“In my lifetime, I’ve seen two demonstrations of technology that struck me as revolutionary ... For decades, the question was when computers would be better than humans at something other than making calculations. Now, with the arrival of machine learning and large amounts of computing power, sophisticated AIs are a reality, and they will get better very fast.”

Bill Gates, Founder Microsoft, The Age of AI Has Begun

***

Most people can recall their first experience with a new piece of technology that changed how they lived or worked. I remember the excitement of watching satnav in a car, the first decent computer in the home and office, the beginning of email at work and the wonder of a smart phone with a screen in your hand. As Head of New Issues at CBA, we acquired the first fax machine in the entire bank to allow documents for Eurobond issues to travel to London and back overnight. It cost $7,000 and filled a small room, and people came from around the Bank to gaze at it. We take all these innovations for granted.

And now a bigger technology is unfolding before our eyes. We have scratched the surface on what Artificial Intelligence (AI), ChatGPT and the like will achieve, and how it will change our lives.

The simplistic view is that OpenAI can write answers, stories or legal documents and journalists and lawyers should fear for their jobs. Play around with OpenAI, ask it some questions, and indeed, it will amaze. In 2022, Bill Gates reviewed the technology in the way many of us have, and was awestruck.

“In September, when I met with them again, I watched in awe as they asked GPT, their AI model, 60 multiple-choice questions from the AP Bio exam - and it got 59 of them right. Then it wrote outstanding answers to six open-ended questions from the exam. We had an outside expert score the test, and GPT got a 5, the highest possible score, and the equivalent to getting an A or A+ in a college-level biology course.

Once it had aced the test, we asked it a non-scientific question: “What do you say to a father with a sick child?” It wrote a thoughtful answer that was probably better than most of us in the room would have given. The whole experience was stunning.

I knew I had just seen the most important advance in technology since the graphical user interface.”

Bill Gates has been at the forefront of watching AI since 2016 and he sees considerable potential:

1. Productivity enhancement

There will always be jobs where humans are better than AI but tasks such as sales (digital or phones) and document handling (payables, accounting, insurance) will be handled by AI. Its ability to express ideas will be like having an assistant to help, such as writing emails and managing email. Gates argues that when productivity rises, society benefits because people are free to do other tasks. This is an optimistic outlook as many will also be left behind.

2. Health and equality

Healthcare staff spend an inordinate amount of time on measuring, filing, insurance, paperwork, taking notes and record-keeping, and AI will streamline most of this. Gates works full-time on philanthropy and sees much potential in poor countries for people who cannot visit a doctor. For example, AI-powered ultrasound machines can be operated by someone with little training. Diseases can be identified remotely. Gates sees a future advising people in poor countries on crops or livestock, better seeds for local conditions, soil and weather information, drugs and vaccines for animals.

3. Creation of a personal agent

A personal agent will help with scheduling, communications and e-commerce across all devices. We will need to work out how much we allow the agent to make decisions for us, such as what to buy and what to tell other people.

4. Education

Gates says computers have not delivered the widespread gains in education that he hoped, but AI-driven software promises a revolution in teaching and learning. Content can be increasingly tailored to specific children or communities, understanding can be measured, and motivation and weaknesses monitored. It might give advice on career planning.

The investment implications, with a warning

The market is recognising this potential with massive enthusiasm, and as always happens in equities, there will be overreactions. At some point, as too many investors jump into the same idea and hedge funds algorithms follow the trends, prices will be pushed beyond reasonable valuations. It is the nature of markets and the human condition, as happened in 2000.

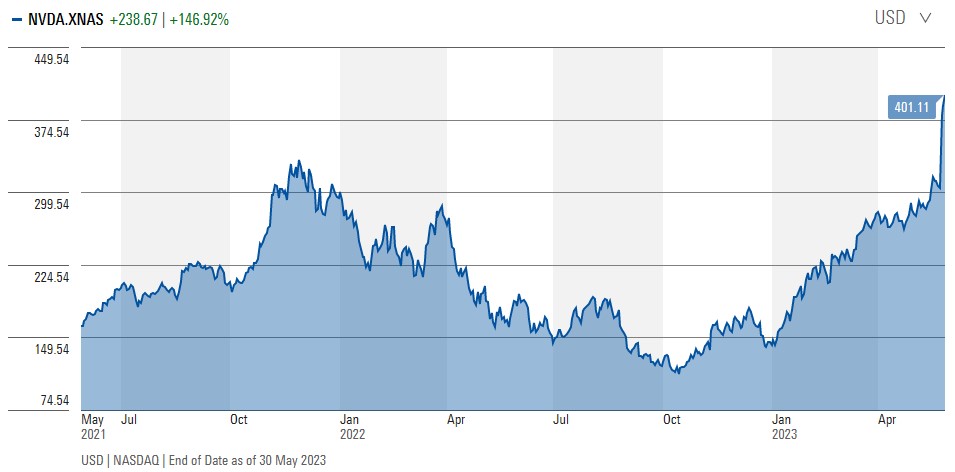

In the current market, anything written about the stock at the height of the AI frenzy, Nvidia, can lose relevance in a day. It recently rose 30% in after-hours trading following an upbeat announcement on future revenues. A week ago, I wrote about Nvidia going above US$300 and it touched US$418 intraday on Tuesday NY time to enter the exclusive US$1 trillion club occupied by only Apple, Microsoft, Alphabet and Amazon. At time of writing, close of Wednesday, it was back below US$380.

Source: Morningstar Premium

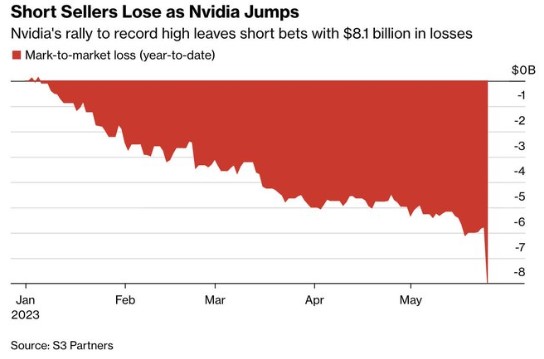

The other side of such meteoric rise is the hedge funds and others who are negative on the stock and take short positions, with losses heading to US$10 billion.

For the moment, Nvidia dominates the AI landscape, a leap above the Central Processing Unit (CPU) technology of other companies. Nvidia CEO Jensen Huang told CNBC:

“The flashpoint was generative AI … we know that CPU scaling has slowed, we know that accelerated computing is the path forward, and then the killer app showed up.”

At some point, other companies will catch up. Nvidia is currently trading on a Price to Revenue ratio of 37 and a Price to Earnings of 204. There is a famous statement from Scott McNealy, then CEO of Sun Microsystems, speaking to Bloomberg in 2002 about the crazy valuations of his company in 2000 and the subsequent collapse:

“Two years ago we were selling at 10 times revenues when we were at $64. At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends.

That assumes I can get that by my shareholders. That assumes I have zero costs of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current revenue run rate.

Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don’t need any transparency. You don’t need any footnotes. What were you thinking?”

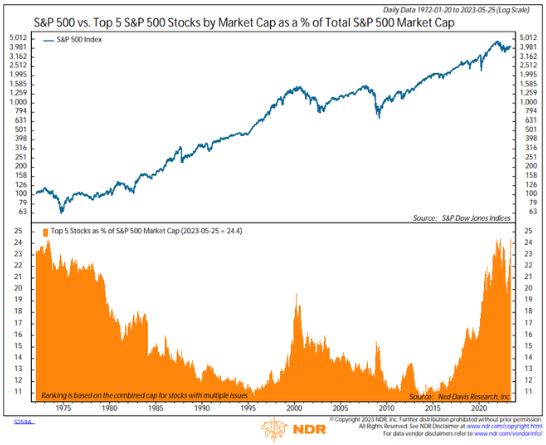

Three charts on how the market is reacting

Here are three charts selected from various sources which summarise AI’s rise.

1. The five largest companies in the S&P500 (Apple, Microsoft, Alphabet, Amazon and Nvidia), comprise almost a quarter of the index of 500 companies, the highest percentage for 50 years, pushed up by the AI promise.

2. The tech Nasdaq index is outperforming the Dow Jones Industrial index by 22% in 2023, the widest margin in any year since Nasdaq launched in 1971.

3. Analysts have widely-different expectations. Morningstar analyst, Abhinav Davuluri, recently updated his valuation for Nvidia, saying:

"Wide-moat Nvidia reported first-quarter sales ahead of management’s guidance, while providing guidance for the second quarter significantly above our prior estimates. Management expects second-quarter revenue to be at a midpoint of $11 billion, which would be up 64% year over year and 53% sequentially. Yesterday shares in the company leapt from around $305 to $386 on the news.

We are raising our fair value estimate on Nvidia stock to $300 per share from $200 per share, as we raise our forecast for Nvidia’s data center segment revenue to grow at a 30% compound annual growth rate over the next five years (up from 19% previously)."

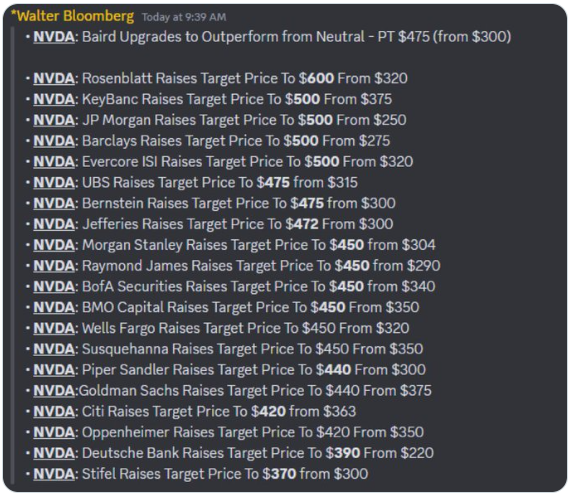

Other analysts report they have never seen such a wide guidance range on technology stocks as they struggle to understand the consequences of the monetisation possibilities of AI. Within 24 hours of the recent earnings update by Nvidia (NVDA), here are the analyst announcements, with a range of US$320 to US$600.

Back to Bill Gates, who reads more widely in a week than most of us do in a year, who concludes:

“I think back to the early days of the personal computing revolution, when the software industry was so small that most of us could fit onstage at a conference. Today it is a global industry. Since a huge portion of it is now turning its attention to AI, the innovations are going to come much faster than what we experienced after the microprocessor breakthrough. Soon the pre-AI period will seem as distant as the days when using a computer meant typing at a C:> prompt rather than tapping on a screen.”

Graham Hand is Editor-At-Large for Firstlinks. This article is general information and does not consider the circumstances of any person.