From the hundreds of responses to Firstlinks’ recent survey question, “What investment advice would you give to a 25-year-old starting an investing journey?”, we published an initial selection last week.

This week, we have chosen a dozen highlights that represent the main themes, plus we attach a PDF of all the suggestions.

Some comments last week suggested we should pick a top five or 10, not simply publish all the comments. But reading through the contributions, there are so many good ideas that publishing a few denies access to a range of alternatives. None of us knows what will work for the future and there are many paths to investing success.

So we attach a full list of all the responses, and we recommend scanning through them. But in our attempt to make everyone happy, here are a dozen goodies ... but we could easily have included many more in this list.

Some highlights from hundreds of great comments

- Do your research thoroughly and for an extended period of time. Make sure your personal aspirations closely align with the companies. Only invest with management teams you are totally happy about. Only buy genuine top quality when good value can be had. See the dips as a great opportunity to buy. Be prepared to keep adding to your position over time. Invest for the long term. Have fun and enjoy it! I would love to be 25 again!

- Try to regularly save. If you are a couple, live on one wage and save the other. get your house paid off as fast as you can so you always have a roof over your head. Try to buy a house in a good area that you can extend and improve later if needed, rather than having to move as Stamp Duty is expensive. when your house is fully paid off then invest in the stock market, either directly (if you have the time and interest) or via a few low cost EFT's if you are happy to outsource it. consider setting up a low cost SMSF when you have sufficient assets. don't be "over frugal". Remember to travel and follow your interests. The money you save is to help you be secure and enjoy life - it is not an end in itself. don't fall victim to fashion. consider those less fortunate than yourself and be grateful for what you have rather than envious of those who appears to have more. More often than not the grass isn't really greener. try to leave the world a better place than you found it.

- Avoid fads. Invest, don't speculate. Be patient, but not indecisive. Find a trusted mentor or adviser. Don't buy at excessive prices, no matter how strong the trend. Be contrarian. Self educate. Remember a stock is a share of the business - if you don't understand the business, don't buy the stock. Invest for the long term so you can benefit from the magic of compound interest.

- Similar to physical health, your financial health will be determined by your actual behaviour rather than your knowledge level. As a payroll accountant, I can attest that one of the most powerful forces in the universe is the automatic payroll deduction. I will back the 25 year who commences automated savings plan over an active investor every day of the week.

- Before you start get educated in finance & inv markets - plenty of courses out there to bring you up to speed. If investing in individual ASX shares don't be afraid of the small cap space but thoroughly research each company & particularly management beforehand. Find a qualified adviser you can trust - fee for service only - & review financial position twice a year. Also invest using the best tax vehicle - IMHO that's a SMSF. Research & engage an SMSF administrative service to handle the compliance paperwork ($1K-1.5K pa) so you can concentrate on the investing. Back your own judgement & stay away from the financial fog.

- Boring advice: The importance of diversification; the magic of compound interest; don't try and pick stocks unless it is your job; don't think you can time the markets; leveraging can work if you are patient.

- After learning everything you can, patience comes as the next biggest virtue. Houses and shares might be grossly overpriced at the moment, but opportunities will inevitably come even if you have to wait years for an entry point.

- Save little and often. Start as early as you can. If you are interested in the business world, find companies you admire and develop a deep understanding of how they make money, buy shares in them and don't ever sell them unless your reason for liking a company in the first place is no longer valid. If this sounds like too much work, invest in low cost index tracking ETFs.

- Everyone knows how to buy. But remember, selling is to investing what braking is to driving. It is part of the process and you have to do it in order to achieve success. Trees don't grow to the sky. Every stock will eventually come off their highs. Try and buy when others are selling and sell when others are greedily buying.

- Start today. Any amount is good. Time is your best friend right now and it will love you more than you think is possible. Believe me, you will be 50 very quickly. But you can still be cool and have lots of fun but only if you have capital reserves to draw on.

- First write down your goals. To be financially secure? To be financially independent? To be filthy rich? Decide how much income you are prepared to commit to savings/investment and accept the limitations on consumption that imposes. Find an individual full service broker with a personal investment strategy, not just a “house broker”. Commit 100% of funds to stocks. Direct all dividends to trading account. Only withdraw CGT liabilities from account for first 15 years. Treat investment account same as super… untouchable. Review portfolio with broker monthly and buy/sell on performance and to rebalance. A 15 year plan is long enough.

- Start early, invest when you have available cash can in equities, avoid bonds, have 3-6 months liquidity in cash. When you can, get into the property market and use your home as a platform for building wealth (releasing built up equity to reinvest in shares and/or additional property. Avoid margin lending (or use very sparingly ). Stick to your long term game plan, run your own race and get wealthy slowly.

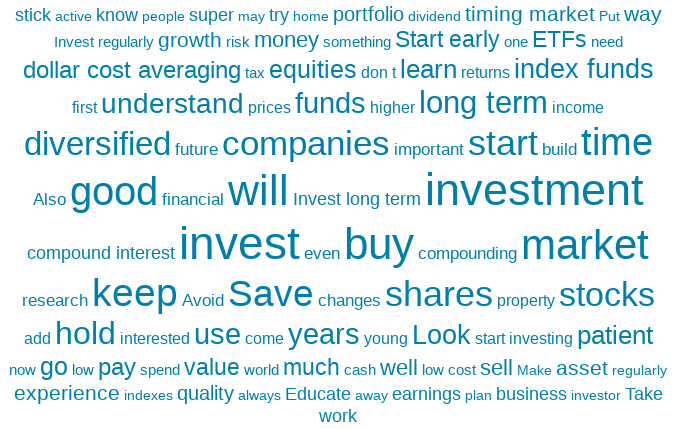

A word cloud summary

This word cloud generated from the survey responses is also a neat way to illustrate the main ideas:

And thanks to all respondents

The full list of all the responses can be accessed here.

Leisa Bell is an Editorial Associate at Firstlinks. The investment tips provided by our survey respondents are general in nature and are not tailored to your individual financial circumstances or goals.