At the recent AFR Super & Wealth Summit, the Assistant Treasurer and Minister for Financial Services used his opening address to say how important it was that superannuation had a defined objective, similar to other initiatives such as Medicare. “We can’t get everything settled for the long term unless we have an understanding of what we are trying to do”, he said.

Following the opening address, a number of speakers during the Summit suggested that the objective for superannuation should reference the following three items – retirement income, all Australians and dignity. For example:

“To provide income in retirement that helps all Australians to live with dignity, by supplementing or substituting the Age Pension.”

It is interesting, this is entirely consistent with the sole purpose test and the guidance provided in Superannuation Circular No. III.A.4 issued by APRA in February 2001. In particular, section 3 of that Circular states that:

“The sole purpose requirements contained in section 62 of SIS (the “sole purpose test”) limit the provision of superannuation benefits by regulated superannuation funds to a range of prescribed or approved retirement or retirement related circumstances. The test is the legislative expression of the retirement income objective which is the key rationale for superannuation savings.”

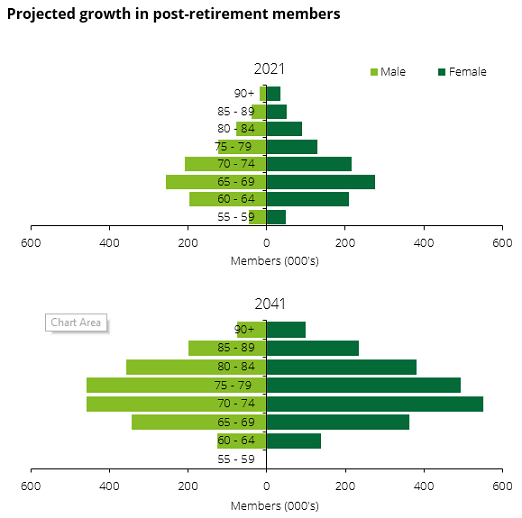

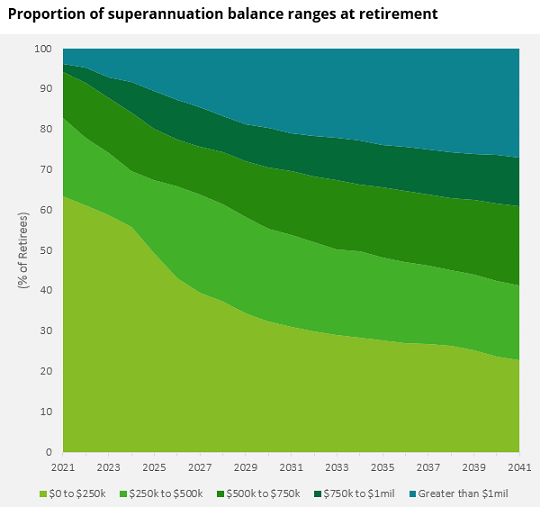

One thing is clear: retirement has become a central part of the conversation about the future of superannuation and member needs. Over the next 20 years we will have more post-retirement members with more superannuation savings than ever before. There are just over 3 million Australians currently aged 55-64 and approaching retirement in the next decade. In 2021, around 65% of retirees had less than $250,000 in super ‘at retirement’ but this is expected to quickly reduce to about 30% over the next 10 years. By 2031, almost 50% of retirees will have more than $500,000 in super.

Research has shown that superannuation fund members start to engage more with their super when they reach age 50 and/or their account balance reaches $250,000 (even more so when it reaches $500,000). So, the time has come, with demographics turning in our favour, to engage more people with their retirement.

To help, there have been two very important developments with effect from 1 July 2022.

First, the Retirement Income Covenant (RIC) came into effect on 1 July, which requires every superannuation fund to have a retirement income strategy for the benefit of members who are retired or who are approaching retirement. The retirement income strategy must address how the trustee will assist those beneficiaries to achieve and balance the following three retirement objectives:

- Maximise expected retirement income

- Managing expected risks to the sustainability and stability of expected retirement income

- Having flexible access to expected funds during retirement

Trade-offs will need to be made to balance the competing objectives (for more information on the trade-offs).

As part of their retirement income strategies, superannuation funds are looking at different cohorts that might have similar objectives to potentially offer them different retirement product combinations, including an Account Based Pension (ABP), a longevity protection layer and of course the government Age Pension (for more information on cohorting).

Importantly, for retirees who are (or will become) eligible for at least a part Age Pension, there is a 40% exemption from the means tests for certain longevity protection products that can provide an immediate uplift in the Age Pension payments.

Second, new relief for superannuation calculators and retirement estimates set out in ASIC (Superannuation Calculators and Retirement Estimates) Instrument 2022/603 also took effect on 1 July 2022. However, ASIC has provided a transition period of six months, during which providers of superannuation forecasts may rely upon either the existing relief or the new relief. Only the new relief will be available from 1 January 2023. For more information on the new ASIC relief, we will shortly be publishing a separate blog, including details about the Flexible Interactive Retirement Estimate API that the team here at Deloitte has built to efficiently assist trustees who wish to better engage their members approaching retirement using retirement income estimates and calculators.

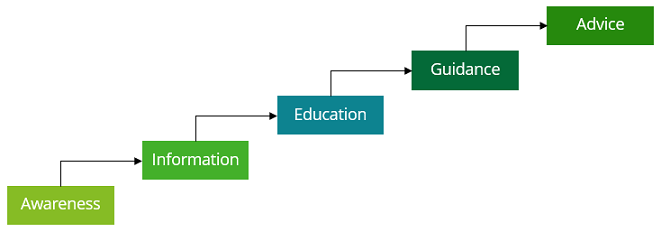

The new retirement estimates will provide a great start on the engagement journey for members who are approaching retirement, providing a much-needed wake-up call with meaningful insights about what retirement could look like. Once “awareness” has been raised, the superannuation fund will then be in a better position to provide further information about retirement, its risks and how to deal with them. As members get closer to retirement, more education materials and financial calculators can be used to help guide members to better outcomes. Ultimately, in some cases, members who are about to retire may seek some form of advice to help them to confirm their preferred retirement strategies and to implement them.

While that may sound simple, it’s obviously not. Retirement is complex and personal, and everyone’s personal circumstances are different. That’s why we have built a range of calculators and tools to assist members to understand how the various components of our retirement income system might interact. While it is tempting for product providers to think about how best to distribute their retirement product, we think that a better approach is to solve the retirement problem from a customer’s perspective – that is, we have a financial literacy problem, not a product scarcity problem.

How much superannuation do I expect to have at retirement? What my spending needs are likely to be, and what additional spending ‘wants’ would be nice? What product strategy is most likely to meet my needs and help me to manage my retirement risks? What drawdown strategy will meet my spending needs at various stages of retirement?

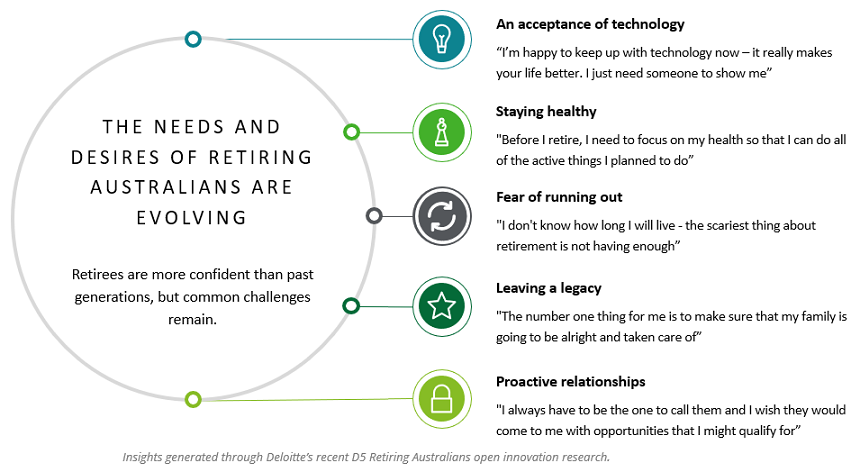

There is plenty of research to show that one of the scariest things about retirement is the fear of running out of money, but on the positive side, retirees are willing to use technology to help them plan for a better retirement.

Five customer insights will shape future offerings

That is where the next generation of retirement calculators come in. Calculators that clearly show variations in how long your money is expected to last under poor, average or strong market conditions. Those that allow you to compare outcomes under a variety of investment portfolios, from conservative to high growth. And are integrated with different longevity protection products to show not only how much Age Pension uplift you can expect, but also how different retirement products might be blended to produce different expected spending patterns during retirement. After all, this is what a retiree is most interested in.

Andrew Boal and Steve Freeborn are both Partners, Actuarial Consulting and Anthony Saliba is a Director, Actuarial Consulting at Deloitte Australia. This article is of a general nature and has been prepared without taking into account your objectives, financial situation or needs. It has been prepared with due care but no guarantees are provided for the ongoing accuracy or relevance.