Claiming a deduction for personal super contributions can reduce personal tax and increase retirement savings, but there are many traps for the unwary.

Misunderstanding the eligibility rules can mean a member isn’t able to claim all (or even any) of the contribution(s) as a tax deduction.

In this article, we explain the requirements for being able to successfully claim a tax deduction for personal super contributions.

Notice of intent to claim

To claim a tax deduction for personal super contributions, a member needs to submit a valid notice of intent to claim a tax deduction to the trustee of the fund. The notice is often known as a section 290-170 notice, which is the section of the tax law that covers deductible contributions. The form is available on the Australian Taxation Office (ATO) website - NAT 71121.

General conditions

Conditions for claiming a tax deduction for personal contributions include:

- the individual is still a member of the super fund at the time of lodging the notice

- the relevant contributions are retained within the fund (ie they haven’t been partially or fully withdrawn or rolled over from the fund)

- the trustee hasn’t begun to pay a pension based in whole or part of these contributions

- the member hasn’t supplied a super splitting notice to the fund in respect of the same financial year

- no part of the contribution(s) are covered by an earlier notice, and

- the member has received a notice of acknowledgement from the trustee of the super fund.

Timeframes

The notice of intent to claim a tax deduction must be submitted on or before the first of the following dates:

- the date the member submitted their tax return, and

- 30 June of the following financial year after the member made the contribution(s).

Work test

Members who are age 67 to 74 at the time the contribution is made need to meet the work test in the financial year in which the contribution is made. To meet the work test, the member needs to have worked at least 40 hours over a 30 consecutive day period.

Alternatively, members may be able to use the work test exemption if:

- their total super balance at the previous 30 June was less than $300,000

- they met the work test in the previous financial year, and

- they have never previously used the work test exemption.

Impact of partial withdrawals and rollovers

Where a member makes a partial withdrawal (including a rollover) during the year, part of the withdrawal is defined as including contributions made before the withdrawal. This means that unless a notice of intent to claim a tax deduction is received prior to a withdrawal, the member won’t be able to claim a tax deduction for all of the personal contributions made that year.

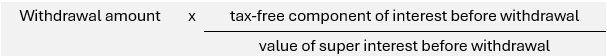

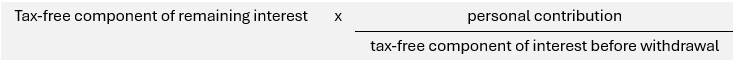

A valid notice of intent to claim a tax deduction will be limited to a proportion of the tax-free component of the superannuation interest that remains after the roll over or withdrawal. The proportion is the value of the relevant contribution divided by the tax-free component of the superannuation interest immediately before the partial withdrawal.

The tax-free component of the withdrawal is:

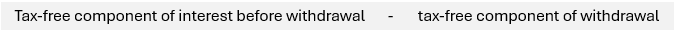

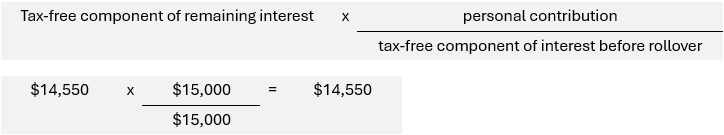

The tax-free component of the remaining interest is:

The remaining amount of the personal contribution is:

Some members use regular rollovers to fund insurance premiums in an insurance only super fund. In some instances, members may not be fully aware of the impact on their ability to claim a tax deduction, as the case study below illustrates.

Case study

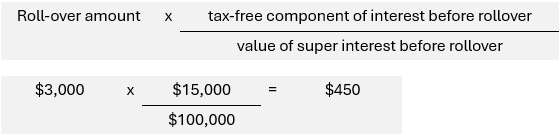

Chai contributes $2,500 per month to super and intends to claim $30,000 as a tax deduction in 2024/25. On 31 December 2024, Chai rolls over $3,000 to pay for annual insurance premiums in an insurance only super fund. Chai doesn’t provide the super fund with a notice of intent to claim a tax deduction before the rollover.

As at 31 December 2024, Chai’s super balance is $100,000 and the tax-free component is $15,000 (the contributions for which a notice of intent to claim a tax deduction hasn’t been received by the fund).

The tax-free component of the rollover is:

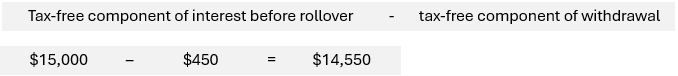

The tax-free component of the remaining interest is:

The remaining amount of the personal contribution is:

Chai contributes a further $15,000 before the next 30 June. Chai then lodges a notice with the intention to claim a deduction for the total of $30,000 contributed in 2024/25. The notice is not valid as the super fund only holds $14,550 of the first half of the year’s personal contributions. Chai can only lodge a valid deduction notice for an amount up to $29,550.

Chai could claim the whole $30,000 by lodging a notice of intent to claim a tax deduction of $15,000 before the rollover occurs, and a second notice for the subsequent $15,000.

Multiple withdrawals

Multiple withdrawals/rollovers further complicate the calculations and further reduce the amount of contributions for which a tax deduction can be claimed. In addition, transactions in the following financial year may reduce the amount available to be claimed.

Conclusion

Understanding the eligibility requirements for claiming a tax deduction for personal contributions will enable members to maximise their tax deductions. The calculations are complex and not necessarily intuitive.

Any members who make partial withdrawals should seek financial advice regarding the amount that can be claimed. However, lodging a notice of intent to claim a tax deduction prior to requesting any partial withdrawal will maximise the amount that can be claimed.

Julie Steed is a Senior Technical Services Manager at MLC TechConnect. This article provides general information only and does not consider the circumstances of any individual.