On 21 March 2019, Bloomberg reported:

"Australia’s best-performing superannuation fund is going against the grain by avoiding cash and bonds, betting the 30-year investment horizon of its youthful members means it can ride out looming economic shocks.

Hostplus, which represents swathes of the country’s baristas and restaurant waiters, had about 53 per cent of its $40 billion invested in the sharemarket, and the remainder in unlisted assets including airports and water-cleaning plants, chief investment officer Sam Sicilia said.

Hostplus beat local peers with a 10 percent return over three years ended January11 31, according to Lonsec Group. It’s also top ranked over five years, up 8.9 percent and outpacing the country’s largest pension fund AustralianSuper, the data show. Hostplus has held no cash since at least 2011 and bonds in its portfolios were effectively zero over the past three years, according to Hostplus. The firm prefers stakes in office buildings, pipelines and emerging technology.

Part of that success was due to the fund’s ability to stomach less liquid unlisted assets, Mr Sicilia said."

Risk and reward

There are different ways to read this.

An implication of the article is that the fund has done the best over the past five years because it shunned low-risk assets like cash and bonds and invested in higher-risk assets, and therefore the same strategy will work going forward. Which is why ASIC requires everyone to add a disclaimer “Past performance is not an indication of future performance.” You need to give Hostplus credit for taking on more risk over a period where stock markets performed well relative to other assets. If it were a conscious tactical decision to allocate more to risk assets (I don’t know if that was the case) then the decision was a good one.

However, the way the article is written implies that Hostplus is taking more risk because its members are younger, which is concerning. The implication would then be:

- Hostplus will go up more when markets rise and down more when they fall as Hostplus has structurally higher risk.

- You don’t want to be in this fund if you are older because they are tailoring the asset allocation for younger members.

Are unlisted assets less risky than listed ones?

Another implication of the article is that unlisted assets are similar to cash and bonds. They aren’t.

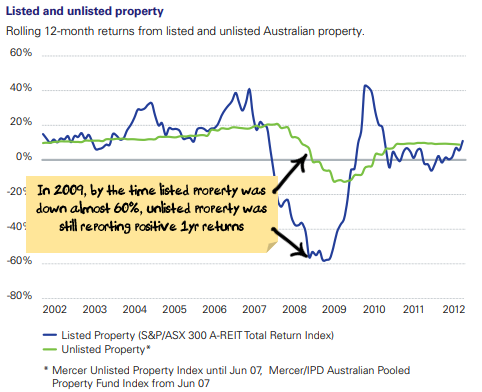

When comparing funds that invest in listed assets versus funds that invest in unlisted assets, there is no way of knowing the actual value of the unlisted assets. A good example is unlisted property funds during the financial crisis. Unlisted property funds invest in effectively the same assets as listed property funds and the underlying properties are worth the same, but the performance differs because of how the values are reported:

Do you really think that while listed property prices fell almost 60% over a year, unlisted property prices had increased slightly over the same year? Both types of funds owned buildings in the same markets, but unlisted assets are not revalued regularly and so the values reported were the values from prior years and did not reflect the actual market value.

By this stage, unlisted property funds were not trading anyway and unlisted assets could not be sold at the inflated prices. Who would want to buy unlisted property assets at last year’s prices when you could buy listed property assets at almost 60% off?

So, this is the trillion dollar question. Is an unlisted property trust less risky than listed property? There are a lot of people who say yes as the reported prices are less volatile but my emphasis is on the word 'reported'.

Preference for liquid versus illiquid

For me, if it is the choice between owning an asset:

- in a listed vehicle where I can see what is happening, how much it is worth and buy or sell at any time; or

- in an unlisted vehicle where I don’t know what is happening, the asset can only be sold at infrequent intervals and the valuation is a mix of prices from prior years and management estimates,

then I will take option 1 every time. Just because I can’t see the price move doesn’t mean that it hasn’t.

The other problem is that I can be diluted by other investors coming and going. To illustrate with an extreme example, let’s say:

- You and I are the only investors in a fund having invested $100 each.

- The fund owns 50% in an unlisted asset and 50% cash. So, the total value of the fund is $200 made up of $100 in the asset and $100 in cash.

- The asset falls 60% ($60) in price, so our fund is now only worth $140 ($70 each for you and me) but the fund doesn’t revalue the asset and so reports the fund still being worth $200.

- I decide to redeem my holding in the fund.

- The unlisted asset can’t be easily sold, and so the fund pays me $100 cash being half of the $200 that the fund is still being officially valued at.

- This leaves you with $40 of an unlisted asset – double the loss that you should have taken.

Is now the right time to have no cash and bonds?

Assets move in cycles. Ordinarily, towards the end of a 10-year bull market in risk assets, you would want to be increasing your holdings of cash and bonds, leaning into the cycle so that when the bull market in risk assets ends you can cushion the downside and you have a war chest to look for bargains. That is my strategy at the moment, but Hostplus has taken the opposite strategy. They are suggesting that now is the time to own more risk assets and to abandon cash and bonds.

Hostplus may be right. Recessions may be avoided, central banks might hit the printing presses, growth and inflation might return and risk assets might continue to go up.

I’m hoping the Bloomberg journalist has misrepresented the Hostplus investment process. I’m hopeful that Hostplus has a more nuanced view about the value of risk assets versus cash and bonds. They are a big fund with lots of investment managers and you would expect that to be the case.

The net effect is if you are looking to replicate the Hostplus asset allocation and abandon cash and bonds, do it because you genuinely think that risky assets will continue their streak, not because you think that unlisted assets have some magical ability to provide stability while their listed brethren fall.

Editor's footnote

In September 2018, Hostplus's CIO Sam Sicilia provided insights to its investment strategy in Investment Magazine.

"Our growing allocation to alternatives is to ensure we remain flexible and adaptive, given we have such a high allocation to unlisted assets."

"For us, having that strong cash flow, [about $7 billion worth of inflows a year], disposable cash if you like, means we can take advantage of not just opportunities that arise, but each opportunity that arises. If I were the CIO of another fund, where the outflows were around the same as the inflows, I would be having a very different conversation with you."

“They (the fund members, average age 34) are not retiring anytime soon, so there is a long investment horizon. The fund itself never gets older. Why? Because the hospitality industry is always a young person’s game."

“The assets themselves are very long-term assets. They have growth characteristics but, in particular, they also have defensive characteristics. They generate income, which is defensive, and capital gains, which is growth. When equity markets are volatile, our unlisted assets – such as real estate and infrastructure – provide downside protection. That is critical. If you say, ‘How come everybody doesn’t do that?’ Well, you need to tolerate illiquidity. I’m pretty happy with the characteristics.”

“People say to us, ‘During the GFC, you must have taken action and moved things around.’ It was quite the opposite, we did nothing. We made no changes to our SAA, because we have the financial cash flow and means to see through all of that volatility. In fact, when equity markets dropped, we purchased equities at a cheaper price.”

Damien Klassen is Head of Investments at Nucleus Wealth. This article is for general information purposes only and does not consider the circumstances of any individual. A version of this article appeared in MacroBusiness.