In a year full of ups and downs in investment markets, many Australian companies have stood out for their strong performance, and they aren’t all at the big end of town. Our investment strategy looks for innovation and growth on the ASX and we consistently find it amongst the smaller players.

Here are five reasons we believe small- and mid-size companies are compelling investments.

1. Smaller companies can outperform

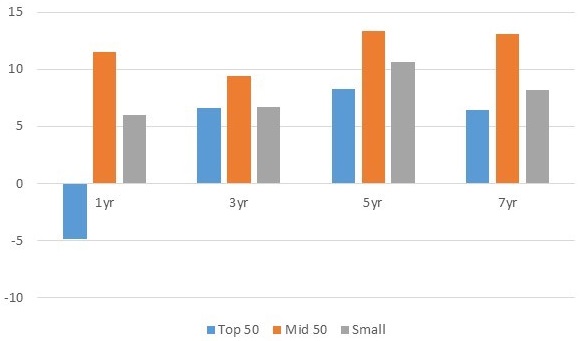

The small- and mid-cap index has provided better annualised, total returns versus the top 50 listed stocks over the past one, three, five and seven years to the end of November 2020. The market rewards innovation and the smaller end of the market is home to growth stocks with innovative and disruptive business models.

Investors who focused on total returns over these time periods may have received better rewards from these smaller companies than if they bought the big banks, miners and other Top 50 companies.

Multi-year total return (per annum) to 30 November 2020

Source: Bloomberg, as at 30 Nov 2020. Indices used: ASX Accumulation 50 Leaders Index; ASX Accumulation Midcap 50 Index; ASX Accumulation Small Cap Ordinaries Index. Past performance is no indication of future performance

2. Aussie tech punches above its weight

Software-as-a-Service (SaaS) provides important technology for millions of businesses around the world, and Australia is home to global operators that started on the ASX as microcaps. Some of these companies have high levels of recurring revenue and attractive long term global growth opportunities and include:

- Xero - Cloud-based accounting software provider for SMEs with more than two million subscribers worldwide.

- Altium - Benefits from demand and proliferation of electronics through the rise of smart connected devices.

- Technology One - Invested heavily and ahead of its peers in a cloud offering of enterprise software.

3. Miners power the future

Australian mining is more than just digging up the Pilbara. In fact, companies that mine metals play a key role in a range of modern digital and green technologies. For example, Lynas is the largest producer of rare earth oxides outside China and the second largest in the world. Mining company IGO is strategically focused on metals critical to clean energy. Its Nova nickel mine is a very low-cost producer vs global peers, and it recently hit the headlines for a high-profile deal to buy a stake in Chinese producer Tianqi.

One Tesla S battery requires more than 50kg of nickel and Tesla CEO Elon Musk recently tweeted that “Tesla will give you a giant contract for a long period of time if you mine nickel efficiently and in an environmentally sensitive way.” IGO’s focus on environmental sustainability puts it in a sweet spot to deliver on Musk’s challenge.

4. Healthcare has a healthy outlook

Australia is home to world-leading innovators in healthcare including ResMed, Fisher and Paykel Healthcare, and Nanosonics. These companies are exposed to an industry sector that tends to perform well in down markets, and their high market penetration and reputation creates high barriers to entry for competitors.

In the Covid environment, ResMed and Fisher and Paykel Healthcare have been on the front line of demand with their world class respiratory products, while Nanosonics, a world leader in high level disinfection technology, will likely benefit from heightened global awareness of virus and bacteria control.

5. Product design is world-class

A number of iconic Australian brands are exporting Intellectual Prpoerty to the rest of the world and taking global leadership positions in their space.

Breville’s targeted investment towards new product development, a scalable supply chain, and clever marketing has led to strong growth in the US and Europe. ARB, Australia’s largest manufacturer and distributor of 4x4 accessories has a vast international presence and has entrenched its leadership in this space via substantial investments into research and design over many decades.

Both Breville and ARB may have been boosted by the lifestyle changes that the pandemic sparked, but beyond that, they are supported by strong financial and strategic characteristics.

Price isn’t everything

Across all investment opportunities in our universe, we focus on identifying businesses with sustainable competitive advantages, strong financials and predictable earnings. Valuation is also important, but it is equally vital to consider the global market opportunity available, particularly to those businesses with high established barriers to entry and relatively low penetration rates.

When we identify businesses with all of these characteristics, we aim to construct portfolios that are preferentially weighted towards these attractive long-term growth opportunities.

Dawn Kanelleas is Head of Australian Small and Mid-Cap Companies at First Sentier Investors, a sponsor of Firstlinks. This article is for general information only and is not a substitute for tailored financial advice. Any stock mentioned does not constitute any offer or inducement to enter into any investment activity.

For more articles and papers from First Sentier Investors, please click here.