The Intergenerational Report (IGR) paints a worrying picture for many of the millions of Australians who retire in coming decades, and it's not due to the affordability of or access to the age pension. It's the lack of ownership of a home.

In making his case for a universal superannuation system in 1991, Paul Keating noted (to a lecture theatre of university students) that:

“When my generation begins to retire after the year 2010, you will be the taxpayers who will have to provide for us. We have lived well. And there are also a lot of us. We will want to retire in a style to which we have become accustomed. If you have to carry us, you will know it.”

At the time, there were about two million Australians of age pension age, with five people of working age (15-64) for every Australian aged 65 and above.

Spin forward to Treasury’s latest IGR and there are now some 4.5 million individuals of age pension age, a number that is expected to double by 2062-63. And currently around 3.8 people of working age to every person aged 65 or over, a ratio that is forecast to fall to 2.6 over the next 40 years.

I’ve been a part, and seen firsthand the growth, of Australia’s superannuation system for some 26 of the 31 years since the introduction of compulsory superannuation in 1992. In that time the system has grown from less than $150 billion to be the world’s fourth largest pool of retirement assets, a leviathan of some $3.5 trillion at present.

I’ve also been a keen follower of all six of the IGRs produced since 2002, specifically as they relate to retirement incomes policy. This most recent IGR is the first to hint at a growing retirement issue that has been apparent for some years now, but has never been openly discussed. It’s time it should.

The age pension isn’t under pressure

Keating’s contemporaries are well into their seventies, with the youngest of the Baby Boomers now approaching retirement age. Yet, the latest IGR suggests no medium-term budgetary pressure on, or to the continuance of, the age pension.

Instead, the total projected annual cost of Australia’s retirement income system is expected to remain relatively steady over the next 40 years, at around 4-4.5% of GDP. Further, spending on the combined age and service pensions is actually forecast to fall over the next 40 years, from 2.3% to 2.0% of GDP.

In short, despite Keating’s warnings, or perhaps because of his creation of universal superannuation, the age pension is not under any foreseeable budgetary pressure. Far from it, as 31 years on from his implementation of a universal superannuation scheme, it is the age pension that still does the heaviest lifting in Australia’s retirement income system.

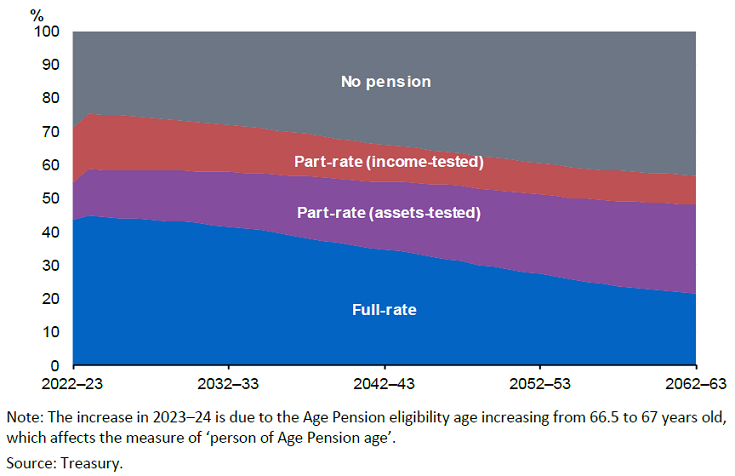

Around 64% of Australians of qualifying age will receive some age pension during this financial year. When Disability Support Pension, Carers Payment and the Service Pension are included, pension and related income support payments are made to around 70% of qualifying age Australians at present, as the below chart from the 2023 IGR illustrates.

Chart 1: Persons of Age Pension age or over, by pension category.

Thus, while universal compulsory superannuation has been a feature of the Australian economy for over three decades now, some two in every three retirees of pension age still rely on the age pension as a key source of their retirement income.

In addition, more recipients receive the full rate of age pension than a part pension, although this is forecast to invert as the superannuation system matures and more Australians retire with super balances capable of creating a viable retirement income stream.

Falling home ownership is the elephant in the retirement room

What is a concern, however, has been the fall in home ownership over time, as two-plus decades of strongly rising property prices relative to real income growth has impacted the ability of average Australians to acquire a main residence and, increasingly, to have it paid off before retirement.

At the heart of Australia’s retirement income system (albeit more whispered in policy circles than shouted) is the presumption of home ownership, unencumbered by debt. The rate of the age pension reflects this assumption, as do many of the ‘retirement budgets’ that purport to inform retirees of retirement income adequacy. As does the main retirement income projection tool currently provided by ASIC on its Moneysmart website.

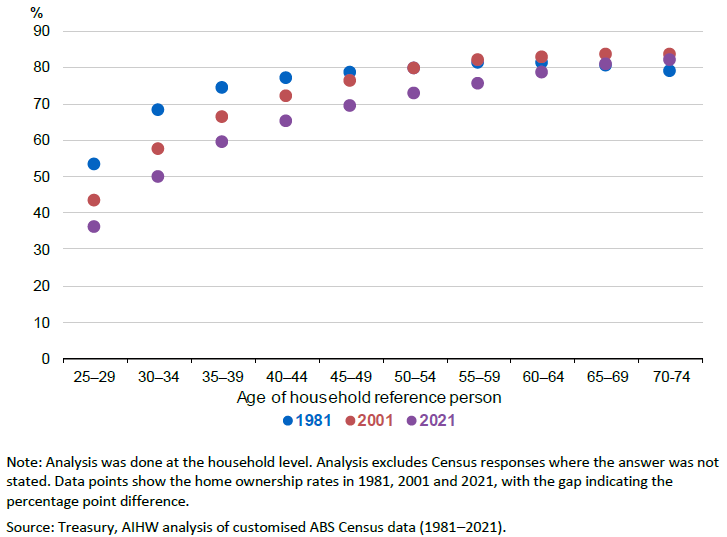

The latest IGR is the first to make explicit the homeownership-retirement connection, showing clearly that those in the key first-home buying years have been most impacted.

“Yet, home ownership can no longer be taken as a fait accompli, as younger (and lower income) Australians struggle to break into the property market at the same rate as previous generations.”

Ownership rate amongst 30-34-year-olds has fallen from 68% in 1981 to under 50% at the last Census. For 35-39-year-olds, the fall has been from 74% to under 60%. In fact, right across the working age spectrum, from 25 to 64, rates of property ownership have declined over the past four decades.

The only groups making headway into property ownership are those 65 and over, with the 65-69 cohort steady at 81% ownership, while the 70-74 cohort actually improved from 79% ownership in 1981 to 82%, as this IGR chart below reveals.

Chart 2: Home ownership rate over past 40 years by age.

This speaks to the growing unease that the social contract underpinning intergenerational equity appears to be fraying in today’s Australia.

Because as Treasury’s own Retirement Income Review of 2020 correctly noted:

“outright home ownership supports retirement income by reducing ongoing expenses and acts as a store of wealth that can be accessed at retirement.”

The retirement maths for renters and the heavily indebted

If you can’t break into homeownership at a reasonable age, giving yourself a fighting chance of being mortgage-free before retirement, it creates pressure at the other end of the journey in achieving both housing security and a dignified standard of living in retirement.

And if you’re one of the 30% of households who rent, and continue to face the private rental market into retirement, that’s a challenge on a different scale altogether.

A simple example illustrates the point.

At present, the full age pension for a single person is approximately $27,600 per year. For a couple, the equivalent amount is approximately $42,000, to which the soon-to-be-increased Commonwealth Rent Assistance (CRA) may add a further circa $4,500 per year at best.

According to CoreLogic data, the current median rent for all dwellings across the country is $577 per week, and $603 in capital cities.

Taking the nation-wide average, that’s approximately $30,000 in annual rent, which would obviously consume more than an entire single full age pension, and be met (just) only with the help of the additional CRA benefit.

In the case of a retired couple, the current median private rent would consume some 65% of their combined full age pension and CRA.

Those who have managed to break into homeownership aren’t exactly out of the woods either, with research done in 2019 showing that the proportion of homeowners aged 55-64 with outstanding mortgages had increased from 14% in 1990 to around 50% by 2015.

And of the main uses of super lump sums during 2016-17, mortgage and other debt retirement accounted for over 40% of such withdrawals.

Little wonder then the latest IGR makes the point that,

“these trends present a fiscal risk to age pension spending in the future and may impact patterns of how superannuation is drawn down.”

Housing security is retirement security

Deciphering this Treasury-speak, it basically means: hitting retirement either as a renter or as a heavily-indebted mortgagor will impact the retirement security of many Australians, possibly putting pressure on both the age pension and superannuation system.

Not quite the outcome Paul Keating had in mind, but here we now are.

Whichever way governments of either persuasion slice or dice it, housing security and retirement security are two sides of the same coin.

The latest IGR makes it abundantly clear, much to our collective dismay, that we have now entered an era where decades of neglect of the former will haunt the latter without meaningful, sustained and impactful policy action.

Harry Chemay has more than two decades of experience across both wealth management and institutional asset consulting and is a regular contributor to investment websites in Australia and overseas, writing on investing and financial planning. He was the founder of the online investment platform, Clover.

This article was originally published by Michael West Media and is reproduced with permission.