Nvidia is now the third largest company in the world. It is larger than Tesla, Meta, Alphabet, Amazon and Saudi oil giant Aramco. Despite this scale, the company grew quarterly revenue at +265% year on year as reported in its latest earnings call. The data-centre segment grew an astonishing +409% year on year. Even as we become strangely accustomed to Nvidia’s beats and raises, this kind of growth should in no way be perceived as anything even remotely resembling normal in the stock market.

Its size and speed, for a company this large, has not been seen in recent history.

Our history with Nvidia

Nvidia has featured in portfolios managed by Loftus Peak since the beginning of 2016. Back then, the share price was around US$8 (after adjusting for the company’s stock splits).

At the end of 2016, Nvidia’s data centre business had grown just +145% (!) year on year and accounted for 12% of total revenue (gaming was 60%). Nvidia was the graphics processing unit (GPU) specialist and it disrupted, in a way, the incumbent central processing unit (the CPU). By processing independent calculations in parallel, Nvidia offered a far more efficient hardware solution for dealing with large calculations.

We held Nvidia as the company grew, powered by the cyclical gaming business and the secular data-centre business, of which Artificial Intelligence (AI) was a driver. We believed the company could grow revenues a little bit faster than 20% p.a. across the next five years. This was the basis of our investment between 2016 to 2022.

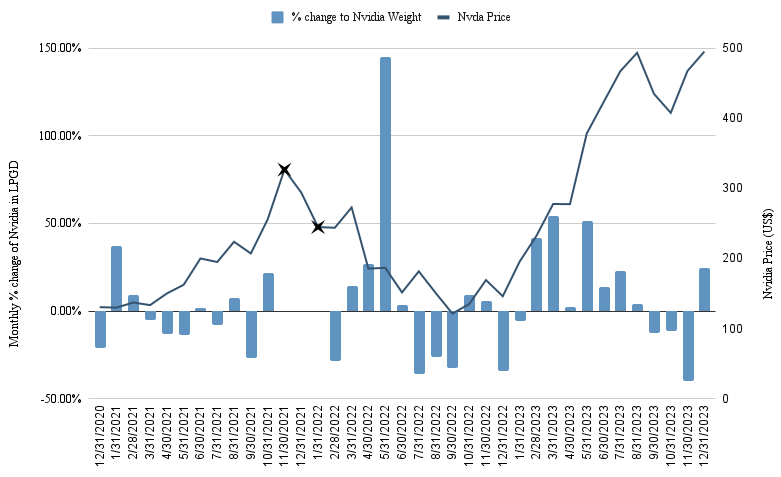

Figure 1: Using these assumptions, Nvidia featured in the portfolios we manage

Source: Loftus Peak

Nvidia went through our price target in late 2021 and we exited all together, up around 10x on initial entry price. The 2022 sell-off brought the company back into an investable range.

Then AI came along…

The nature of Nvidia’s disruptive edge has not changed since 2016. However, the demand for its cloud compute has exploded due to AI and Large Language Model workloads. This is the fundamental driver of the company’s incredible growth.

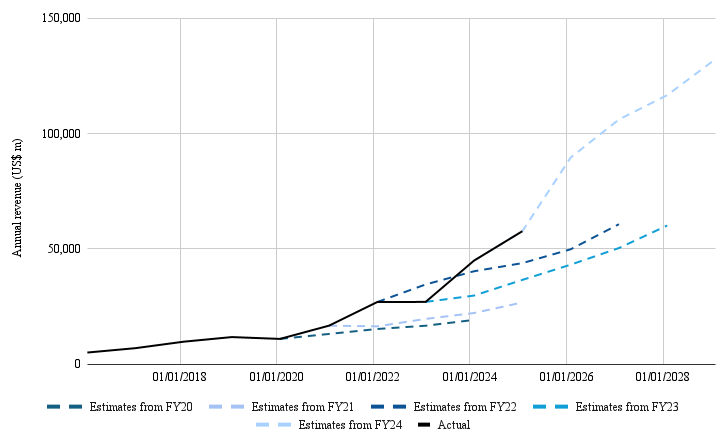

Figure 2: We understood the potential, but we did not expect the pace of growth

Source: BBG, note that the Nvidia financial year is eleven months ahead of the calendar year.

The translation of AI demand into Nvidia revenue became clear to us from February 2023. We increased our growth assumptions, our price target climbed and we lifted the company’s weight in the portfolios managed by Loftus Peak. After falling -50% in 2022, the stock grew +239% in 2023, and has approximately doubled in the 2024 year to date.

What comes next?

Commentators flit between euphoria and scepticism. To confuse matters further, projected earnings upgrades make the company appear as one of the cheaper semiconductor names on a forward P/E basis. Some cynics have acquiesced. This capitulation combined with the capex numbers from customers like Meta and Microsoft have fuelled Nvidia’s share price.

But for the Fund, investing in AI, in a risk-controlled way, requires some level of diversification.

This is because within Nvidia’s enormous growth numbers are the seeds of a downward move in the valuation. Nvidia is forecast to generate sales of around US$105 billion by the end of 2024 and US$127 billion by the end of 2025 – but this last figure implies a reduction in the growth rate from 100% to just 20%! Investing in AI therefore is very different to using AI.

This is the reason that the Fund holding in Nvidia has been cut by around half over the past 6 months. It is not because of scepticism on the AI roll-out, but because the share price as it stands better reflects the shape of that roll-out to come, and so is now less attractive.

Just to be clear, there is more value to be had from investing in AI. The hardware build we have seen should be viewed as a prelude to a usage and device boom which has yet to be captured, in a return sense, from other major players including Qualcomm, AMD, Apple and Alphabet among others.

But reducing the exposure to companies such as Nvidia provides more room to invest in other companies that we believe are more prospective and not so richly valued, and on which future returns will be earned.

Alex Pollak is Chief Investment Officer and Co-Founder of Loftus Peak. This article is for general information only and does not consider the circumstances of any individual. Loftus Peak Global Disruption Fund (ASX:LPGD) is available to investors on the ASX as an active Exchange Traded Managed Fund.