growth.

A message to financial advisers: the value communication gap

We consistently find there’s a big gap between what investors believe advisors do and what advisors actually do. In other words, there’s a value communication gap between advisors and their clients. Advisors don’t always know what their clients really value. But what if you could tell your clients that by regularly rebalancing their portfolio, you have maintained their asset allocation in line with their goals, helped smooth out returns and maintained their desired risk profile?

We believe that rebalancing is one of the most vital functions advisors provide. But the value of it is often downplayed. And when it comes to devaluing this vital service, advisors may be the main culprit. Why? Because it’s something they do every single day.

Unless you clearly communicate the value of rebalancing, don’t expect your clients to appreciate it. We believe that without the help of advisors, clients are more likely to make serious mistakes, such as buying high, selling low, or running to cash at precisely the wrong time. Indeed, many investors did flee the markets in March 2020, when the initial pandemic shock hit, and may have then missed out on the subsequent rebound.

We recommend four simple touchpoints to make the communication about rebalancing both easy for you and meaningful for your investor clients.

To help your clients understand the value of active rebalancing, make sure you let them know:

- The benefits of a systematic rebalancing policy

- What the strategic rebalancing policy is

- How frequently the portfolios are rebalanced

- Your approach to strategic rebalancing during periods of market volatility.

Sophie Antal Gilbert is Head of Business Solutions at Russell Investments. To learn more about the 2021 Value of an Advisor Study, click here.