2023 had been a strong year for the share performances of large technology companies. The Magnificent Seven tech stocks - Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL), Amazon (AMZN), Nvidia (NVDA), Meta Platforms (META) and Tesla (TSLA) drove the bulk of market returns for the S&P 500.

Looking forward to 2024, we see many opportunities for smaller, less discovered companies. At Munro, we believe that stock returns follow a company’s earnings trajectory over a long time horizon, and we search all over the world for sustainable earnings growth. We are now observing earnings growth re-acceleration in many high-quality small companies.

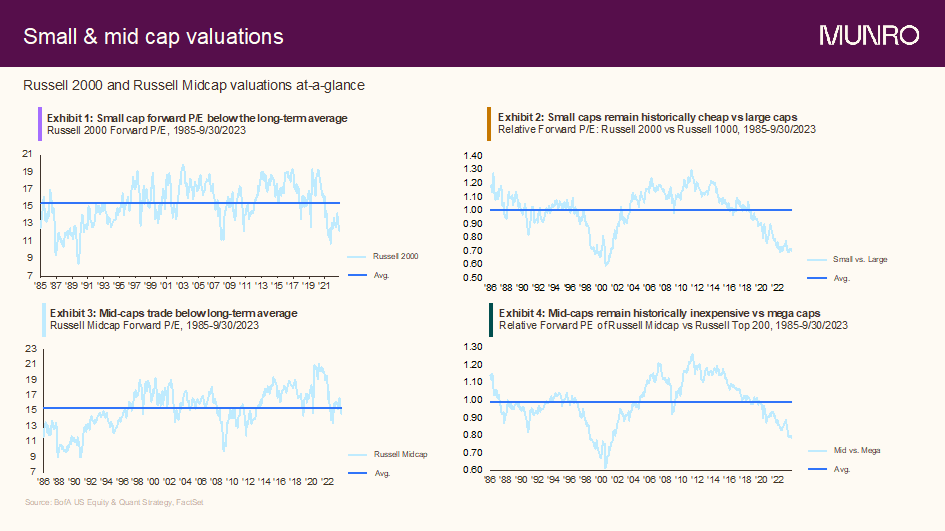

Fortuitously, these companies are also ‘on sale’ – in our opinion these companies are cheap both relative to their own historical average valuation and their larger peers.

Why Generative Artificial Intelligence will start to benefit smaller companies too

Generative AI is a revolutionary tool, and so far, it mostly benefits the largest companies. The simple reason is cost – it takes over US$1 billion to train a large language model, so very few companies can afford it. However, 2024 is when these models are finishing the initial ‘training’ phase and entering the ‘inferencing’ realm, which is another way of saying now the world will try to generate real use cases from these staggeringly intelligent models.

Few companies outside of the Magnificent Seven can enjoy their fruits during the model training phase. During inferencing, however, anyone can benefit from them. This is an Appstore moment for Gen AI, and we expect to see a sharp increase in the number of smart, entrepreneurial companies racing to incorporate AI more deeply into their products and services.

Pinterest

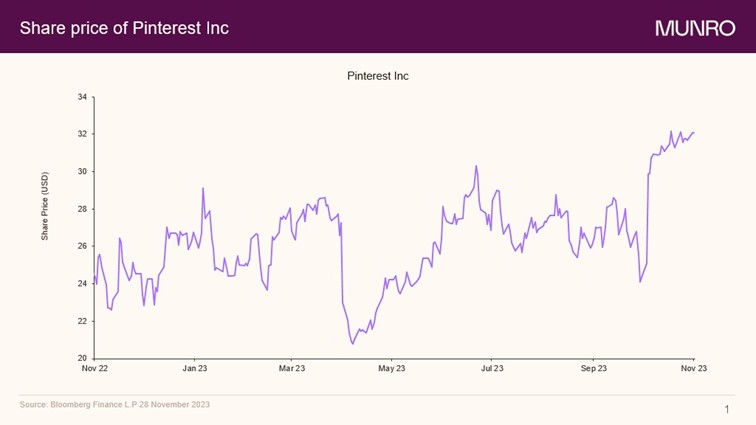

An example of the kind of company we like is ‘visual discovery engine’ Pinterest (PINS). It had been labelled as a ‘boring’ legacy company, but we have observed how they have reinvented themselves into something much more exciting.

They brought in a stellar management team from Google and transformed Pinterest from a website for browsing pretty pictures to an incredibly shoppable interface on both the mobile app and their webpage. We are seeing many positive early results – user growth has re-accelerated, revenues are growing strongly again, and margins have expanded substantially. The stock jumped 20% on the recent positive earnings announcement, and we think this is just the start.

Area of Interest - Consumer

Activewear and outdoor living sportswear brands are a subsector of broader consumption which is becoming more of a focus for us. In our all-cap funds, we like companies like Lululemon, and in the small and mid-cap funds, we currently own On Running (ONON).

On Running

On Running started up 13 years ago in the Swiss Alps by a retired athlete who wanted to create a running shoe with a new feel. It is a small, specialised brand pulling ahead of the pack. It is also not as impacted by the range of macro factors hitting the market as it has a very specific set of devoted target customers to which it can sell a differentiated product.

We were able to add the company to our portfolio at, what we consider to be, a very attractive entry point, potentially its lowest valuation since the initial public offering (IPO), because at the time, the share price was being impacted by overall market macro concerns around consumer stocks.

It was encouraging to see that reported earnings for the financial year far exceeded expectations. The outlook for On Running is also looking very positive with a slew of innovative products in the pipeline.

Qiao Ma is a Partner and Small-Mid-Cap Lead Portfolio Manager for Munro Partners, a specialist investment manager partner of GSFM Funds Management. GSFM is a sponsor of Firstlinks. The information contained herein reflects the views of Munro Partners as at the date of publishing and is provided for informational purposes only. It should not be considered investment advice or a recommendation of any particular security.

For more articles and papers from GSFM and partners, click here.