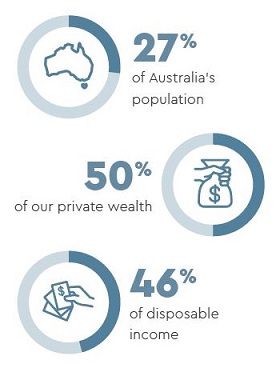

Australians over the age of 50 have the highest levels of wealth and disposable income of any age segment, they outspend millennials in entertainment, auto, health, travel and almost every other category, but are largely ignored by brands.

The Secrets & Lies – Ageless and Booming Report also reveals that 94% of the over 50s dislike the way marketers communicate with them. More than a quarter of all Australians are over 50 and yet it’s almost impossible to find organisations and brands that understand this high-value audience. There is an unrivalled opportunity in the enormous purchasing power. This report is based on research involving 2,500 Australians aged 50 to 79 years which reveals this group is booming and growing.

The risk of treating as a homogenous group

The risk of using ‘over 50’ as segmentation shorthand is that we treat this vast and diverse population as a homogenous group. It’s symptomatic of how little attention is paid to this audience that they’re typically lumped together with their parents without due consideration for the different life stages. Many Australians in their 50s are still busy raising kids, building careers and paying off mortgages. They’re a long way off 80, and not even close to traditional retirement, but this distinction is often overlooked.

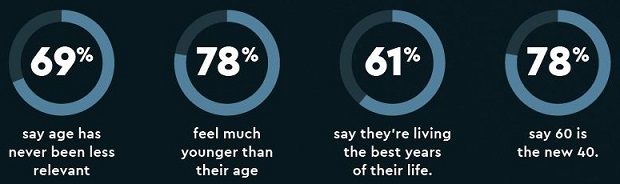

They have a sense of self-assurance not felt in their 30s and 40s. That’s why 71% of them say they’re happier and more comfortable in their skin than they’ve ever been. Retirement becomes a big discussion topic once people hit their 60s, but the fact that the word ‘retirement’ hasn’t been retired is an opportunity begging to be taken. Language and imagery matter. More over 50s have no intention of ‘retiring’ in the traditional sense. They might change the way they work, how they work, how much they work or even what they do for a living, but this ‘ageless’ sentiment lacks the new language needed to describe it.

Business needs to engage better with this wealthy segment

For hundreds of past generations, in cultures around the world, being an older member of the tribe, family or community was associated with wisdom. Valuable knowledge could be passed on to the next generation. This gathering and transferring of wisdom wasn’t simply bestowed upon the elders as a polite or patronising mark of respect, but stemmed from a sensible and useful realisation. What better way to plan ahead than to speak to, and listen to, people more advanced in their years?

But have we become biased against ageing? What happens when a culture is evolving so quickly that the central knowledge base that traditionally provided such a steady hand on the tiller of effective decision making no longer fits in the context of a new world?

An important question for organisations to ask is whether they have an unconscious bias against older people. Apart from the obvious sectors such as retirement, aged care and health services, many organisations do not have a strategy to engage this rich and growing segment of society.

They have ambition, purpose and money

Ageing is a loaded word but it’s a topic that gets lots of play. It’s bursting at the seams with emotion and angst. Beauty companies, the fashion industry, the media and many others treat it as something to be avoided. And yet, Australians over the age of 50 are embracing life with ambition, purpose and money in their pockets. Ageing is poorly understood, particularly by business and marketers who largely ignore or misfire with this audience. The fallacy is that they can’t do tech. They’re not cool. They’ve retired from work and shut the door on meaningful life. They have no aspirations. They’re boring, unattractive and irrelevant. None of this is true.

The majority of the over 50s audience don’t think of themselves as old, and they have no time for brands and organisations that lazily shove them into that category. The clichés and misnomers surrounding ageing are as insulting as they are inaccurate. Marketing is littered with images of the over 50s slowing down, disconnecting, opting out and generally frittering away their time. Their ‘secret’ is that age is a state of mind.

The size of the prize

The Australian Bureau of Statistics (ABS) latest Household, Income and Wealth Report shows that over 50s make up 27% of Australia’s population yet hold 50% of private wealth. Nielsen data shows this group buys most of the car and travel purchases.

Strong work ethic and plenty of money to spend

Baby boomers are the generation with the highest disregard for age. Those born between 1946 and 1964 experimented with drugs in the 60s, protested the Vietnam War, waged relentless campaigns for women’s liberation and revolutionised music. Now into their 50s, 60s and 70s, they’ve spent a lifetime challenging the status quo to build a legacy of change and they’re not about to become complacent or invisible now. When they weren’t pushing against the establishment, they were working hard to build lives and families in a period of great economic uncertainty.

The over 50s segment is now being bolstered by Generation X, bringing even greater expectations of a full and active life in their later years. This is driven by a work ethic instilled by their parents.

Over 50s Australians outspend millennials in entertainment, auto, health, travel and almost every other category but 94% dislike the way brands, organisations and marketers communicate with them. Of all the marketing briefs received during the past 12 months, we estimate that only 2% of them focus on targeting over 50s. This demonstrates a stunning lack of understanding and respect for the audience. Not to mention an alarming lack of attention on those who have the most money to spend.

The over 50s audience is a new kind of mass consumer. It’s a mature and diverse group of people enjoying the same things as the younger generations. They want to continue to be their best selves for as long as they can. And they want marketers to realise that they’re just as interested in ‘new’ as everyone else. Australia’s over 50s are in much better financial shape than the rest of the population. They have the highest levels of wealth and disposable income, with a tendency to make financial decisions a little more quickly than other audience groups. They want to enjoy life and they’re ready to pay for experiences.

When it comes to buying consumer good online, the over 50s spend about $40 billion more than millennials and Generation X each year. They spend an average of 27 hours per week online, with 77% regularly researching and buying products.

Still breaking the rules

A classic misconception of this audience is that they’re ‘set in their ways’. Nothing could be further from the truth. They’re revaluating and reinventing their lives in ways large and small.

The divorce rate among women over 55 saw double-digit growth from 2015-16 and many are remarried in their 50s. More than half of new clothing, household items and furnishings are purchased by people over 50. They’re going back to university, starting new relationships and buying new homes. They’re reshaping their lives and looking nothing like their peers of a generation ago. Plenty of others are embracing single life.

One-third of people over 55 have never married – a figure which has doubled during the past 15 years. More than half of women over 50 always expect to be sexually active. Imagine the opportunities here in fashion, gym memberships, cosmetics, hospitality and holidays. This group is also challenging traditional work patterns.

One-third of Australian start-ups are founded by over 55s. It’s not the image the movie industry has perfected when marketing the entrepreneurial stereotype, where everyone is 20 years old and rides around the open-plan office on a scooter. They’re also embracing the gig economy and people over 50 will account for most of the self-employed workforce by 2024.

And, despite what many assume, they’re not blindly loyal to brands. Change is in their generational DNA and they’ll happily move on from products or services that no longer meet their needs. They are happy to forge new relationships with brands and people.

Six-point action plan for marketers

To help brands forge these relationships and better connect with the over 50s, we have identified a six-point action plan for marketers:

- Get forensic and make sure you understand the data around this powerful demographic; their consumer behaviour, purchasing habits and intentions. There’s a significant new market to explore

- Invent new ways, new models, new products and new brand positions to connect with this audience

- Ensure you are reflecting the vibrancy and optimism of the over 50s; they’re gearing up, not down

- Recognise the change and evaluate what role your brand or organisation can play for an audience that’s changing their lives

- Differentiate between 50 and 80. The over 50s are not a homogenous group. Investigate their various sub-segments and target them accordingly

- Model diversity and ensure your organisation values the skills, expertise and voices of the over 50s.

Those of us in the marketing industry have failed to fully appreciate and embrace this audience. We are urging a rethink across the industry. After all, those organisations and brands that accurately relate to, and connect with, this audience will win their attention and gain a bigger share of wallet.

Rose Herceg is Chief Strategy Officer at WWP AUNZ. Ageless & Booming is the third and latest research report in a series called Secrets & Lies, which analyses the difference between what Australians say and what they think or do.