In a monthly column to assist trustees, specialist Meg Heffron explores major issues on managing your SMSF.

My last article on this new tax didn’t actually cover the mechanics of how the tax is supposed to work. But as it happens, the majority of the comments were questions about exactly that.

So consider this a follow up – an opportunity for more considered answers to some of the questions raised. And given how many there were, this might have to be just Part 1!

If you’ve read my articles before, you’ll already know I’m not surprised the Government is seeking to lower super tax concessions for people with a lot of money in the system. But at the same time, I firmly believe this particular way of doing it is dumb. So let me say up front that this article is purely about how it works, rather than trying to defend it.

Some terms to help the explanation

This tax really is deceptively simple in how it’s worked out:

15% x a proportion x earnings

(The big bone of contention, of course, is how the earnings are worked out – but more on that shortly).

This tax is entirely separate to – and on top of – the tax paid in the super fund itself. That’s calculated as:

15% x the fund’s taxable income

The only thing the two taxes have in common is 15%.

The ‘earnings’ used for Division 296 and the ‘taxable income’ used for the fund’s own tax will have some common elements (for example, rent, dividends, interest are included in both). But there are also some big differences. Most importantly, earnings for Division 296 are basically anything that makes the member’s super balance go up which will include all growth in assets whether they’ve been sold or not. Taxable income in the fund, of course, only includes gains from assets that are actually sold.

For example, Dave’s super balance increased from $4.5 million to $5 million during 2025/26 and he didn’t take any money out during the year or add any new contributions. His earnings for Division 296 would be $500,000 ($5 million less $4.5 million).

Whether this was $500,000 in (say) rent or capital gains really matters when it comes to his fund’s tax bill but not when it comes to Division 296. For example, if it was all interest (no growth in the fund’s assets), the super fund would also pay tax that year (15% x the interest). If, on the other hand, it was all growth in investments that weren’t sold (no taxable income), the fund would pay no tax at all that year.

But for the new tax, none of this matters. All we care about is that Dave’s super is bigger than it used to be. We’ll come back to Dave shortly but let’s address some of the questions first.

Double taxation or not?

A lot of outrage about this tax is directed at the fact that it represents double taxation – super earnings are taxed first within the super fund and then again via this new tax.

Yes.

But that’s entirely intentional and exactly what the Government has said right from the start. Their rhetoric about increasing the tax rate from 15% to 30% for people with large super balances tells us so. They haven’t changed the way super funds are taxed, they’ve simply added a second tax on top that only applies to some people – those with more than $3 million in super. So by definition it’s taxing income twice.

We may not like it but to say its unprecedented is actually wrong. If you’re a higher earner still receiving employer contributions (or making contributions yourself and claiming a tax deduction for them), you’ll already have felt the full force of Division 293 tax (is the very similar name a coincidence? I think not). This is an extra 15% tax on contributions known as ‘concessional contributions’. It’s paid by people who earn more than $250,000 pa. They have the normal 15% tax (same as everyone else) deducted from their super contributions in their fund and then they get another personal tax bill on these same contributions as their ‘Division 293 tax’. It probably flies under the radar because the amounts are much smaller. The cap on concessional contributions is $27,500 pa (rising to $30,000 from 1 July 2024) so in most cases, the bill is $4,125 at most. But it’s still a second tax on income that has already been taxed – just like Division 296.

When it comes to Division 296 (the new tax), of course, there are some extra factors that make the whole situation opaque, and the amounts are potentially much larger. So not surprisingly, the double tax element comes in for much more criticism than it does with Division 293. But it’s not new, it’s definitely intentional and the Government has been pretty clear about it.

It’s also worth noting that people impacted by Division 296 are not paying double tax on all their super fund earnings. They are paying double tax on just a proportion of their super fund earnings. The theory behind the proportion calculation is that the Government is quite happy for them to only pay tax once on the bit of their earnings that relates to the first $3 million of their super. It only wants to double tax the earnings on the bit of their super that is over $3 million.

But how that’s worked out is another thing that people are definitely finding confusing.

How much of the earnings will be hit with double tax?

To keep things simple, the Government has taken a short cut when it comes to working this out. It isn’t worked out by actually breaking up earnings during the year into ‘earnings on the first $3 million’ and ‘earning on the rest of the super balance’. Instead, there is a much simpler approach.

The ‘proportion’ in the formula above is simply: what proportion of the balance at the end of the year is over $3 million?

In our Dave example earlier, Dave’s balance was $5 million at the end of the year. So $2 million (or 40% of his $5 million balance) is over $3 million. That means Dave’s proportion is 40%.

It doesn’t matter if he had much more or much less during the year, all that matters for this proportion is the size of his balance at the end of the year.

So Dave’s super earnings in 2025/26 were $500,000. He will pay Division 296 tax on 40% (the proportion) of those earnings ($200,000). He pays no extra tax on the other $300,000.

His Division 296 tax bill will be $30,000:

15% x 40% x $500,000 = $30,000

That’s on top of the tax his super fund has already paid.

What about an example

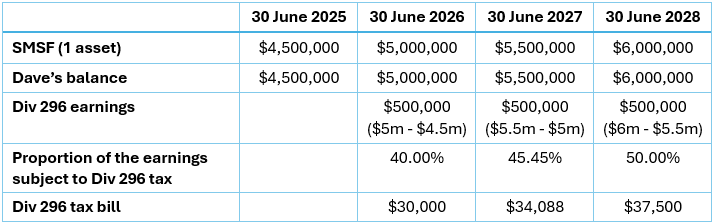

Let’s make things simple and assume Dave is the only member of his SMSF. And let’s assume for a moment that his super fund bought an asset on 30 June 2025 with all of its money ($4.5 million). Of course in practice this wouldn’t work – Dave’s fund needs money to pay his accounting fees and ATO levies at the very least but for the moment we’re going to ignore that inconvenience.

Let’s also assume – really stretching the boundaries here – that this asset doesn’t earn any income, ever. It’s just growing in value. (The investment strategy for this fund would be super interesting.) It is sold on 1 July 2028. Until then, Dave’s super fund (and his balance) looks like this:

What tax would Dave’s super fund be paying during this period? Nothing – until 2028/29 when the asset was sold. At that time, the capital gain would be $1.5 million ($6 million less $4.5 million). When a super fund holds an asset for more than 12 months, it only pays tax on two-thirds of the capital gain. So Dave’s SMSF would have a tax bill of $150,000 in 2028/29:

15% x 2/3 x $1,500,000 = $150,000

Importantly, Dave’s SMSF would pay tax on this capital gain in the normal way even though Dave has already paid Division 296 tax along the way. And as we can see from the table, each year that gain built up, Dave paid Division 296 tax on 40% - 50% of it (which added up to around $100,000 over those three years). He didn’t get any one-third discount either when it came to his Division 296 tax.

Yes, it’s definitely double taxation and that’s exactly what the Government intended.

This is, of course, really oversimplified:

- the fund isn’t earning any taxable income at all (just a capital gain when the asset is sold),

- Dave doesn’t have a pension (whereas many people in this position do), and

- the fund’s accountant could make provision for capital gains tax each year, effectively recognising each time the asset grows in value there will be a tax bill down the track when it’s sold. This would make Dave’s balance (and earnings) a little lower each year and reduce his Division 296 tax bill a little.

But hopefully it highlights two points:

- The fund’s tax and Division 296 are completely divorced from each other, and

- Dave is being double taxed but not on all the growth in his super, only some.

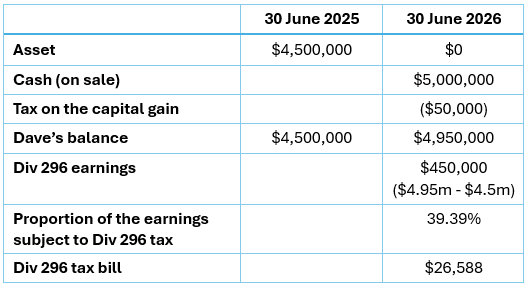

Would selling assets before 30 June and re-buying on 1 July help?

Not really. It would change all the numbers and result in slightly less Division 296 tax each year but would also bring forward the fund’s tax bill and make Dave a bit poorer overall.

Let’s imagine that was possible in 2026 for Dave (and let’s assume the fund held the asset for a fraction over 12 months so the discount on its capital gains still applied). The position at the end of that first year would be:

The reason the earnings amount is a little lower is that we’ve allowed for the tax that will be paid by the SMSF when it lodges its 2025/26 tax return. But see how the earnings amount is still pretty close to $500,000? (And in fact, Dave’s a little poorer because his super fund has paid tax and can only re-buy $4.95 million in assets, not $5 million.)

As mentioned above, Dave could achieve a better result by hanging on to the asset but specifically recognising in the fund’s accounts that there is a future liability building up – the capital gains tax that will eventually be paid on the asset.

Actually selling the asset doesn’t make it any better, it just means paying the ATO quicker.

What would be even worse would be selling an asset bought well before 1 July 2025.

Let’s say the $4.5 million asset in our example wasn’t actually bought in June 2025. Instead, it was bought 10 years earlier for $2 million.

Selling it in 2025/26 would make no difference at all to Dave’s Division 296 tax bill. That’s all based on growth during 2025/26, not what’s happened before. But it would make a very large difference to the SMSF’s tax bill. Instead of $50,000, the fund would part with a much larger amount:

15% x 2/3 x ($5,000,000 - $2,000,000) = $300,000

Ouch.

This is another big difference between fund tax and Division 296. Division 296 is focused exclusively on how much growth Dave sees in his super after 30 June 2025. Growth already factored in (as in this case) won’t get double taxed.

These are just some of the areas of confusion around Division 296 tax - it seems I might need that Part 2 after all.

Meg Heffron is the Managing Director of Heffron SMSF Solutions, a sponsor of Firstlinks. This is general information only and it does not constitute any recommendation or advice. It does not consider any personal circumstances and is based on an understanding of relevant rules and legislation at the time of writing.

For more articles and papers from Heffron, please click here.