The market for electric vehicles (EV) is growing, driven by tougher regulation and increased consumer demand.

Time for change

There aren’t too many occasions in business history where a well-established market shifts its form entirely in the space of just a few years.

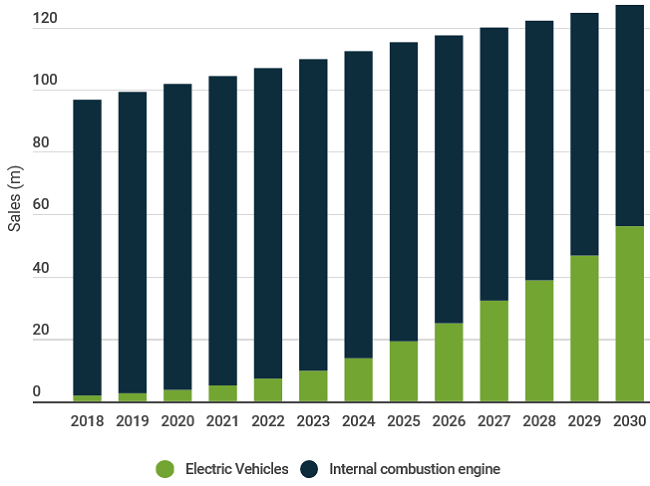

But it looks like that’s exactly what’s in store for the motoring industry, as EVs become the norm and the internal combustion engine is rendered obsolete. Our own forecasts show the EV market’s volumes are likely to grow at a greater than 30% compound annual growth rate (CAGR) to 2030, with the drive coming from tougher regulation and increased consumer demand.

Source: Martin Currie forecasts

The growth opportunity

China is currently the world’s largest market for electric vehicles, and there is a huge push from its government to grow it even further. The country’s green aspirations now mean tough minimum requirements for manufacturers to produce more New Energy Vehicles (including plug-in hybrids, pure-battery electrics and fuel-cell autos). In Europe, a clean-mobility package, approved by the European Parliament, includes new CO2 emission standards for cars and light commercial vehicles as well as incentives for zero-emission vehicles.

At the same time, while consumers have so far been slow to switch to EVs (only 16% of US motorists surveyed by AAA say they are considering an EV as their next purchase) there is evidence of growing consumer support for greener transportation measures.

The most obvious avenue is not always the right one

Tesla is probably the best-known EV brand for now, with its Model 3 the best-selling model in 2018. Worryingly for Tesla, many other manufacturers have their own EV models, such as BAIC (a Chinese state-owned enterprise), Nissan, Toyota, Renault and BMW. What’s notable for us though, is that while this part of the value chain is the most visible, it is not such a rich mine of opportunity for investors.

There are two reasons for this. The first is the potential exposure to consumer choice risk. With decisions on brands dependent on consumer tastes, which can shift rapidly, making a call on whether the consumer will favour a Tesla, a Porsche or a Renault – or any other car brand – is an unnecessary risk for investors to take.

Secondly, being right at the forefront of the consumer end market exposes investors to a lot of competitive intensity, which again, as investors, we tend to want to avoid. In fact, looking at the increased R&D and capex intentions of car makers, there is a sizeable ramp up in production capacity, highlighting a growing competitive pressure in this part of the value chain. These increased competitive pressures might explain why Tesla recently announced a significant drop in its prices.

Enhanced value-chain analysis

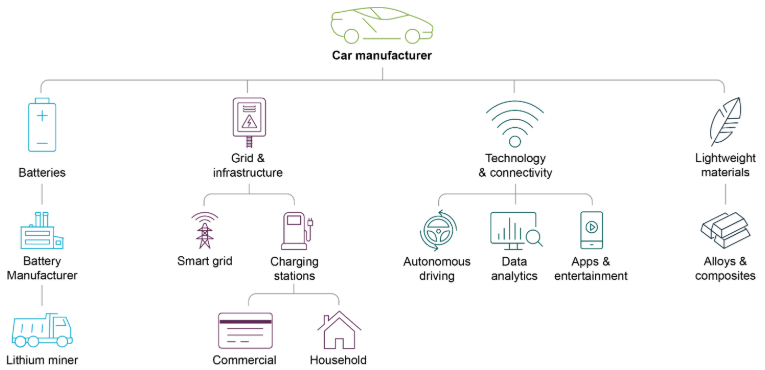

The EV industry is a perfect example of the way we approach investing in companies. Fundamental data analytics and a clear understanding of industry structures are important aspects to help us generate attractive returns for our clients. By taking a broad and deep approach to analysing segments of the market across the entire value-chain, we are able to deploy our clients’ capital on the best ideas.

We prefer to analyse the whole ecosystem of EV and find opportunities in attractively priced higher value-add areas throughout the value-chain, where there is typically more pricing power.

Dutch firm ASML, for example, has an enviable position as the key supplier to the major semiconductor chip suppliers for these growing markets. ASML makes precision lithography systems that pattern transistors and other components onto chips. With a strong market position and close relationships with customers, the company is critical in enabling innovation and development in the semiconductor industry, and therefore its pricing power is very strong.

Another semiconductor-related firm, German firm Infineon, has a wide range of products for the automotive industry as it transitions towards EV and hybrid technology, as well as autonomous cars. These products range from power controllers to Advanced Driver-Assistance Systems (ADAS). Infineon’s leading position in the autos segment is further cemented through the acquisition of chipmaker Cypress. Infineon is benefiting from the increased use of semiconductors in cars. While the average value of semiconductor products in vehicles is around US$360 [Statista, IEA, May 2018], this figure is expected to increase rapidly – as some estimates put the value of content in EV/hybrids at closer to US$1,000. When compared with the cost of a car, the benefit of increasing technological content in a car comes at a small additional cost, making companies like Infineon attractive ways to invest in the industry’s strong growth potential.

Another vital part of the value chain is batteries. Global material and recycling company Umicore has the patent to Cellcore®, which is an important brand name for NMC (lithium, nickel, manganese and cobalt), that forms the cathode of a lithium-ion rechargeable battery. It is the material of choice for the entire EV industry except Tesla. Umicore’s key competitive advantage is its closed-loop approach, where it recycles battery materials. This gives a distinct competitive advantage over peers who don’t make use of ‘urban mining’ and are therefore more reliant on raw materials from less-sustainable sources.

The benefits of taking a wider approach

The EV industry is a perfect example of the way we approach investing in companies. Fundamental data analytics and a clear understanding of industry structures are important aspects to help us generate attractive returns for our clients, analysing the market across the entire value-chain.

Zehrid Osmani is Head of Global Long-term Unconstrainted, Martin Currie, a Legg Mason affiliate. Legg Mason is a sponsor of Cuffelinks. The information provided should not be considered a recommendation to purchase or sell any particular security. It should not be assumed that any of the security transactions discussed here were, or will prove to be, profitable. Please consider the appropriateness of this information, in light of your own objectives, financial situation or needs before making any decision.

For more articles and papers from Legg Mason, please click here.