For many years, superannuation has provided significant tax benefits for retirees. However, recent changes in legislation will limit the amount that can be placed into super, and investment returns may not be as good as in the past. As a result, future generations will pay more tax in retirement as they will hold more of their wealth outside super.

This problem can only be minimised with long-term planning.

What is the problem the next generation is likely to face?

Many future retirees will not able to transfer adequate funds into superannuation because:

- On average, mortgages are higher and take longer to pay off. Superannuation is not the main financial priority for many people until well into their 50s.

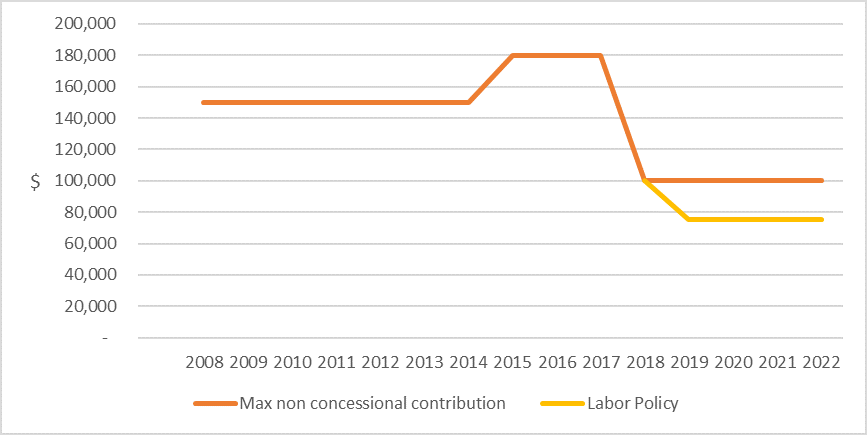

- There has been a progressive reduction in the amount that an individual can contribute to super. The graph below shows how the maximum annual non-concessional (after-tax) contribution has fallen in recent years (and to zero if the $1.6 million Total Superannuation Balance (TSB) has been reached).

It is Labor policy to reduce the annual amount to $75,000. These rules disadvantage individuals who obtain wealth later in life.

- A steady increase in life expectancy means that many children will not receive an inheritance until they are in their 60’s. Given that an individual cannot contribute to super after the age of 64 unless they are working, this will give little time to make more contributions.

So, while the $1.6 million TSB may be a concern of many retirees of the current generation, it will not be a concern for the next as many will not get even close to this level.

Helping a child make a concessional (tax-deductible) contribution

There are many different views on whether parents who have money available to help their children should do so. This is a discussion for another time. However, it is my view that the child’s tax position should be considered if assistance is provided. Superannuation should be a factor.

The major benefit received from making tax deductible superannuation contributions is the compounding effect of paying a lower tax rate. This can be shown by a simple example:

Bryce is 40-years-old and earns $100,000 a year. His employer contributes the minimum required superannuation guarantee (SGC) of 9.5% or $9,500. Including the SGC, he is entitled to make a deductible contribution of $25,000 but does not have the financial resources to use his full limit.

He expects to retire at age 65. His mother would like to help Bryce build some wealth in a tax-effective way. Note that:

- Bryce’s marginal tax rate is 39%

- Contributions to super are taxed at 15%

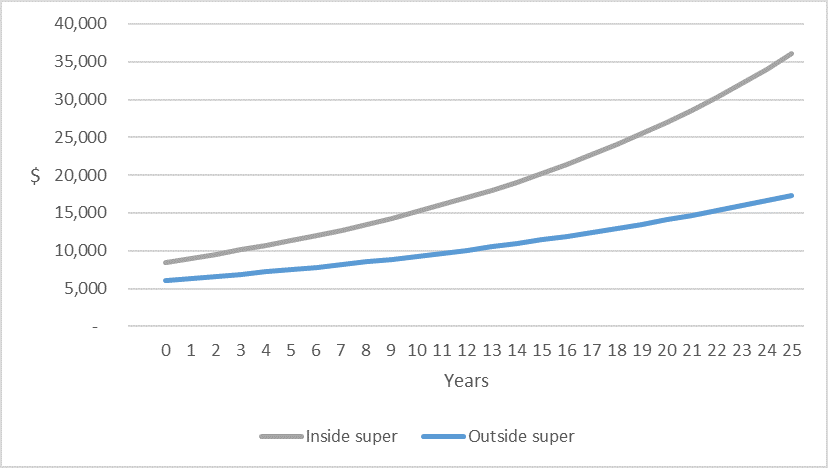

So there is a 24% tax saving if assistance is added to his super. As shown in the graph below, the long-term effect of this tax saving is substantial. Assuming future earnings are taxed at 15% inside super, compared to 39% outside and the investment return is 7%, the value of this $10,000 will be worth over double if held inside super compared with outside. Bryce will also have more in super at 65 resulting in a more tax-effective retirement.

Helping a child to make non-concessional (after-tax) contributions

Given that there is no initial tax deduction, lending money to a child to make a non-concessional contribution is not so beneficial in the short term. However, it still may be considered by high net worth individuals. For example, an individual who is 75 with children who are 50 may take the opportunity to add to their child’s super progressively knowing that they may otherwise be left with considerable funds outside superannuation when they receive an inheritance.

Overall it is becoming increasingly difficult to maximise the benefits of superannuation. More thought needs to be put into not only how much wealth is transferred to the next generation but also how it is transferred.

Two final points of caution.

Firstly, the contribution must be made by the child. In other words, the parent would need to deposit the money in the child’s bank account and the child will need to make the contribution. It cannot come directly from the parent.

Secondly, a strategy like this may have significant tax, family and estate planning consequences. As a result, it should not be entered into without first receiving both financial and legal advice.

Matthew Collins is a Director of Keystone Advice Pty Ltd and specialises in providing superannuation tax, estate tax and structural advice to high net wealth individuals and their families. This article is general information and does not consider the circumstances of any individual investor. It is based on a current understanding of related legislation which may change in future.