The number of people in Japan of working age was outnumbered by non-workers for the first time in 1994. In China, that number turned negative in 2015 and in Europe, 2011. The global population is ageing and changing the expectations and needs of a class of investors who may presently be uncatered for. In particular, those approaching retirement must consider risk much more seriously for they can least afford a permanent loss of capital.

Drawing out capital is opposite of 'dollar cost averaging'

For retirees, regular withdrawals of capital may be required where income is insufficient to meet lifestyle requirement. In an environment of ultra-low rates, generating a sufficient income is made more challenging. Consequently, restricted income means many investors must decide between spending less or eroding capital to meet lifestyle demands.

When an investor is required to make regular withdrawals regardless of the market level, capital losses experienced early in retirement can be deleterious. Sequencing risk, which describes the pattern of investor returns, or the order in which they are received, therefore looms large for retirees.

The impact of sequencing risk on retirement incomes is the opposite to the impact of dollar cost averaging, which can be employed to accumulate wealth. Dollar cost averaging involves making regular investments, while retirees in pension phase are required to take regular payments from their investment portfolio.

Typical dollar cost averaging examples involve an investor investing a fixed sum of money at predetermined regular intervals, for example, $20,000 every month. By fixing the dollar amount, a discipline is forced upon the investor. When share prices are low, more units are acquired, and when share prices are higher fewer units are purchased. For the dollar cost averaging strategy, volatility becomes an investor’s best friend. As a net purchaser of shares, lower prices can be anticipated with eagerness.

The opposite however is true for the retiree in pension phase and required to receive regular fixed dollar or percentage payments from their portfolio. For example, compulsary withdrawals from a superannuation pension account vary by age from 4% for people under 65, to 7% for aged 80 to 84, to 14% for over 94. These levels are set to encourage depletion of super assets to fund a retirement, not pass to an estate.

An investor, required to take fixed dollar withdrawals regularly from their portfolio, would experience the opposite of the dollar cost ‘averager’. At lower prices, a retiree would be forced to sell more units simply because more units are required to meet their minimum pension payment. After those units are sold, the remaining portfolio is smaller, and with fewer units, a greater burden is placed on the remainder of the portfolio to recover the losses.

It is therefore essential that large losses early on the investment journey are avoided or the risk at least mitigated.

Reserving a cash allocation

One method employed by advisers is to quarantine from volatile assets the cash needed for spending, lifestyle and healthcare needs to cover a period estimated to be required for markets to recover.

Take a hypothetical investor with $2 million at retirement who is advised to quarantine $300,000 to cover three years of expenditure, and invest the remaining $1.7 million. What happens if the markets decline 50% at the end of the three-year period, when there is nothing left in the cash reserve?

Clearly, the solution is to ensure that $300,000 is always quarantined and therefore $100,000 must be withdrawn each year from the commencement of the second year.

An alternative is to mitigate the anticipated volatility by diversifying the portfolio into a suite of asset classes or funds where returns are not correlated with the share market. But here again, zero interest rate policies and QE have ensured very high prices across all asset classes, increasing the level of correlation between asset classes that might one have offered protection.

A less familiar option is to invest in funds that have demonstrated some ability to protect the downside to some extent.

Less of the upside with less of the downside

The hypothetical example in Figure 1 shows the benefit to retirees of investing in a fund that captures 80% of the upside when the market rises but only 60% of the downside when the market falls.

Figure 1. Retirees benefit from 80% upside and 60% downside.

The blue upper line represents the performance of a $1 million invested in the S&P/ASX 200 Accumulation Index (dividends reinvested) over the past 27 years, which is roughly a period of retirement for somebody in excellent health retiring at age 65 today.

The performance depicted by the index however is not that experienced by a hypothetical Australian retiree required to make regular ‘super pension’ withdrawals over the same period.

The red line at the bottom illustrates the experience of a retiree who is 100% exposed to the vagaries of the market and required to begin drawing 5% a year from the age of 65, ratcheting up to 14% annually once they reach 90 years of age. Their ending balance is $1.85 million and super pension payments have amounted to $10.1 million.

Being required to withdraw funds irrespective of market conditions dramatically changes the outcome for an investor exposed to 100% of the upside and downside of the market.

An understanding of this dynamic confirms there is merit in aiming to preserve capital for investors simply by capturing less of the downside.

The green line in Figure 1 represents the hypothetical picture for a retired investor who invests $1 million at 65 years of age in a hypothetical fund that captures 80% of the market’s upside movements and 60% of its downside movements over the last 27 years.

The vast improvement over an index investment can be achieved by investing in a fund that preserves capital on the downside. The retired fund investor ends the investment period with a portfolio valued at just over $2.5 million and has received super pension payments of $12.9 million. The active fund investor’s portfolio is worth 37% more than the ‘index’ investor and it has generated 28% more in pension payments.

A significant proportion of the population is rapidly approaching retirement or has just entered it. Market conditions, and in particular, stretched market valuations, must put sequencing risk at the forefront of advice. Therefore, finding a fund with an upside/downside capture strategy should feature in discussions between a retiree client and an adviser.

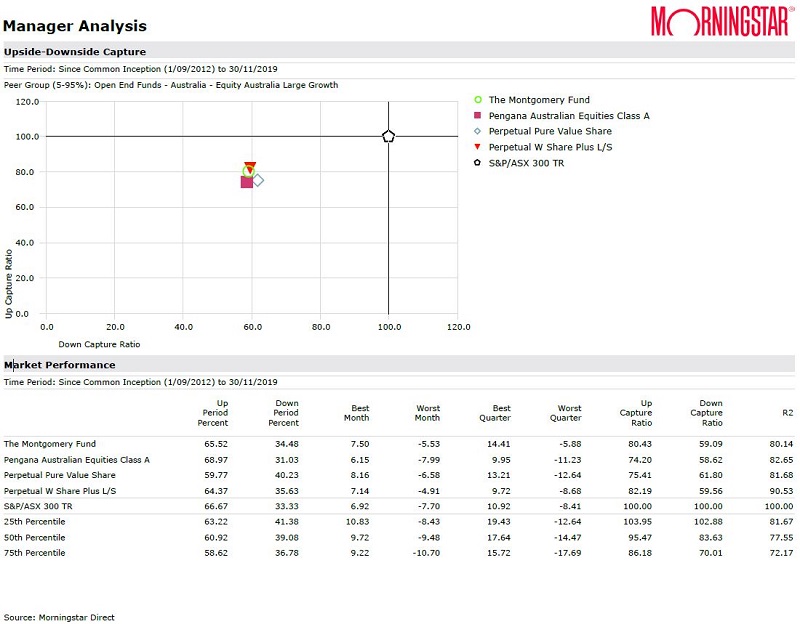

Using the Morningstar database, here are some examples. Other funds using terms such as 'managed volatility' or 'low volatility' attempt the same.

Roger Montgomery is Chairman and Chief Investment Officer at Montgomery Investment Management. This article is for general information only and does not consider the circumstances of any individual.